As the dichotomy between corporate earnings under pressure and share market indices near an all-time high persists, it should be no wonder stockbroking analysts continue issuing decisively more downgrades than upgrades for individual ASX-listed stocks.

It should be noted that, while the RBA is widely criticised for lowering the cash rate further in 2019, a record number of Australian companies is issuing profit warnings; a trend that continued up until last Friday.

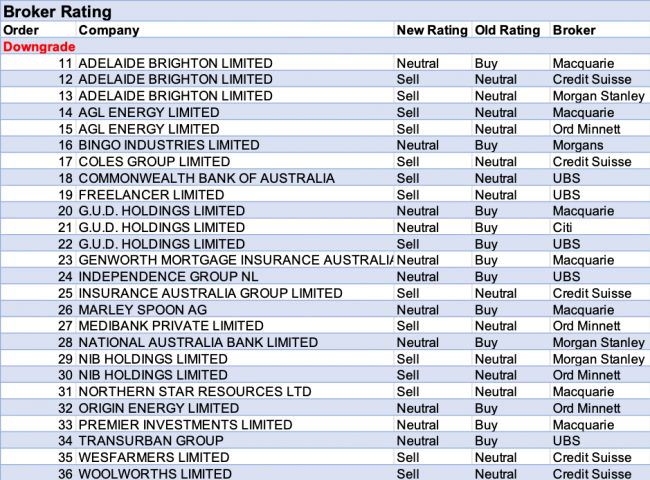

For the week ending Friday 2 August 2019, FNArena registered 10 upgrades versus 26 downgrades.

Equally noteworthy is the observation that seven out of the ten upgrades only moved to Neutral from Sell, leaving only three fresh Buy ratings. Karoon Gas, ResMed and Xero are the week’s lucky three. Further emphasising the bifurcated nature of the 2019 bull market rally is the added observation that both ResMed and Xero are high PE multiple, quality growth stocks. Need I say more?

An important third observation completes the week’s trifecta: the table for stocks receiving downgrades throughout the week is populated with companies releasing financial results and/or profit warnings ahead of the release. Adelaide Brighton (profit warning) received three downgrades against one upgrade, AGL Energy received two downgrades (both to Sell), GUD Holdings (FY19 release) received three downgrades, and nib Holdings was downgraded twice.

Fifteen out of the 26 downgrades moved to Sell, which includes household names such as Woolworths, Wesfarmers, Medibank Private and Insurance Australia Group (IAG).

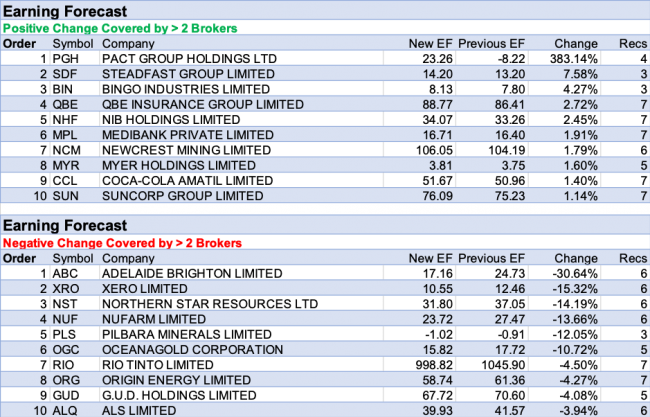

Increases to earnings estimates remain rather mild, though battle-hardened, bruised and dented Pact Group saw a gigantic increase during the week. Out of the rest of the table, only Steadfast Group and Bingo Industries are worth mentioning.

As expected, there’s a lot more happening inside the table for negative revisions to earnings estimates. Adelaide Brighton tops the ranking, followed by Xero, Northern Star, Nufarm, Pilbara Minerals, and OceanaGold. They all suffered double-digit percentage declines. Further down the table we also find Rio Tinto (half-yearly update), Origin Energy and GUD Holdings.

The August reporting season is only just getting started. Meanwhile, international markets are being dominated by macro and geopolitical matters. August 2019 might well turn into a surprising, levelled experience for local investors.

In the good books

1. ADELAIDE BRIGHTON LIMITED (ABC) was upgraded to Hold from Lighten by Ord MinnettB/H/S: 0/2/4

Following the company’s second downgrade to 2019 net profit estimates, Ord Minnett now believes guidance is achievable. Management has signalled a -32-37% decline in net profits over the year. The broker upgrades to Hold from Lighten, although reduces the target to $3.50 from $3.90. Despite the sharp reaction in the share price following the announcement, Ord Minnett does not believe the stock is cheap.

See downgrades below.

2. MYER HOLDINGS LIMITED (MYR) was upgraded to Neutral from Underperform by Credit SuisseB/H/S: 1/2/1

Credit Suisse retains bearish forecasts for discretionary retailers but upgrades Myer to Neutral from Underperform. Target is 44c.

