It’s heartbreaking watching COVID tear through India. As a second wave infects more than 350,000 Indians in a day, one wonders how the country will contain the crisis.

Sadly, India has many hard months ahead. A large population, cramped living conditions and inadequate healthcare are creating a COVID humanitarian crisis. Our thoughts are with India.

India’s dire COVID outbreak could halt equities momentum in emerging markets this year. Flows into emerging-market funds had been strong as investors bet on the vaccine rollout and a quickening recovery in global economic growth.

However, India’s COVID nightmare reinforces the risks for other emerging markets. The pandemic is far from over, particularly for developing nations that face COVID vaccine shortages. An even bigger division between developed and developing nations will emerge.

My view is more capital will flow out of emerging-market funds in coming months as investors retreat to the relative safety of developed markets. That will create a buying opportunity in emerging markets, albeit not as attractive as this time last year.

To be clear, I’m not suggesting investors buy emerging-market funds today. Instead, that portfolio investors keep a close watch on quality emerging-market equity and debt exposure over the next few months, with a view to increasing portfolio allocations.

It’s not just COVID. Growing talk of military conflict with China over Taiwan is concerning. Australian Defence Minister Peter Dutton recently said the chance of a military conflict involving China and Taiwan “should not be discounted”. Rhetoric alone can rattle markets.

This means the two key countries in emerging markets – China and India – have growing risks for investors. Then, there’s the political wild card of Russia and continuing high daily COVID cases in Brazil, Argentina and other South American countries.

That’s the bad news. The good news is that the medium-term outlook for emerging markets (1-3 years) is still strong, assuming COVID is contained by then.

Higher commodity prices are good for large mineral and energy producers, such as Brazil, Russia and Indonesia. This commodities cycle can be stronger for longer as global economic demand in developed nations and, later, emerging markets roars back to life after COVID.

Weakness in the United States dollar is another positive. Emerging markets tend to outperform when the Greenback falls. Company financing risks ease, and foreign capital usually flows into emerging markets. When the Greenback rises, emerging markets can underperform.

The US dollar has mostly moved sideways in 2021 against a basket of major currencies. But the long-term trend, in my opinion, is down due to the US’s unparalleled money printing and massive fiscal deficit. That should be good for emerging-market equities.

COVID could have an upside for emerging markets in terms of reform. Some governments in developing nations have implemented reforms during the pandemic to help their economies. The response to COVID might be the kickstart some emerging markets need.

Digitisation is another factor. As in developed markets, COVID is condensing a decade’s worth of digitisation into years in some emerging markets. Imagine the potential of telehealth and online education and shopping in developing markets that lack physical infrastructure.

These and other factors explained why investors became more bullish on emerging markets this year. India’s COVID outbreak has quelled that enthusiasm for now, but a positive longer-term story for those markets remains.

The International Monetary Fund (IMF), for example predicts India’s economy will grow at 12.5 per cent in 2021. That will come down, but the expected growth in India and other key emerging markets is still miles ahead of developed nations.

Australian investors need a cautious approach to emerging markets. They can be highly volatile and do not suit risk-averse investors. I prefer active management over passive management in emerging markets given the risks. But some emerging-market allocations are best served through Exchange Traded Funds (ETFs) because of the lack of active fund choice.

Growth investors (5-10 years before retirement) might allocate 5-10% of their portfolio to emerging markets and Asian (ex-Japan) equities. Although these markets have potential for high returns, emerging markets should never be a large part of diversified portfolios, given the risks.

Here are three emerging market ETFs to consider over the next three months. Currency risk is a consideration given each fund is unhedged.

1. BetaShares Legg Mason Emerging Markets Fund (EMMG)

The actively managed fund invests in a portfolio of emerging-market shares. Martin Currie, a specialist investment manager of Franklin Templeton, manages the fund.

About 60% of the fund was invested in China, South Korea and Taiwan at end-March 2021. India comprised 12% of the fund and the rest was mostly spread among smaller emerging markets.

