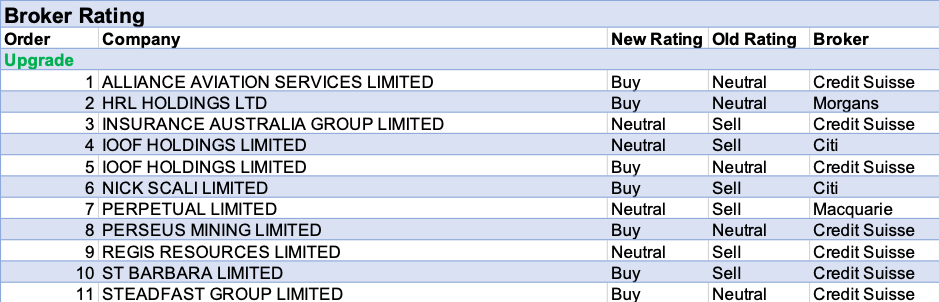

For the week ending Friday, 18th October 2019, FNArena counted 11 upgrades and 14 downgrades for ASX-listed stocks by the seven stockbrokers monitored daily. Of the 11 upgrades, seven moved to a fresh Buy. Half of the downgrades stopped at Hold/Neutral.

Among those stocks receiving a fresh Sell rating we find Bank of Queensland, twice, on the back of yet another disappointing financial report release, also again including a reduction for the shareholders’ dividend. Alumina ltd, HT&E, OZ Minerals, Pilbara Minerals and Suncorp all received one fresh Sell rating during the week.

On the other side of the ledger, fresh Buy ratings befell each of Alliance Aviation Services, HRL Holdings, IOOF Holdings, Nick Scali, Perseus Mining, St Barbara, and Steadfast Group.

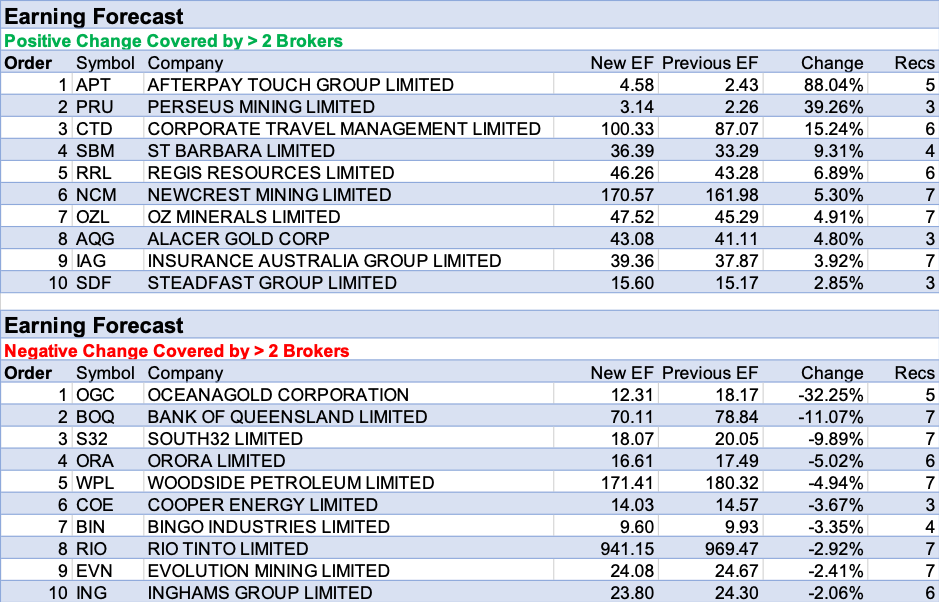

The week’s table for positive revisions to earnings estimates shows plenty of action, this time with Afterpay Touch in pole position, followed by Perseus Mining and Corporate Travel Management. The table for negative amendments remains equally busy, with the week’s largest reduction reserved for OceanaGold, followed by Bank of Queensland, South32 and Orora.

Investor sentiment remains closely tied to international, geopolitical and macro-economic matters, while the domestic AGM season and out-of-season financial result reports are about to ramp up.

In the good books

1. HRL HOLDINGS LTD (HRL) was upgraded to Add from Hold by Morgans B/H/S: 1/0/0

The company has issued a positive trading update at the AGM, providing earnings guidance for the first half that was stronger than Morgans expected. The broker highlights earnings are significantly skewed to the second half, in line with the production profile of New Zealand’s dairy and honey seasons. The broker increases FY20 forecasts for underlying operating earnings (EBITDA) by 8.2%. FY21 and FY22 forecasts have risen 6.0% and 5.9% respectively. Rating is upgraded to Add from Hold and the target raised to $0.14 from $0.12.

