The average SMSF has 98% of assets in domestic investments in Australian dollars. In my opinion, this is not the optimal asset allocation for today, or the next 20 years.

I believe the pullback in global equity markets is giving SMSFs a chance to deploy Australian dollar cash holdings to world-leading global companies.

The last few weeks have been a lesson to Australian investors about the lack of diversification. If you only hold Australian banks and Australian resource stocks in Australian dollars, you’ve had a torrid time.

I am not recommending selling those Australian investments, I think Australian SMSFs should consider their lack of diversification and ask themselves the very simple question… why do I own no global investments in global dollars?

Australians have enough exposure to Australia, particularly when you include direct property investments. I understand the nuances of the Australian taxation system that drive these home biases, but tax should not be the primary reason for an investment.

In my opinion, you can increase returns and concurrently lower risk via sensible diversification to high-quality global companies held in global currency. You can sensibly diversify via stock, sector, and by currency.

Most of you use an Apple iPhone, Microsoft software, tap and go on your Visa or Mastercard, like photos on Instagram (Facebook), search on Google (Alphabet), watch a movie on Netflix, walk in Nike shoes, use Estee Lauder face creams, enjoy the occasional Heineken, and have probably bought something on Amazon. So why don’t you own their shares?

Many of you own four Australian Banks and only do business with one. You own Telstra but you hate their service….unsurprisingly, ANZ, NAB, WBC and TLS are the same share price they were a decade ago. They are effectively growthless utilities with regulatory risk that still have Australians addicted to their high dividend payout ratios and franking credits. The question has to be asked.. does the desire for franking credits lead to poor stock selection and asset allocation decisions? Has the search for yield led to poor stock selection and asset allocation decisions?

With this note today, I am trying to challenge your thinking. I simply want you to consider why you have no exposure to global companies in global dollars.

So what is the case for global equities?

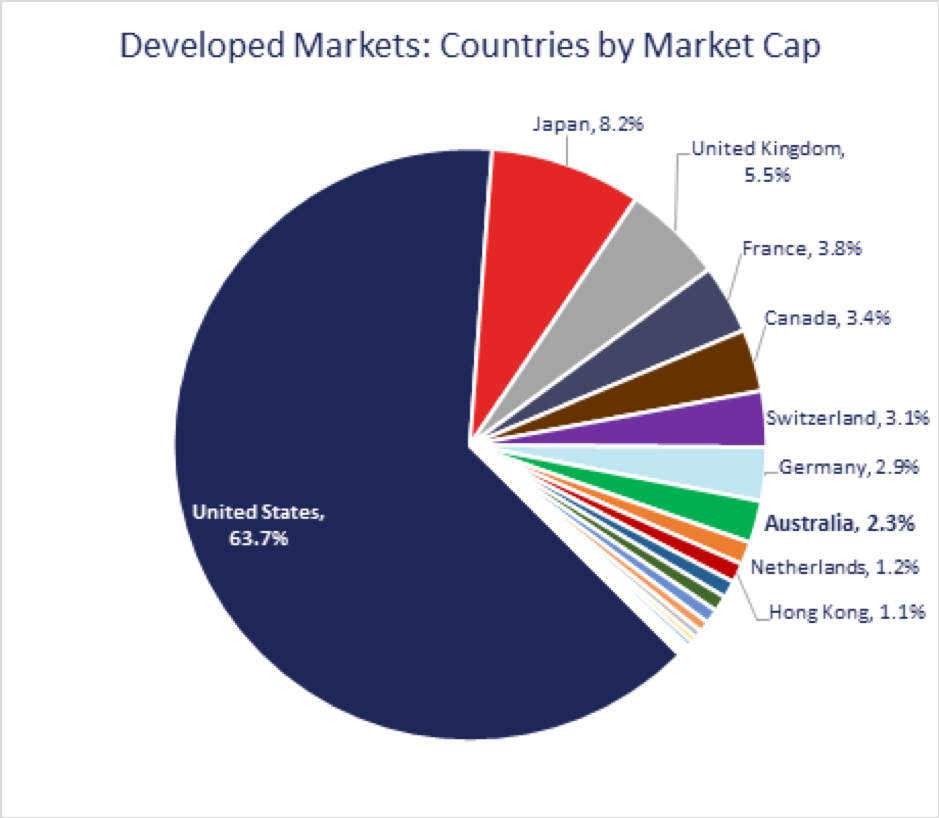

Australian equities only represent 2.3% of the world equity markets. If you only invest in Australian equities, you’re ignoring 97.7% of the equity market opportunity set.

