Whoops! Tyro, a stock I like and one that was a part of my ZEET stocks has become a target of a short seller and its share price has been slammed, putting the company into a trading halt!

As investors in the stock (and I’m one, as I could never talk about a stock I’ve liked and written about unless I was prepared to put my money where my mouth is), we all want to know if the short seller is:

- An honest broker alerting us to a real problem with Tyro; or.

- A manipulative bunch simply trying to make money out of a company that’s had a temporary but significant problem with its card-swiping machines?

The short seller is a mob called Viceroy, which is overseas-owned with a couple of locals, who contribute to the analysis of companies that ultimately get smashed, after journalists publish the summary findings of a more sizeable report.

Being overseas-based means they can’t be sued if they’re wrong or gilding the lily to make money.

Viceroy stuck it to Wisetech (WTC) late last year and the share price copped it, but the company’s response has minimised the damage. WTC was accused of creating “fake value” via its many acquisitions. Returning fire, its chief financial officer Andrew Cartledge told the SMH in response that he had “serious concerns” over the claims, which he says “lacked understanding of the firm’s acquisition strategy and the risk, cost and time involved in developing technology internally versus acquiring it”.

Let’s have a look at how the stock market responded to all this argy bargy, in order to see what might happen when Tyro returns fire some time before trading re-opens tomorrow to guess what might happen to the share price. In case you missed it, the stock’s price fell 11% on the news but it was already falling, undoubtedly helped by the short-seller sales before they announced the market-hitting news.

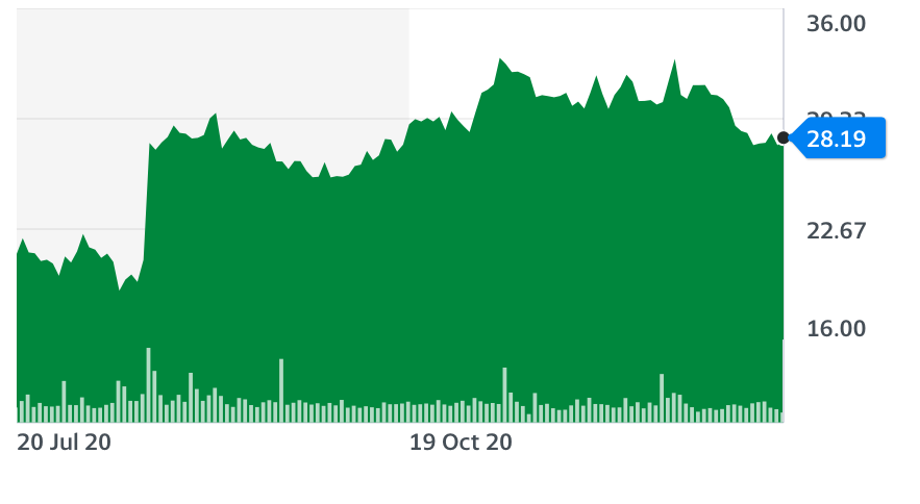

Wisetech (WTC)

The late December bagging of WTC by Viceroy took the share price down from around $32 to $28, but it has seemingly arrested the sell off.

Back to Tyro and in last Monday’s Switzer Report, I underlined the problems the company was having with its terminals and many small business customers.

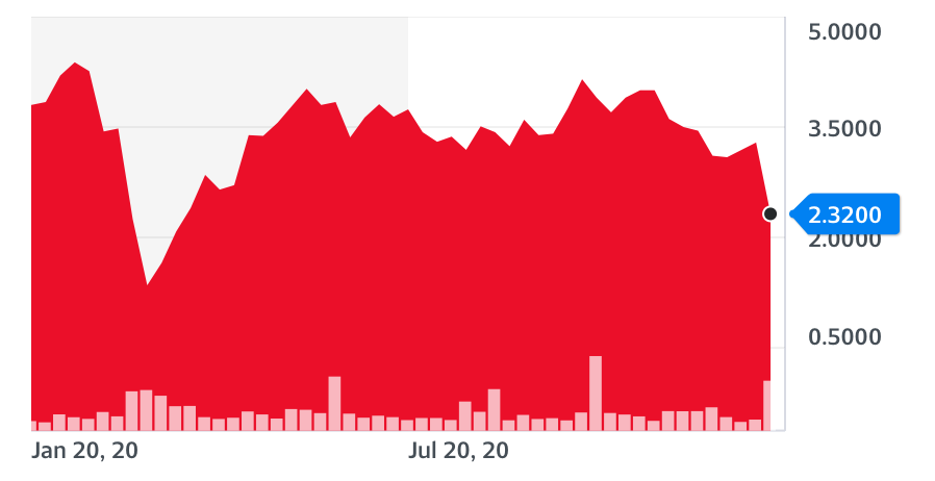

Tyro one year

That said, I never expected it to be the target of a short seller because I rated the company, the management and the board. Of course, the current problem was unforeseen and is a software problem that ultimately could hurt the company’s reputation and will involve compensation costs, which will hurt future profitability.

However, there are a lot of uncertain issues that surprise me that Viceroy has so much confidence about. One might be how quickly a small business customer will desert the service — that’s guesswork.

And then no one has mentioned the possibility that the company that’s alleged to have provided the faulty terminals to Tyro (one of the biggest players in this space) could be targeted for compensation, for which they should have product liability insurance.

It would be churlish to argue that all Viceroy’s analysis is wrong and coloured to help them make money by bringing the share price down, at which they would be a buyer of the stocks of this currently ‘troubled’ company.

It will take time to work out who knows best —Tyro’s CEO Robbie Cooke or Viceroy. But therein lies the investment decision and opportunity.

If Robbie Cook trumps Viceroy, then $2.32 looks like good value. And right now, FNArena’s analysts’ collective view says the 5th biggest merchant acquiring bank has a whopping 84.6% upside!

The big battleground has to be over how many merchants and their terminals have been put out of action for a week. Viceroy says 50%. But when I inquired earlier last week before the short-seller report was released, the company was saying a much smaller number.

Because we haven’t heard from the company, it’s too soon to give a full assessment of whether Tyro is a buy or a sell. But let me throw a few in unforgettable points about this company, which has me keener to be a buyer rather than a seller tomorrow.

- Fund managers like Julia Lee of Burman Invest and Jun Bei Liu have been consistent fans of the company. I respect their analyses.

- Not long ago, the stock analyst Simply Wall Street gave the company a positive wrap and underlined its lack of debt.

- The earlier falls in the share price were undoubtedly part-related to the reclosure of the borders in December, which affected hospitality. This company’s bread and butter is in this sector.

- There have been some share sales by directors, which will always unsettle a share price.

- One fund manager who looked at the weekly update from the company says “on the latest numbers, there’s no way 50% of terminals have been bricked.”

Ultimately, what happens tomorrow with the share price will depend on Robbie Cooke’s return of service, answering Viceroy’s allegations. I suspect there are a lot of informed investors itching to get a piece of Tyro at $2.32.

As an investor in the company, I hope I’m right but it is a work-in-progress. We are in the hands of Robbie and the media’s reaction.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.