I’m a big fan of using the major ETFs (exchange traded funds) to quickly adjust exposure to the Australian share market. Once I get the market risk right, I can then “take my time” to select or deselect the stocks for my portfolio.

The major ETFs are so easy to trade on the ASX. They have deep markets, the spread between the “bid” and the “offer” is narrow, and with brokerage rates on the way down, the transaction costs aren’t going to kill me.

ETFs can also be used by long-term investors (including first-timers) who do not want the hassle of managing individual stocks. Or by investors for the core of their portfolio, with the focus directed to generating the “alpha” (or outperformance) from the stocks making up the satellite.

Because they are index tracking and the management fees are low, you are “guaranteed” to get index performance, less the tiny management fee. Nothing more, but importantly, nothing less.

But there are alternatives to ETFs, particularly the broad-based listed investment companies (LICs) such as Australian Foundation (AFI), Argo (ARG) or Milton Corporation (MLT). Although actively managed, they are big funds and their returns tend to be highly correlated to the index. Historically, periods of material outperformance (or underperformance) have been rare.

The broad-based listed investment companies aren’t as liquid as ETFs, but their management fees are almost as low. There are times when they are a better investment alternative than ETFs. And for the thousands of investors in these LICs, putting capital gains tax considerations to one side, there are times when they should sell their LIC and invest the proceeds in an ETF.

Here is a run-down on the ETFs, the LICs, the best in each class, and when to use one or the other.

Exchange Traded Funds (ETFs)

The major ETFs track an index and invest in accordance with the make-up of that index on “autopilot”. If the index weight for (say) the Commonwealth Bank is 7.9%, very close to 7.9% of the ETF will be invested in Commonwealth Bank shares. The Manager doesn’t try to beat the market – all he/she does is to try to reduce the index tracking error.

With their low management fees, they should provide a return that closely matches the return of the underlying index. Nothing more, nothing less.

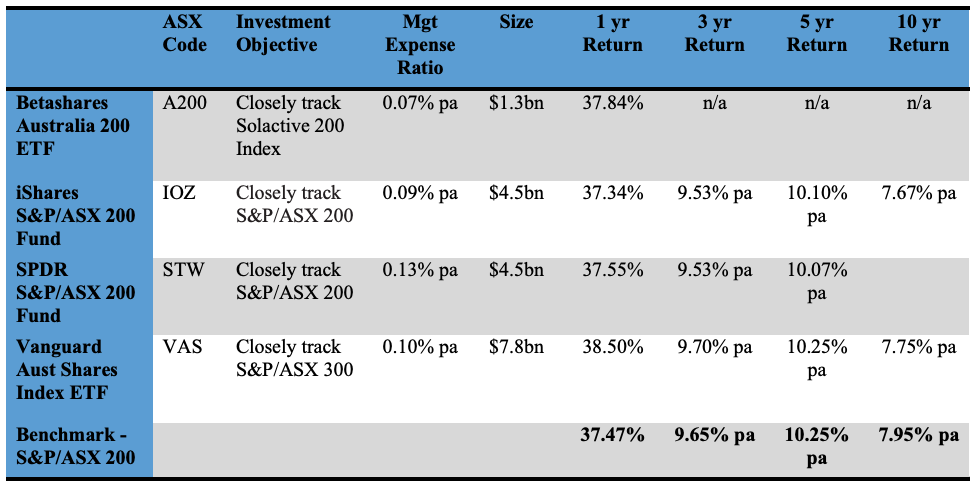

The major broad market ETFs are set out below. Blackrock’s iShares IOZ and SPDR’s STW track the S&P/ASX 200, while Vanguard’s VAS tracks the broader S&P/ASX 300. Betashares has the A200, which tracks an index of 200 ASX companies produced by Solactive rather than S&P.

Performances (after fees) to 31 March 2021 are shown below, as is the benchmark S&P/ASX 200 accumulation index.

