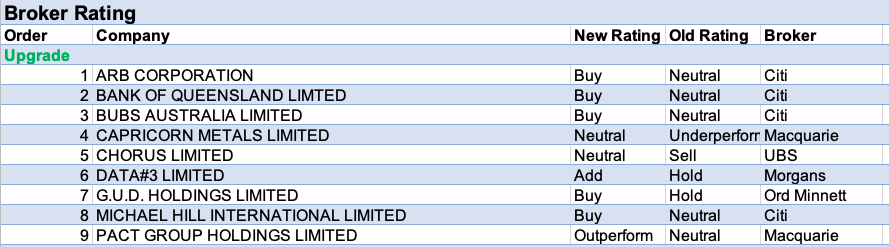

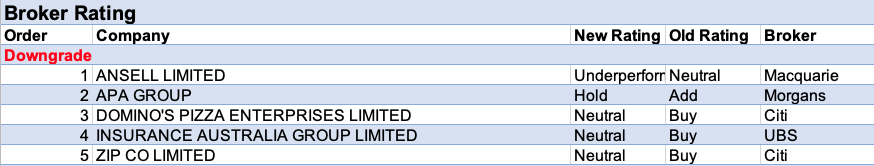

For the week ending Friday October 15, there were nine upgrades and five downgrades to ASX-listed companies covered by brokers in the FNArena database.

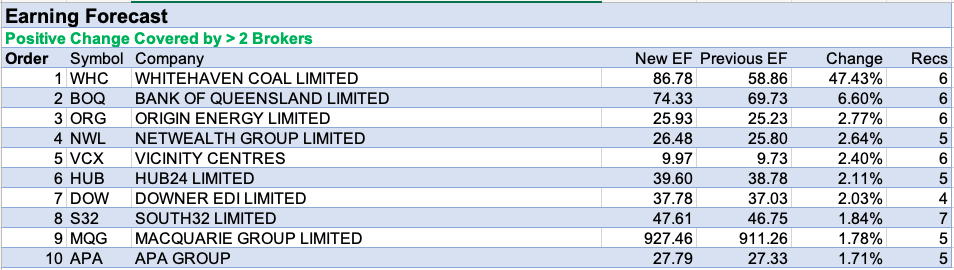

Whitehaven Coal had the only material percentage increase in earnings forecast by brokers over the week, after September quarter production revealed significantly better than expected production at both the Maules Creek and Narrabri projects, according to Morgan Stanley.

Realised thermal coal prices rose 51% quarter-on-quarter and Macquarie sees further upside ahead. If current spot prices were entered into the analyst’s financial model, the company would be offering a free cash flow yield in excess of 50%. While Credit Suisse feels December quarter production may moderate, inventory drawdowns are expected to sustain sales.

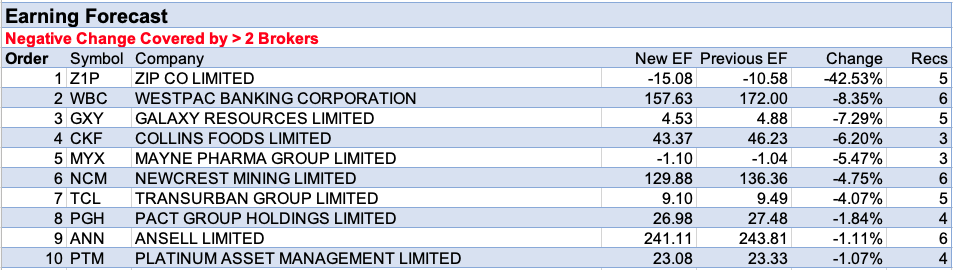

Meanwhile, Zip Co sat atop the table for the largest percentage decrease in forecast earnings last week. This occurred as Citi downgraded its rating to Neutral from Buy and lowered its target price to $7.40 from $7.95 to reflect lower customer growth forecasts and higher operating expenditure forecasts. The latter is thought to reflect increasing promotional activity and global expansion.

Moreover, app downloads for the company’s BNPL offering fell for the sixth consecutive month in September, notes the broker. There’s also considered potential for an equity raise should Zip Co accelerate its global expansion plans.

Total Buy recommendations take up 55.27 % of the total, versus 37.59% on Neutral/Hold, while Sell ratings account for the remaining 7.14%.

In the good books

ARB CORPORATION LIMITED (ARB) was upgraded to Buy from Neutral by Citi, B/H/S: 2/2/1

Citi upgrades its rating for ARB Corp to Buy from Neutral, following both a first quarter update and an -11% share price decline since the August peak. The update revealed better-than-expected profit momentum, despite lockdowns in NSW and Victoria.

