BHP has been a wonderful stock to own in recent years, after a fall from grace in late 2014 to early 2015, when its share price fell $34 to $15.

BHP

Of late, the price of iron ore (BHP’s main game) incredibly has pushed above $US200 a tonne and has taken the share price with it. On Friday, it closed at $53.49 and the analysts think it likely to fall 4.5%. But does this make it a sell?

The company analyst at UBS says ‘yes’ with a price target of $42. But experts on the big miner at Macquarie and Ord Minnett think a $60 target lies out there waiting to happen.

Now historically, most players of companies such as Rio Tinto and Fortescue, as well as BHP, would say “if the iron ore price falls, so will the share price of the big miners.” So when I saw the Global Resources Portfolio Manager at Aubil go public with “the party is over for iron ore”, I started to wonder if I should hold onto my BHP shares for the dividend or simply cut and pocket my profit?

I have a soft spot for BHP because when it slumped in 2016 I posed the question on my Sky Business TV programme that if buying BHP at $14 would be a good idea. I asked this on the basis that if it makes $20 in three years’ time, that would be a 42% gain in three years or 14% a year. And even it took five years, that would still be an 8.4% gain a year. Plus dividends!

It actually got to $33 within three years, which was a gain of 135%! I must admit I didn’t have the courage to buy in at $14 but it was in the high $15 region. This taught me a lesson that buying quality companies when the market falls out of love with them can be very rewarding. It’s the competitive advantage we long-term investors have over fund managers, who have to play a more short-term game to impress their clients/investors.

Of course, BHP is in the opposite position now, being priced at very high levels. So if Luke Smith from Ausbil says the party is over for iron ore, is that a reason to sell?

Luke says “a number of factors, both in terms of supply and demand, will ease over coming years – and we expect prices to taper from current levels.”

Here are the reasons why Luke is negative on the iron ore price:

- Chinese steel demand will ease into 2022 by 3% to 4% year-on-year.

- The Brazilian iron ore miner, Vale, is likely to increase its supply to the market in 2022, despite having issues with its tailings dams, a fire at their Madeira Port (which is limiting shipments) and then the Coronavirus challenges in Brazil.

- Smith says he’s seeing early signs of a supply response from non-traditional producers, and also from a number of smaller producers. The numbers are small but a small increase in supply is evident

So what will happen to the iron ore price?

“Given this market backdrop, we currently forecast iron ore prices to taper from current levels towards $US170/ton in the second half of 2021, $140/t in calendar year 2022 and $110/t in 2023,” Smith predicts.

If he’s right, it looks like bail-time for BHP shareholders. Or is it?

Interestingly, despite a prediction of a falling iron ore price, the prices are still very high compared to costs for the big miners.

Ausbil’s forecasts for iron ore would result in +29% year-on-year earnings growth in FY22 and then +4% earnings growth in FY23.

Interestingly, Smith and Ausbil think BHP’s share price can go higher, but that’s because it will be helped by its exposure to copper and even in a small way to nickel.

The funds management group has a core positioning for their global resources portfolio, which includes going long battery materials, base metals and energy. “Our base metals and energy views are driven by a global reopening and supply chain restocking cycle as the impact of COVID dissipates,” Smith explains. “Battery materials remain very tight, and the demand outlook continues to get better.”

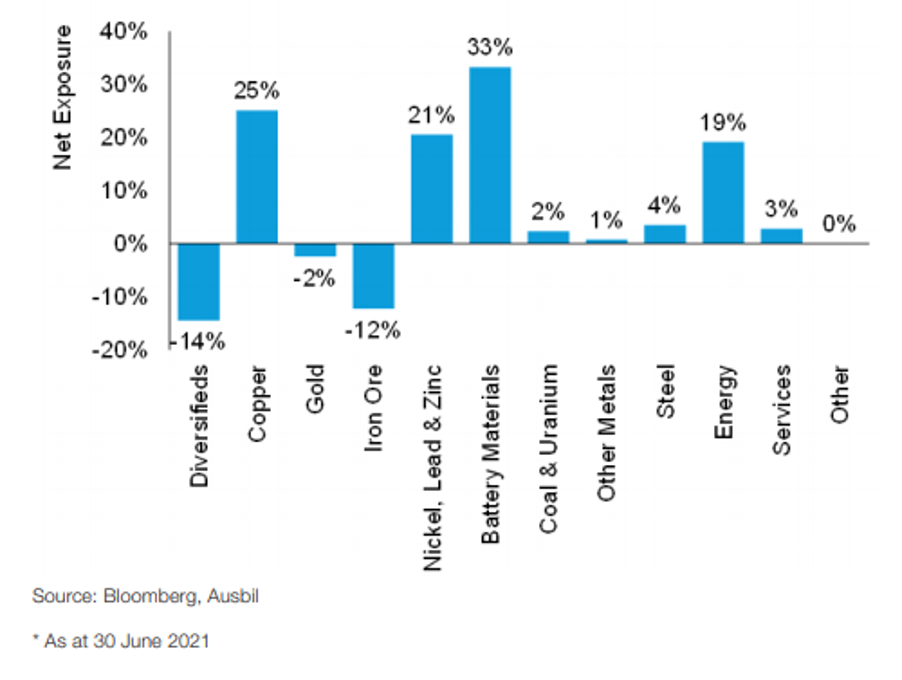

This chart shows how the company is positioning itself with respect to resources.

