Share market “bubbles” are usually associated with loss-making tech stocks or minerals explorers that soar during bull markets – not renewable energy companies.

My money is on renewables as the next great share market bubble. Perhaps that bubble is already here with US electrical-vehicle star Tesla worth an astonishing US$635 billion.

To be clear, I like renewable energy stocks and clean-energy investing. Climate change is the great megatrend of our time. Companies on the right side of that trend will create huge value, just as laggards that take too long to transition from fossil fuels will destroy wealth.

Nor am I comparing renewables to other share market bubbles, such as the dot.com boom and bust at the turn of the century. This trend has far more substance and longevity.

Also true is that share market bubbles can be great for early investors and terrible for those late to the party. Recent gains in clean-energy stocks have further to run.

The speed of change in renewables – and the trillions of dollars flowing into renewable assets and funds globally – will drive prices higher, possibly irrationally so, in some cases. A renewables frenzy is underway, thanks to long overdue policy pledges.

Consider recent changes. Joe Biden’s presidency in the US and China’s pledge for carbon neutrality by 2060 are huge turning points for renewables. For the first time, the market has the regulatory certainty to price assets for a carbon-neutral future.

Simply, markets will pay more for renewable assets and less for those that rely heavily on fossil fuels or cannot make the transition to lower carbon emissions.

As the race to own lower-emitting assets intensifies – across asset classes – it’s likely that some companies, particularly those late to address climate change, will overpay for assets.

That’s good if you own these assets and can sell when sentiment peaks. And bad if you buy renewables late or your portfolio is full of companies with stranded fossil-fuel assets.

Clean-energy proponents usually buy tech developers, suppliers to wind and solar farms, or resources companies that produce minerals for the clean-tech revolution. Lynas Rare Earths (LYC), for example, is more than fivefold from its 52-week low, such is the interest in rare earths supply.

For conservative, income-focused investors, I prefer the big New Zealand renewables utilities that are dual-listed on the ASX.

As an aside, I follow dual-listings on the ASX closely because several terrific NZ companies have joined this market in the past decade, most notably Xero (now solely listed on the ASX under code XRO), Meridan Energy (MEZ), Mercury Energy (MCY) and Contact Energy (CEN) stand out. Tilt Renewables (TLT), a NZ-based owner of wind farms and solar assets is another.

Tilt soared this year on takeover approaches, and its board has recommended an acquisition proposal from an Australian/NZ consortium that includes the Queensland Investment Corporation, Future Fund and AGL, and Mercury NZ.

The Tilt deal is further evidence of the market’s heated competition to acquire renewables assets. Expect more deals like this as companies hunt for renewables assets.

As large-cap utilities, Meridian and Mercury won’t soar in price over one year, like Tilt. But both companies suit long-term portfolio investors who want exposure to clean-energy trends, and some yield along the way.

Of the two, I prefer Meridian on valuations grounds. Here is a snapshot of each stock:

1. Meridian Energy (MEZ)

Meridian is one of NZ’s largest companies and its biggest electricity generator. It owns five wind farms and seven solar power stations in NZ; and two winds farms and three hydro-power stations in Australia. All its electricity comes from renewable sources.

Meridian also has a retail electricity business (through its Meridian and Powershop brands), and energy software and dam-management businesses.

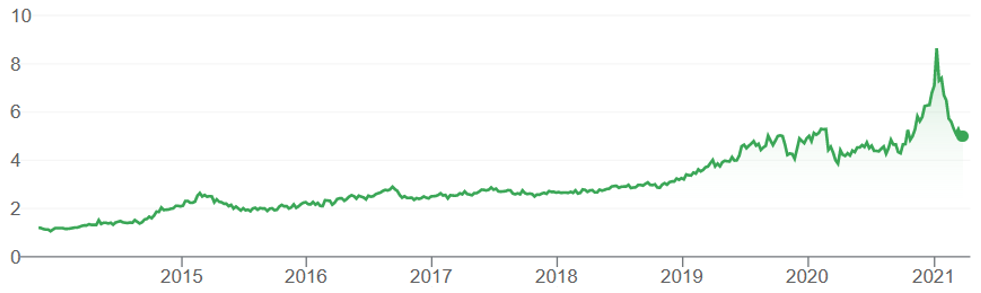

The stock hovered between $2-3 for a few years after its 2013 privatisation and dual listing on ASX (it is also listed on the NZX exchange). Meridian shares almost doubled in the fourth quarter of 2020 to $8.64 as interest in renewable assets soared.

