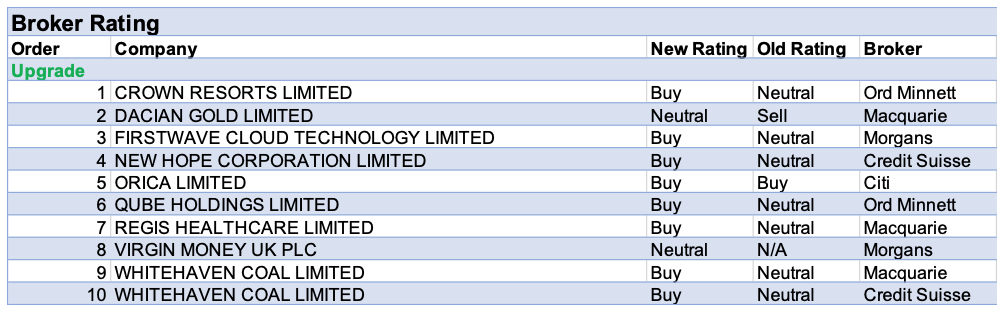

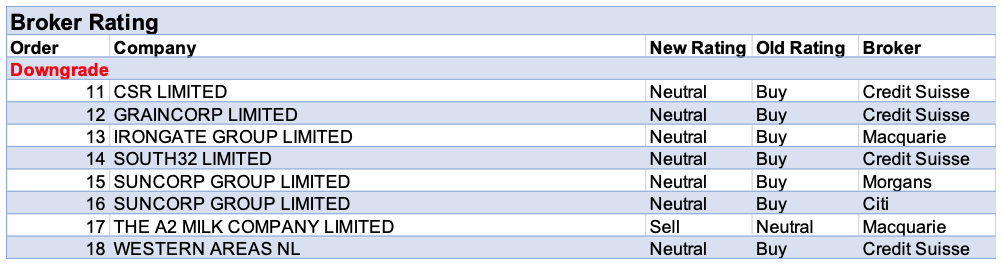

For the week ending Friday 14 May, there were 10 upgrades and 8 downgrades to ASX-listed companies by brokers in the FNArena database.

Both Macquarie and Credit Suisse upgraded their ratings for Whitehaven Coal to Outperform from Neutral. While Credit Suisse is wary of the miner’s operational stability, both brokers agree the share price slide has been overdone against a backdrop of rising thermal coal prices. Macquarie forecasts upside to operating income, margins and free cash flow.

Citi and Morgans attribute recent share price strength as the primary reason for downgrading their ratings for Suncorp Group. Citi retains confidence in the medium-term growth profile, and while Morgans is happy enough with recent margin targets set by management, earnings upside seems limited in FY22.

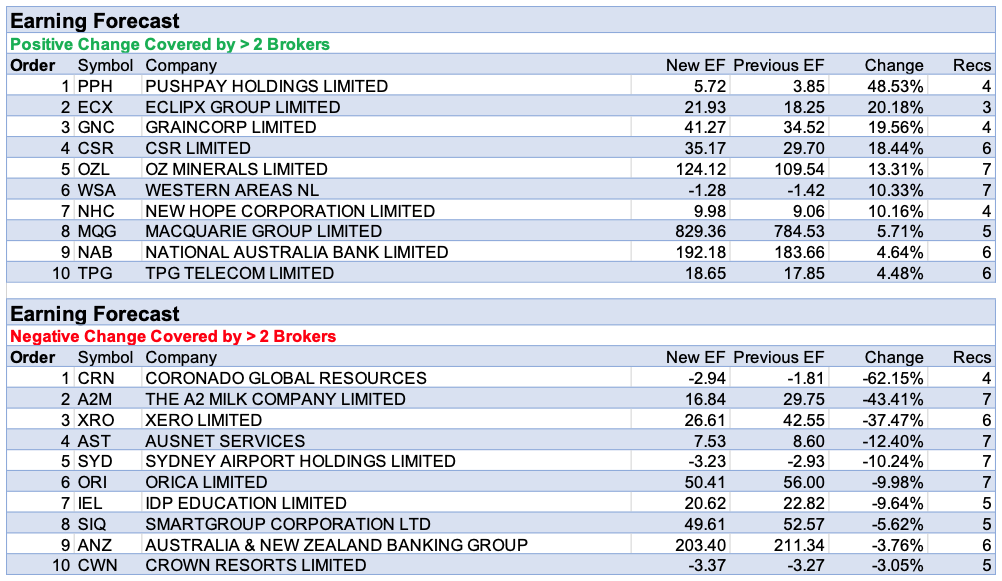

Credit Suisse downgraded metallurgical coal forecasts for the June quarter and December half, which had the effect of reducing net profit forecasts for Coronado Global Resources by circa -67%. The company led all comers for the highest percentage downgrade to forecast earnings by brokers in the FNArena database. The ‘beneficiary’ was none other than a2 Milk which was bumped down to second.

