“Picking & sticking” is a good investment strategy, provided what you select is a quality company in an industry that has growth ahead. Of course, picking is the easy bit. Sticking and being patient is the more challenging part of this money-making play.

Personally, I’m ‘walking the talk’ with A2Milk, which is a quality company (arguably the best of breed globally) but needs international travel to get back to normal. It also would benefit from Canberra and Beijing getting along better, but once again that will be a waiting game. As Rod Stewart’s ex-wife, Kiwi Rachel Hunter, once told us about the miracles that lay ahead for our hair with Pantene shampoo: “It won’t happen overnight but it will happen.”

“Picking & sticking” with troubled travel stocks has worked for the likes of Qantas, Webjet, Corporate Travel Management and Flight Centre, but is it time to put more into your investment chests ahead of another leg up?

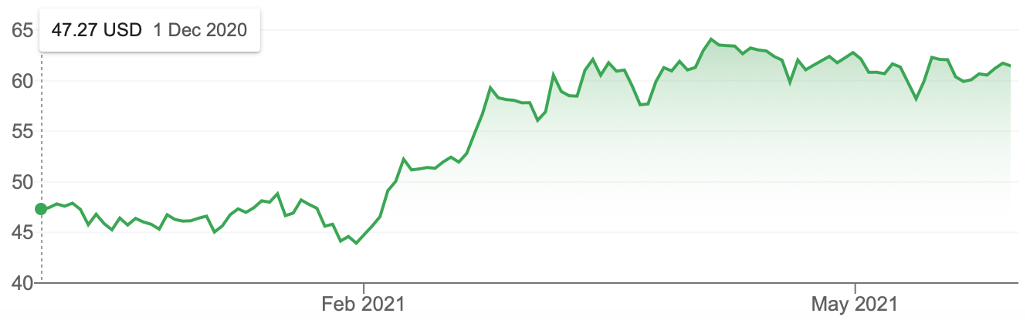

I started to ponder this question after reading a CNBC story about the comeback of travel businesses and travel stocks as the US gets vaccinated. The chart below looks at how the share price of US airline Southwest Airlines (LUV) has spiked since jabbing escalated in February this year.

Southwest Airlines (NYSE:LUV)

So what’s happening here? And could our slow vaccination programme create a buying opportunity for the patient “picker & sticker”?

Update on our flying kangaroo

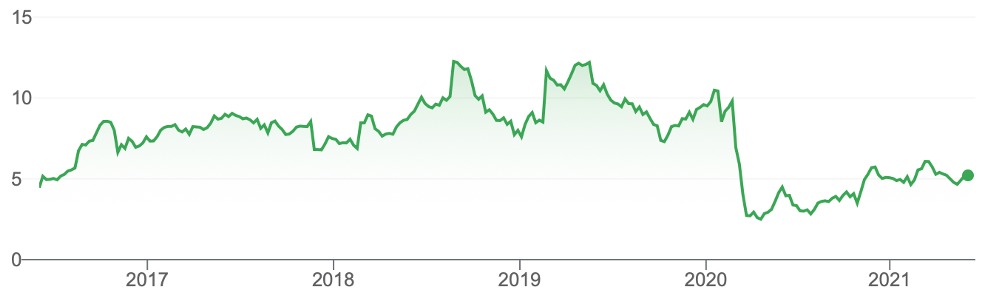

Let’s start with the flying kangaroo first, which has been up after the Coronavirus crash of the market but has lost a bit recently. This chart looks promising, in a nice uptrend despite some down days. And at $4.77 today against being over $7 before the pandemic suggests further rises should be expected when vaccines have been delivered locally and we’re flying overseas by early next year.

Qantas (QAN)

The experts surveyed by FNArena see an 18% rise ahead but given the new version of Virgin Australia since delisting, I’d argue the rises over the next two years could be better than that.

