My local pub was in a sorry state last year. Like most Victorian pubs, it shut amid COVID-19 restrictions and lockdowns. Roller shutters boarded its windows and doors for months.

Fast forward 12 months and the pub is thriving. It was standing room only (with a pretence of social distancing) when I visited on the weekend. A line of cars queued for its bottle shop.

Listed pub operators and hotel property owners are obvious “reopener” beneficiaries as the vaccine rolls out and life gradually returns to normal. The share market knows this and has factored a health recovery into a recovery in valuations of pub-related stocks.

This rally can go further, although price gains will be slower from here. Pub operator Redcape Hotel Group (RDC), Hotel Property Investments (HPI) and ALE Property Group (LEP) are stocks to watch.

To recap, I’ve been researching alcohol-related stocks this year, mostly wine and craft-beer producers and raw material suppliers. The logic was straightforward: reopenings in European and United States markets would spur demand for on-premises alcohol sales.

I wrote favourably about Treasury Wine Estates (TWE), United Malt Group (UMG) and whisky producer, Lark Distilling (LRK). Australian Vintage (AVG), a microcap best known for McGuigan wines, is another making good progress and looks moderately undervalued (more on AVG in a later column).

That interest led me to pub operators and hotel owners. For all the short-term headwinds, the pubs, bars and nightclubs industry in Australia has good long-term prospects.

First, the bad news: COVID-19. Business forecaster IBISWorld expects revenue in the $12.6-billion Australian pub industry to fall by an annualised 7.7% over five years to FY21.

The pandemic is a big contributor to that fall. Pub industry revenue will fall 16.7% in the current financial year, tips IBISWorld. That’s because on-premises trading in most pubs nationwide shut from late March until June. Or to late October, for Victorian pubs.

Declining per-capita alcohol consumption is another challenge for pubs. Today’s more health-conscious twentysomethings are just as likely to meet in a coffee shop as they are in a pub. Or drink a few beers at a pub rather than the half a dozen favoured by earlier generations.

Online gaming is another threat. Punters who flocked to pubs to bet on horses are increasingly betting on their phone, at home. Lower gambling revenues have weighed on industry profitability.

For all the near-term challenges, pub industry revenue will grow 9.1% annually over five years to FY26, predicts IBISWorld. If that forecast holds, the pub industry will have a strong recovery as domestic tourism roars back to life, boosting on-premises alcohol sales.

Also, industry profit margins are expected to expand as more consumers favour premium alcohol and food options at pubs. The best pubs have upgraded their dining options and added more craft beer, to boost margins. By FY26, the industry will be worth $19.5 billion, says IBISWorld.

Redcape, Hotel Property Investments and ALE Property Group are the main ways to play a pubs recovery in the next few years. Although each stock has solid capital-growth prospects, I’m more interested in their yield at the current price.

A word of warning: these and other Australian Real Estate Investment Trusts (AREITs) could underperform the share market if bond yields keep rising, hurting interest-rate-sensitive stocks.

I don’t expect an inflation breakout or a continued large rise in bond yields, but care is needed with AREITs if interest rates keep rising.

All bets are off if COVID-19 flares up and lockdowns ensue. Were pub stocks to fall heavy on such news, buying opportunities would emerge.

Here are the three stocks:

1. Redcape Hotel Group (RDC)

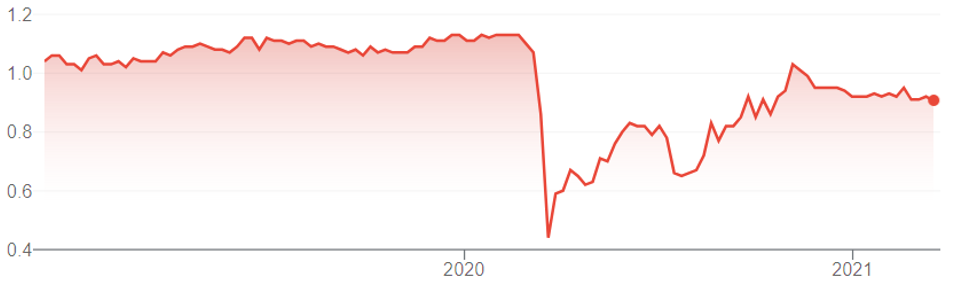

The well-run pub operator listed on the ASX in late 2018 after seeking up to $60 million through the issue of $1.13 securities. After falling to 42 cents at the peak of the COVID-19 share market sell-off last year, Redcape recovered to $1.07 in November. It now trades at 90 cents.