In a podcast I did with Luke Smith, he not only said he liked BHP with its copper assets, he also gave a leg up for Oz Minerals (OZL), which is a pure copper play. He says the tech-opportunities of future business, such as electric vehicles, will increase the demand for copper and other resources such as nickel, rare earths, lithium and so on.

The chart below shows how they’re reducing their exposure to iron ore miners by12% and diversified miners by 14% but going long copper, battery material and energy players.

Luke doesn’t think it’s time to dump BHP, but that time might come. But it’s not now. Meanwhile, he like Oz Minerals, which rose 9.29% last week, which tells you that you should be reading, watching and listening to everything I punch out weekly!

He also likes Galaxy Resources (GXY), being in lithium. And he likes Lynas (LYC) with its rare earth resources. Note, these are for the long term. Ideally, they’d be great buys if and when the market dips or has a significant pullback.

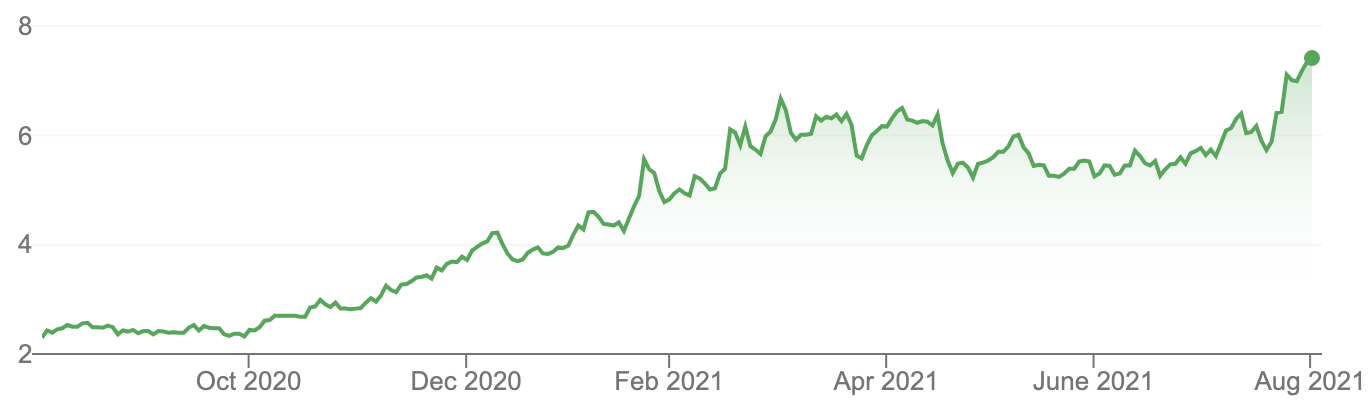

OZ Minerals (OZL)

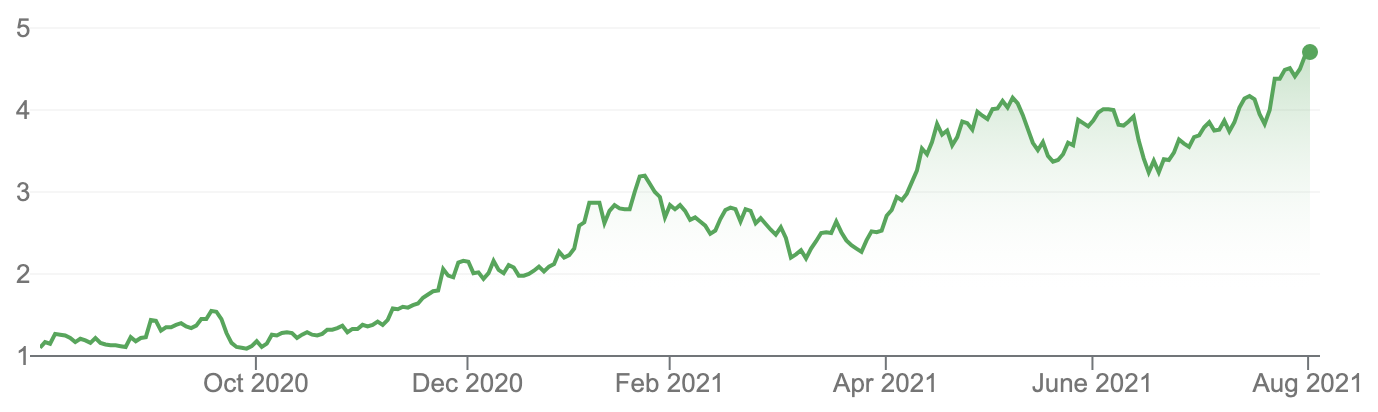

Lynas Rare Earths (LYC)

Galaxy Resources (GXY)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.