An area of Australia’s mineral endowment that is rapidly coming into its time in the spotlight is rare earths. The 16 rare-earth metallic elements comprise neodymium, praseodymium, dysprosium, lanthanum, cerium, promethium, samarium, europium, gadolinium, terbium, holmium, erbium, thulium, ytterbium, lutetium and yttrium. Scandium is also included in manly lists of rare earths, but its geological occurrences and chemical properties differ from the rest.

At the moment, the glass industry is the biggest user of REE (rare earth element) raw materials, using them for glass polishing and as additives that provide colour and special optical properties. The REEs are used as components in steel alloys, in high-technology devices, including smart phones, digital cameras, computer hard disks, fluorescent and light-emitting-diode (LED) lights, flat screen televisions, computer monitors, and electronic displays. Large quantities of some REEs are also used in defence technologies, and the metals also have a growing range of uses in medical technology. All of these play a role in the growing demand for REEs, but what excites most investors is the metals’ exploding use in “clean energy.”

The REE basket of minerals are crucial to the manufacture of permanent magnets that are essential for electric motors, batteries, lasers, robotics and wind-power generation. In particular, the global push for net-zero carbon emissions through the adoption of Electric Vehicles (EVs) and renewable energy (particularly wind turbine) installations is driving global demand for rare earths.

This demand will only grow, and at very large rates, as more countries commit to the energy transition. For example, one of President Biden’s first acts in office was to sign a US$2 trillion ($2.7 trillion) executive order setting-out goals for the US to achieve economy-wide net zero carbon dioxide emissions by 2050, and a carbon-free electricity sector by 2035. Rare earths are absolutely crucial to this goal, and to the goals of every country that has “pledged” to achieve net-zero emissions, by whatever date.

But there is a supply problem. The fact that China dominates the global rare earths market: China produces more than 70% of global supply, and also consumes about the same proportion of global demand – and what is more concerning for the developed world, China holds more than 90% of global processing capacity, and increasingly, it reserves much of its production for domestic use.

There are no known substitutes for REEs in most applications, given their unique magnetic, chemical and luminescent properties. Simply put, the developed world is desperate for reliable non-Chinese sources of supply for these materials. And that’s where Australia (and Australian companies) comes in.

The flagship of the Australian rare earths industry is, of course, Lynas Rare Earths (LYC), which is the only non-Chinese supplier of rare earths. Lynas is well on the way to becoming a major supplier of rare earths metals to the US defence industry: it has struck a deal with the US government to build a commercial light rare earths separation plant in Texas. The facility, expected to produce about 5,000 tonnes of rare earths a year, would help Washington’s push to secure domestic supply of essential minerals for military uses, as well as clean-energy uses.

But coming along under Lynas, there is a small group of companies planning to bring REE deposits into production.

Speculative-minded investors could look at other ASX-listed potential rare earth producers, and), with the caveat that these are not yet producing – and it’s a race to get into production, which requires offtake agreements. Investors must keep an eye on the news flow of these companies, but the stocks could in the right circumstances perform well.

