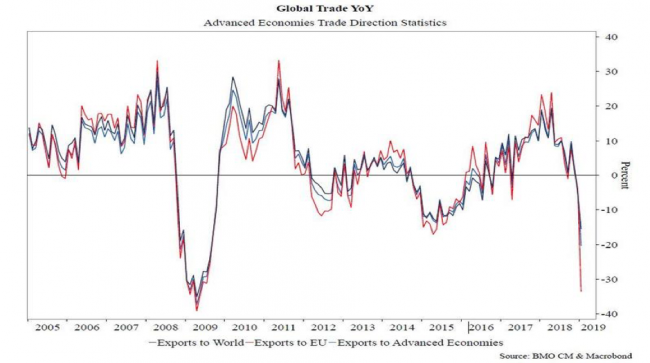

With US/China trade tensions escalating, global trade has plunged to an extent not seen since the financial crisis of 2008. See chart below.

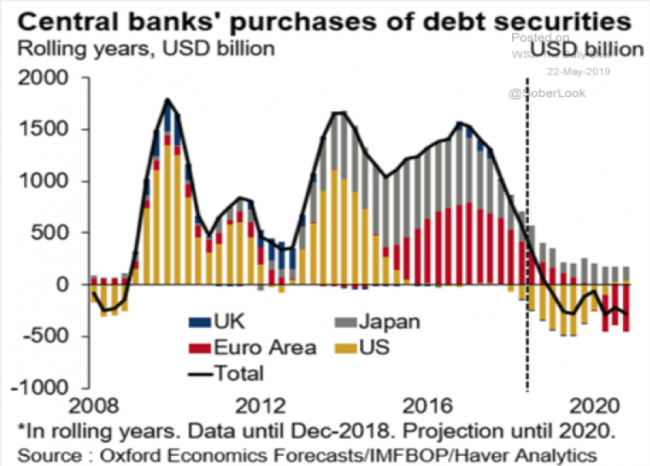

Also central banks have collectively stopped buying bonds, which fuelled the boom in asset prices since 2009. See next chart.

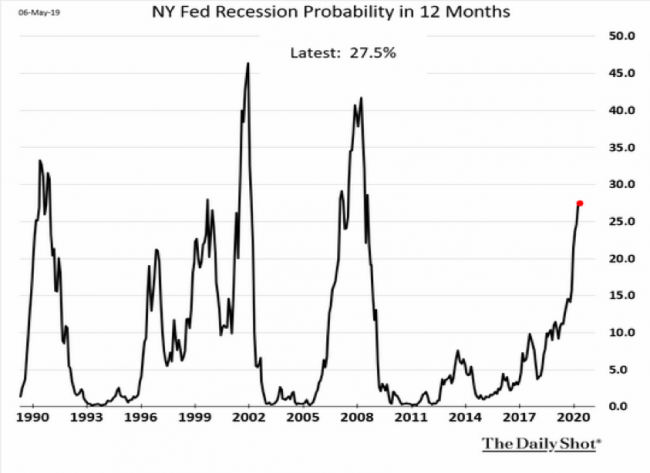

And the New York Federal Reserve Bank’s calculation of US recession risk over the next 12 months is the highest it has been for more than a decade. .

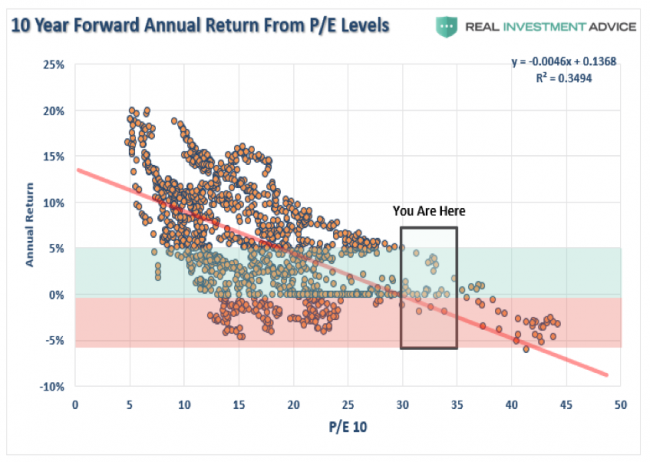

Assuming the overstretched S&P 500 share index reverts to its average historical price to earnings ratio, then future returns for American share investors is low or negative, as the chart below suggests.

Of course, Australia is not America. Indeed our market looks fair value by comparison.

But if the USA was to crash (possibly triggered by its economic war with China), other markets would not escape the shock.

So a shift in emphasis from shares to bonds in what could be a problematic year is tempting.

Here are some bonds and income funds listed on the Australian Securities Exchange (ASX).

Before buying any, please consult your financial adviser because this list is not an in-depth analysis or recommendation, but simply possibilities for consideration.

Low risk Bond Funds

These have low yields but being investment grade they should have low downside risk. Yet all fixed interest bonds, by definition, are overvalued because their interest yields remain at historic lows. Nevertheless in a stock market crash, they should rally in price because they offer a safe haven.

