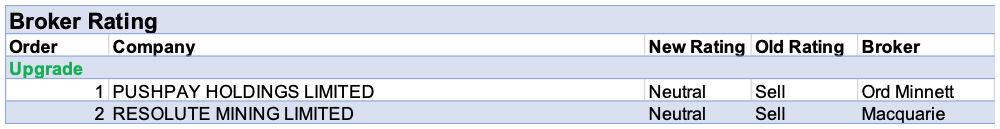

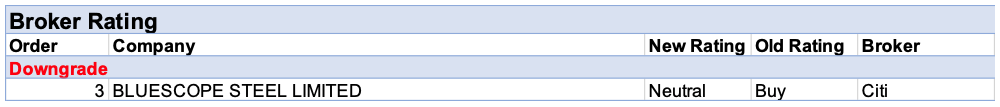

For the week ending Friday 9 April there were two upgrades and one downgrade to ASX-listed companies by brokers in the FNArena database.

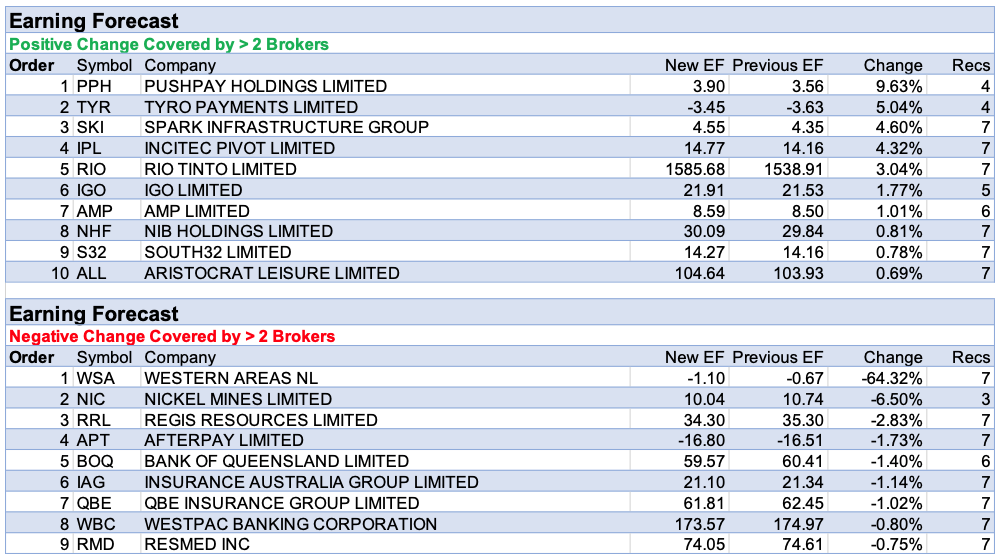

Pushpay Holdings received the largest percentage increase in forecast earnings by brokers last week. Ord Minnett upgraded the rating to Hold from Lighten and lowered the target price to $1.95 from $4.45. While highlighting that a stock sell-down may be over, after several key holders completed transactions, the broker suspects competitor offerings are closing the gap, particularly in the small and medium church segments. However, Ord Minnett notes the company’s CCB acquisition adds an important opportunity to capture a larger share of existing and new customer digital spend beyond the giving platform.

The second placed Western Areas released third-quarter preliminary production numbers that either met or exceeded broker forecasts. Reasons for the outperformance included a drawdown in stocks, better grades and an improved performance from the Forrestania project. Of course the prevailing nickel price helps and prompted the analyst to raise earnings forecasts for FY22 and FY23 by 80% and 55%, respectively.

In the good books

PUSHPAY HOLDINGS LIMITED (PPH) was upgraded to Hold from Lighten by Ord Minnett B/H/S: 1/3/0

Ord Minnett upgrades the rating to Hold from Lighten. The target price is lowered to $1.95 from $4.45 due to caution over one-off benefits of covid-19 and front book growth in FY22 and beyond. New customer acquisition is expected to become more difficult. The analyst highlights total customers remained flat between FY20 and 1H FY21 and suspects that competitor offerings are closing the gap, particularly in the small and medium church segments. One positive is that sell-downs from several key holders have now largely completed removing an overhang of stock, explains the broker.

RESOLUTE MINING LIMITED (RSG) was upgraded to Neutral from Underperform by Macquarie B/H/S: 0/2/0

Macquarie upgrades its rating on Resolute Mining to Neutral from Underperform with the target rising to $0.50 from $0.45. Resolute Mining’s updated life of mine (LOM) plan for the Syama operation shows expected production to be 176kozpa over the next 11 years. The miner expects production from the Tabakoroni underground mine from 2024-30. Production from the mine is expected to replace oxide production from 2024 onwards and is better than Macquarie expected.

In the not-so-good books

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.