This week has seen the start of a coordinated monetary and fiscal policy response from G7 countries to the economic and market impacts of Coronavirus. China commenced their response three weeks ago.

Of course, everyone understands that monetary and fiscal policy response won’t slow the spread of the virus, but they are a necessary first step to provide liquidity and relief to businesses and consumers being directly hit by the impacts of this virus.

Nobody should believe for a second that central banks think they can cure the virus as such. To quote Fed Chairman, Jay Powell: “A rate cut will not reduce the rate of infection. It won’t fix a broken supply chains. We get that. But we do believe that our action will provide a meaningful boost to the economy”.

The Fed surprised the market by cutting US cash rates by a full 50bp on Tuesday morning and doing it in between scheduled Board meetings. This has only occurred after September 11, 2001 and in 2008 in the midst of the GFC. It could be considered an emergency piece of policy action.

The Fed’s action surprised in both magnitude and timing. That led to most market commentators focusing on three possibilities for the action.

- The Fed panicked.

- The Fed got forced into it by the White House.

- The Fed is seeing data in the US that is much worse than they forecast.

My view is the Fed is acting as part of a coordinated global central bank response. For once, they are trying to get ahead of the problem by acting pre-emptively. This will be followed by a fiscal policy response globally. It’s worth noting that even after Wednesday’s pullback on Wall St, the US equity market remains around 11% above the intraday low of Friday, before Jay Powell first spoke. You could argue Wall St. forced the Fed to act, as it did in December 2018 as well.

Of course, this does come back to the topical debate about further interest rate reductions doing more harm than good. I can understand why people think “what do these guys know that we don’t?” and “why are they panicking”. However, this was a necessary monetary policy response to an unexpected global development that has destabilised markets, disrupted global trade, global supply chains and led to a dive in consumer and business confidence. It is part of a response to attempt to slow the negative feedback loop that can lead to far worse economic and market outcomes.

While the Fed’s communication policy is far from perfect, in amongst all this noise and market volatility it is worth remembering the old adage “Don’t fight the fed”. The Fed has limitless firepower and no benchmark as such to achieve its twin goals of full employment and price stability. Time and time again over the last decade, their deep pockets have stabilised markets and returned consumers and business to a more confident position over the medium term. Not instantly, but over the medium-term. They don’t have a magic wand as such.

It wasn’t that long ago that investors were watching the daily gyrations of Greek 10-year bond yields, believing they would potentially lead to widespread EU bank collapses and eventually the break-up of the Eurozone. That proved to be far too pessimistic. While a global viral epidemic is different, in many ways it is similar, with short-term traders focused solely on the virus and its spread. Just like Greek citizens drained ATMs of cash, Australians are draining Woolworths of toilet paper. Let’s hope that proves too pessimistic as well.

With advances in telecommunications (smartphones + 4/5g Networks), bad news spreads faster than in anytime in human history. Would it therefore be a surprise that the equity markets suffered their fastest correction in history in response to bad news? To put this in context, they made all-time highs in mid- February.

Everyone knows what is happening and why we are here. As an investor and custodian of my clients hard-earned savings, I must calmly work through these developments with my team and estimate where are the short, medium and long-term investment opportunities inside this current market dislocation. Conversely, it’s just as important to work out what not to own: perhaps more important.

I remain of the view that cash rates are going lower. In Australia, the RBA will drop the cash rate to 25bp and then consider QE. This could see the AUD approach to low 60c range vs the USD in the 2H of this year. I believe currency diversification away from the Australian dollar remains a sensible asset allocation decision for Australian-based investors.

Globally, interest rates will be lowered further, and long bond yield will remain negative in real terms. The alternative return in cash and fixed interest will be negative, potentially for a very long time. This will further punish retirees and savers, while banks net interest margins will remain under pressure. Loan losses could also rise in a tougher economic environment.

