One of the biggest investment themes that’s emerging is that of electrification and decarbonisation, as the world grapples with policies that attempt to move away from reliance on fossil fuels.

Of course, an investor has to sift through what is wishful thinking, and what is actually possible. However, on any objective reading of what the world’s policymakers are trying to do on the energy front, the need for much of Australia’s menu of mineral commodities can only grow – not only for some of the traditional staples, like nickel and copper, but also for lithium, rare earth elements, metals like manganese, cobalt, molybdenum and vanadium, and mineral materials like graphite (a form of carbon), high-purity alumina (HPA, a high-purity form of aluminium oxide) and borate (minerals containing boron, which is an essential material for green energy generation, magnets for electric vehicles and wind turbines, and energy storage applications).

Many of these are found in Australia; alternatively, quite a few ASX-listed companies have access to deposits of them overseas.

There are dozens of ASX-listed companies offering access to these “new-age materials.” It is a minefield for investors, with many of the kind of “boomtime” predictions that have bedevilled the stock market since the first Australian exchanges sprang up on the goldfields in the 1850s.

There are as many alluring stories as there are companies – here are three that I think might have the goods.

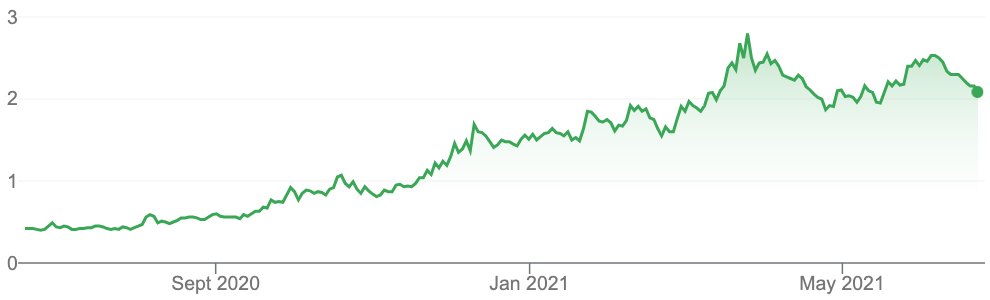

1. Element 25 (E25, $2.09)

Market capitalisation: $321 million

One-year total return: 408%

Three-year total return: 112.5% a year

Analysts’ consensus valuation: n/a

Earlier this month, WA manganese producer Element 25 (manganese is the 25th element on the periodic table) sent off the first shipment of manganese concentrate from its Butcherbird open-pit mining and processing operation, located in the southern Pilbara region. Butcherbird Australia’s largest manganese deposit, with 260 million tonnes of manganese ore in resources and a current projected mine-life of at least 42 years.

While the vast majority of manganese is used in the steel industry, where it is used in specialty alloys, the metal is emerging as an increasingly important ingredient for EV batteries, with potential supply constraints for nickel and cobalt forcing battery manufacturers to look to high-manganese cathodes to produce the huge amount of cathode material that will be required by the EV industry in coming years. Stage One of the operation will produce high-quality manganese concentrate for export markets; in Stage Two of its operation Element 25 plans to convert the concentrate material into high-purity manganese sulphate monohydrate (HPMSM) for EV batteries. Stage Three envisages using a combination of carbon offsets and renewable energy to produce battery-grade “zero carbon manganese,” a term that Element 25 has trademarked.

The investment case for Element 25 is that manganese is the cheapest and most abundant of the NMC cathode materials (nickel-manganese-cobalt), and that while nickel and cobalt have supply constraints, manganese does not. For cobalt, there are serious ethical concerns around production methods: and technically, the industry may be moving to a solution that uses only nickel and manganese.

Element 25 (E25)

Source: Google

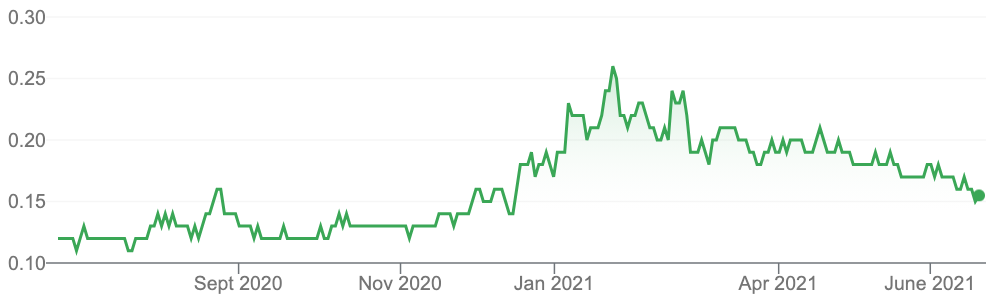

2. Hastings Technology Metals (HAS, 15.2 cents)

Market capitalisation: $261 million

One-year total return: 25%

Three-year total return: –12% a year

Analysts’ consensus valuation: 32.5 cents (Thomson Reuters)

It’s quite a race among Australian miners to emulate Lynas Corporation (LYC) as an ASX-listed supplier of rare earths, and eat into Lynas’ enviable position as the only supplier outside China, in a world that is both desperate for more supply of rare earths, and desperate for non-Chinese sources.

Hastings Technology Metals, Arafura Resources (ARU), Australian Strategic Materials (ASM), Northern Minerals (NTU), Peak Resources (PEK), Vital Metals (VML) and Greenland Minerals (GGG) are all jockeying for this position, the latter three with deposits outside Australia.

Hastings Technology Metals has stolen a march on its rivals – several of which describe themselves as “shovel-ready” – by calling itself “Australia’s next rare earths producer,” but it is starting to put flesh on the bones of its presumptiveness.