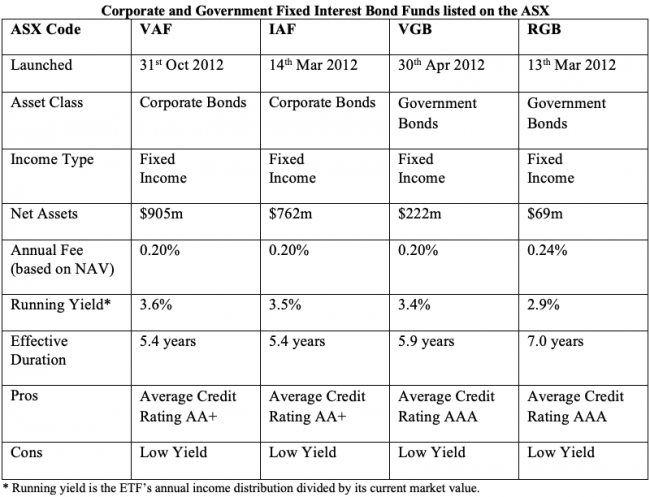

The largest listed two corporate and two government fixed interest bond funds are:

- Vanguard Australian Fixed Interest Index Fund – (ASX Code: VAF)

- iShares UBS Composite Bond Fund – (IAF)

- Vanguard Australian Government Bond Index Fund – (VGB)

- Russell Australian Government Bond Fund – (RGB)

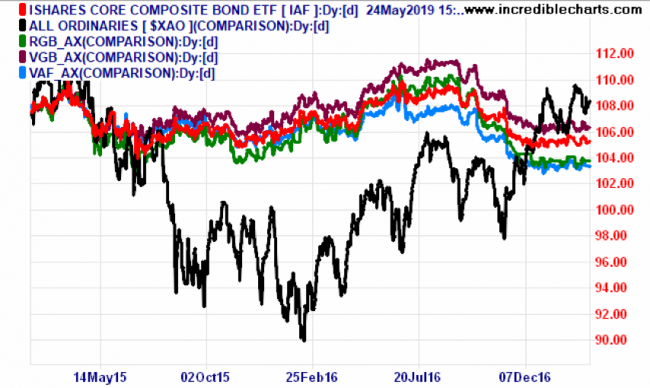

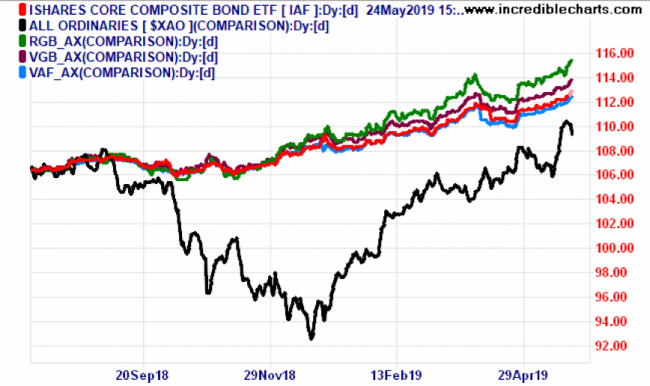

The charts below show their price movements during the stock markets slumps of 2015/16 and 2018/19. Notice in each case how the prices of these bond funds largely defied the fall in the All Ords share price index.

Corp and Govt Bond Fund Prices versus All Ords Index during 2015/16 stock market slump

Corp and Govt Bond Fund Prices versus All Ords Index during 2018/19 stock market slump

Here’s a table of their key features.

Source: Individual fund managers’ websites, BondAdviser Research Reports and ETFWatch 2018 ETF Review.

High-yield Income Funds

These pose a higher risk than government or corporate bonds, though it is different to stock market risk. Their main attraction is their higher yield.

Most have a short existence as listed funds, though some invest in unlisted funds with a longer lifespan. They include:

- Qualitas Real Estate Income Fund – (ASX Code: QRI)

- MCP Master Income Trust – (MXT)

- Gryphon Capital Income Trust – (GCI)

- Neuberger Berman Global Corporate Income Trust – (NBI)

The next chart shows how the unit prices of these income funds performed during the 2018/19 stock market correction. As can be seen, two of them (MXT and GCI) sailed through this turbulent time easily, one (QRI) rallied after its launch during the All Ords trough and one (NBI) swooned in sympathy with the share sell off, though had less downside and bounced back quickly.

High Yield Income Fund Prices versus All Ords Share Index, 2018/19

BondAdviser.com.au rates NBI as a high security risk and the other three (QRI, MXT and GCI) as upper medium risk. Yet on a risk/return basis and taking account of each manager’s experience and skill, it recommends all four funds to its clients. One reason is that the reduction in bank lending in response to the Hayne Royal Commission and APRA’s tougher macro-prudential controls has provided an opportunity for non-bank lenders to charge the local clients a premium for credit.

QRI lends directly to property developers, primarily in residential real estate. BondAdviser’s report can be downloaded at https://app.bondadviser.com.au/uploads/document/file/1640/Bond-Adviser-QRI-Research-Report.pdf

MXT accesses the Australian corporate debt market which historically has been restricted to major global banks and institutional investors. BondAdviser’s report is available at https://app.bondadviser.com.au/uploads/document/file/1708/MXT_Feb_Update_Report_Final__Long_.pdf

GCI invests in residential mortgage-backed securities (RMBS) which are not generally available to retail investors. BondAdviser’s report can be read at https://app.bondadviser.com.au/uploads/document/file/1644/Bond_Adviser_Research_Report.pdf

NBI is a listed income trust (LIT) which provides exposure to the global high-yield bond market which offers more diversity than possible within Australia. The fund is not leveraged and all foreign currency risk is hedged into AUD. BondAdviser’s report can be found at https://www.nb.com/documents/public/en-au/nb_gcit_bondadviser.pdf

The key features of each high yield fund are summarised in the table below.

Private Debt Market Income Funds listed on the ASX

Source: Individual fund managers’ websites, BondAdviser Research Reports and ETFWatch 2018 ETF Review.

What’s clear is that the choice with bond and income funds largely comes down to return versus risk, though fixed income securities exhibit different risk profiles and price fluctuations to share markets. That can be useful to ensure a portfolio’s asset prices don’t all jig to the same beat. Different patterns of price movements can aid a portfolio’s overall stability.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.