At face value, stockbroking analysts have started zooming in on undervalued laggards resulting in, finally, more upgrades being issued than downgrades for individual ASX-listed stocks.

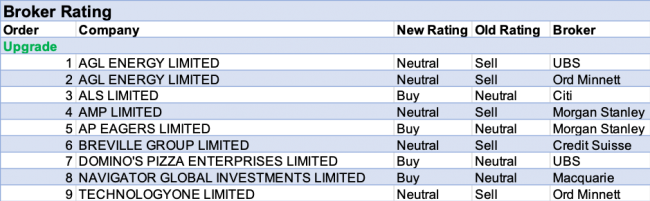

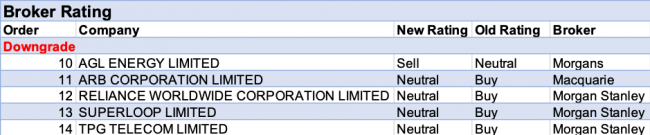

For the week up until Friday 9 August 2019, FNArena counted nine recommendation upgrades versus five downgrades. Most changes on both sides of the ledger ended in Neutral territory.

Only four of the upgrades moved to Buy with Navigator Global Investments (FY19 release), Domino’s Pizza, ALS ltd and AP Eagers the lucky receivers. AGL Energy’s FY19 report was good for two upgrades and one downgrade. That one downgrade marked the sole fresh Sell rating for the week.

There is a lot more happening with earnings estimates where battle-weary Pact Group finally enjoyed a rare moment under the sun, topping the week’s ranking for largest positive amendment to earnings forecasts, followed by Pinnacle Investment Management (FY19), Suncorp (FY19), Telstra and Kathmandu (trading update).

The negative side of the ledger is over-populated with many suffering double-digit percentage reductions to forecasts. The table is led by AMP, AGL Energy, Xero, Nufarm, and Aveo Group. Other profit report updaters seem to have ended mostly on this side of the ledger, with Insurance Australia Group, Coronado Global Resources, CYBG and Rio Tinto all represented.

The local reporting season picks up pace this week, ahead of the true seasonal onslaught as the end of August approaches.

In the good books

1. AGL ENERGY LIMITED (AGL) was upgraded to Neutral from Sell by UBS and to Hold from Lighten by Ord Minnett B/H/S: 0/3/4

FY19 net profit was ahead of UBS estimates. The broker expects there will be some support for the share price from the $650m buyback in FY20, although challenges will arise from retail regulation and lower forecast long-term wholesale electricity markets. The broker believes the Perth Energy acquisition confirms some retail growth potential in the west but the company needs new material growth projects to fill the earnings gap that is expected to emerge by FY22. Rating is upgraded to Neutral from Sell and the target raised to $18.50 from $18.35.

FY19 results were slightly ahead of Ord Minnett’s estimates. The broker’s concerns were confirmed, nonetheless, as FY20 guidance implies earnings are set to decline -17-25%. The broker notes there is some evidence of share gains, with electricity retail customer numbers increasing in FY19. Rating is upgraded to Hold from Lighten as the stock is now in line with the revised valuation. The broker estimates the stock now offers a dividend yield in excess of 5% which compares favourably with most ASX-listed utilities and infrastructure stocks. Target is reduced to $18.90 from $19.75.

See downgrade below.

2. AMP LIMITED (AMP) was upgraded to Equal-weight from Underweight by Morgan Stanley B/H/S: 0/6/1

First half underlying profit was below Morgan Stanley’s estimates. The $650m capital raising should fast-track the company’s strategic overhaul, in Morgan Stanley’s view, as it seeks to exit the life business, divest New Zealand and transform its wealth operations. The revised deal with Resolution Life surprised the broker as it is a cleaner transaction – $2.5bn cash and 20% equity – expected to be completed in the first half of 2020. The proceeds will pay down debt and fund separation costs as well as provide funding for the company’s strategy. In wealth, the broker notes if successful, AMP will have a contemporary platform without the legacy overhang. The new 40-60% cash net profit pay-out ratio suggests AMP is seeking a more aggressive growth setting. Rating is upgraded to Equal-weight from Underweight and the target is raised to $1.65 from $1.50. Industry view is In-Line.

3. BREVILLE GROUP LIMITED (BRG) was upgraded to Neutral from Underperform by Credit Suisse B/H/S: 1/3/0

Credit Suisse believes Breville is unlikely to disappoint at its upcoming result release, given persistent guidance of 11% earnings growth despite overall weakness in retail. Yet nor is the stock likely to re-rate given it is already expensive as far as the broker is concerned. The broker has lifted its target to $16.44 from $12.59 (February) and on balance moves back to a Neutral stance from Underperform.

4. NAVIGATOR GLOBAL INVESTMENTS LIMITED (NGI) was upgraded to Outperform from Neutral by Macquarie B/H/S: 2/0/0

FY19 results were in line with the recent trading update. Macquarie observes the outlook is stabilising and the risk has shifted to the upside. The company continues to invest in a proprietary platform and management is progressing with marketing, confident in its opportunity and product offering. Hence, the broker upgrades to Outperform from Neutral and raises the target to $3.63 from $3.62.

In the not-so-good books

1. AGL ENERGY LIMITED (AGL) was downgraded to Reduce from Hold by Morgans B/H/S: 0/3/4

FY19 results were slightly better than Morgans expected. However, guidance for FY20 underlying net profit has missed forecasts. The broker believes the fundamentals paint a bleak picture over the long-term. Risks from regulation and the increasing age of the generation fleet are expected to weigh on the stock, despite the short-term support from the buyback. The company has announced a share buyback of up to 5% of outstanding capital. The broker suspects AGL will need to increase its debt to pay for the buyback as well as its expansion plans. Rating is downgraded to Reduce from Hold and the target reduced to $16.86 from $18.33.

See upgrade above.

2. ARB CORPORATION LIMITED (ARB) was downgraded to Neutral from Outperform by Macquarie B/H/S: 0/4/0

Macquarie observes cyclical headwinds are weighing on the business and likely to persist amid a soft retail environment, with weakness in utility vehicle sales and construction sector activity. The broker downwardly revises FY19-20 estimates by -1-3%. While the business is considered quality, Macquarie downgrades to Neutral from Outperform, envisaging earnings risks are skewed to the downside. Target is reduced to $18 from $20.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.