Hastings’ flagship is the Yangibana rare earths project in the Upper Gascoyne region of Western Australia, which incorporates a mine and a proposed beneficiation and hydro-metallurgy processing plant, which will treat rare earths deposits hosting high neodymium and praseodymium contents (Lynas’ major product, and the main rare earth product used in the world, is NdPr) to produce a mixed rare earths carbonate that will be further refined into individual rare earth oxides at processing plants overseas. Neodymium and praseodymium are vital components in permanent magnets which are used in a wide and expanding range of advanced and high-tech products including EVs, wind turbines, robotics, medical applications and others.

Hastings also owns the Brockman heavy rare earths and rare metals deposit, near Halls Creek in Western Australia. The deposits at Brockman contain high quantities of the heavy rare earths niobium pentoxide and zirconium oxide, as well as the rare metals tantalum, hafnium and gallium.

Hastings has progressed Yangibana project to feasibility stage, based on initial mine life of at least 15 years and payback in 3.4 years, and has two German offtake contracts and further ones planned using European Union (EU) funding. In April, it signed a binding offtake contract with thyssenkrupp for high-grade mixed rare earth carbonate (MREC) from Yangibana, under which thyssenkrupp will take 60% of annual Yangibana production volume for the first five years and 33% for the second five years.

Hastings also has a “master agreement” with thyssenkrupp’s fellow German company Schaeffler Technologies to supply a “substantial volume” of MREC from Yangibana over an initial period of ten years: Schaeffler wants an independent supply chain for its e-motor business for the EV industry. There is also a smaller offtake agreement with Chinese company Sky Rock Rare Earth New Materials: with these three deals, Hastings says almost two-thirds of planned production is contracted for the first ten years.

In statements to the stock exchange, Hastings has said that Yangibana has:

- The highest content of key rare earth elements for any known rare earth project (the higher the Nd-Pr content, the lower is the separation cost);

- The highest value rare earths project for ore value per kilogram, at up to 175% higher-value ore products than any current producing rare earth project;

- World-leading grades of Nd and Pr = 52% of the TREO (total rare earth oxides) values; and

- 92% of its ore value is represented by the four key elements required for the electric vehicle market.

To this it has now added an announcement earlier this month, saying that new drilling results at the Simon’s Find area of the Yangibana deposit contain “the highest NdPr levels of any known rare earths project in the world.” Fully permitted to long-life production and with project finance and offtake talks well advanced, construction is scheduled to start at Yangibana this year, ahead of projected first output in 2023.

Hastings Technology Metals (HAS)

Source: Google

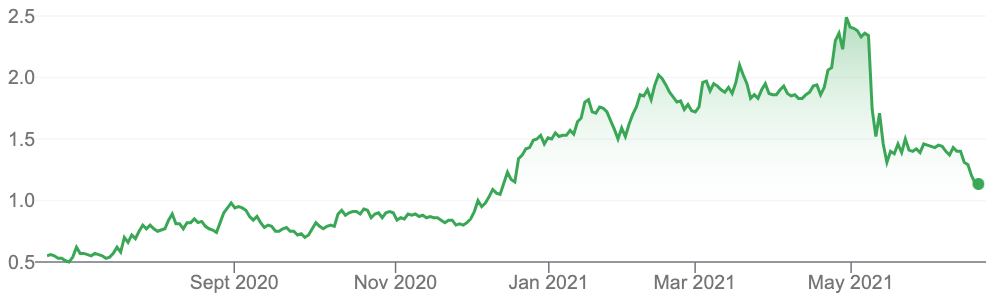

3. American Pacific Borates (ABR, $1.10)

Market capitalisation: $430 million

One-year total return: 107.3%

Three-year total return: 58.7% a year

Analysts’ consensus valuation: n/a

The ASX-listed American Pacific Borates, which listed in 2017, owns the fully permitted Fort Cady borate mine in California, from which it plans to produce borates, materials containing boron. The usual uses for boron have been in areas such as fibreglass, ceramics and fertilisers, but boron has huge potential emerging uses in the EV industry, both in the permanent magnets in the powertrain of an EV and in the lithium-ion batteries (and in the highly promising lithium-sulphur battery technology) used in EVs and renewable energy. (As an each-way bet on energy technologies, borates are also used in nuclear power plant reactors.) There is also potential for boron nitride nanofilms to replace antibiotics in the medical field, while protecting against bacterial and fungal infections.

However, borate supply is limited, with the market dominated by a duopoly of Rio Tinto (which produces in California) and the Turkish government-owned Eti Maden: more than 60% of supply comes from Turkey with Rio Tinto supplying another 20% from its Boron operation in California.

It is a similar story to rare earths – just swap Turkey in for China as the country on which the global supply chain has an unhealthy dependence, which users of the commodity would dearly like to see reduced by new supply diversity.

At Fort Cady, which has been mined previously, American Pacific Borates plans to produce boric acid and sulphate of potash (SOP), used in fertilisers, which the company says would give it a “negative cash cost of production” – in other words, more than pay for the borate production. Fort Cady is fully financed for the US$50 million ($66.7 million) initial production phase, which was initially scheduled for the September quarter of 2021, with initial product scheduled for 2022.

However, last month, ABR alarmed investors with the announcement that it would defer Phase 1A, and shift its focus to a larger borate operation and production of borate specialties combined with sales of boric acid. But the company expects the larger initial operation to have stronger financial metrics, and be more attractive for US market involvement – ABR is also planning to list its shares on a US stock exchange.

American Pacific Borates (ABR)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.