Xero was next as earnings for the second half and FY21 were well below consensus expectations. Most brokers were comfortable looking through the lower-than-expected FY21 margin and FY22 margin guidance, due to structural tailwinds and strong management execution. This was underscored by rising revenues. Morgan Stanley was less sanguine and expects FY22 margins will be more like the previous 15-20%, rather than the first half’s 30%. Even then, the broker believes the company is adopting the right strategy for creating long-term shareholder value.

Pushpay Holdings received the highest percentage upgrade to forecast earnings in the FNArena database though brokers were fairly restrained in commentary on the outlook. Ord Minnett sees success for the Catholic opportunity as far from guaranteed, a long way off and requiring material investment in the near-term. Also, while Macquarie felt the FY21 result provided some comfort around customer churn, there was no meaningful acceleration in customer growth.

As mentioned last week, first half results for Eclipx Group exceeded the expectations of three brokers on the FNArena database. Profit was 43% above Morgan Stanley’s estimate on materially higher end-of-lease profits (up 107% on the pcp), despite volumes being -14% lower. It’s felt the $20m share buyback signals confidence in the underlying growth trajectory and the balance sheet.

Positivity reigned among brokers after GrainCorp reported strong first half results and materially upgraded FY21 guidance. The initial outlook for the 2021/22 east coast winter crop is considered encouraging by Morgans. UBS goes further and believes significant upside remains if FY22 produces a bumper crop and feels the solid balance sheet offers M&A or capital return potential.

Finally, CSR received general applause from brokers for cost control and higher-than-expected dividends and consequently also received material upgrades to broker earnings forecasts.

In the good books

CROWN RESORTS LIMITED (CWN) was upgraded to Buy from Hold by Ord Minnett B/H/S: 3/2/0

After reading into the board’s silence over the two recent offers, Ord Minnett sees Crown Resorts offering additional upside at current share price levels and lifts the target price to $15 from $11. The rating is upgraded to Buy from Hold. The broker estimates the company’s real estate value alone (on an FY23 basis) provides $5.85bn of value and $8.60 per share of total value to shareholders. While the announcement of the NSW casino levy was no surprise, it did remove the discount bidders applied on fears the Independent Liquor & Gaming Authority (ILGA) would never grant a NSW casino licence, explains the analyst.

FIRSTWAVE CLOUD TECHNOLOGY LIMITED (FCT) was upgraded to Speculative Buy from Hold by Morgans B/H/S: 1/0/0

Third quarter results were announced along with a $6m placement and a Share Purchase Plan for up to $2.5m (both at 9cps). Morgans estimates a balance of 12-15m of cash after the raise, which should fund the company for 12-24 months. The broker highlights meaningful progress with nine Level 1 and 49 billing partners already signed. These existing partners are considered to have the potential to generate around $70m of revenue and make the company profitable. Morgans reduces the target to $0.16 from $0.18, which represents significant upside to the current share price. The rating is increased to a Speculative Buy from Hold.

NEW HOPE CORPORATION LIMITED (NHC) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 2/2/0

Post the heavy rainfall during late March in Australia, Credit Suisse notes an already tightly supplied thermal coal market was further squeezed, leading the NEWC Index benchmark prices to remain elevated above the circa US$90/t levels. The broker has increased the near-term thermal coal price forecast to US$82/US$70 per tonne from US$75/US$65. As a result, New Hope Corp’s earnings forecasts have been lifted by 14-44% in FY21-22 with minor flow-on impacts to outer years. Credit Suisse upgrades to Outperform from Neutral with a target price of $1.30.

ORICA LIMITED (ORI) was upgraded to Buy from Neutral by Citi B/H/S: 2/5/0

After first half results, Citi upgrades the rating to Buy from Neutral in the belief the cyclical low for ammonium nitrate (AN) volumes has been reached. An increase in group volumes into FY22 is expected, and FY22 will likely be more representative of a normalised year. Higher volumes will see unit opex lower, and combined with modestly improved pricing should lift underlying earnings (EBITDA) from $840m in FY21 to $1.05bn in FY22, forecasts the broker. The target price is increased to $15.40 from $13.60.

