The doomsday merchants who make money out of scaring the pants off investors (who are by nature suspicious of the stock market and every other force that can make or break money-making in any assets) are out in force looking for publicity.

Yep, I’ve fallen into the media trap that the likes of Harry Dent and Robert Kiyosaki have set to publicise their books and the end-of-financial-days that they always predict. And let me say that one day the market will crash but Harry and Bobby are only valuable if they call it before it falls.

Let’s imagine this market has a sell off (which is likely at this time of the year) but then rebounds to end up being a little higher by May next year. Anyone who cashes up now and say buys gold (as doomsday merchants often peddle) could be badly out of pocket.

Harry & Co are doing a positive service if they scare people now and the market crashes before the year’s up. But what if we’re only mid-cycle for this stock market comeback?

One expert who I referred to in my Saturday Switzer Report isn’t seeing the stock market edging towards the precipice overlooking the asset abyss, just yet.

Mike Wilson (Morgan Stanley’s chief U.S. equity strategist in New York) isn’t wary of stock prices just yet. “The market is solidly mid-cycle and with that typically comes a 10-15% index level correction. We expect such a correction will create buying opportunities, given a still strong growth backdrop.”

And he’s not alone in discounting the doomsday doubters. A hard look at stock movements ahead by HSBC and reported by CNBC came up with the following headline that stock market optimists would be happy to see: “Rebalance your portfolio now as the economy enters an expansion phase, HSBC says…”

The huge international bank advises that “investors need to prepare for the business cycle to transition from recovery to expansion, bringing a period of lower investment returns and a shift toward “activist” fiscal policy.”

Yes, lower returns, but we are talking about positive rewards for being long stocks. But remember, the past year of returns has been distorted by the flash crash in February/March last year, then the rampant rebound that was powered by historically low interest rates and Keynesian fiscal stimulus on steroids worldwide!

Those who say a crash is imminent are using old thinking and old market and stock price analysis, ignoring the big drivers of valuations nowadays. One day old analysis for working out good and bad value for stocks will reassert itself, but these are wild and wacky times.

Old thinking said when price-earnings ratio went over 20, you might have become wary about being exposed to stocks. But interest rates then were typically 5% but now are less than 1%. Even if you use an interest rate of 3%, then a PE of 30 is still OK for a good quality company making heaps of money. Apple’s trailing 12 months PE is 20, so what are we worried about? Microsoft is 38 but this is a company that owns Microsoft Teams, which is the business of the future (along with Zoom) and is a virtual monopoly in the space it plays in the computer world.

That’s all good but it makes sense to expect share prices to rise at a slower rate, rather than expecting that they will nosedive, as Harry and others might argue.

“After a period when rising investor optimism lowered perceptions of risk and re-rated risky asset classes, the outlook is now the reverse,” Joseph Little, global chief strategist at HSBC, said. “Increasingly, valuations are set to become a drag on returns as a lot of good news about the recovery has already been factored into prices.”

Little thinks playing a safer game might make sense, as the heady post-virus spending days dissipate. His thinking looks like it’s being shared by the super funds that are trying to buy that great infrastructure asset called Sydney Airport. “Investors should look to get as close to real, inflation-protected cash-flows as possible. Infrastructure debt is a strong candidate for that and has delivered decent historic returns, offers a higher spread today than global credit, and has a more benign loss profile,” he said.

I think Little maybe a little too cautious and we might have some more time to make money out of more adventurous stocks because next year promises very strong growth. Also reopening-like stocks such as Qantas, Webjet and so on would have to be beneficiaries if most of the Western world is jabbed and we start travelling by mid-2022.

The Economist magazine thinks there are three fault lines that could shake markets. They are:

- The virus

- Supply bottlenecks.

- Stimulus withdrawal.

Right now The Economist’s team says central banks think:

- The pandemic will be all but eradicated in rich nations by mid-2022.

- Supply bottlenecks are few and temporary.

- Stimulus withdrawal will be slow and gradual.

And I’m on board with these assessments and it’s keeping me long and confident about stocks, even if a sell off or two comes along.

Why? Well, I like this from CNBC’s Patti Domm, who I rate as a very good markets journalist. If anything could create a sell off or sow the seeds for another great crop of price-rising stocks, it will be the US earnings season that starts this week.

Be clear on this: the profit numbers will be huge but it will be the outlook statements from CEOs that will guide where share prices go and Patti’s sources are optimistic. “The second quarter could be as good as it gets for economic growth,” said Callie Bost, senior investment strategist at Ally Invest. “Earnings growth may slow, but analysts still expect S&P profits to grow by double digits in the next two quarters. It’s crucial not to lose faith in the market just because the economy’s strongest growth may be behind us.”

US industrial stocks are up an unbelievable 570% since the Coronavirus crash of the stock market but these numbers are straight out of La La Land.