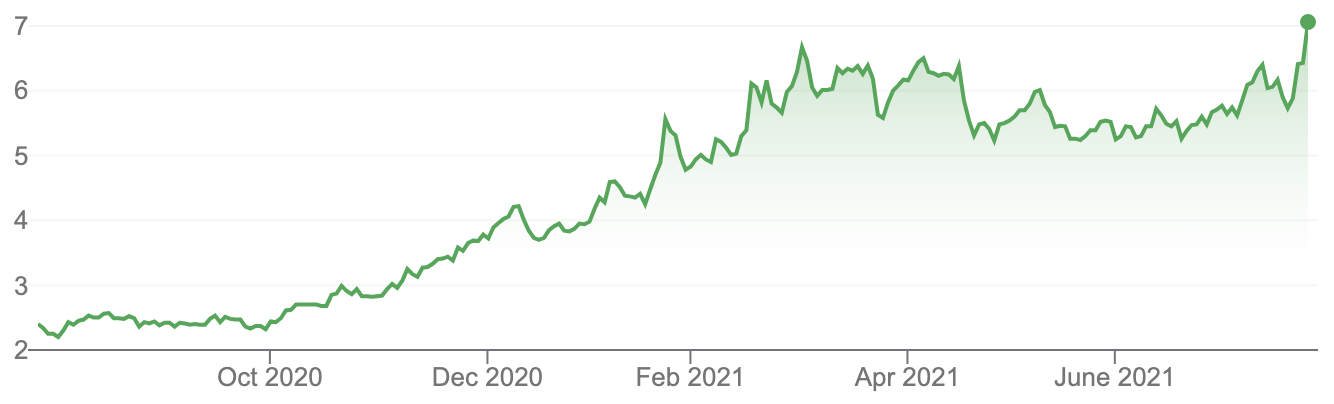

1. Lynas Rare Earths (LYC, $6.43)

Market capitalisation: $5.8 billion

Three-year total return: 45% a year

Estimated Y22 dividend yield: no dividend expected

Analysts’ consensus valuation: $6.25 (Thomson Reuters)

The world is growing increasingly keen on Lynas’ products: for example, broker UBS expects the market, just in electric vehicles (EVs), for LYC’s major product, neodymium-praseodymium (NdPr), to triple in size over the next 10 years. Aside from NdPr, which is also used in batteries and wind turbines, consumer electronics, robotics, appliances and medical devices, the company’s dysprosium, terbium, lanthanum and cerium products are also finding new uses in these areas. Lynas’ exposure to global thematic megatrends is first-class.

Lynas mines rare earths at its world-leading orebody at Mt. Weld in Western Australia, which is expected to grow as further exploration is conducted, and operates the largest single rare earths processing plant in the world, in Malaysia, which it built in 2012 to process rare earth material at a lower cost than it could in Australia (the Malaysia plant has struggled over the last 18 months with the country’s COVID restrictions at the moment.) However, the June 2021 quarter saw Lynas rack-up record quarterly revenue, of $185.9 million, reflecting what it described as “sustained demand” for its NdPr products and strong market pricing, “as end-users and governments around the world continue to recognise the need for a diversified supply of responsible rare earth materials.”

Lynas has an ambitious 2025 plan to grow its processing capabilities, including a fully funded rare earths processing facility in Kalgoorlie, Western Australia, which is expected to begin operations by July 2023, and a commercial light rare earths separation plant in the US – co-funded by the US Department of Defense, which tells you how keen the US is on having a non-Chinese supply option – which may also include processing of heavy rare earths and specialty materials. By 2025, Lynas plans to have a production capacity of at least 10,500 tonnes a year of NdPr (to put that in context, first-half FY21 production was 2,709 tonnes) and to have its Kalgoorlie facility able to supply downstream operations in the US and Malaysia. As an investment exposure to the technologies of the future, LYC is right up there with the best of them – but the problem for investors right now is that the stock has pushed past what analysts see as fair-value for it right now.

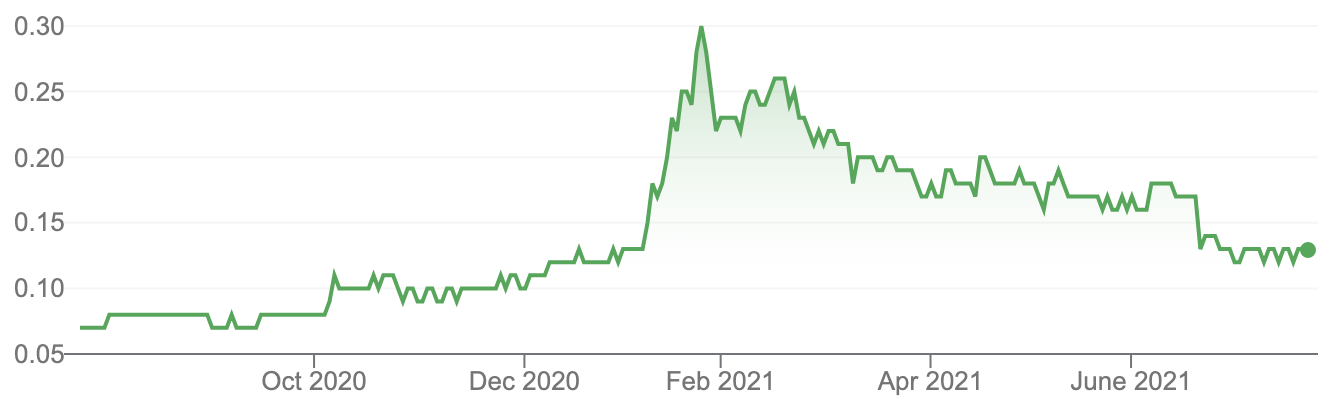

Lynas Rare Earths (LYC)

