Question 1: Which is the best ETF to gain exposure to growth in Europe?

Answer (by Paul Rickard): I would probably go for Vanguard’s FTSE Europe Shares ETF, which trades under the code VEQ. It tracks a very broad based index of companies from developed Europe. The index has about 1,300 companies.

An alternative is the iShares Europe ETF (ASX: IEU), which tracks a S&P index of Europe’s 350 biggest companies (read more in Tony Featherstone’s article). Interestingly, both VEQ and IEU have similar country and sector weights, although VEQ is broader.

If you thought “exporting outside the Eurozone” was a proxy for growth, then you could consider BetasShares Europe ETF – Currency Hedged (HEUR). This tracks an index from S&P of Eurozone Exporters, those companies that generate a substantial portion of their revenue from outside the Eurozone. By definition, companies from the UK are excluded.

Question 2: Could you please give me an indication of how you think the AUD will perform against the Pound Sterling and the USD over the next 12 months? Do you think our Aussie dollar is going to rise or fall against these currencies?

Answer (by Paul Rickard): I expect the Australian dollar to rise, buoyed by stronger world growth, rising commodity prices and ongoing weakness in the US dollar. The latter is a function of ballooning US budget deficits, rampant money supply growth and a lessening of the US dollar’s status as the “world’s reserve currency”.

The AUD has been on a strong upward trend until the last few months or so, but has taken a bit of a breather as the spectre of rising inflation and higher US interest rates has supported the US dollar.

With the pound, it is not quite as clear because since Brexit, the pound has been under pressure (and the AUD has risen against the pound). If the British Prime Minister can negotiate some material trade deals, a sharp rally in the pound can’t be ruled out.

On balance, I favour a higher AUD against both currencies over the next 12 months.

Question 3: What are your thoughts on Qantas (QAN)? Is it a buy?

Answer (by Paul Rickard): I like Qantas as my preferred “re-opening” stock. It has used the Covid-19 crisis to cut costs, re-organise its business, and focus on productivity. It is, and will remain, Australia’s number one airline. Obviously, if lockdowns continue and international borders remain closed, the price will be under pressure. But I expect the market will “look through” these issues.

As for the major brokers, they are in the main positive on the stock with 5 buy recommendations and only 1 sell. The consensus target price is $5.84, about 24.5% higher than the current ASX price of $4.69. The range is a high of $7.00 from Morgan Stanley to a low of $4.15 from Credit Suisse. The latter is worried about competition from Rex, and “lockdown risk” not being reflected in the price.

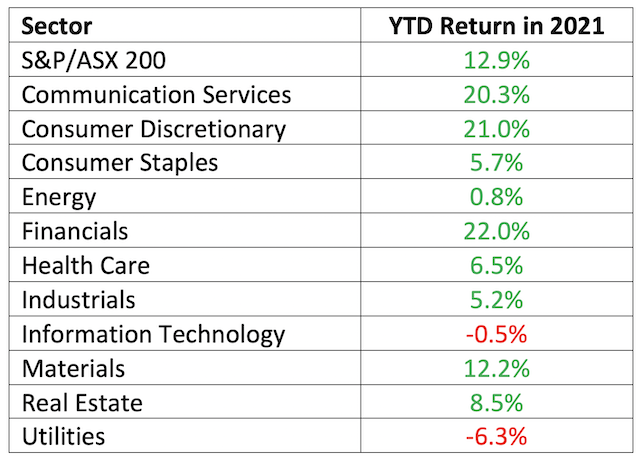

Question 4: Which have been the best performing sectors in 2021?

Answer (by Paul Rickard): To 30 June, the best performing sectors have been Financials and Consumer Discretionary, both with returns over 20%. Utilities is the worst performing sector. The overall market, as measured by the S&P/ASX 200, has returned 12.9% (including dividends).

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.