Like

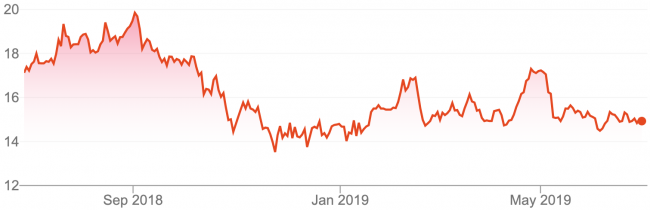

“I like Treasury Wine Estates (TWE). Trading nearer multi-year share price and P/E lows, the estimated long term growth for TWE (Bloomberg consensus) is around 16%,” Michael says.

“Sales growth around 10%, a premium offering and Asian expansion are good reasons for investors to consider TWE,” he adds.

Source: Google

Dislike

However, Michael doesn’t like Nearmap (NEA)

“It’s an exciting business prospect and a great Australian story,” he says

“However, with no earnings to speak of until 2021 and an expansionary spend on the horizon, I think NEA could come back to earth. Repeated failures at $3.90 may indicate a pullback to $2.70 to $3,” he adds.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.