Here are 8 charts investors need to look at and comprehend what they’re saying. They in many ways reinforce my views on investing this year.

Here are my views in a nutshell:

We are reasonably upbeat on the outlook for investment markets this year, but it won’t be smooth sailing and after a strong start to the year share markets are vulnerable to a further pull back in the short term given ongoing issues around inflation, interest rates, recession and geopolitics.

Key charts worth keeping an eye on remain:

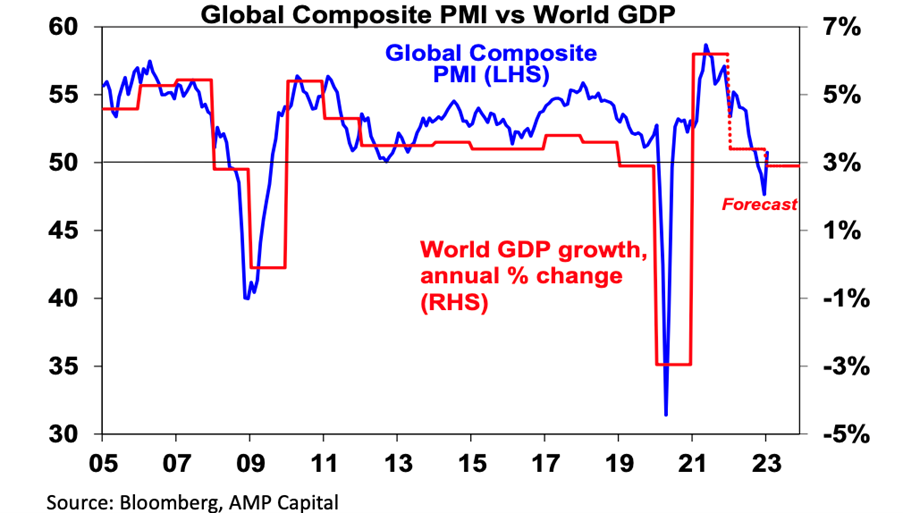

- global business conditions PMIs

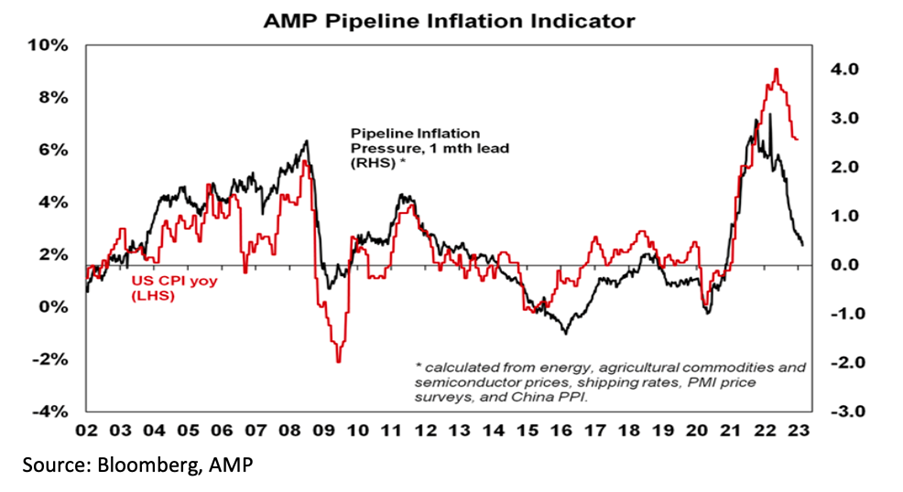

- US inflation and our Pipeline Inflation Indicator

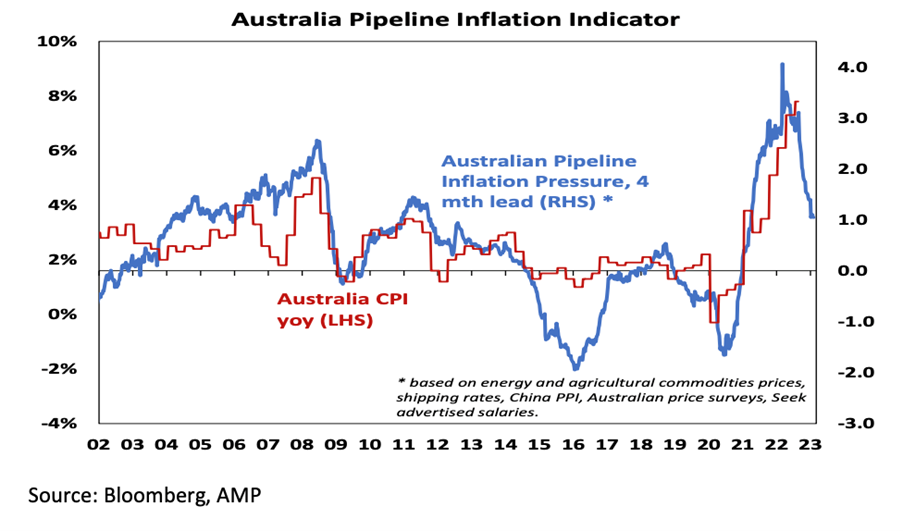

- unemployment & underemployment

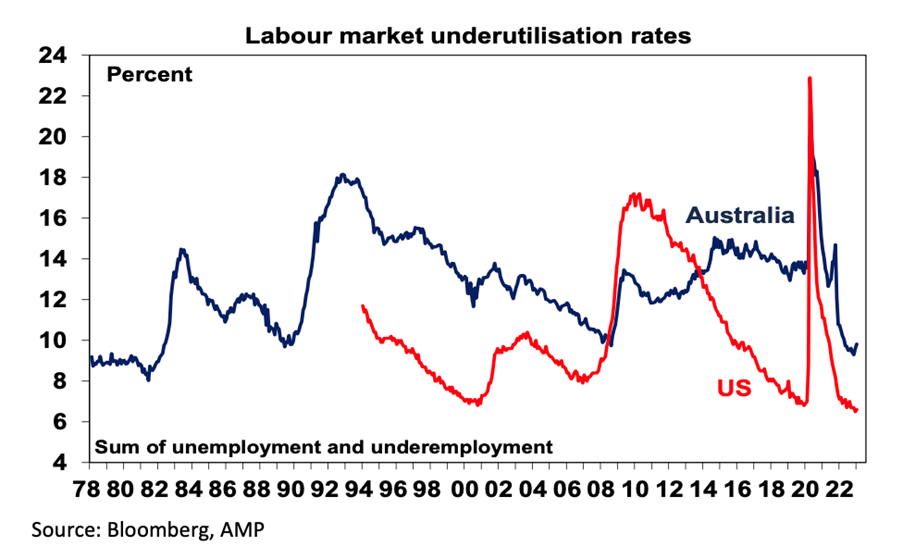

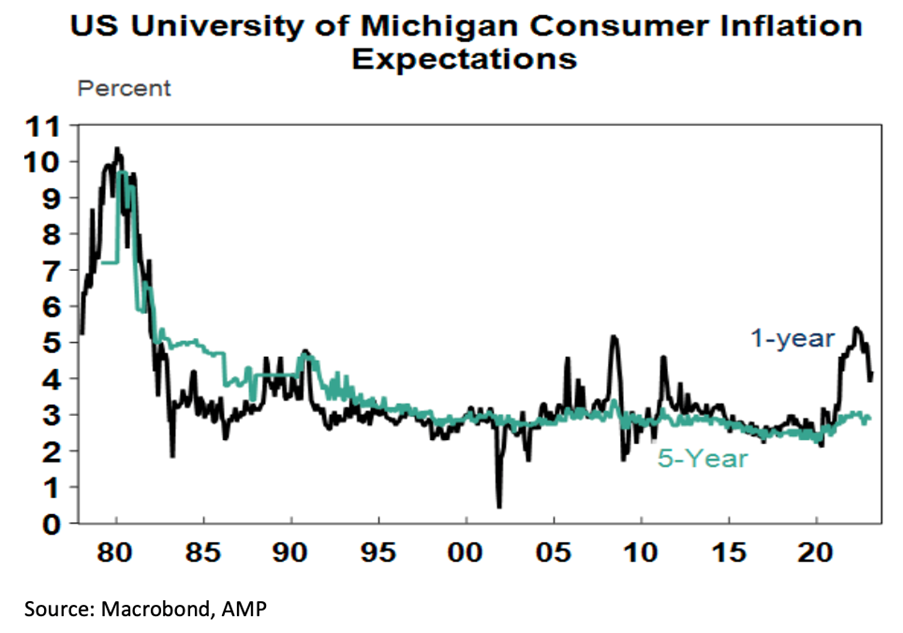

- inflation expectations

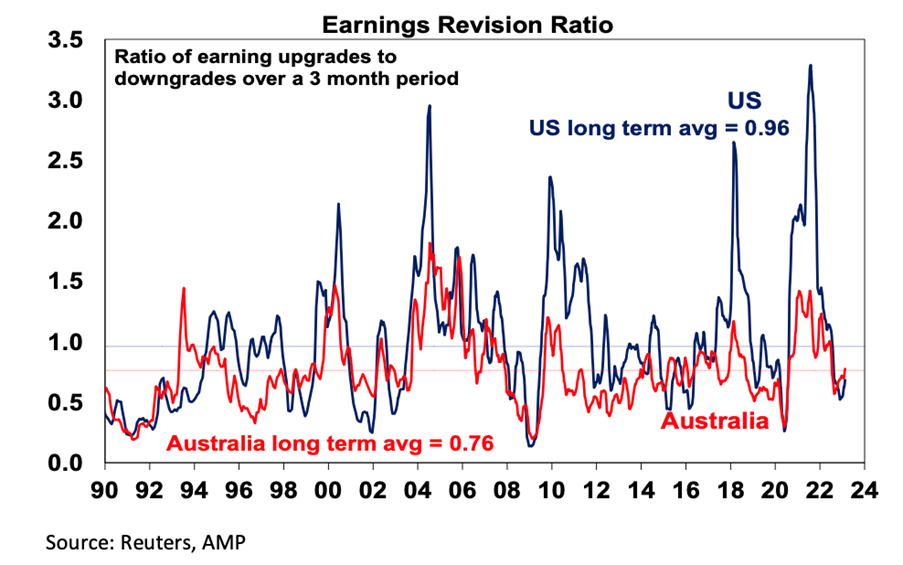

- earnings revisions

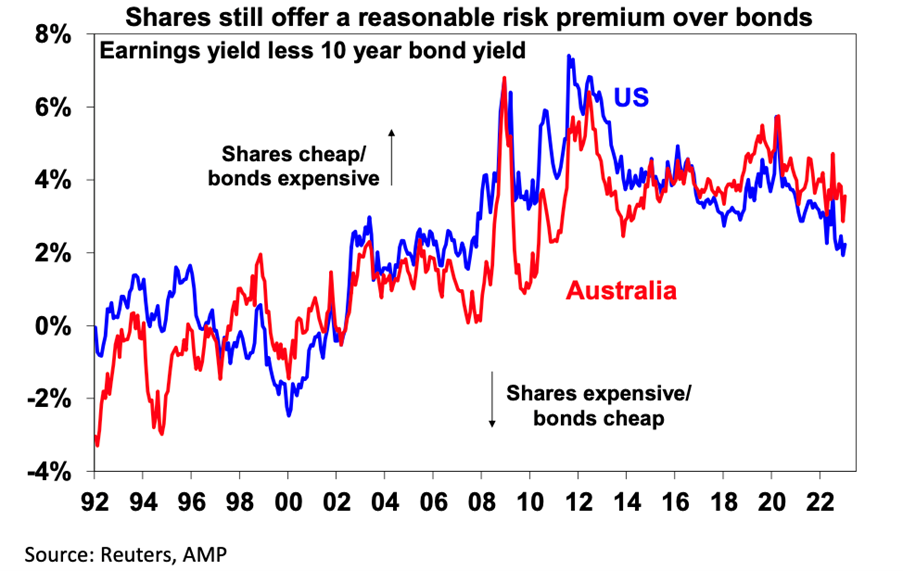

- the gap between earnings yields and bond yields

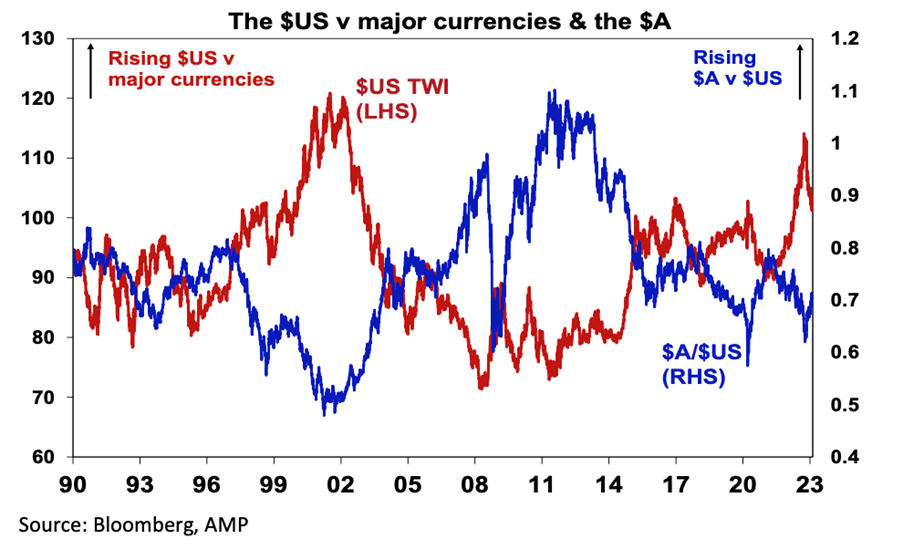