Source: MSCI

Similarly, the majority of ASX-listed companies are domestic and have an addressable market of 25 million people. Large global companies may have an addressable market of up to 7 billion people.

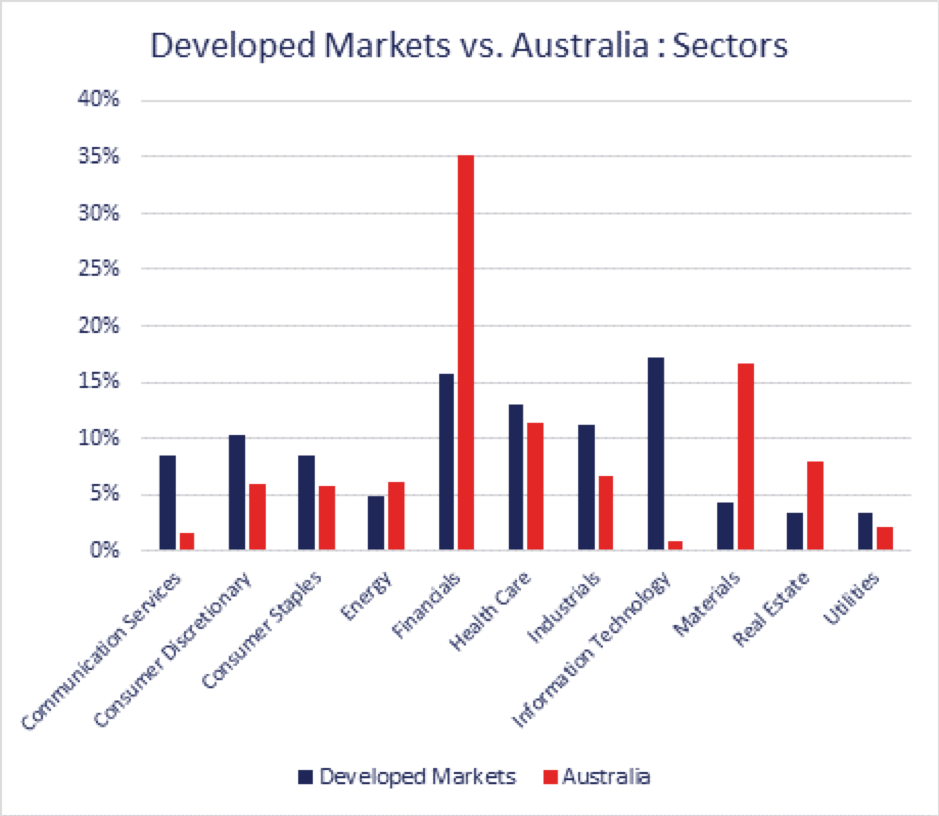

Source: MSCI

The chart above is the real reason you need global equities in your portfolio. These are the 11 MSCI sectors in equities. The red bars are ASX sector weightings. The blue bars are MSCI World Equity Index sector weightings.

You can clearly see Australian equities are massively exposed to financials, which include banks, insurers, and asset managers. 35% of the ASX is financials, versus 15% in global benchmarks.

Similarly, due to Australia’s natural resource endowment, the ASX’s combined energy and materials weighting is 22%, versus the combined weighting of 8% in global indices. Financials and resources make up 57% of the ASX, making it vulnerable to commodity led routs like we experienced this week.

However, the case for global investing from my perspective is what you can’t get exposure to on the ASX. Information technology (IT) is the fastest growing structural growth sector in the world. We can all see that technology is playing a greater role in our daily lives.

IT represents 17% of global benchmarks and just 1% of the ASX. My fund has 25% invested in world-leading IT stocks such as Microsoft and Salesforce, to name a couple.

Similarly, Communication Services, which represents 8.6% of global benchmarks, is just 2% of the ASX. My fund has 16.5% in Communication Services in world leading stocks such as Alphabet, Facebook, Netflix, and Walt Disney.

The attraction of IT and Communication Services isn’t just growth: it is the very high returns on investment capital they consistently produce.