Redcape has 32 pubs. Most are on a freehold basis, meaning Redcape can refurbish them to boost performance. Twenty two pubs are in Sydney, four in Wollongong and six in Queensland.

Redcape’s first-half result for FY21 impressed. Like-for-like revenue rose almost 10% compared to the same time a year earlier. Distributable earnings were up almost 25%.

The business bought four pubs in the first half of FY21 and had a solid lift in valuations for 12 of its properties. That’s a good result given that Redcape, like all pub operators, was coming out of a horrific period for the industry during shutdowns in the second half of FY20.

I like Redcape’s strategy on two fronts. First, its pub portfolio is concentrated in Sydney. Regional pubs will benefit from the increase in domestic tourism, but Sydney pubs (and their valuations) have more to gain when international tourists eventually return.

Second, Redcape is maximising economies of scale as it buys and integrates more pubs. It has a five-year refurbishment strategy and enough balance-sheet firepower to buy more properties.

At 90 cents, Redcape is on a trailing dividend of 8% (after annualising its interim distribution). That’s attractive given the leverage to a pubs recovery. Add in rising pub valuations, and Redcape should deliver a modest double-digit total return over 12 months.

Chart 1: Redcape Hotel Group

Source: ASX

2. Hotel Property Investments (HPI)

The AREIT owns 48 pubs, mostly in Queensland. Of these, 42 are leased to Queensland Venue Co, a joint venture between Coles and Australian Venture Co (backed by private equity giant, KKR).

Like Redcape, HPI was smashed during the sharemarket sell-off in March last year. It fell from about $3.50 to $1.92 in a few weeks as the market correctly feared mass pub closures. HPI has since recovered to $2.94, but remains a long way off its 52-week high.

Also like Redcape, HPI is a recovery play on pubs reopening and patronage returning to normal levels. HPI has a high-quality tenant in Queensland Venue Co and long-term leases. Its weighted average lease expiry is about 11 years, providing rental security.

At $2.93, HPI has a 6.6% forecast yield on Morningstar numbers. HPI’s yield is a little higher than that of listed peer, ALE Property Group, because it has a touch more risk.

HPI’s high exposure to Queensland could be an issue if its State Government lets bottle shops operate without a licence attached to a pub.

However, that regulatory risk has been around a long time and withstood much pressure for change. Woolworths and Coles ongoing exit from pubs operations reduces that risk, and KKR remains strongly committed to its pub business, given its latest acquisitions in this area.

HPI is trading at a fraction below its fair value ($3 a unit), according to Morningstar. The 6.6% yield is attractive given HPI’s long-term leases, and risks are on the upside as the pub industry recovers and asset valuations rise.

Income investors should put HPI on their radar.

Chart 2: Hotel Property Investments

Source: ASX

3. ALE Property Group (LEP)

Like other pub-related stocks, ALE tumbled during last year’s COVID-19 selloff. From a 52-week high of $5.51, it fell to $3.32. ALE now trades at $4.52.

The property investment and funds management group has 86 pubs. About two thirds are in Queensland and Victoria. The pubs were valued at $1.2 billion in December.

Like HPI, ALE has a high quality tenant (currently a Woolworths subsidiary) and long-term leases, with no major lease renewals until 2028. Rising valuations for ALE pubs strengthens the case for significantly higher rents at its property, from 2028.

Nearly all (83 out of 86) of ALE’s pubs are leased on a triple-net basis, which reduces its capital-expenditure obligations.

That makes ALE highly defensive. ALE has had higher insurance and other costs during COVID-19 and extra legal bills. These headwinds should soon pass for ALE.

Like HPI, ALE looks fairly valued at the current price. But its forecast yield of almost 5% is attractive and it too could surprise the market with better-than-expected increases in asset valuations as the pub industry recovers.

The market is factoring in rising book values based on where ALE and HPI trade relative to their net tangible assets. But there’s a lot to like about both AREITs at the current price for investors who position for steady rising distribution from pub AREITs in the next few years.

Chart 3: ALE

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 16 March 2021.