Source: Google

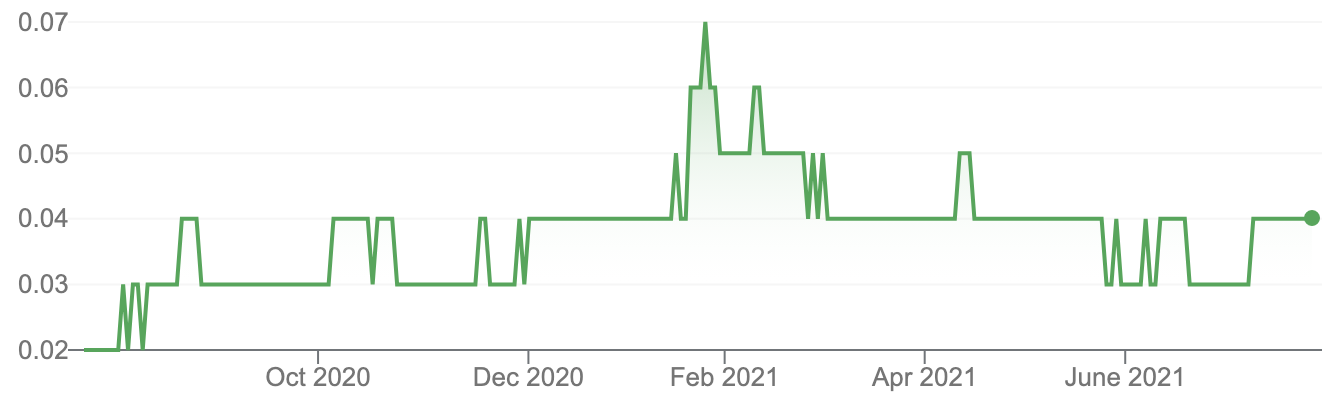

2. Northern Minerals (NTU, 3.8 cents)

Market capitalisation: $184 million

Three-year total return: –22.4% a year

Analysts’ consensus valuation: n/a

Northern Minerals is developing its wholly owned Browns Range heavy rare earths project in northern Western Australia. NTU is a producer: it began producing heavy rare earth carbonate (REC) in late 2018 as part of a three-year pilot assessment of economic and technical feasibility of a larger-scale development of the project. COVID-19 caused a shutdown in March 2020, but the operation resumed again in August 2020.

In November 2019, Northern Minerals signed an offtake agreement with German-based thyssenkrupp, which is buying all of the output of the pilot plant, and working with NTU as a partner to expand the project. In March, NTU shipped the latest shipment of 40,406 kilograms of REC, containing 1,835 kg of dysprosium oxide and 233 kg of terbium oxide, to thyssenkrupp, bringing total production of REC to 211,109 kilograms, in turn containing 9,751 kg of dysprosium oxide and 1,245kg of terbium oxide.

NTU says both dysprosium and terbium are critical elements in the permanent magnet motors used in EV powertrain applications; and dysprosium is an essential ingredient in the production of DyNdFeB (dysprosium neodymium iron-boron) magnets used in clean energy, military and high-technology solutions. Ultimately, NTU plans to leverage what it learns in running the pilot plant into becoming one of the few significant world producers of dysprosium outside of China.

