My betting App needs to stop pounding me with gambling offers. Barely a day goes by without another offering a free $10 bet, juicier odds or something to entice me to punt.

I’m not much of a gambler at the best of times, so their offers are wasted. Clearly, the App believes many of the 12 million Australians in lockdown are eager for a bet.

As an investor, my interest in gambling is what happens to casino companies when lockdown restrictions ease and life normalises. I expect a strong recovery in casino activity – possibly more than the market expects – and gains in the main casino stocks.

Granted, there are many risks with casino stocks. Crown Resorts has stumbled from one disaster to another in the past 18 months. In February, NSW’s Independent Liquor and Gaming Authority found Crown was unsuitable to operate a new Sydney casino at Barangaroo.

This week, counsel assisting the Victorian Royal Commission into Crown Melbourne said it was “unfit” to run its casino in that city and should be stripped of its Victorian casino licence.

Allegations of money laundering are not just a problem for Crown: heightened regulatory oversight and risk of large money-laundering fines are an industry-wide issue. If that wasn’t enough, the casino industry was rocked by Coronavirus-induced lockdowns.

But every stock has its price. In early May last year, I nominated Crown as a takeover target at $9.30 a share. I wrote in that column: “Buying casinos when the sector is on its knees due to COVID-19 must appeal to private equity. For all the immediate problems, integrated casino resorts have an attractive long-term outlook, amid the coming boom in middle-class consumption in developing countries this decade.”

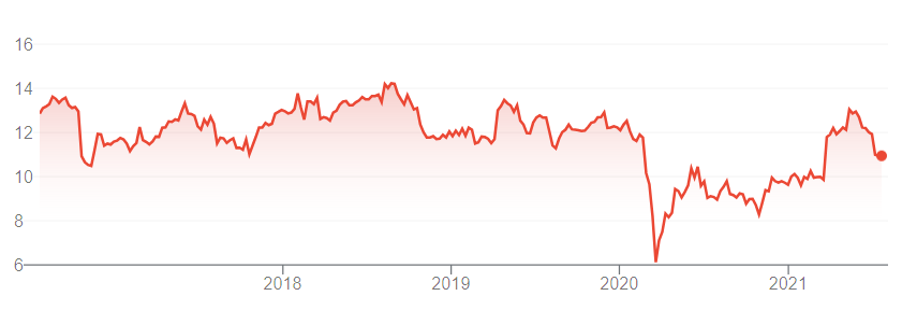

1. Crown Resorts (CWN)

In mid-May, The Star Entertainment Group proposed a merger with Crown, soon after an indicative acquisition proposal from a US private-equity firm, The Blackstone Group. Crown shot to a high of $13.32 and now trades at $10.49. A poor trading update in July and ongoing fallout from the Royal Commission scuttled its gains.

Crown is no screaming buy (it was at $9.30), but still looks a touch undervalued. It is trading below the Blackstone and The Star bids. Regulatory action against Crown – and latest news from the Victorian Royal Commission – might dissuade suits or encourage lower bids

However, board renewal and independent compliance oversight should ensure Crown keeps its Sydney casino licence to start operating in that market in 2022, and its Melbourne licence (albeit with lots of painful, much-needed change). This year should be “peak bad news” for Crown.

For all its problems, Crown has valuable property and a still lucrative market position in a recovering industry over the next two years.

Chart 1: Crown Resorts

Source: ASX

Global casino recovery

As Australian investors focus on Crown’s regulatory problems, it’s easy to overlook the strength of recovery in casino stocks in markets that have rebounded from Covid.

In May 2021, Nevada casinos reported record winnings of US$1.23 billion. This was 25 per cent up on the equivalent 2019 figure and the first monthly record in 14 years.

Judging by the result from Las Vegas casinos, pent-up demand for gambling, entertainment and accommodation is larger than the market anticipated. A recovery was always likely, but I doubt investors factored in record gaming at US casinos with the pandemic in full swing.

Australian casinos, of course, are in a different position. Our bungled vaccine rollout means we are further behind the US in getting through Covid. Tourists are streaming back to Las Vegas casinos even though Nevada had the highest rate of Covid cases in the US in early July.

Also, our casinos rely more on international tourists given our smaller domestic market. Covid lockdowns mean international tourists in big numbers are unlikely anytime soon. Sydney’s current lockdown, if extended for weeks or months (let’s hope not), is another headwind.

Tougher regulatory restrictions on junkets for overseas high rollers to gamble at our casinos will also weigh on growth. We could lose more high rollers to Macau and other offshore casino markets.