3. SYDNEY AIRPORT HOLDINGS LIMITED (SYD) was upgraded to Neutral from Sell by UBSB/H/S: 2/3/2

Following a material decline in bond yields UBS is reducing its cost of equity assumptions, which drives an upgrade to valuation. The stock’s long-dated concession, and longer-term cash flow, means it has strong leverage to lower bond yields. UBS upgrades to Neutral from Sell. The broker expects weakening bond yields to be the primary driver of share price performance. Target is raised to $8.50 from $7.00.

4. WESTPAC BANKING CORPORATION (WBC) was upgraded to Equal-weight from Underweight by Morgan StanleyB/H/S: 2/4/1

Morgan Stanley assesses major bank PE multiples have re-rated since the federal election but have underperformed the broader Australian market since the first cut to official rates in June. The combination of subdued loan growth prospects, downward pressure on margins from lower interest rates and a reinvestment burden is likely to mean the banks remain in a downgrade cycle, in the broker’s view. Westpac has become the broker’s preferred major bank and the rating is upgraded to Equal-weight from Underweight because of relative valuation support and more scope to mitigate the impact of lower rates. Target is raised to $26.60 from $26.00. Industry view: In Line.

5. XERO LIMITED (XRO) was upgraded to Outperform from Neutral by MacquarieB/H/S: 2/1/2

Macquarie has decided to upgrade Xero to Outperform from Neutral while bumping up its price target by 21% to $76.50. The analysts believe Xero is well positioned to establish itself as a global platform of choice for SMEs, underpinned by its core subscription SaaS product. The underlying thesis is that strong unit economics will drive operating leverage for the company. The analysts argue Xero is still only at the precipice of its long-term growth story. They see the US market as equally ripe for cloud disruption.

In the not-so-good books

1. ADELAIDE BRIGHTON LIMITED (ABC) was downgraded to Neutral from Outperform by Macquarie, to Underperform from Neutral by Credit Suisse and to Underweight from Equal-weight by Morgan Stanley B/H/S: 0/2/4

Macquarie had already set its forecasts below Adelaide Brighton’s prior guidance range on concerns over Queensland demand, but new guidance is lower still, given weak demand in SA and Victoria as well, leading the broker to cut forecasts a further -22%. The broker had expected a lower dividend, but now no interim will be offered. Macquarie downgrades to Neutral from Outperform, citing concerns over earnings visibility. It’s not just weak demand that is the issue, the broker believing the business model may need to be reconsidered. Target falls to $3.75 from $4.80.

The company has downgraded net profit guidance for the second time for 2019. Management has attributed this partly to market deterioration and partly to company-specific factors. Credit Suisse notes the company’s business model has been caught poorly positioned, affected by circumstances more than peers. Adelaide Brighton is not sufficiently vertically integrated in Queensland and Victoria to pick up infrastructure work, which is one of the factors. The company will not declare a first half dividend and special dividends are dependent on land sales. Credit Suisse downgrades to Underperform from Neutral and reduces the target to $3.00 from $3.70.

Adelaide Brighton has downgraded net profit guidance, again, to $120-130m, a -25% reduction to Morgan Stanley’s estimates. No interim dividend will be paid. The main drivers of the weakness are soft conditions in residential and civil construction markets and continued competitive pressures in Queensland and South Australia. Morgan Stanley is concerned about the dramatic decline in earnings since the last downgrade in May and the lack of a dividend removes one of the key pillars of support for the stock. Rating is downgraded to Underweight from Equal-weight and the target lowered to $3 from $4. Industry view: Cautious.

See upgrade above.

2. COMMONWEALTH BANK OF AUSTRALIA (CBA) was downgraded to Sell from Neutral by UBSB/H/S: 0/3/4

UBS is finding it too difficult to justify the share price. While Commonwealth Bank has a strong franchise, with a technological lead and robust financial returns the earnings profile is declining. Hence, the broker downgrades to Sell from Neutral. UBS believes the bank has a dilemma regarding whether to return excess capital or face a potential shortfall, should the Reserve Bank of New Zealand proceed with its capital review proposals and/or the Australian Prudential Regulatory Authority closes its “capital re-positioning” regulatory arbitrage. The broker believes it would be more prudent to retain capital for New Zealand until the rules are clarified by the end of the year. However, UBS assesses investors appear to favour a full return of around $5bn up front and then rebuild capital for NZ over time. Target is steady at $72. The bank will report its results on August 7.

3. COLES GROUP LIMITED (COL) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 0/4/2

Credit Suisse notes, while retail share prices appreciated strongly in the fourth quarter, retail trade remains subdued. The broker believes the market has set earnings expectations low for most retailers and any misses will result in significant reductions to the share prices. The broker downgrades to Underperform from Neutral. Target is $12.04.

4. FREELANCER LIMITED (FLN) was downgraded to Sell from Neutral by UBS B/H/S: 0/0/1

FX was a key driver of top-line growth in the first half and UBS estimates the underlying marketplace revenue was essentially flat. While the broker likes the stock, the share price is seen incorporating a hefty recovery as well as some undeveloped opportunities. Further monetisation and uplift in growth is required. The broker downgrades to Sell from Neutral. Target is raised to $0.88 from $0.70.