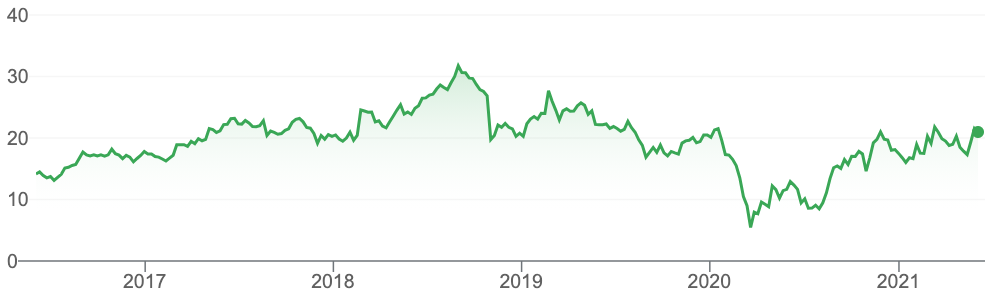

Here’s the Webjet story

Webjet was smashed by COVID-19, hitting lows around $2.50. It has since rebounded over 100% to $5.16 but this company too should benefit from the normalisation of international and even domestic travel. So seeing a $7 price within two years doesn’t seem to be a big call. If that happened, it would be a 40% rise or 20% per annum for a “picker & sticker”.

The analysts see a 4.3% rise in the short term. But I don’t care about the short term with these stocks.

Webjet (WEB)

Surprised by Corporate Travel Management (CTD)!

One stock that has surprised me with its resilience has been Corporate Travel Management (CTD). This stock really has rebounded stronger than I expected, given the disruption to business travel and the threat of stay-at-home star business rivals, such as Zoom, Microsoft Teams and Skype.

This was a $21 stock before the virus cruelled travel but it’s now a $21 stock again! That said, in 2018 before it copped a lot of negative press (which was largely because a hedge fund was trying to make money out of press releases riddled with negative takes on the business), it was a $30 stock.

Corporate Travel Management (CTD)

Not surprisingly, the analysts think the company has 0.5% upside but, over time, I’m sure it will gain from the coming back of overseas travel.

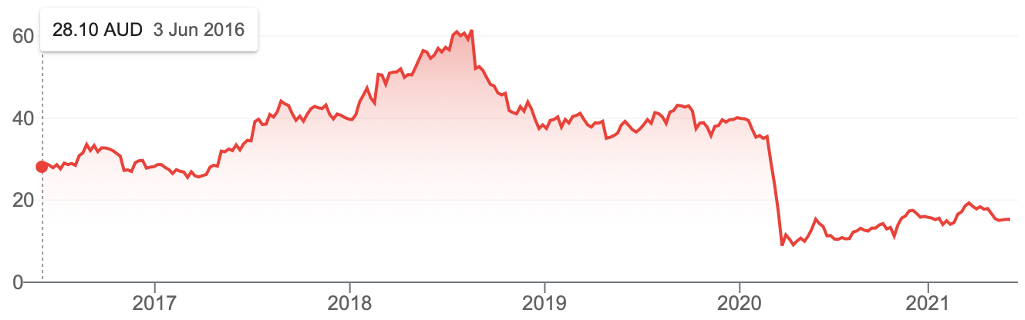

What about Flight Centre?

Finally to Flight Centre (FLT), which has fallen from share price grace. It’s now around $15 but was $40 before the Coronavirus crash. And in 2018, it was a $61 stock!

Flight Centre (FLT)

My thoughts

The experts see 9.8% upside but, over time, you’d expect better results and share prices. However, I have two takes on Flight Centre. On one hand, its business is challenged by the new age and digital disruption. But against that, I’ve always been surprised at how good Graham ‘Skroo’ Turner is at reinventing his travel business with a fantastic brand name. I bet we won’t see a $60 share price but could it be a $20 stock? Yep! And making $5 on a $15 outlay is a 33% gain, which I could easily take on any investment, even over a two or three-year period.

If you allow time into your “flying the friendly skies” investment equation, you could see some great numbers from these travel-related stocks. That’s my call and I’m sticking with it, unless good reasons tell me not to.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.