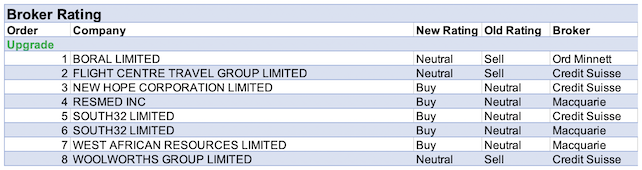

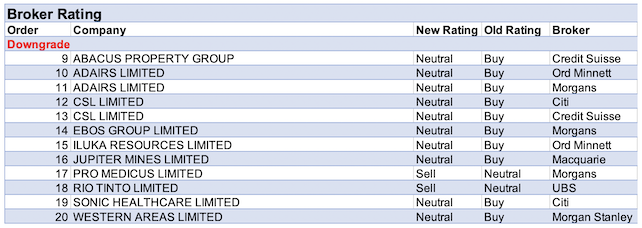

For the week ending Friday 25 June, there were 8 upgrades and 12 downgrades to ASX-listed companies by brokers in the FNArena database.

Both Macquarie and Credit Suisse upgraded their ratings for South32 to Outperform from Neutral. The commodities team at Macquarie lifted its 2021-25 aluminium price forecast by 4-5%, driving strong longer-term earnings upgrades for the company. In raising the target price to $3.60 from $3.00, Credit Suisse cited the potential for the global aluminium market to head into protracted deficits from 2022. The broker expects a free cashflow contribution from the company’s aluminium division of 44% in 2022, or 62% if the alumina refineries are included. It’s also felt the ESG-compliance of the company is a big plus.

Adairs suffered a downgrade in rating to Hold from both Morgans and Ord Minnett. Morgans continues to forecast earnings will fall by circa -20% in FY22. This is based on the assumption that like-for-like (LFL) sales growth turns negative, gross margins ease from elevated levels and operating expense deleverage will occur, on the negative LFL sales growth assumption. Ord Minnett feels sales growth has been well above average while operating margins appear unsustainably high, after the company has benefited from elevated demand in the home improvement segment over the past 12 months.

Two separate brokers downgraded the rating for CSL. Citi downgraded to Neutral from Buy, purely on valuation, due to share price outperformance since March. Also, Credit Suisse downgraded to Neutral from Outperform, partly due to valuation but also because the market hasn’t factored-in the negative margin impact from lower volumes and higher donor fees. Additionally, the broker sees headwinds for the recovery in FY23, not only from structurally higher donor fees, but also from continued pressure on collections, resulting from the US customs and border protection prohibiting Mexican nationals from donating.

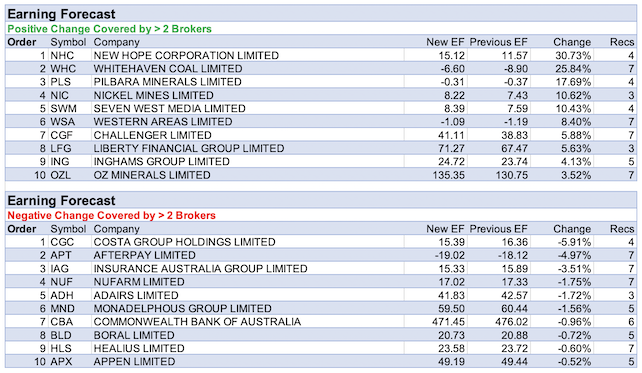

Meanwhile, New Hope Corporation had the largest percentage upgrade in forecast earnings. This was a result of coal price revisions by both Credit Suisse and Macquarie. The latter raised forecast thermal coal prices by 9% and 7% for 2021 and 2022, respectively, resulting in material upgrades to earnings estimates for those years. After adjusting thermal coal prices for the June quarter, Credit Suisse lifted FY21 estimates for New Hope Corporation’s operating earnings by 23%. The broker also increased its Newcastle thermal price assumption to US$100/t for FY22.

The same rationale by both brokers also applied to Whitehaven Coal, which had the next largest percentage rise in earnings forecast. Across the sector, Macquarie continues to prefer the company after a recent upgrade to the long-term metallurgical coal outlook. Despite management guiding to a FY21 production downgrade last week, Credit Suisse considers the damage to be limited, given spot prices remain above US$120/t.

Finally, the Macquarie commodities team remains bullish on the outlook for lithium. This elevated Pilbara Minerals last week into third position on the table for percentage increase in forecast earnings by brokers in the FNArena database.

In the good books

SOUTH32 LIMITED (S32) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 6/1/0

Credit Suisse lifts the rating for South32 to Outperform from Neutral and raises the target price to $3.60 from $3. It’s anticipated the global aluminium market will head into protracted deficits from 2022. It’s also felt being ESG-compliant is a big plus for the company. The broker believes aluminium should be in high demand for its role in electricity transmission, solar projects and light-weight. Credit Suisse forecasts the aluminium price to climb to US$1.20/lb next year. The analyst expects a free cashflow contribution from the company’s aluminium division of 44% in 2022, or 62% if the alumina refineries are included.

WOOLWORTHS GROUP LIMITED (WOW) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 3/3/0

As Woolworths traded ex-Endeavour Group from June 24, Credit Suisse lowers the target price to $32.92 from $37.98. The rating increases to Neutral from Underperform. The broker explains the demerger results in Woolworths being an almost pure-play supermarket retailer and has the attraction of negative working capital and relatively high return on invested capital (ROIC). The analyst notes covid-19 travel restrictions did not appear to have a material negative impact on supermarkets in May, and therefore solid two-year growth is likely in the fourth quarter.

In the not-so-good books

ADAIRS LIMITED (ADH) was downgraded to Hold from Add by Morgans B/H/S: 1/2/0

From a long-term management/investment perspective, Morgans considers the bringing forward of the deferred consideration payment is positive. However, the multiple is considered to imply a softer second half earnings performance versus expectations. The broker lowers the rating to Hold from Add with the stock now within 10% of the target price. The target price is reduced to $4.46 from $4.50. The analyst continues to forecast earnings will fall by circa -20% in FY22. This is based on the assumption that like-for-like (LFL) sales growth turns negative, gross margins ease off elevated levels and opex deleverage on the negative LFL sales growth assumption.

CSL LIMITED (CSL) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/5/0

Credit Suisse sees potential for a short-term de-rate of CSL at current multiples and downgrades the rating to Neutral from Outperform. It’s felt the market hasn’t factored-in the negative margin impact from lower volumes and higher donor fees. The broker also sees headwinds for the recovery in FY23, due to the structurally higher donor fees and continued pressure on collections. This is due to the US customs and border protection (CBP) prohibiting Mexican nationals from donating. The analyst forecasts CSL Behring gross margin to fall -310 basis points in FY22 to 54.1% (vs FY20 gross margin 61.2%) and remaining at around 57% into the medium term. It’s estimated EPS for FY23 will fall by -3% and the target is decreased to $310 from $315.

PRO MEDICUS LIMITED (PME) was downgraded to Reduce from Hold by Morgans B/H/S: 0/1/1

Morgans decreases the rating to Reduce from Hold after the share price has risen by over 35% in the last month to record highs. In the absence of news, it’s felt this may be due to unwinding of short positions in the stock, (down to circa 3.5% from over 5% in January). While the broker increases the target price to $49.69 from $41.30, current prices are considered unsustainable in the short term. The analyst suggests trimming heavily overweight positions and looking for a better entry point (below $45.00) into this quality name. Morgans makes no changes to forecasts. The company will post its full year FY21 result in mid-August.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.