5. GENWORTH MORTGAGE INSURANCE AUSTRALIA LIMITED (GMA) was downgraded to Neutral from Outperform by Macquarie B/H/S: 0/2/0

The company reported in line, with a seasonally stronger second half to come. The market responded favourably to the remaining buyback being paid as an unfranked special dividend instead. Macquarie notes shareholders have already approved the buyback of another 100m shares which could happen in the next six months, subject to regulatory approval. A reserve release is also possible, with reserves levels remaining high. This, and a cut to forecast investment yields, lead the broker to cut earnings forecasts and its target to $3.25 from $3.50. On the strong share price response, Macquarie pulls back to Neutral from Outperform.

6. INSURANCE AUSTRALIA GROUP LIMITED (IAG) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 0/5/2

Credit Suisse expects Insurance Australia Group will hit the lower end of its insurance margin target in FY19. Guidance was initially considered conservative and likely to be beaten but following downgrades to consensus estimates over the year, the broker’s is not so sure this is the case. Rating is downgraded to Underperform from Neutral as the risk to the share price is considered skewed to the downside. Target is steady at $7.80.

7. INDEPENDENCE GROUP NL (IGO) was downgraded to Neutral from Buy by UBS B/H/S: 1/4/1

Cost guidance for FY20 is modestly higher than UBS expected and Tropicana production is lower. This has resulted in a -10% downgrade to the broker’s FY20 estimates for net profit. The broker remains concerned that the move higher in the nickel price may not be fundamentally backed. The stock appears to be trading around fair value and UBS downgrades to Neutral from Buy. Target is steady at $5.40.

8. MARLEY SPOON AG (MMM) was downgraded to Neutral from Outperform by Macquarie B/H/S: 0/1/0

Investors should expect volatility in Marley Spoon’s operating metrics as the company scales up, Macquarie suggests, but a June Q reversal of the prior positive cash flow trend and a decline in active customers has led to market uncertainty when cash flow breakeven is the key focus. Meal kits still offer high growth potential and the partnership with Woolworths (WOW) is supportive but the broker pulls back to Neutral from Outperform, expecting uncertainty to weigh on valuation in the near term. Target falls to 68c from $1.10.

9. NATIONAL AUSTRALIA BANK LIMITED (NAB) was downgraded to Equal-weight from Overweight by Morgan Stanley B/H/S: 2/4/1

Morgan Stanley assesses major bank PE multiples have re-rated since the federal election but have underperformed the broader Australian market since the first cut to official rates in June. The combination of subdued loan growth prospects, downward pressure on margins from lower interest rates and a reinvestment burden is likely to mean the banks remain in a downgrade cycle, in the broker’s view. National Australia Bank’s rating is downgraded to Equal-weight from Overweight, as it has outperformed the other major banks since the federal election. The target is lowered to $26.40 from $27.30. Industry view: In-line.

10. ORIGIN ENERGY LIMITED (ORG) was downgraded to Hold from Buy by Ord Minnett B/H/S: 4/3/0

Ord Minnett believes strong cash flowing from APLNG in FY19 could be overshadowed by earnings downgrades. The broker reduces net profit estimates by -15%, ahead of the results on August 22. The broker also expects energy market operating earnings (EBITDA) guidance for FY20 will be -10-20% lower. Rating is downgraded to Hold from Buy and the target is steady at $8.35.

11. TRANSURBAN GROUP (TCL) was downgraded to Neutral from Buy by UBS B/H/S: 1/4/2

Following a decline in bond yields, UBS is reducing its cost of equity assumptions, which drives an upgrade in valuation. Despite this, the broker finds insufficient upside to warrant a Buy rating and downgrades to Neutral. With such low bond rates and a low cost of equity the broker muses about whether Transurban may become more aggressive in its growth plans. Target is raised to $15.10 from $13.75.

12. WESFARMERS LIMITED (WES) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 0/2/3

Credit Suisse notes, while retail share prices appreciated strongly in the fourth quarter, retail trade remains subdued. The broker believes the market has set earnings expectations low for most retailers and any misses will result in significant reductions to the share prices. The broker downgrades to Underperform from Neutral. Target is $33.41.

13. WOOLWORTHS LIMITED (WOW) was downgraded to Underperform from Neutral by Credit Suisse B/H/S: 0/2/4

Credit Suisse notes, while retail share prices appreciated strongly in the fourth quarter, retail trade remains subdued. The broker believes the market has set earnings expectations low for most retailers and any misses will result in significant reductions to the share prices. The broker downgrades to Underperform from Neutral. Target is $29.51.

Earnings forecast

Listed below are the companies that have had their forecast current year earnings raised or lowered by the brokers last week. The qualification is that the stock must be covered by at least two brokers. The table shows the previous forecast on an earnings per share basis, the new forecast, and the percentage change.

The above was compiled from reports on FNArena. The FNArena database tabulates the views of seven major Australian and international stock brokers: Citi, Credit Suisse, Macquarie, Morgan Stanley, Morgans, Ord Minnett and UBS. Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.