GrainCorp (GNC) is an Aussie company whose core business is the receiving and storage of grain and related commodities. It also provides logistics and markets these commodities. Founded by the NSW government as a public sector agency, it was privatised in 1992 with a majority of shares being transferred to grain growers, and listed on the Australian Securities Exchange in March 1998.

Since July 2000, GNC’s operations have extended into other Australian states by amalgamations with other grain handling operations. The company operates an extensive network of rail-linked storages across south-east Australia, as well as seven export terminals in Brisbane, Geelong, Gladstone, Mackay, Newcastle, Port Kembla and Portland. In November 2009, GNC expanded into North America and in July 2011 extended its reach into Europe. And Julia Lee thinks GNC is a buy.

“Agricultural stocks like many sectors on the market moves in cycles,” Julia said.

“After drought and bushfires over the last half decade, the cycle has turned,” she added.

“The company is in an upgrade cycle.

“Moisture levels in the soil are positive as is the outlook for rain over the next three months, which bodes well for the planting of winter crops.

“Pricing remains strong globally, which is supporting margins and demand for Australian grains.

“While GrainCorp has recently upgrade its guidance for FY21 to EBITDA $225-285 million, given the positive drivers, we believe there’s an upside bias to these forecasts,” Julia said.

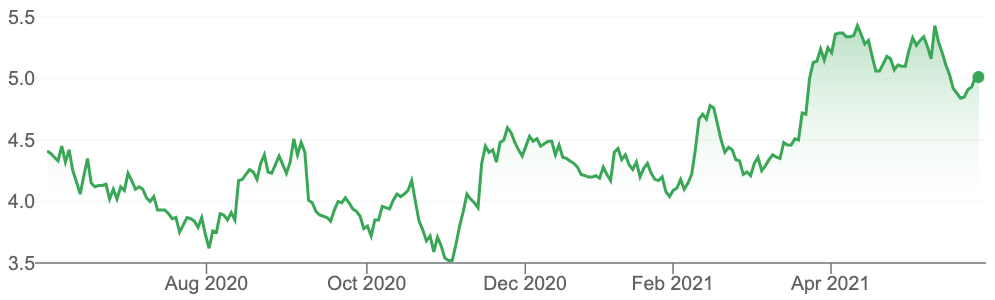

GrainCorp (GNC)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.