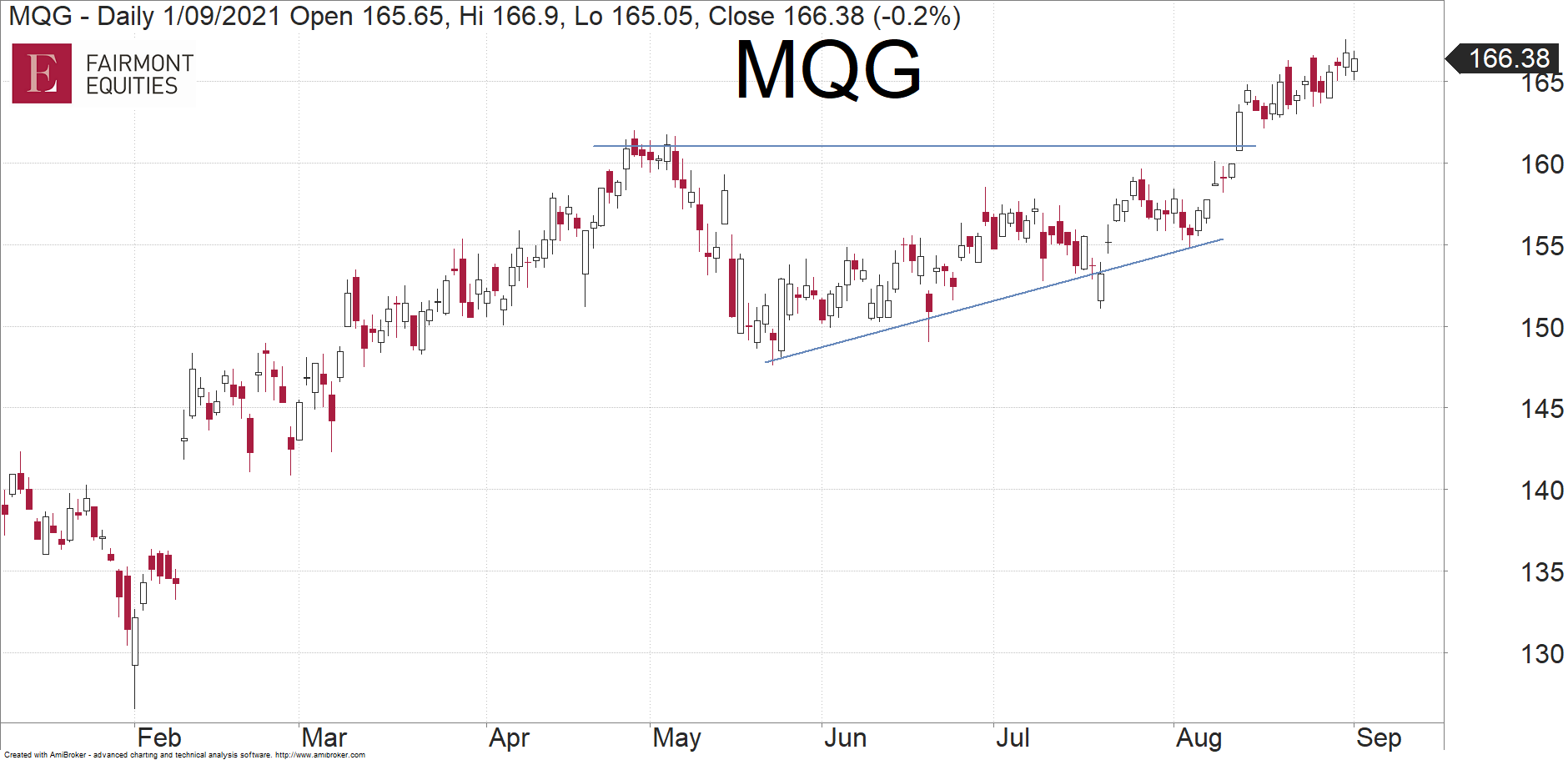

“The MQG share price has made some steady progress over the course of the year,” Michael said.

At its latest quarterly update in July, the market initially seemed to be disappointed in a lowering of the dividend payout ratio.

“However, that short-term weakness in the share price was short lived.

“Its share price had been steadily increasing since May and was once again retesting its all time high just above $160.

“In mid-August, it gapped up and finished strongly at a new high.

“This was a clear sign that MQG had shrugged off any concerns over its dividend, and was ready to trend higher again.

“Its share price performance over the last few weeks looks sustainable.

“I therefore expect the share price to grind higher from here,” Michael concluded.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.