Like

“I like Smartgroup (SIQ),” Michael said.

“This administrative outsourcing group experienced share price pressure as private car sales fell over Q2 2018. Its February result was slightly below forecast, but it’s possible the relentless selling is overdone. With both Federal and State governments on the client roll and a P/E around 13x on fairly modest projections, some investors may view this as a value buy,” he added.

Source: Google

Dislike

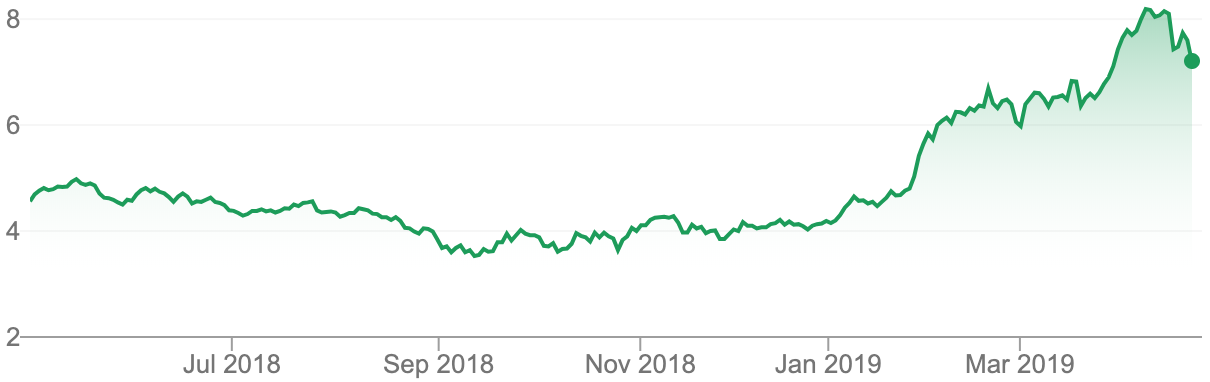

On the other hand, Michael doesn’t like Fortescue (FMG).

“As much as I admire this company’s achievements, the share price has more than doubled in six months. This could reflect an investor scramble due to last year’s almost universal bearish opinion on iron ore. The rejection at $8 may mean a pullback to between $5 and $5.50 is on the cards,” he added.

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.