The shares have since retreated to $4.64, providing a more attractive entry point for long-term investors. Poor rainfall in NZ that limited Meridian’s hydroelectric output, and market expectations of lower wholesale electricity prices in NZ in the medium term, weighed on the stock.

Meridian has an excellent market position. As a vertically integrated renewable electricity provider, it accounts for about a third of NZ’s total electricity output. The company has performed strongly in recent years, acquiring customers and increasing its market share.

Like other leading renewable energy providers, Meridian has years of growth ahead as decarbonisation in NZ and Australia encourages more industrial users to change from fossil fuels to grid electricity. This transition will drive higher demand growth for renewable energy.

Rio Tinto’s planned closure of its Tiwai Point aluminium smelter in NZ – recently extended to 2024 – is a headwind. The NZ aluminium smelter previously terminated its 572MW electricity supply agreement with Meridian. The extended exit period helps (Meridian negotiated an amended contract) although the smelter’s eventual closure provides uncertainty for the NZ electricity market.

Meridian is no screaming buy, even after recent heavy price falls. But it has excellent hydro-electric assets, a strong balance sheet and capacity to buy or build renewable assets.

Longer-term, Meridian has strong leverage to rising prices for renewable assets. Investors who want higher portfolio exposure to renewable trends – without speculating on emerging clean-tech companies or miners – should consider Meridian.

Chart 1: Meridian Energy

Source: ASX

2. Mercury NZ (MCY)

Like Meridian, Mercury Energy is a key NZ electricity generator and retailer, accounting for about 15% of the country’s electricity supply. The NZ Government owns 51% of Mercury.

The company generates all its electricity from renewable sources, including nine hydro stations, five geothermal stations and a solar farm (Mercury is building its first wind farm).

As mentioned, Mercury was part of the consortium that recently bid for Tilt Renewables. The deal, subject to shareholder approval, is expected to proceed.

Although the deal looks expensive, Mercury already owned 20 per cent of Tilt and get Tilt’s wind-farm and development projects in NZ – strategically important assets.

Also like Meridian, Mercury will be affected by the Tiwai Point aluminium smelter closure and expected lower wholesale electricity prices in the medium term, as the NZ energy market moves back into balance.

Mercury’s high free cash flow should support steady dividend increases and enable more acquisition bids, such as that for Tilt. Mercury has one of its industry’s lowest-cost structures thanks to the renewable focus, and it is well run.

The main issue is valuation. Mercury soared from a 52-week low of $3.66 to $7.17, before retreating to $5.88. It fell less than Meridian, possibly because it is relatively less affected by the Tiwai Point closure. At the current price, Meridian looks fully valued.

Morningstar values Mercury NZ at $3.70 a share. The research house expects solid earnings growth from Mercury in the next few years, but believes increases in new-generation electricity supply in NZ and lower wholesale prices will weigh on its valuation.

Morningstar’s view is reasonable. My sense is the Tilt deal will look attractive in the next few years as renewable asset valuations keep climbing.

Longer term, Mercury is a good company with an good position in renewables. But patient portfolio investors should watch for better value in its stock, to build a position.

Mercury would look more interesting for portfolio investors, closer to $5. However, it wouldn’t surprise if Mercury, in the short term, pushed towards its 52-week high of $7.17, such is the market’s booming interest in renewable assets.

Chart 2: Mercury NZ

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 23 March 2021.