2. INSURANCE AUSTRALIA GROUP LIMITED (IAG) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 0/6/1

The company will sell its 26% interest in the joint venture with State Bank of India. Total consideration is over $640m with an expected increase in Insurance Australia Group’s regulatory capital position of over $400m once the transaction completes. Credit Suisse increases FY20 estimates for reported profit by 34% and also increases the expected FY20 buyback to $750m from $300m. Target increases to $8.00 from $7.50. The broker’s rating is now upgraded back to Neutral from Underperform.

3. IOOF HOLDINGS LIMITED (IFL) was upgraded to Outperform from Neutral by Credit Suisse and to Neutral from Sell by Citi B/H/S: 2/3/0

The OnePath Custodians have approved the acquisition by IOOF Holdings of the ANZ Wealth Pension & Investments. A purchase price of $825m has been agreed, $125m below the original price. Credit Suisse believes it likely the business will transfer to IOOF in the second half of FY20 and incorporates the acquisition in estimates from January 1 2020. APRA has also advised it will not appeal the Federal Court decision to dismiss its action against IOOF entities, directors and executives. Target is raised to $8.45 from $5.05 and the rating is upgraded to Outperform from Neutral, as the company has made significant progress on two fronts.

As the ANZ P&I deal now has a strong likelihood of proceeding, having been approved by the custodians, Citi lifts estimates for earnings per share in FY20 and FY21 by 29% and 46% respectively. The company still faces major hurdles, such as the need to restructure its advice business, but the broker suggests the added scale and associated cost synergies from the acquisition should provide flexibility. In view of the improved earnings outlook, the rating is upgraded to Neutral/High Risk from Sell/High Risk. Target is raised to $7.30 from $4.40.

4. STEADFAST GROUP LIMITED (SDF) was upgraded to Outperform from Neutral by Credit Suisse B/H/S: 3/0/0

The company has reaffirmed FY20 guidance for underlying earnings (EBITA) of $215-225m. This implies 11-16.5% growth and Credit Suisse suspects, given the solid trading results in the first quarter, the top of the range is likely. The broker upgrades estimates by 3%. Given the recent pull back in the shares, Credit Suisse believes here is an opportunity to pick up the stock at a reasonable price and upgrades to Outperform from Neutral. The main risk is a softening in the premium environment and regulatory changes. Target is raised to $4.00 from $3.85.

In the not-so-good books

1. BORAL LIMITED (BLD) was downgraded to Hold from Accumulate by Ord Minnett B/H/S: 2/3/0

Ord Minnett assesses Boral’s share price is trading at roughly fair value, having recovered almost to levels pre-FY19 results. However, the outlook for concrete demand underwhelms the broker and this is forecast to trend lower through to FY23. The broker is also reluctant to factor in the benefits from the USG joint venture in Asia and the formation of the North American division, following the acquisition of Headwaters. Returns for North America and Asia are expected to be well short of the rate required to cover the cost of capital. Ord Minnett downgrades to Hold from Accumulate and lowers the target to $4.80 from $5.00.

2. BANK OF QUEENSLAND LIMITED (BOQ) was downgraded to Sell from Neutral by Citi B/H/S: 0/1/5

Citi notes an unexpected rise in bad debts drove a weaker result for Bank of Queensland, attributed to the small number of commercial exposures. While management remains cautious heading into FY20, Citi suspects falling borrowing costs are likely to keep bad debts in check for now. The broker suspects earnings, the capital position and, possibly, the dividend are all set to deteriorate again. Rating is downgraded to Sell from Neutral and the target lowered to $8.50 from $9.50. FY20-21 estimates are downgraded by -10%.

3. NETWEALTH GROUP LIMITED (NWL) was downgraded to Hold from Buy by Ord Minnett B/H/S: 0/3/3

Net flows were the best ever in the first quarter of FY20. While the likelihood of a reduction in cash spreads increases as the cash rate nears 50 basis points, the revenue impact needs to be weighed against the other obvious risk – booming net inflows, Ord Minnett suggests. However, the broker downgrades to Hold from Buy as the stock is now trading in line with the target, which is raised to $9.00 from $8.95.

4. OZ MINERALS LIMITED (OZL) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 4/2/1

September quarter production was softer than expected. Cash costs benefited from elevated gold prices and production. Credit Suisse notes Antas is bleeding cash despite a cost-cutting strategy. Meanwhile unconventional technology is being trialled at West Musgrave. Rating is downgraded to Underperform from Neutral and the target reduced to $8.50 from $9.50.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.