Major Exchange Traded Funds

Returns to 31/03/21. Source: Respective Managers

The advantages of an ETF over a LIC are improved transparency and market pricing. ETFs update their NTA (net tangible asset value) every working day, sometimes intraday (IOZ , A200 and VAS), and due to their fungibility and appointment of market makers, you will buy or sell an ETF within 0.10%/0.20% of the NTA of the fund. The premium or discount should always be small. Unlike LICs, they don’t offer share purchase plans.

Each of the major ETFs pays distributions on a quarterly basis. As they effectively replicate the market, their distributions will yield around 2.7%, franked to 75% (that is 75% fully franked and 25% unfranked). This will increase as dividends increase (for example, each of the major banks is set to increase their dividend compared to those paid in 2020), but will not get back to 2019 levels quickly. A yield of around 3.3% can be expected (based on the current market prices).

The major LICs

There are 3 major broad market LICs – AFI, Argo Investments and Milton Corporation. They are big, professionally managed and very credible investment companies. Milton Corporation, for example, was listed on the ASX in 1958 and has paid a dividend to its shareholders every year since.

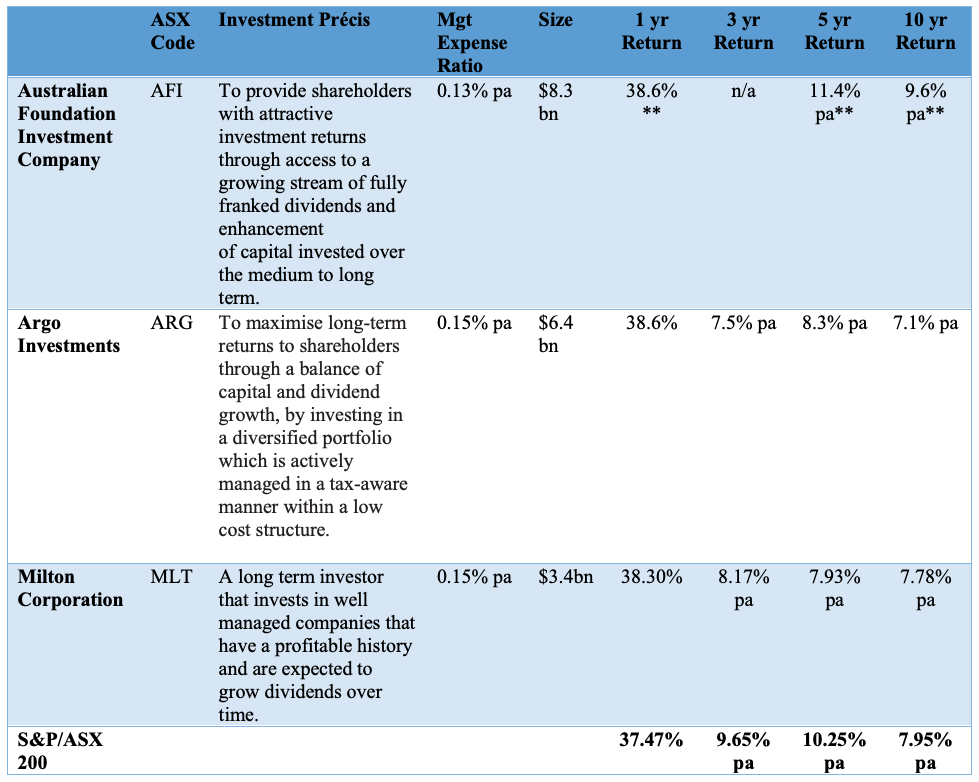

LICs are actively managed. That said, these broad market LICs essentially invest in the major blue chip companies, placing considerable emphasis on companies that have reliable earnings, pay fully franked dividends and have an ability to grow these dividends. An investment précis is set out below.