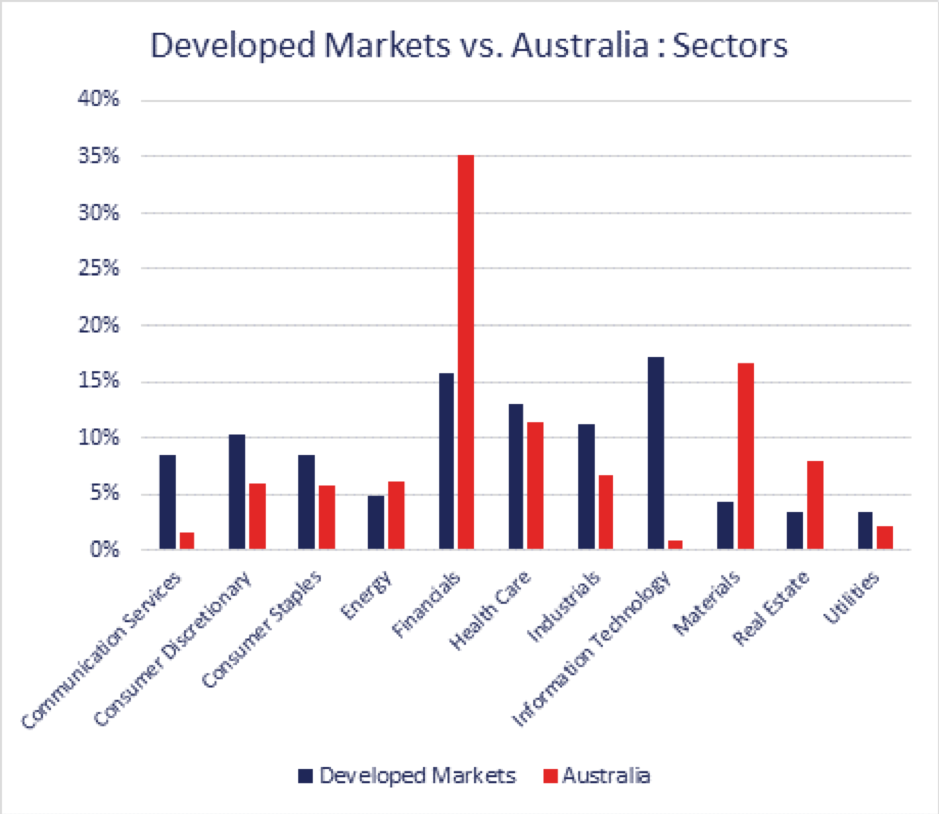

This is a problem for the ASX200. We are an extremely “financials” heavy index. The table below reminds you 35% of the ASX200 is “”financials”, about 2.5x the global benchmark.