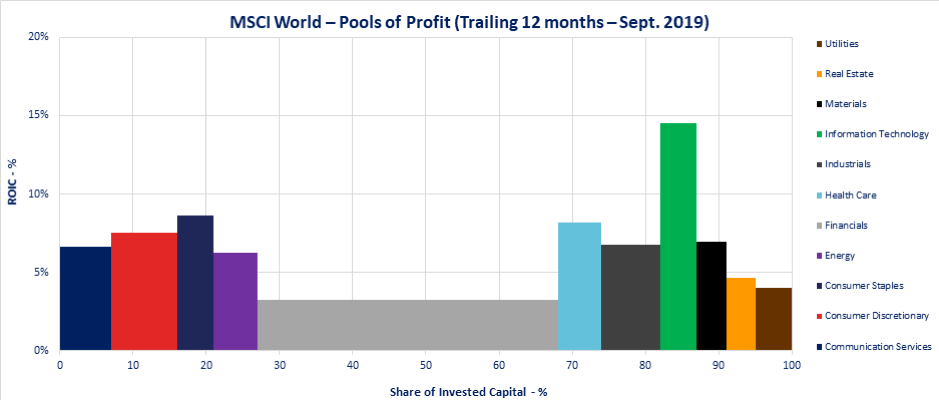

The table below illustrates the pools of profit in global equities per sector and the capital required to generate them.

Source: AIM, MSCI

The green bar is IT and you can understand why that sector is our largest weighting. The sector uses a small amount of capital to generate high returns. Ditto Health Care (light blue bar) and Communication Services (dark blue bar).

Now if you want to understand why banks have been such a dud investment for the last decade (in capital growth terms), look at the big grey rectangle in the middle of the table above.

The financial sector (dominated by banks) in the post GFC world holds substantially more regulatory capital (US banks 13% tier 1 capital from 8% pre-GFC). At the same time, falling interest rates have crushed net interest margins and stricter lending standards have restrained revenue growth. FinTechs have also increased competitive pressure by chipping away at the margin. This has led to a sector ROIC of just 3%. The point is that financials use huge amounts of capital and generate sub-standard returns on those pools of capital. This is unlikely to change in an ultra-low interest rate environment.

My fund owns no banks globally. We own the payment systems such as Mastercard and Visa that are benefitting from the structural tailwind of the move to a cashless economy. Unlike banks, Mastercard and Visa have no credit risk. They don’t physically lend anyone any money and have extraordinary ROIC’s.

The final attraction of global investing is currency diversification. The Australian dollar is a commodity currency. Always has been, always will be. It provides a natural hedge in times of global economic concerns such as right now. It’s worth noting the AUD/USD price is -7.5% in 2020 alone, despite the Fed cutting rates by 25bp more than the RBA. That -7.5% fall in the AUD/USD has provided a real degree of protection to global portfolios, particularly those with a large US equities weighting.

In summary, during this period of Coronavirus and OPEC driven equity market duress, I believe Australian SMSFs are being presented with a chance to diversify into global equities. Coronavirus will pass with time, and you’d expect rationality to return to the oil market at some stage. In the meantime, expect central banks to continue to lower cash rates and governments to aggressively ramp up fiscal spending. I’m obviously aware cash rate cuts and fiscal spending can’t slow a virus, but they can provide a cushion and support markets at the other end.

I want to finish on a positive note in this period of fear and volatility. I know it’s hard to see the light when there are so many unsettling headlines, but there could be a scenario 3 to 6 months from now where Coronavirus has been contained and the world has returned to normality. We could well come out the other side, awash with stimulus/liquidity and improving confidence. We will have the lowest cash rates in history, the lowest mortgage rates in history, low energy prices (essentially a tax cut for the world), and large-scale government stimulus.

It’s worth noting before the coronavirus interruption that the US consumer was in excellent shape. In February alone, the US economy added +273,000 jobs and prior numbers were revised up. My point is when normality returns, and let’s hope it does, that the US consumer will have fuel poured on the consumption fire from the incredibly supportive macro settings. With 70% of US GDP being consumer spending, I think it would be unwise to have zero exposure to US consumers, US equities and the US dollar once the recovery starts.

It’s always darkest before the dawn. Ask yourself why you aren’t considering global equities in this correction. Do you prefer 1.5% pa on your term deposit or Microsoft?

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.