By sector, almost a third of the fund is invested in technology. Roughly another third is invested in large consumer discretionary and financial stocks. Key holdings include Alibaba Group, Tencent Holdings, Samsung Electronics, Taiwan Semiconductor and LG Chem.

The fund returned 30.8% over one year to end-March 20201, a few percentage points better than its benchmark index (after fees). Martin Currie has a good record in emerging-market investing and I like that the fund is actively managed and holds lots of large tech stocks.

The annual management fee is 1%.

Chart 1. BetaShares Legg Mason Emerging Markets Fund

Source: ASX

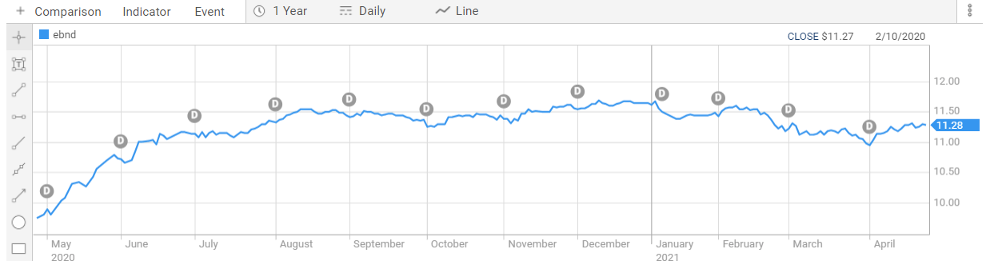

2. VanEck Emerging Income Opportunities Active ETF (EBND)

Investors typically buy equities in emerging markets for capital growth. Buying debt securities in emerging markets for income is a less-considered strategy.

At face value, the volatility of emerging markets does not suit income investors. That is true for those with a conservative portfolio. But emerging-market debt securities have had less volatility than popular yield instruments, such as Australian listed hybrids, over the past decade.

Improving global economic growth, hyper fiscal stimulus worldwide, low interest rates and a slightly weaker US dollar should support emerging-market debt in coming years.

The VanEck Emerging Income Opportunities Active ETF invests in about 90 government and corporate bonds, mostly investment grade, in developing nations. Its largest holdings include government bonds in Chile, South Africa, Mexico and Indonesia.

EBND returned 16.6% over 12 months to end-March 2021, well ahead of the 2.3% return from its comparable benchmark fund. Of that, about 6% came from yield. Over three months, the total return is -3.2%, but still well ahead of its benchmark.

Like the BetaShares emerging-markets fund, the VanEck fund is actively managed to account for higher volatility in emerging markets. So far, the VanEck fund is performing much better than its underlying index due to its active management.

The annual management fee is 0.95%.

Chart 2: VanEck Emerging Income Opportunities Active ETF

Source: ASX

3. ETFS-NAM India Nifty 50 ETF (NDIA)

As mentioned, it’s too soon to buy into India given COVID uncertainty. Daily infection rates could be higher than reported. Also, COVID could affect sentiment towards the Modi government and slow its reform process. My view is COVID’s medium-term effect will be to quicken India’s reforms and digitisation.

Launched in April 2018, the ETFS-NAM India Nifty 50 ETF provides exposure to the Indian economy through the NSE Nifty 50 Index. The Nifty 50 is about two thirds of India’s stock market by value, and that country’s equivalent of our S&P/ASX 200 index.

Just over half the ETF is invested in the financial and technology sectors. The median market capitalisation of companies in the index was $23.1 billion at end-March 2021. Although the ETF is used for emerging-market exposure, its constituents are mostly tech and banking giants.

The NSE Nifty 50 Index recovered strongly last year after the first wave of COVID, up almost 44% over 12 months to end-March 2021. However, on a year-to-date basis, the index is up only 5.8%, reflecting recent weakness in Indian equities during the second COVID wave.

The ETF’s management fee is 0.69%. Tracking-error risk (the difference between an ETF’s return and its underlying index) is another consideration.

Chart 3: ETFS-NAM India Nifty 50 ETF

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 27 April 2021