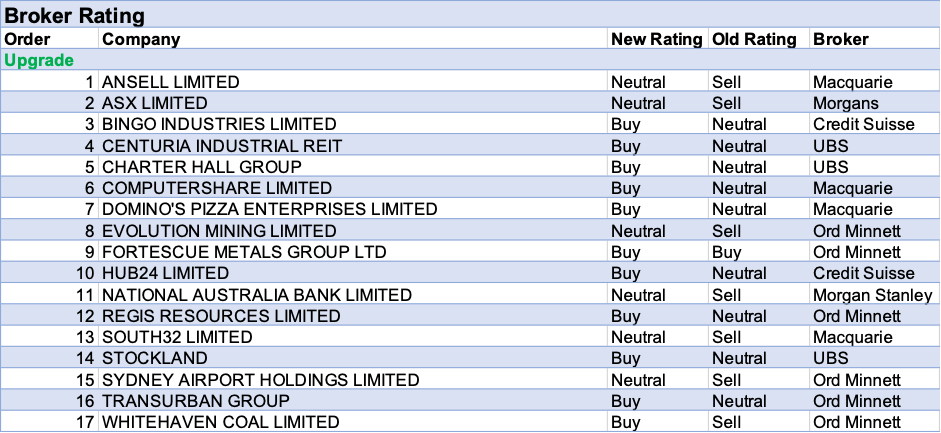

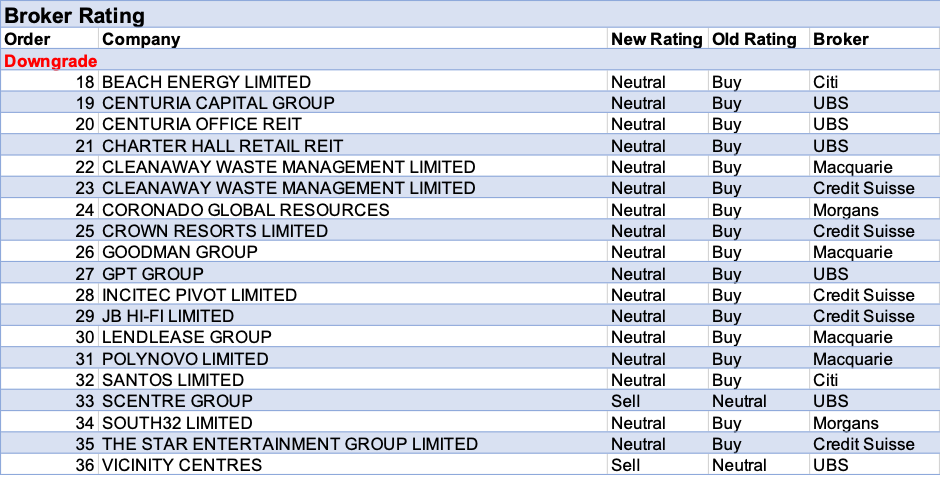

For the week ended Friday January 22, there were 17 upgrades and 19 downgrades to ASX-listed stocks covered by brokers in the FNArena database. Macquarie and Credit Suisse both lowered their ratings for Cleanaway Waste Management to Neutral from Buy. The brokers were surprised that CEO and Managing Director Vik Bansal will step down in the first half of 2021. However, Credit Suisse was more concerned by a currently overvalued share valuation than any worries over a smooth management transition.

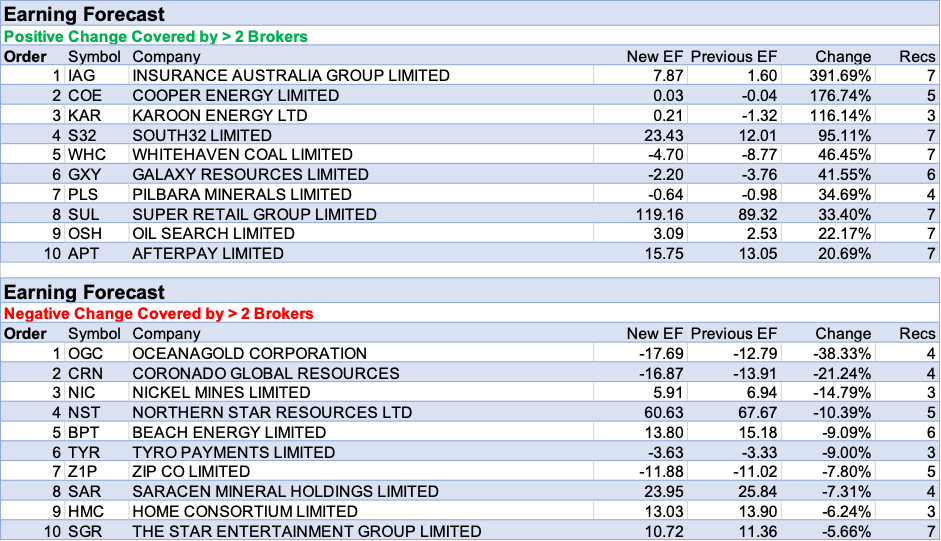

Over the week, Insurance Australia Group had the largest percentage earnings upgrade by brokers in the FNArena database. This largely resulted from some adjustments to earnings for business interruptions claims and other one-off costs that the group will book in the first half.