Northern Minerals (NTU)

Source: Google

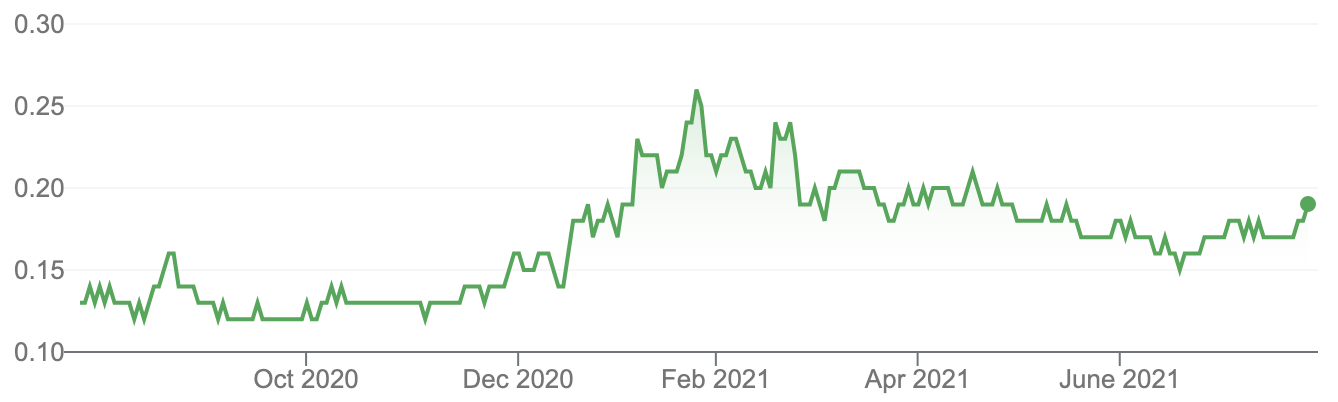

3. Hastings Technology Metals (HAS, 18 cents)

Market capitalisation: $313 million

Three-year total return: –9.8% a year

Analysts’ consensus valuation: 32.5 cents (Thomson Reuters),

Hastings Technology Metals calls itself “Australia’s next rare earths producer,” with its flagship Yangibana rare earths project in the Upper Gascoyne region of Western Australia incorporating a mine and a proposed beneficiation and hydro-metallurgy processing plant, which will treat rare earths deposits hosting high neodymium and praseodymium content, to produce a mixed rare earths carbonate that will be further refined into individual rare earth oxides at processing plants overseas.

In April, it signed a binding offtake contract with thyssenkrupp for high-grade mixed rare earth carbonate (MREC) from Yangibana, under which thyssenkrupp will take 60% of annual Yangibana production volume for the first five years and 33% for the second five years.

In statements to the stock exchange, Hastings has said that Yangibana has:

- The highest content of key rare earth elements for any known rare earth project (the higher the Nd-Pr content, the lower is the separation cost);

- The highest value rare earths project for ore value per kilogram, at up to 175% higher-value ore products than any current producing rare earth project;

- World-leading grades of Nd and Pr = 52% of the TREO (total rare earth oxides) values; and

- 92% of its ore value is represented by the four key elements required for the electric vehicle market.

Last month, Hastings augmented that with testing on the Simon’s Find deposit at Yangibana, saying that up to 57% of Simon Find’s TREO is neodymium and praseodymium, a ratio it says is “unrivalled for any known rare earths deposit worldwide.”

At the moment, Yangibana’s mineral resource estimate (all deposits) stands at 27.42 million tonnes @ 0.97% total rare earth oxides (TREO), for 266,000 tonnes of rare earth oxides, giving a mine life beyond 15 years; and exploration is likely to increase this. It’s obviously an outstanding NdPr deposit: Yangibana is fully permitted to long-life production, and construction is due to start in 2021, with first output scheduled for 2023.

Hastings Technology Metals (HAS)