After a couple of tough years, the major LICs have marginally outperformed the market over the last 12 months as “value” style investing has come back into fashion. Over the long term, they have generally delivered index performance. For example, Argo boasts a 20 year return of 8.6% pa, compared to the index’s return of 8.4% pa. Milton has done even better at 9.08% pa. However, over 3yrs, 5yrs and 10yrs, they are behind the index.

Australian Foundation (AFI) includes franking credits when it measures its return, and benchmarks against the S&P/ASX 200 Accumulation Index, adjusted for franking credits. This adds in the order of 1.6% to its total return.

The smallest of the LICs, Milton Corporation, holds a materially over-weight position in W H Soul Pattinson (SOL). SOL is Milton’s largest investment at 8.6%. The Chair of Milton (Robert Millner) is also the Chair of Soul Pattinson. Brickworks, which is arguably another related company, is Milton’s tenth largest holding with a weighting of 2.0%.

Major Listed Investment Companies

*Returns to 31/03/21. Source: Respective Managers

** Includes franking credits

An advantage of LICs over ETFs is that they usually offer share purchase plans, which allows shareholders to subscribe for new shares at a marginal discount to their underlying value or NTA (Net Tangible Asset value). Dividends, while only paid twice a year (compared to the quarterly distribution cycle offered by ETFs), are usually fully franked. They are currently yielding about 3.2% pa, but with a higher final dividend expected in FY21, this is likely to rise to around 3.5%.

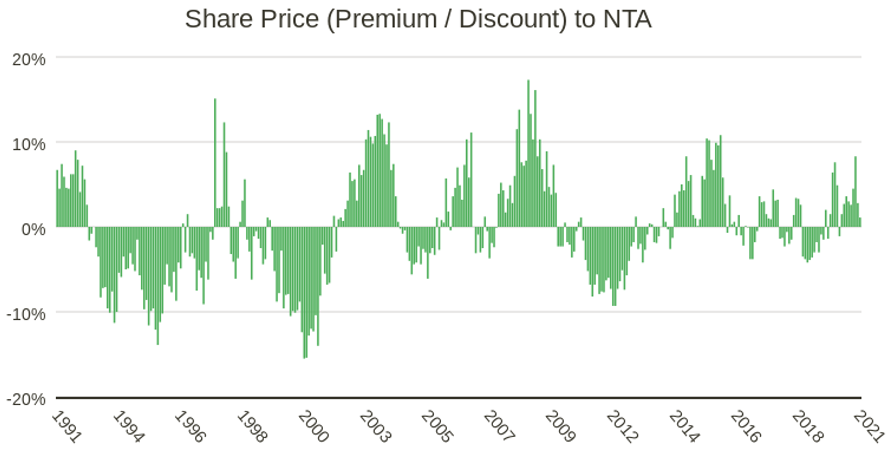

A disadvantage is that as close ended funds where new investors become investors by buying shares from other investors on the ASX, the LIC can at times trade at a significant premium or discount to its NTA.

LIC or ETF?

The tables above demonstrate that despite their different investment styles, objectives and benchmarks, the broad market LICs can be expected to deliver over the long term close to an index return, and the ETFs an index return less a fraction. While this is not a “given”, the outcome is not that surprising given the concentrated nature of the domestic sharemarket and the relatively conservative investment style adopted by the LICs.

So, an answer to the question – “LIC or ETF, which is better?” – comes down to the premium or discount that the LIC is trading at.

The graph below shows Argo’s share price compared to its underlying NTA over the last 30 years. At times, it has traded at a discount of up to 15% and at other times a premium as high as 17%. Over the last decade, this range has narrowed to around 5% either way, most recently trading at a premium.