Cooper Energy and Karoon Energy were the next on the earnings upgrade table. This resulted from Morgans’ suggestion now is an opportune time to invest in the oil and gas sector. The broker has gained additional conviction that both oil and LNG markets have moved off their lows.

Backed by an improved earnings outlook, Macquarie upgraded the rating for South32 to Neutral from Underperform. Morgan Stanley also noted December quarter performance overall was better-than-expected. The soon to be divested South African Energy Coal (SAEC) was universally seen by brokers as an underperformer.

After Ord Minnett marked-to-market commodity price forecasts, both Galaxy Resources and Pilbara Minerals received a material percentage increase in forecast earnings. December sales volumes for both companies had also beaten the broker’s estimates.

Finally, all seven brokers in the FNArena database were effusive in praise for Super Retail Group after a strong finish to the first half. A combination of increased sales and margins, along with strong operating leverage makes for a heady mix.

The top five percentage earnings downgrades for the week were dished out by brokers to mining companies. OceanaGold had the most material slippage despite reporting a stronger-than-expected preliminary production result for the December quarter.

Coronado Global Resources was runner up with mixed quarterly production results. Morgans simultaneously agreed there is compelling leverage to a higher-than-expected met coal price and lowered the company rating to Hold from Add on valuation concerns. The broker also warned investors of the risks wet weather poses to the Curragh mine output, costs and the company’s ability to de-gear.

Total Buy recommendations take up 51.09% of the total, versus 39.71% on Neutral/Hold, while Sell ratings account for the remaining 9.2%.

In the good books

ANSELL LIMITED (ANN) Upgrade to Neutral from Underperform by Macquarie B/H/S: 4/3/0

Ansell’s trading update ahead of its first-half results shows the company is doing better than expected, observes Macquarie. Earnings per share in the first half are expected to be between US81-84cps, 20% ahead of Macquarie’s forecast with FY21 earnings expected to exceed the previous guidance range of US135-145cps.

The robust outlook can be attributed to covid related demand across several business units and market share gains in mechanical and surgical segments. The company has also been able to pass through price increases. Rating is upgraded to Neutral from Underperform with the target rising to $36.35 from $33.35.

NATIONAL AUSTRALIA BANK LIMITED (NAB) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 3/3/1

Morgan Stanley believes banks will outperform the ASX200 in 2021 given domestic economic trends, a cyclical earnings recovery and healthy balance sheets. In addition, there is considered a lower overall risk profile and ongoing sector rotation. The broker favours those banks with the most earnings and dividend leverage to a recovery and potential upside to operating performance. Also, additional relatively low investor expectations and more attractive valuations are considered important factors. Morgan Stanley has increased earnings and EPS estimates due to modest upgrades to housing loan growth forecasts for all banks, and material reductions in impairment charges for the majors. The broker believes National Australia Bank’s strategy is clear, the operating performance has been sound and loan losses have peaked. Additionally, capital is strong and there is potential for a strong dividend recovery. The broker upgrades the EPS estimates for the bank for FY21-23 by 22%, 5% and 4.5%, respectively. The rating is increased to Equal-weight from Underweight and the target is increased to $24.50 from $20.10. Industry view: In-line.

SOUTH32 LIMITED (S32) was upgraded to Neutral from Underperform by Macquarie B/H/S: 5/2/0

South32’s second-quarter result was mixed with stronger production offset by higher tax expenses. The outlook for Cerro Matoso and Cannington mines has improved, driving 20-30% upgrades to Macquarie’s short and medium-term earnings outlook. Backed by the improved earnings outlook, Macquarie upgrades its rating to Neutral from Underperform. Price target rises to $2.70 from $2.10.

See downgrade below.

In the not-so-good books

CORONADO GLOBAL RESOURCES (CRN) was downgraded to Hold from Add by Morgans B/H/S: 3/1/0

Morgans thinks marginal investors at the current share price are positioning for a potential met coal price spike. As a result, the broker notes the disappointing 2020 headline financials didn’t surprise the market. While the broker agrees there is compelling leverage to a higher-than-expected met price, the rating is lowered to Hold from Add on valuation. Despite the analyst highlighting solid improvement for second half production, investors should be conscious of the risks wet weather poses to Curragh output, costs and the company’s ability to de-gear. The target price is increased to $1.35 from $1.31.