Source: Google

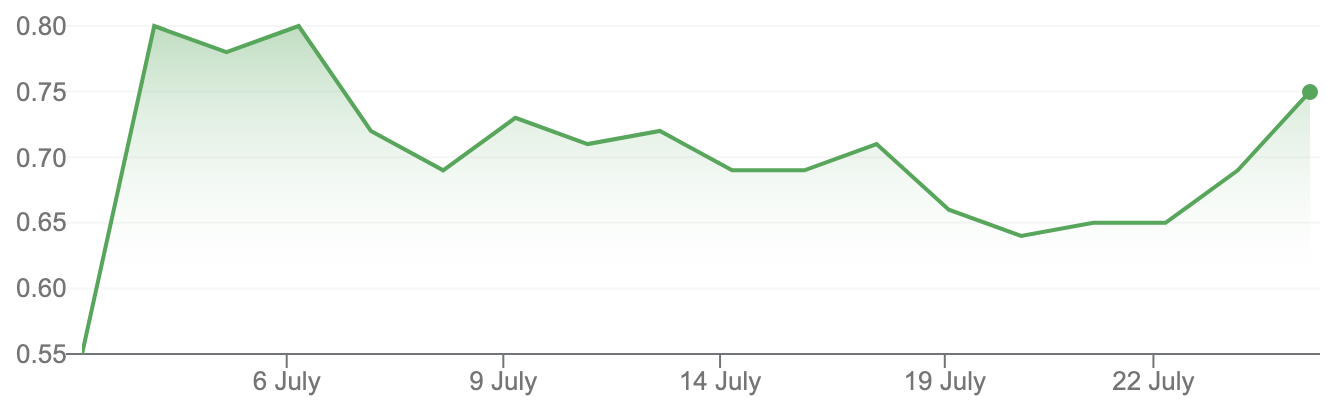

4. Australian Rare Earths (AR3, 68.5 cents)

Market capitalisation: $75.8 million

Three-year total return: n/a

Analysts’ consensus valuation: n/a

Australian Rare Earths, which only listed on the ASX earlier this month, has had a great reception: the shares, which were offered in the IPO at 30 cents, have more than doubled.

Australian Rare Earths owns the Koppamurra rare earths project, which straddles the South Australia/Victoria border. The deposit contains the full suite of REE metals; the company describes it as “uniquely rich in all the REEs required in the manufacture of rare earth permanent magnets which are essential components in energy-efficient motors.”

Even more unique is the fact that instead of being a hard-rock REE deposit, like most of the other Australian-listed rare earths companies, Koppamurra is a hosted in ionic clays. Ionic rare earths clays are currently mined in China and Myanmar, but resources are depleting. The ionic clay deposits supply virtually all “heavy” REEs (those with higher atomic weights, including dysprosium) and a significant portion of “light” REEs (including NdPr). But crucially,

the ionic rare earths have much simpler metallurgy than hard-rock deposits; and are far easier to process and obtain the metal. Importantly, there are no radioactive tailings with an ionic clay deposit; no deep open pits or underground mining; and thus, far less capital spending and time to bring to production.

The inferred mineral resource at the moment is 39.9 million tonnes @ 725 parts per million (ppm) TREO, or 0.07% TREO. The results of a recent 79-hole drilling program can be expected to increase that. Australian Rare Earths says the deposit has “a relatively high proportion of heavy rare earths, particularly dysprosium and terbium, along with neodymium and praseodymium, all of which are used in rare earth permanent magnets (REPM) which were responsible for over 90% of total global REO value traded in 2020.” The company has a unique asset, but is behind some of the others in that it does not yet have offtake customers. It is still exploring and has not yet formally committed to mining. But something drastic would have to go wrong for that not to come to fruition.

AR3 is a great story – investors just have to accept the fact that the IPO subscribers have already doubled their money.

Australian Rare Earths (AR3)

Source: Google

5. Arafura Resources (ARU, 12.7 cents)

Market capitalisation: $146 million

Three-year total return: 11.6% a year

Analysts’ consensus valuation: n/a

Arafura is developing its $1 billion Nolans rare earths project, in the Northern Territory, with which it has ambitious plans of securing 5%–10% of the market for supplying permanent magnet demand. Arafura says the deposit is a “globally significant and strategic NdPr project,” big enough to sustain a minimum mine-life of 38 years.

It’s not just NdPr: Nolans is a rare earths-phosphate-uranium-thorium (REE-P-U-Th) deposit, with a JORC-compliant mineral resource of 56 million tonnes at an average grade of 2.6% total rare earth oxides (TREO), and 11% phosphate (P2O5). Two-thirds of the contained rare earths are in the high-confidence measured and indicated resource categories.

The company says Nolans is the only NdPr-focused project in Australia that has secured complete environmental permitting for mining, beneficiation, extraction and separation of rare earths, including the on-site management and disposal of radioactive tailings and process wastes, as well as progressive site rehabilitation. The company says the project will make it the world’s second-largest large-scale non-Chinese source of rare earths.