I’ve laughed at those funds and financial experts who have been praising themselves for ‘best ever’ returns when they measure it from just after the crash and rebound. For our financial planning clients, I’ve told our Switzer advisers to also show the three-year return to explain that the portfolio has been pressure-tested and is a good’un.

Next year will still have a lot of economic growth tailwinds because government stimulus will still be there, central banks won’t be raising interest rates, vaccination rates will help business and consumer confidence and businesses that have struggled in a locked-down world will start to rebound.

But the gains will bring ups and downs for the market. “Once you pass the peak of economic growth as well as earnings growth, you do get higher levels of volatility,” said Matt Stucky, portfolio manager, equities, at Northwestern Mutual Wealth Management Co. “We still think the path of least resistance is higher when it comes to equities but with more volatility than we’ve had.”

However, he emphatically adds: “There’s fundamental reasons to be optimistic about the market in the next year.”

My chief filters for buying stocks will get down to a couple of questions:

- Is this a quality company in a good industry?

- Will it benefit from the reopening of the economy and the path back to normalcy?

- Has the market been too hard on the business?

This makes me think:

1. CSL fits the bill perfectly.

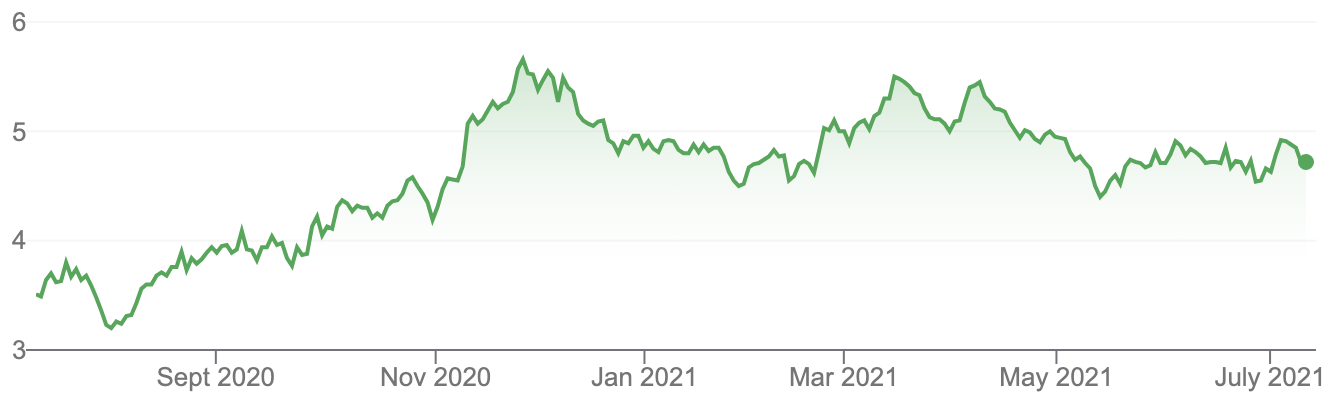

CSL (CSL)

Source: Google

2. So does Qantas (QAN)

Qantas (QAN)

Source: Google

3. And as a more speculative play, I’ll stick with Elmo Software (ELO). In fact, I bought some more today!

Elmo Software (ELO)

Source: Google

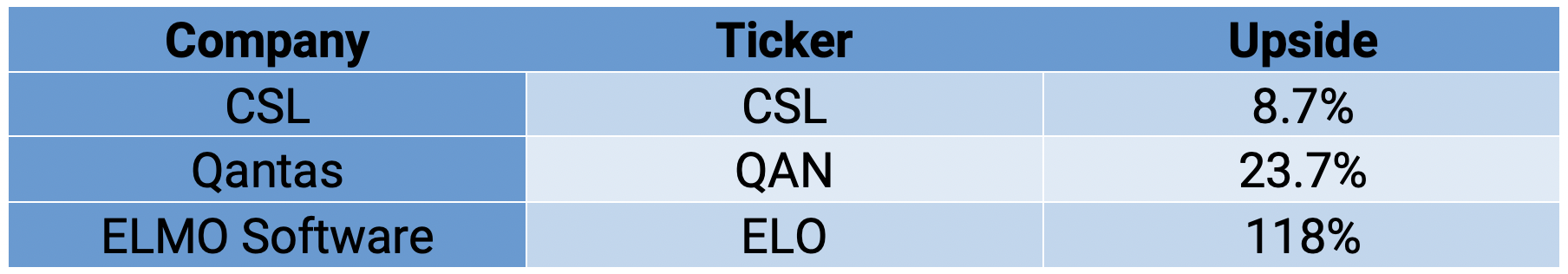

The analysts view on these companies going forward are:

My view on these companies is that it might take six months or more for their share prices to spike to where I see some great returns but as I don’t believe a crash is imminent, time is on my side.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.