QUBE HOLDINGS LIMITED (QUB) was upgraded to Accumulate from Hold by Ord Minnett B/H/S: 2/3/1

Ord Minnett upgrades Qube Holdings to Accumulate from Hold after upgrading FY21 profit (NPATA) forecasts by 6%. This reflects better-than-expected port volumes and transport conditions in the logistics and ports/bulk segments. Additionally, the Federal budget has extended the asset purchase write-off for purchasers of eligible equipment until FY23. The broker expects this to lower the cash tax payable for the company. The analyst sees potential for a material deleveraging of the balance sheet and/or capacity to re-invest in accretive customer led projects or acquisitions. The target price rises to $3.31 from $3.23.

REGIS HEALTHCARE LIMITED (REG) was upgraded to Outperform from Neutral by Macquarie B/H/S: 1/3/0

Post the additional funding announced by the Australian government in response to the report by the Royal Commission into Aged Care Quality and Safety, Macquarie has updated its forecasts. The broker sees the additional funding as positive for the residential aged care sector. For Regis Resources, the broker notes operating income changes are in line with the broker’s previous analysis. Also, Macquarie thinks additional funding will lead to better cash flows. Led by an improved funding outlook, Macquarie moves to Outperform from Neutral with the target rising to $2.95 from $2.1.

WHITEHAVEN COAL LIMITED (WHC) was upgraded to Outperform from Neutral by Credit Suisse and to Outperform from Neutral by Macquarie B/H/S: 7/0/0

Post the heavy rainfall during late March in Australia, Credit Suisse notes an already tightly supplied thermal coal market was further squeezed, resulting in the NEWC Index benchmark prices to remain elevated above circa US$90/t. The broker has nudged up its near-term thermal coal price forecast to US$82/US$70 per tonne from US$75/US$65. While some earnings upside has been offset by a moderated met coal price deck, overall Whitehaven Coal’s operating income forecast is lifted by 3-8% over FY21-22. While still wary of the miner’s operational stability, Credit Suisse admits the stock’s share price deterioration since the March quarter makes it look cheap and thus the broker upgrades to Outperform from Neutral. The target remains $1.55.

Whitehaven Coal’s share price has decreased -32% over the past 12 months while thermal coal prices have increased 91% over the same period. With spot prices higher than expected, Macquarie notes there is upside to operating income, margins and free cash flow. The broker sees value in the company not targeting growth and rather harvesting cash from existing operations and increasing returns to shareholders over the remaining life of operations. Led by thermal coal prices, the broker increases its earnings forecasts by 130% and 290% in a spot price scenario for FY22 and FY23. Macquarie upgrades to Outperform from Neutral with a $1.70 target.

In the not-so-good books

CSR LIMITED (CSR) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 2/4/0

A good cost outcome more than offset the decline in CSR’s FY21 building products revenue, observes Credit Suisse. Group net profit was 3% higher than consensus while operating cash flow was 11% above Credit Suisse’s forecast. Building products revenue was in line with consensus and the operating income was $10m higher than expected which can be attributed to SG&A savings of $31m, $11m greater than expected. The broker increases its average end-market growth to 6.3% and -1.8% for FY22-23, an increase of 4.3% and 8.5% led by stronger housing approvals data and less negative non-residential segment. Credit Suisse downgrades to Neutral from Outperform with the target rising to $6 from $5.60.

GRAINCORP LIMITED (GNC) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/1/0

GrainCorp upgraded its FY21 guidance with the higher grain carry-out providing additional support for FY22. Credit Suisse notes the weather forecasts point to above-median winter rainfall and therefore production upside for 2021-22. While the upgrade is likely due to favourable trading outcomes, Credit Suisse notes the company did achieve a substantial structural improvement in efficiency. The broker expects $242m from Agribusiness in FY21 – a circa $100m improvement in operating income. Credit Suisse downgrades to Neutral from Outperform with the target price decreasing marginally to $5.54 from $5.59.

SOUTH32 LIMITED (S32) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 5/2/0

Credit Suisse has increased South32’s net profit estimates by 1-4% over the forecast period after considering the broker’s updated commodity price deck including higher aluminium and alumina spot prices, partly offset by lower nickel. The broker, anticipating the market is heading into a protracted deficit from next year, has materially lifted its aluminium price forecast by circa 18-51% over 2021-25. Even so, the broker notes South32 has rallied circa 25% year to date led by strengthening demand in materials and pricing and Credit Suisse views the share price as full. Thus, Credit Suisse downgrades to Neutral from Outperform with the target rising to $3 from $2.90.

WESTERN AREAS NL (WSA) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 4/3/0

Credit Suisse has reduced its nickel price forecasts by -6-19% over 2022-23 leading the broker to reduce earnings forecast for Western Areas. Credit Suisse lowers its rating to Neutral from Outperform with the target dropping to $2.40 from $2.45.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.