At the moment, Arafura is applying its recent $45 million fundraising to fund front end engineering and design (FEED) activities, commencing in the current half-year, with a final investment decision (FID) expected by the second half of 2022.

When the plant is in operation, Arafura expects to produce more than 4,400 tonnes of NdPr Oxide product a year. The project is on track to begin production by the end of 2024 – right when Arafura expects the NdPr market to enter a deficit, due to under-investment in the rare earth oxides supply chain. So far, there have been no offtake agreements announced, but Arafura says it is in discussions with nine parties, for more than 120% of planned production; it wants to secure 85% as binding offtake to seal the project’s future.

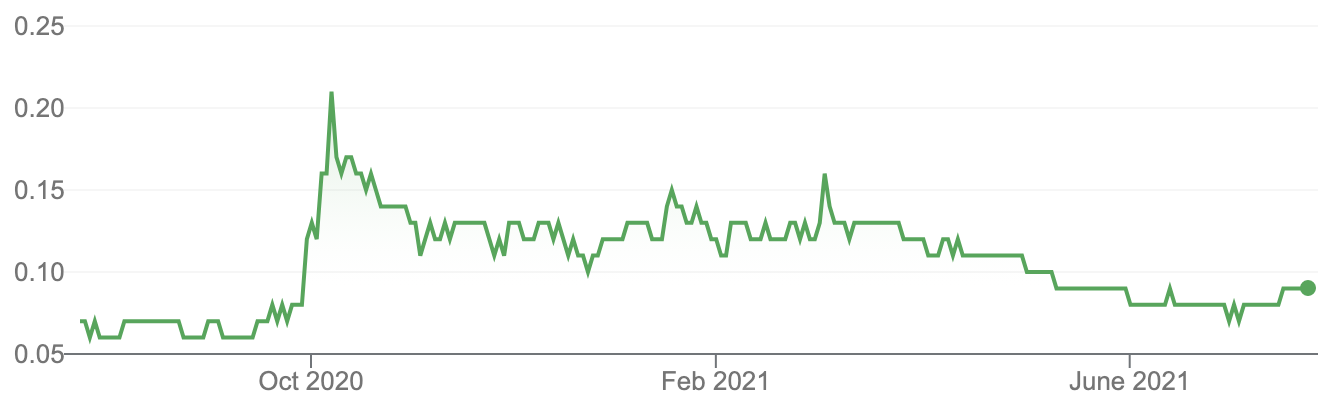

Arafura Resources (ARU)

Source: Google

6. Australian Strategic Materials (ASM, $8.79)

Market capitalisation: $1.2 billion

Three-year total return: n/a

Analysts’ consensus valuation: n/a

Australian Strategic Materials wholly owns the Dubbo project in central western New South Wales, which it describes as a long-term, globally significant resource of rare earths, as well as zirconium, niobium and hafnium, which are also in demand for clean-energy applications. In common with the other emerging producers, ASM bills its project as an alternative, sustainable and secure source of critical metal oxides, and one of the few supply options outside China.

ASM is slightly different to the others, in that the integrated metals business it is developing is founded on what it calls “an innovative carbon-free metallisation process that converts oxides into high-purity metals, using less energy than conventional methods.” Following a successful commercial piloting phase, ASM plans to build its first metals plant in South Korea to supply a range of critical metals including rare earths (e.g. neodymium, praseodymium and dysprosium), zirconium and titanium, to supply a NdFeB (neodymium-iron-boron) alloy to manufacturers of permanent magnets.

Earlier this month, ASM signed a “conditional exclusive framework agreement” that will see a consortium of South Korean investors subscribe for a 20% equity interest in the Dubbo project along with offtake from the company’s Korean Metals Plant. The investors will invest US$250 million ($342 million) in the project’s holding company Australian Strategic Materials (Holdings) Ltd (ASMH), and the deal includes provision for a 10-year offtake agreement for up to 2,800 tonnes a year of the NdFeB alloy from the plant – that offtake agreement would cover 100% of the neodymium oxide planned to be produced at Dubbo.

