Investors in the Magellan’s $16 billion Global Fund have received an offer to invest further monies. Described as a “partnership offer”, it proposes very favourable terms to invest in this flagship international equities fund.

Apart from the obvious question about whether you should invest or not, I also propose to explore why Magellan is making such an attractive offer. This highlights how fund managers and the investment community value different investment entity structures, in particular open ended vs close ended.

Restructure of funds

In August last year, Magellan announced the restructure and consolidation of its three global retail equities funds – the unlisted Magellan Global Fund, the ASX listed Magellan Global Equities Fund that traded under the ticker MGE, and the ASX listed close ended fund Magellan Global Trust, which traded under the ticker MGG. All the funds were managed according to Magellan’s Global Equities Strategy (although MGG had some different investment parameters) and were subject to the same management fees. MGG was also “currency managed”.

Unitholders approved the restructure in November. This resulted in a single trust with two unit classes – open and closed – both listed on the ASX, as follows:

- Investors in the Magellan Global Fund continue to hold open class units in the Magellan Global Fund, but these are now quoted on the ASX under ticker MGOC;

- Investors in Magellan Global Equities Fund (MGE) received open class units in Magellan Global Fund, which are quoted on the ASX under ticker MGOC; and

- Investors in Magellan Global Trust (MGG) received closed class units in Magellan Global Fund, which are quoted on the ASX under ticker MGF.

The “‘sweetener” – the Partnership Offer

Provided the restructure was approved, existing investors were offered the opportunity to participate in the Partnership Offer. This is now open and is due to close on 23 February.

Under the Partnership Offer:

- Investors can subscribe for $1 of closed class units for every $4 of Magellan Global Fund Units held. The subscription price is the NAV (net asset value) of the closed class units on the day prior to the allotment. As a bonus, they will receive an additional 7.5% closed class units at no cost (with the investment manager, Magellan Financial Group, funding this bonus);

- If they invest, they will also receive (for no cost) one MGF Option for every closed class unit issued. These options are expected to be listed on the ASX under ticker MGFO, and will entitle the holder to acquire one closed class unit it in Magellan Global Fund at an exercise price of 92.5% of the prevailing NAV at the time of exercise. If exercised, the discount of 7.5% will be funded by Magellan Financial Group to ensure that there is no dilution. The options have a three year term, and can be exercised after three months.

Why is Magellan offering the “sweetener”?

Magellan Financial Group wanted to get the restructure approved and needed to incentivise unitholders to vote in favour. There are efficiency, simplification and cost benefits for Magellan in running one trust rather than three.

But more importantly, this was about securing and then increasing close ended funds. Once the money is invested in a close ended fund, it can’t go away – it is there for life. If an investor wants out, they have to find another investor to purchase their units. On the other hand, open ended funds grow or contract depending on whether investors want to invest or exit. Typically, if a fund is performing well, it will grow, and if performance wanes, it contracts in size as investors redeem.

So, the investment community values fund managers with monies in close ended funds (such as listed investment companies or closed class units) at a materially higher premium to those with monies in open ended funds (such as ETFs or open class units).

If all investors take up their entitlement, this will see the closed class units in Magellan Global Fund increasing from approx. $2.2bn to $6.2bn. Not all investors will apply, but if they do attract $1bn of new monies, this will be a significant funds flow, with potentially more to come from the exercise of the options.

As the old adage goes, “there is no such thing as a free lunch”. But that doesn’t mean it can’t be “win” and that you shouldn’t invest.

Should you invest?

Assuming you have the cash or can find the cash, the most important question to ask is “do you want to increase your exposure to global equities?”

If that is yes, the next question to ask is “should this be via the Magellan Global Fund?”, using Magellan’s reasonably concentrated, unhedged “global equities strategy. There are of course alternatives.

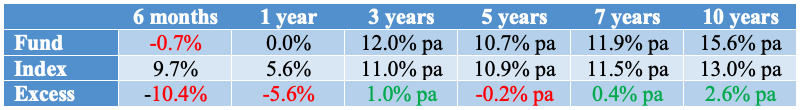

Historically, Magellan’s global equities strategy has been a fantastic performer. Recent performance has been a little underwhelming (see Table below).

It is also unhedged, so if you think the Aussie dollar is going to rise, this could impact performance. Conversely, if you think the Aussie dollar is over-valued, this could boost performance.

If it is yes to both global equities and Magellan, the final question: “is this the right structure?”. While you are being paid a bonus to invest in the closed class units, you could forgo the bonus and invest in the open class units.

In the restructure explanatory memorandum, the Directors of Magellan argued that a benefit would be “greater efficiency in ASX trading of closed class units”. It said that it was more likely that “trading would occur at prices closer to the prevailing NAV”. In other words, there shouldn’t be any material discount or premium to NAV, because investors could readily access both classes of units. Further, the increased size of closed class units would improve trading efficiency.

But investors (particularly financial planners) aren’t always rational, and while this structure of one trust, two unit classes may facilitate an opportunity for arbitrage, discounts or premiums can persist for some time.

Looking at MGF (the closed class units), they traded at a discount of 2.7% according to its last weekly NAV report. By Friday, this had largely evaporated.

One concern is that the overhang of options to be exercised over the next 3 years (effectively at a discount of 7.5% to NAV) could perpetuate a small discount.

Investors need to determine that the sweeteners (the additional units and the free options) sway the argument in favour of closed class units. On balance, and assuming that Magellan’s investment performance doesn’t wane, I think they do.

While “traders” could potentially sell their open class units to invest in the partnership offer, the critical questions for most investors remain as to whether they want to increase their exposure to international equities, and then through Magellan.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.