CROWN RESORTS LIMITED (CWN) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/3/0

Credit Suisse downgrades rating on Crown Resorts to Neutral from Outperform on the basis of share price appreciation. Covid and casino closures make predicting earnings a difficult task in the near-term. The broker has been valuing Crown based on its FY23 operating income forecast that matches pre-covid FY19 numbers. Although Crown is undergoing a number of regulatory inquiries and investigations, Credit Suisse thinks the probability of Crown losing its Sydney restricted gaming licence is low. $10.35 target retained.

CLEANAWAY WASTE MANAGEMENT LIMITED (CWY) was downgraded to Neutral from Outperform by Credit Suisse and to Neutral from Outperform by Macquarie B/H/S: 2/5/0

Cleanaway Waste Management’s CEO Vik Bansal has decided to step down, leaving Credit Suisse surprised since the company is navigating through the pandemic and Vik Bansal has a solid track record. While the search for a replacement has commenced, Chairman Mark Chellew will take on duties as Executive Chair in the meantime with CFO Brendan Gill delaying his retirement and staying on as COO. Noting the considerable uncertainty around CEO transition, Credit Suisse downgrades to Neutral from Outperform with a target of $2.45.

Cleanaway Waste Management’s CEO and Managing Director Vik Bansal will step down in the first half of 2021. This comes as a surprise to Macquarie since the broker expected Mr Bansal’s tenure to extend longer especially after overcoming a difficult first half. The broker sees little change in the strategic and operational direction of the business during this transition and retains its forecasts. Even so, the rating is downgraded to Neutral from Outperform on valuation grounds with a target of $2.55.

GOODMAN GROUP (GMG) was downgraded to Neutral from Outperform by Macquarie B/H/S: 1/5/0

Underlying fundamentals for Goodman Group like higher asset valuations, equity flows for logistics assets and rising tenant demand remain attractive and all point towards the group achieving earnings growth of 9% pa. On the flip side, a rising bond yield and an elevated valuation offset the strong fundamentals and are likely to negatively impact the group’s relative attractiveness in the sector, predicts the broker. Rating is downgraded to Neutral from Outperform with the target falling to $18.77 from $19.86.

INCITEC PIVOT LIMITED (IPL) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 5/2/0

Fertiliser prices are strengthening and even with a weaker USD, have created a stronger near-term outlook for Incitec Pivot, suggests Credit Suisse. The broker has upgraded its FY21 forecasts while downgrading its FY22 forecast figures due to AUD/USD currency assumptions. With robust demand and moderate supply additions, the broker expects a more favourable backdrop for fertilisers in 2021. While constructive on the near-term outlook, Credit Suisse reduces its rating to Neutral from Outperform led by the recent share price strength. Target rises to $2.73 from $2.70.

LENDLEASE GROUP (LLC) was downgraded to Neutral from Outperform by Macquarie B/H/S: 2/4/0

For Lendlease Group to hit its return on equity targets, the group has to increase its profitable capital recycling, suggests Macquarie. Having said that, the broker is of the view the capital cycling initiatives are likely to be more difficult given the current macro backdrop. Rating is downgraded to Neutral from Outperform with the target price falling to $13.16 from $13.98.

POLYNOVO LIMITED (PNV) was downgraded to Neutral from Outperform by Macquarie B/H/S: 0/1/0

PolyNovo’s first half NovoSorb BTM sales were below Macquarie’s expectations, mostly led by US weakness in October-November due to hospital capacity constraints. The broker has updated its Hernia revenue forecasts, assuming first product sales occurs in the second half of FY22 rather than the first half. The addressable market has also been updated to include only ventral hernia surgeries, estimates to comprise of circa 20-25% of all hernia surgeries in the US. With an uncertain near-term outlook, Macquarie moves to Neutral from Outperform. Target price rises to $2.75 from $2.55 on higher costs.

SOUTH32 LIMITED (S32) was downgraded to Hold from Add by Morgans B/H/S: 5/2/0

Despite a second quarter result ahead of estimates, Morgans lowers South32’s rating to Hold from Add, due to a recent share price rally. Divestment of the company’s South African Energy Coal (SAEC) business is progressing, and management is now targeting sale completion by 31 March 2021. The broker sees further upside potential from a continuing commodity cycle. While it’s considered there’s less upside potential from aluminium and manganese, coal markets are likely to recover. The broker reduces the target price to $2.60 from $2.65. See upgrade above.

THE STAR ENTERTAINMENT GROUP LIMITED (SGR) was downgraded to Neutral from Outperform by Credit Suisse B/H/S: 3/4/0

Credit Suisse has reduced its rating on Star Entertainment Group to Neutral from Outperform with the target Price unchanged at $3.85. The broker’s FY21 earnings forecast is down substantially while earnings forecasts for FY22-FY23 have been increased. In FY19, the group was incurring about $78m/month in operating costs and the broker expects $75m/month in FY22. In the first half, the broker expects operating income of $231m, down -25% versus last year due to Covid restrictions.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stockbrokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.