Iron ore prices are now pushing beyond US$180 per tonne, and strong demand from China is now leading to forecasts of prices soon hitting US$200 per tonne.

“Whilst over the horizon there are headwinds for FMG such as increasing supply from South America and China’s potential move to diversify away from Australia, at the moment FMG is a money-printing machine,” said Michael.

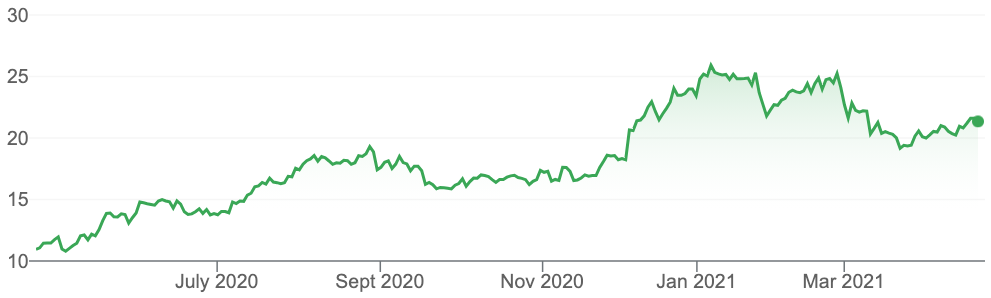

“These longer-term concerns helped contribute to a decline in FMG’s share price across January – March.

After selling FMG in January, Michael said he bought back in at the end of March, once it was clear that a lot of heat had come out of the share price.

“FMG’s share price performance these last few weeks is confirming to me that it has further to run and current levels still represent an attractive buying opportunity if you are looking to get invested.

“Towards the end of March we could see the share price decline slow down and then FMG’s share was able to jump higher off $19, which was an obvious support level.

In the last few weeks, Michael says FMG’s peaks and troughs have been moving higher and higher.

“This is telling us that investors are stepping back into FMG and are buying the dips.

“With FMG shares still quite low compared to their January peak, current levels provide a good margin of safety for new buyers,” he said.

Fortescue (FMG)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.