It pays to follow what the smart money is buying and selling. Quadrant Private Equity last week bought Affinity Education from Anchorage Capital Partners, another private equity firm.

Affinity is one of the largest early-learning groups with more than 150 centres nationwide, covering childcare, kindergartens preschools and Outside-School-Hour-Care (OSHC).

Private equity firms trading assets among each other is nothing new. But the deal, reportedly worth $650 million, says much about the growth prospects of the childcare sector, particularly now after the effects of Covid on centre enrolments.

When Covid erupted last year, it was feared that enrolments would plummet as childcare facilities closed temporarily due to localised outbreaks. Or that parents, some of whom lost their jobs, would take their kids out of expensive childcare facilities to save money.

That was the last thing the industry needed, given the supply of childcare centres has outpaced demand for several years. Surplus capacity and low occupancy rates have been a persistent sector headwind and reason why some childcare-related stocks have underperformed.

So why is Quadrant, a top private equity firm, making such a big bet on childcare now?

Like many industries, childcare has had a strong recovery after Covid. After halving at the peak of the pandemic last year, operator occupancy has mostly returned to pre-Covid levels and there has been no structural change to childcare demand as result of the pandemic, said Charter Hall Social Infrastructure REIT during its interim-results presentation in late March.

Longer term, my view is that three inter-related factors are at play. The first is Australia’s falling unemployment rate. As the economy booms, more people will return to the workforce, driving higher childcare demand. More people returning to the office after working at home, either temporarily or permanently, will add further demand for childcare, at the margin.

The Federal government will want to lift the workforce participation rate, particularly among women. The key to making it easier for more women to return to work – a smart policy measure if ever there is one – is making childcare more accessible and affordable.

The second factor is higher government assistance for childcare. Business forecaster IBISWorld says pressure for further childcare funding reforms “will likely continue to mount” during and after Covid, as more parents seek more flexible childcare options amid a changing workforce landscape. Greater emphasis on individualised childcare options will feature.

Private equity firms might be betting on the government increasing childcare assistance (it introduced temporary free childcare during the peak of the Covid crisis) in response to growing public pressure. Industry bodies want an increase in subsidies to improve childcare affordability for parents.

The third factor is moderating growth in supply of childcare centres. There was annual growth of 3.7% in 2020, down from 4.2% in 2019, noted Charter Hall. That’s still too high, but it’s possible that Covid-related disruptions will slow the supply of new childcare centres, giving childcare demand more of a chance to catch up.

Quadrant’s acquisition is timely. It follows a bidding war this year between Busy Bees Early Learning and Alceon Private Equity for the ASX-listed Think Childcare Group. (Busy Bees prevailed). Again, the deal reinforced the renewed interest in childcare assets.

Here are two ways to play the childcare sector on ASX:

1. Arena REIT (ARF)

Arena, an owner of childcare properties, has been one of my favoured niche Australian Real Estate Investment Trusts (A-REITs) for years.

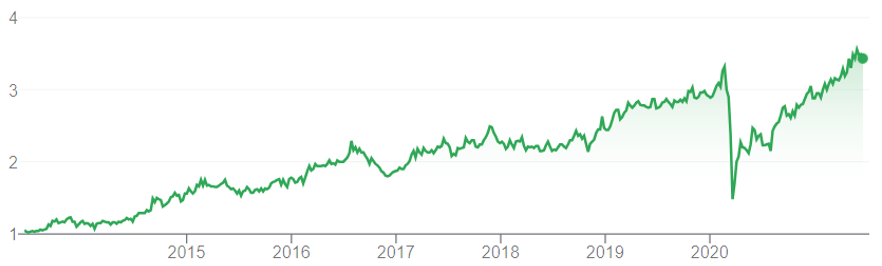

I first wrote favourably about Arena in 2015 for The Switzer Super Report at $1.61 a unit. It now trades at $3.40. Arena has been an excellent income stock given its reliable distribution: the annualised average five-year total return is 18% (assuming distribution reinvestment).

Arena is a lower-risk way to play the childcare sector compared to investing in childcare operators, some of which have been volatile over the years. Owning an A-REIT that owns childcare properties leased to childcare operators appeals.

Arena had 234 Early-Learning Centre (ELC) assets and 11 healthcare properties worth $1.017 billion at December 2020. This month, Arena reported a $72 million increase (7%) in the value of its properties (that were independently assessed) for six months to June 30, 2021.

The weighted average lease-expiry profile of Arena was 14.7 years in the first half of FY21, up 0.7 years on the same period in FY20. Simply, Arena is signing tenants to slightly longer leases, reducing occupancy risk. Its gearing is modest and its distribution keeps edging higher.

The well-run Arena has a scalable strategy. Each year, it buys a small number of ELC assets and divests other properties trading at a substantial premium to book value. Compared to childcare operators that have to deal with parents and children, and respond to Covid-induced demand fluctuations, Arena remains one the best ways to play the sector.

More will be known when Arena reports its full-year result on June 30. I expect another solid set of numbers given the childcare sector’s recovery since the peak of Covid, and as Arena benefits from rising prices for quality childcare properties.

Chart 1: Arena REIT

Source: ASX

2. G8 Education (GEM)

I have had positive and negative views on G8 Education, a leading childcare operator, for this Report over the past few years. That’s not surprising given the volatility in G8 shares.

To recap, I became bullish on G8 Education’s prospects in mid-2018, believing the market had become too negative on fears of childcare-centre oversupply.

But after G8 Education almost doubled from its 52-week low to $3.60 in less than six months, I turned bearish in the stock in early 2019.

G8 shares tumbled to $1.83 in late 2019 and I became bullish on it again. But my positive view was too early, although nobody knew Covid was just around the corner. G8 Education now trades at $1.01, having mostly tracked sideways for the past nine months.

G8 was hammered after its latest full-year profit even though the profit was in line with management guidance. G8 said its occupancy rate was better than it expected, but the market was spooked by an occupancy rate turning lower and down on 2019 levels.

At the Annual General Meeting in May 2021, G8 said its like-for-like occupancy rate of 70.8% was 3.3% below 2019 pre-Covid levels. The gap had closed by 0.7% since February.

The market will need to see a stronger recovery in occupancy before G8 shares are re-rated. But the occupancy rates are at least heading in the right direction and G8 has plenty of initiatives underway in its regional and metro centres to boost use of its facilities.

After several tough years, G8 should have much-needed tailwinds as Australia’s job market recovers strongly, female labour-force participation rises slightly and pressure builds for the Federal government to increase childcare assistance, making it more affordable for families.

At $1.01, G8 is on a forward Price Earnings (PE) multiple of almost 12 times and yielding 5.9% fully franked, on Morningstar numbers. That looks undemanding given the unfolding recovery in childcare demand and growing interest in the sector from private equity firms.

As a volatile small-cap stock, G8 does not suit conservative investors (long-term investors seeking sector exposure are better off with Arena). The company has had plenty of issues after arguably growing too quickly through acquisition and underinvesting in service quality and training – something management is addressing.

Active investors will find more appeal in G8 at the current price, given the amount of bad news factor into the stock. If the market continues to overlook G8’s leverage to a stronger recovery in childcare demand over the next five years, a private equity firm will surely take a closer look.

I note that Allan Gray Australia, one of this market’s best contrarian investors, have increased its stake in G8 over the past 12 months.

For all the Covid-related challenges, the long-term drivers of childcare are firmly intact: a growing population of young children; more kids spending more time in childcare centres; and more women entering the workforce and families needing childcare. And, hopefully, higher Federal government assistance to make it easier for families to afford childcare.

Chart 2: G8 Education

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 23 June 2021.