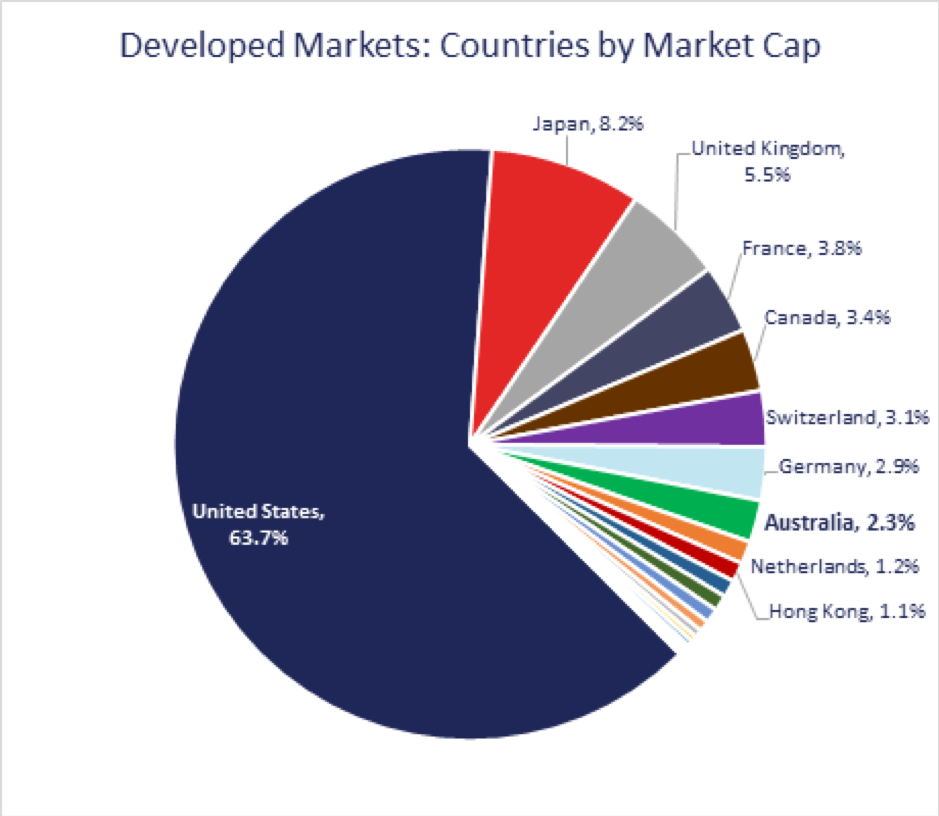

It’s also worth remembering the ASX200 is just 2.3% of the world’s equity benchmark. In other words, 97.7% of the investment opportunities in equities lie outside Australia.

I am strongly of the opinion that the better investment opportunity set lies outside Australia for the medium term. The most attractive sectors in the world, such as IT, are broadly underrepresented on the ASX. I also believe the medium-term outlook for the US economy is far stronger than the Australian economy.

In a period of uncertainty, you must go for strength. I want to own “fortress balance sheets”; companies who can “see it through” under tough operating conditions.

When thinking about the possible economic disruption that an extended quarantine can cause, it’s clear that a substantial challenge to businesses will be to make fixed payments when cash inflows potentially dry up – either due to supply chain disruption or demand rapidly slowing.

In this regard, focusing on the balance sheet and cash cycle of a business is more instructive than earnings growth, which we believe will have to be downgraded almost across the board for the entire market.

Of the 22 companies currently held in my fund, 11 have net cash on their balance sheet; in the case of names like Microsoft, Alphabet, Facebook, Apple and Amazon, these balances are significant, running into the tens or hundreds of billions of US dollars. While these companies do have some debt maturities in 2020, they can easily cover them. In addition, it’s worth understanding that these businesses are also in the somewhat unique position of being able to fund their suppliers with vendor finance, meaning their supply chains – while disrupted – can be kept afloat. At the risk of using a cliché, having a fortress balance sheet helps.

Of the 11 companies that do not have net cash, nine have debt maturities in 2020. Current cash balances cover these maturities by at least 2.2x, and interest payments are well covered. In the utmost need, these businesses have the capacity to delay capital deployment to cover fixed payments.

As such, I am very comfortable with our portfolio from a balance sheet quality perspective.

While the next few weeks and months may well remain volatile as we swing between daily “fear” and “hope”, I want to calmly increase the quality in the portfolio, and selectively deploy cash reserves when Mr Market is paying us a “margin of safety” to deploy that capital.

I want to stress, however, that I will only be deploying capital into the best businesses in the world with wide business moats, experienced management, and fortress balance sheets. These stocks are rarely on sale as such, and we will take the opportunity to increase our exposure to them when we get the appropriate margin of safety. When passive is indiscriminately selling, it’s time to be active.

I know it’s hard to focus on the medium term when you’re checking how much toilet paper you have in the laundry cupboard, but it is in these moments you can make, or break, your future investment returns.

If the volatility is difficult to handle, outsource your investments to a professional fund manager. Market moments like these are where we should generate medium-term returns for our unit holders, while concurrently protecting their capital.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.