- the US dollar.

Shares had a strong start to the year seeing gains into early February around or above what we expect for the year as a whole, but we still expect that it will be a volatile year. Why? Try these reasons:

- The process of getting inflation back down won’t be smooth.

- The topping process in central bank rates will take time with setbacks along the way, as we’ve seen for both the Fed and the RBA recently.

- Recession risks are high.

- Raising the US debt ceiling around the September quarter won’t be smooth.

- Geopolitical risks around Ukraine, China (as highlighted by the balloon over the US) and Iran (which is getting close to nuclear weapon breakout capacity) are significant.

With shares becoming overbought after the new year rally and seasonality turning less positive, shares both globally and in Australia are vulnerable to more of a pull back in the short term.

Here are the charts:

1. Global growth

Our assessment is that global growth will be around 2.5-3% this year. Global Purchasing Managers Indexes (PMIs) – surveys of purchasing managers at businesses – will be a key warning indicator.

2. US inflation

The key is that US inflation continues to fall – if so, this should allow the Fed to stop hiking in either March or May and it could find itself needing to cut rates from later this year.

3. Australian inflation

Our Australian Pipeline Inflation Indicator also suggests that Australian inflation has peaked and will fall through this year, albeit Australian inflation and the RBA are lagging the US and the Fed.

4. The jobs market

There’s some evidence that labour markets have seen the best and may now be slowing, which is good for the battle against inflation.

5. Inflation expectations

The good news is that short term (1-3 years ahead) inflation expectations have fallen lately in the US and longer-term inflation expectations remain low.

6. Company earnings

Consensus earnings growth expectations for this year are around 11% for the US and around 7% for Australia. They look a bit too high, but a deterioration on the scale seen in the early 1990s, 2001-03 in the US and 2008 would be bad news. So far so good

7. Earnings versus bond yields

Over the last year, rising bond yields have weighed on share market valuations. As a result, the gap between earnings yields and bond yields (which is a proxy for shares’ risk premium) has narrowed to its lowest since the GFC in the US. Compared to the pre-GFC period, shares still look cheap. Australian share valuations look a bit more attractive than those in the US though helped by a higher earnings yield. Ideally, bond yields need to continue to decline and earnings downgrades need to be limited in order to keep valuations okay.

8. The Greenback on the slide in 2023

Since September it has fallen back as inflation and Fed rate hike fears have eased and geopolitical risks receded a bit. A further fall in the US dollar would be consistent with our reasonably upbeat view of investment markets this year, whereas a sustained new upswing would suggest it may be vulnerable. So far so good.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.