Risks aside, Australian casinos, like those in the US, should benefit from strong pent-up demand when lockdowns are behind us. Yes, it’s hard to see that in the middle of Sydney and Melbourne’s latest lockdown, but the market always looks a year or more ahead.

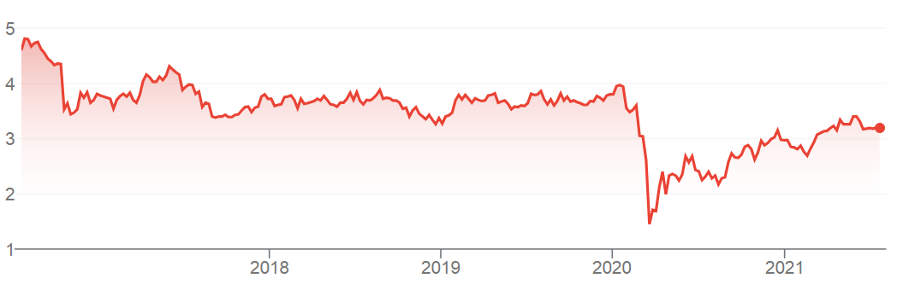

2. The Star Entertainment Group (SGR)

I have written favourably about Crown’s Sydney rival, The Star Entertainment Group, for the past three years in this report. The Star has disappointed: the one-year total return (including dividends) is 40%, but over three years the annualised return is minus 7%.

Like other casinos, The Star has been hammered by lockdowns during Covid. It’s flagship casino in Sydney has been whacked again by that city’s latest Covid wave. Longer term, the market fretted about competition from Crown’s new casino in Sydney.

My positive view on The Star was too early (lockdowns didn’t help), but I’m not giving up on it now. If anything, the latest lockdown is an opportunity to buy into The Star at a cheaper entry point. The stock is down from a 52-week high of $4.30 to $3.51.

Four factors underpin my view on The Star:

- As mentioned, I expect a strong recovery in casino activity.

- The Star will benefit for Crown’s woes and management distractions.

- The Star’s eye-catching Queen’s Wharf integrated casino resort development remains on time and budget, thanks in part to Queensland’s better performance with Covid. I don’t think the market’s paying enough attention to Queen’s Wharf.

- The Star looks reasonably priced. On Morningstar’s numbers, it trades on a forecast FY22 Price Earnings (PE) ratio of 22 times, which is hardly excessive for a growth stock. Morningstar’s valuation of $4 a share provides a reasonable margin of safety.

Apart from Covid, the main risk for The Star is regulatory action and potential fines if non-compliance of money-laundering laws is established. In June, the AUSTRAC’s Regulatory Operations Team said it had identified potential serious non-compliance by The Star.

Nobody knows how this will end, but The Star and other casino operators were given a big heads-up on regulatory risk through the actions against Crown. My hunch is the casino operators have been quietly bolstering their compliance process after Crown’s problems – and that the market has already factored regulatory risks into The Star’s valuation.

Chart 2: The Star Entertainment Group

Source: ASX

3. SkyCity Entertainment Group (SKC)

The dual-listed New Zealand casino operator is also worth watching. It owns the SkyCity Auckland casinos and integrated casinos in Queenstown, Hamilton and other NZ cities. The company also owns the SkyCity Adelaide casino.

In June, SkyCity issued a positive updated due to “stronger than expected trading” in its NZ electronic gaming (pokie) machines and a consistent performance at its Adelaide casino. That fits my thesis about a larger recovery in casino activity due to pent-up demand.

Sadly, there is an army of gambling addicts who will pour money back into poker machines, card games and other betting at casinos worldwide when lockdown restrictions end.

International border closures are hurting SkyCity’s tourism-related businesses in Auckland and Adelaide, but the company says it is benefiting from stronger domestic tourism.

A significant fire in October 2019 at the construction site of the New Zealand International Convention Centre was another one-off problem for SkyCity and affected comparisons for its interim result. SkyCity is funding the Centre, which is one of NZ’s largest construction projects.

SkyCity doesn’t have the same leverage as a “re-opening trade” compared to The Star or Crown, principally because New Zealand and Adelaide have been less affected by lockdowns, and both are smaller markets compared to Sydney and Melbourne. SkyCity’s growth outlook is steady rather than spectacular, compared to larger casino operators.

But there’s a lot to like about a casino operator that has exclusive long-dated licences in Auckland and Adelaide that provide a barrier to entry, and resilient earnings. Like Crown and The Star, SkyCity looks a touch undervalued at the current price.

Chart 3: SkyCity Entertainment Group

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 21 July 2021.