Argo’s Share Price to NTA – Relative Premium/Discount since 1991

Source: Argo

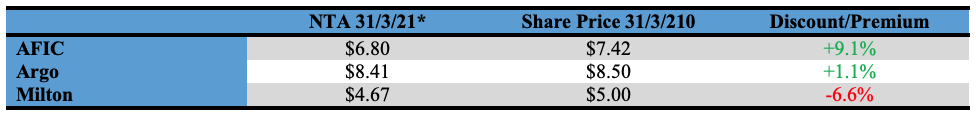

At the end of March, both AFI and Argo were trading at a premium, AFI at an astonishing 9.1%. Milton, on the other hand, was trading at a discount of 6.6%.

Discount/Premium (as of 31 March 2021)

*NTA sourced from Company Reports

LICs will generally pay a higher dividend yield and frank these at 100%. For many investors, this is a significant benefit. But their returns will be more volatile, they are not as liquid, and despite the recent improvement in performance, they haven’t done as well in the last decade as they did in the decade before. Potentially, size and other factors are working against them.

So, my rule of thumb is:

if the LIC is trading at a (not immaterial) discount, then invest in the LIC;

otherwise, invest in the ETF.

Calculating the premium or discount

LICs are required to publish their NTA each month (ASX announcement, plus on their website), which is generally available by the 5th working day of the following month. They publish two NTAs, one that is done on a pre-tax basis, and the other that provides for tax on unrealised gains/losses in the portfolio. As LICs are long term holders and won’t be wound up, use the pre-tax NTA.

Outside the monthly publication, you can estimate their NTAs. Take the last published NTA, remove the impact of any dividends, and adjust up or down by the percentage movement in the S&P/ASX 200 since the calculation date (i.e. end of month). To calculate the premium or discount, compare the estimated NTA with the current market price on the ASX.

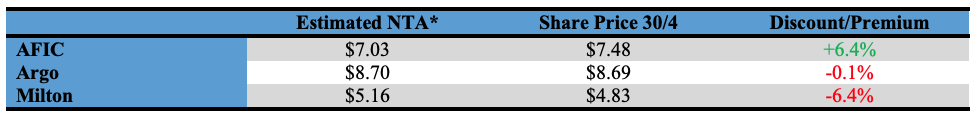

Listed below is my estimate of the discounts for the major LICs as at the close last Friday (30/4/21) based on a move up in the S&P/ASX 200 accumulation index in April of 3.47%. (I am less confident about Milton Corporation because its largest holding, SOL, fell by 3.4% in April).

Estimated Discount/Premium (as of 30 April 2021)

*NTA estimated by Switzer Report, based on reported 31 March NTA adjusted for the movement in the S&P/ASX 200 Accumulation Index in April

Which one?

My ranking of the ETFs (based on management fees and index tracked) is:

- VAS (Vanguard)

- IOZ (iShares)

- STW (SPDR)

There is little in this assessment – any of these ETFs could be selected. It is heavily influenced by fee, and a longer term view that smaller companies will in time do better and hence a preference to opt for a broader index (the S&P/ASX 300) rather than the S&P/ASX 200. I have excluded Betashares A200 from this ranking as I want to see a track record and in particular, how closely the Solactive index matches the S&P/ASX 200.

With the LICs, AFI is trading at a 6.4% premium and is a sell on this basis. Milton on paper looks interesting given the discount, but its holding in Washington Soul Pattinson leaves me feeling uneasy. I should point out that I am not querying SOL’s investment track record, but rather, it just doesn’t feel right from a governance perspective. So right now, Argo gets the gong. If AFI comes back to a discount at about the same level of Argo, I think it would marginally preferred.

My order right now is:

- ARG (Argo)

- MLT (Milton Corporation)

- AFI (Australian Foundation Investment Company LT (Milton Corporation)

Buy ETFs, sell AFI

For those looking to establish or increase exposure to the market, or take a short term position, exchange traded funds currently represent better value than broad based LICs. Australian Foundation (AFI) on the basis that it is trading at a premium is a sell (potentially, buy VAS as a substitute).

Premiums and discounts can change quickly, so always check these before investing in LICs or ETFs.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.