ASM’s pilot furnaces in Korea will start supplying the local market with titanium and rare earth permanent magnet alloy powders in the second half of 2021, with the company hoping to move into commercial-scale production by the end of 2022.

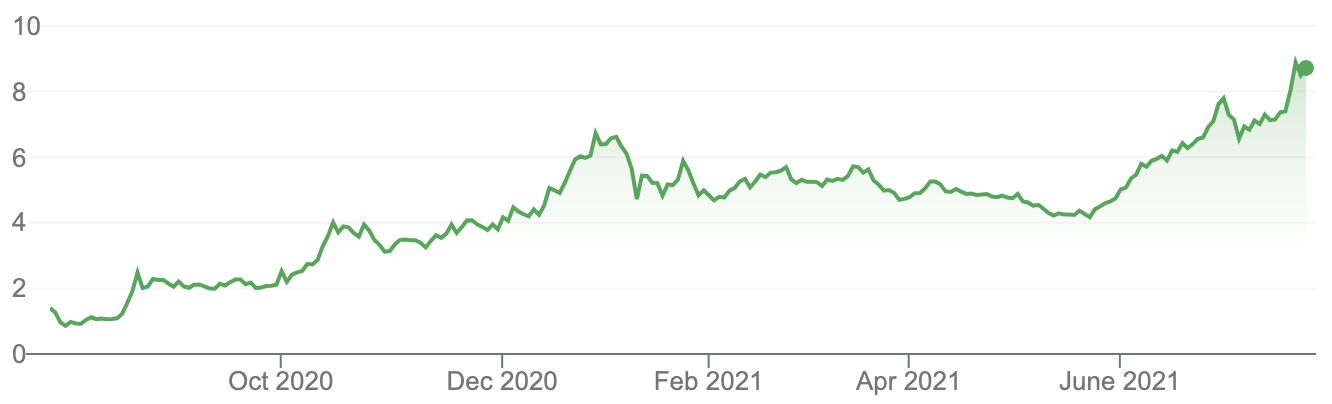

Australian Strategic Materials (ASM)

Source: Google

7. RareX (REE, 9 cents)

Market capitalisation: $37 million

Three-year total return: 4.3% a year

Analysts’ consensus valuation: n/a

RareX wholly owns the Cummins Range rare earths project in the Kimberley region of Western Australia, at which, earlier this month, it upgraded the overall resource by 47%. Cummins Range now has a resource of 18.8 million tonnes at 1.15% total rare earth oxides (TREO), with a maiden indicated resource of 11.1 million tonnes at 1.34 per cent TREO. The major constituents of the deposit are neodymium, praseodymium, terbium, dysprosium and scandium; the latest upgrade brought-in a potentially highly lucrative byproduct, niobium, for the first time. Further drilling is likely to extend the resource.

The company believes the project now has the potential to support a standalone rare earth oxide production hub as well as becoming a concentrate supplier to third parties within Australia and overseas.

RareX (REE)

Source: Google

8. Ionic Rare Earths (IXR, 3 cents)

Market capitalisation: $96 million

Three-year total return: 115.4% a year

Analysts’ consensus valuation: n/a

As the name suggests, Ionic Rare Earths is in the ionic clay rare earths business, in its case, at its 51%-owned Makuutu project in Uganda. This is already a globally significant deposit: in March, Ionic increased its mineral resource estimate (MRE) to 315 million tonnes at 650 parts-per-million (TREO).

The company says its potential “product basket” is a major differentiator for it in the global rare earths market – where it says many hard-rock REE projects generate their revenue mainly from NdPr, Makuutu’s product basket appeal (with 15 elements) is more balanced, and extends across EVs, offshore wind turbines, communications, and defence, and has “unparalleled strategic importance.”

In April, Ionic signed a non-binding memorandum of understanding (MOU) with China Rare Earths Jiangsu, one of the largest, if not the largest, global ionic adsorption clay operator and refiner, with four plants in operation. Ionic is now working on a feasibility study report, which will be submitted to the Ugandan Directorate of Geological Survey and Mines as part of the company’s submission for a mining licence application by October 2022.

Ionic Rare Earths (IXR)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.