The target rises to $55.45 from $48.80. The broker sees both a big US opportunity from more (significant proportion driving) vacations, and the potential for Australian sales to accelerate over the second quarter after lockdowns.

Citi lifts long-term export and US earnings forecasts to allow for gains in the US, benefits from the Ford partnership and an expansion of Thai manufacturing facilities.

BANK OF QUEENSLAND LIMITED (BOQ) was upgraded to Buy from Neutral by Citi, B/H/S: 6/0/0

Bank of Queensland’s FY21 results met Citi’s estimates and the outlook for FY22 is better than expected.

Yet the broker suspects the negative stock reaction stems from a fixation on costs that deceivingly appear to be accelerating.

After adjusting for an accounting reclassification and slightly higher volume growth, the broker suggests management is on track to deliver broadly flat expenses. Rating is upgraded to Buy from Neutral and the target lifted to $10.50 from $9.90.

BUBS AUSTRALIA LIMITED (BUB) was upgraded to Buy from Neutral by Citi, B/H/S: 1/0/0

Bubs Australia’s trading update suggests improved momentum in the daigou channel, and that continued focus on innovation should allow further expansion into new markets and categories. Gross sales were up 97%.

Citi believes the improvement in daigou, despite international borders being closed, is a reflection on how corporate daigou has evolved.

The broker upgrades to Buy/High Risk from Neutral/High Risk and raises its target to $0.63 from $0.41.

CHORUS LIMITED (CNU) was upgraded to Neutral from Sell by UBS, B/H/S: 0/2/0

UBS upgrades the rating for Chorus to Neutral from Sell after recent share price underperformance and a low probability the Commerce Commission will lower its regulated asset base (RAB) estimate in December.

Moreover, higher dividends are estimated for the long term. The target price moves up to NZ$6.35 from NZ$6.30.

MICHAEL HILL INTERNATIONAL LIMITED (MHJ) was upgraded to Buy from Neutral by Citi, B/H/S: 2/0/0

In expectation of improved sales in AN&Z upon store reopenings, Citi upgrades its rating to Buy from Neutral. The broker advances other positives including potential M&A and the marketplace strategy, which should allow entering and testing new markets with low capital risk.

While first quarter sales were below the analyst’s expectation, gross margins improved by 100bps-200bps across all markets. It’s thought this validates the company’s growth initiatives.

PACT GROUP HOLDINGS LIMITED (PGH) was upgraded to Outperform from Neutral by Macquarie, B/H/S: 3/0/1

Pact Group Holdings has ceased the sale process for its contract manufacturing. Continued market uncertainty and disruptions in the supply chain have created problems in realising the value target.

Hence, the company now believes retention of the business will deliver the greatest value. Pact Group was not a forced seller and the balance sheet is in good shape so the announcement is not that surprising for Macquarie.

Rating is upgraded to Outperform from Neutral. Target price is steady at $4.20.

In the not-so-good books

APA GROUP (APA) was downgraded to Hold from Add by Morgans, B/H/S: 2/3/0

After a further review of the takeover proposal for AusNet Services ((AST)), Morgans fails to see the value accretion opportunity and downgrades its rating to Hold from Add. The target price is lowered to $8.71 from $10.13.

The analyst points out that over the last five years, AusNet Services has invested over -$4bn of capital and delivered minor earnings and cashflow growth. The next step in the takeover process is the Takeovers Panel’s ruling on the group’s access to due diligence.

DOMINO’S PIZZA ENTERPRISES LIMITED (DMP) was downgraded to Neutral from Buy by Citi, B/H/S: 0/3/2

Given the potential for a weak performance in the first half in Australasia and France, and because of the share price appreciation in the year to date of about 64%, Citi downgrades Domino’s Pizza Enterprises to Neutral from Buy.

Net profit estimates for FY22 are trimmed, as slower sales growth is expected in the first half in Australasia and Europe.

The broker remains positive about the longer term, noting opportunities in existing territories and the potential for acquisitions. Target is reduced to $148.70 from $159.05.

INSURANCE AUSTRALIA GROUP LIMITED (IAG) was downgraded to Neutral from Buy by UBS, B/H/S: 5/2/0

UBS downgrades its rating to Neutral from Buy after the broker was surprised by only a marginal share price lift after the recent second business insurance (BI) test-case win. Also, an expected medium-term improvement in underlying margin has not materialised.

Moreover, the analyst is concerned over the prospect for increased regulatory scrutiny. The target price falls to $5.35 from $5.65.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.