Many investors focus on what to buy. They want the ‘next big thing’ and quick gains. A better focus is on how to buy and build long-term wealth.

Over the next three weeks, my Monday column will explain how I identify stocks. Each January, this newsletter asks me to supply an additional Monday column on investment education. My usual stock column will still run on Thursday.

This week, I start with the seven traits I look for in small- and mid-cap companies. Of course, every investor is different. What works for me might not suit your investment style, financial goals, or investment timeframe.

Also, different forms of investing require different techniques. The list below would change if I was investing in mining companies, biotechs or emerging tech stocks. I’d also vary the list below if the focus was on large-cap stocks.

I focus mostly on small- and mid-cap industrials outside the ASX 100 for a few reasons. First, I’m more likely to add value in under-researched or ignored small caps compared to a behemoth like BHP Group that the market pores over.

Second, small caps are, on average, easier to understand. I’d rather analyse a $500-million small-cap that has a few key operations than a $190-billion bank that provides a diverse range of financial products and services.

Third, I find small-caps more interesting to analyse. I first developed an interest in small caps during a stint at a global investment bank. Editing Shares magazine in the late ‘90s allowed me to delve further into small caps.

If you’re a retired investor seeking dividends, small caps (and this list) won’t suit your needs. This list below suits long-term investors who want to build wealth through capital growth and have a higher risk tolerance.

Caveats aside, here are seven traits in small-caps I look for:

1. Simplicity

You’ve probably heard the investment maxim ‘If you don’t understand it, don’t buy it”. That’s why I rarely cover early-stage biotech companies in my Thursday column. In my experience, you need specialist knowledge – and lots of time – to understand drug developers and other biotechs.

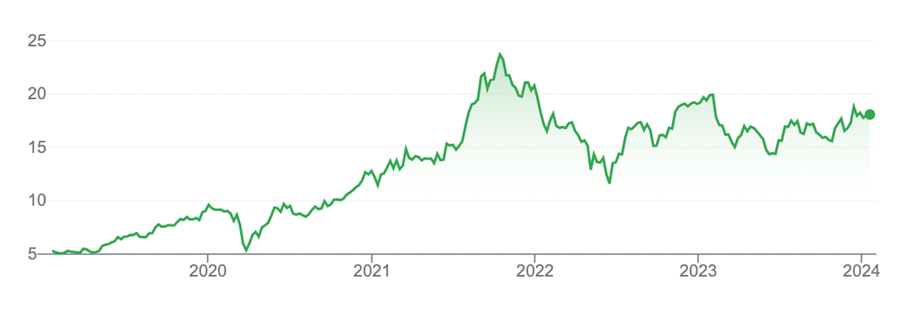

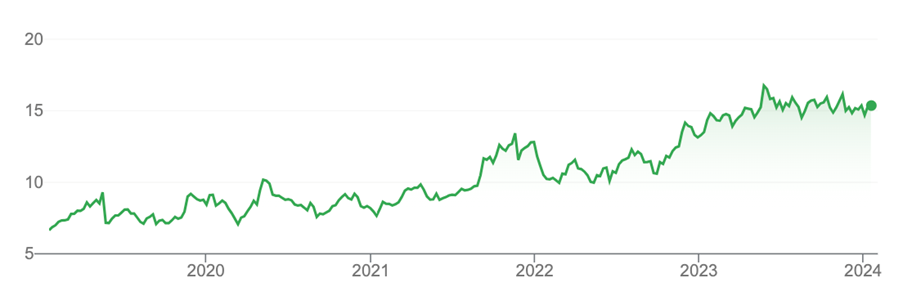

I like small caps that have clear business models. Consider Lifestyle Communities (ASX: LIC), a favourite small cap of mine over the years. It provides affordable, resort-style housing in Victoria for older people. It’s a lower-risk, deceptively powerful business model that has delivered terrific long-term returns for investors in the affordable housing sector.

Chart 1: Lifestyle Communities

Source: Google Finance

2. Repeatable idea

Editing BRW magazine in the early 2000s meant poring over Rich Lists and stories about entrepreneurs. The best ones often had a simple idea they repeated over and over through a ‘cookie-cutter approach’.

These entrepreneurs didn’t expand into exotic markets or risky new products; they stuck to what they knew and scaled a good idea. In doing so, they became more efficient and knowledgeable in their market and reduced risk.

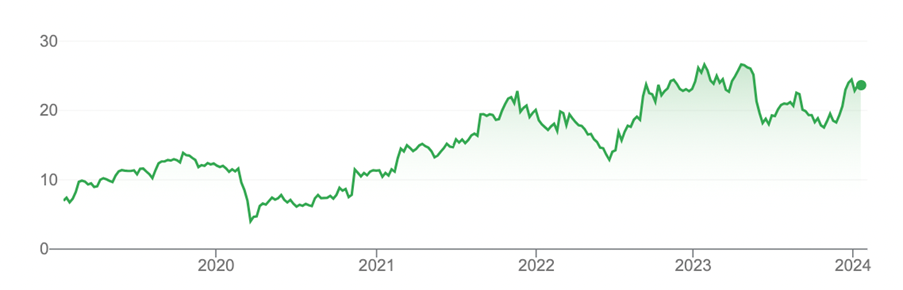

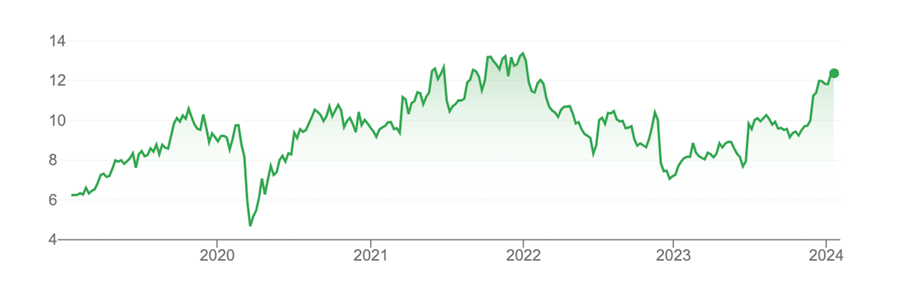

One of my favourite small-cap retailers, Lovisa Holdings (ASX: LOV), is an example. The fast-fashion jewellery retailer has opened 800 stores in 39 countries in the past 13 years. Lovisa opened 172 stores in the previous financial year alone. The company’s success has been built on rapidly scaling a good idea.

Chart 1: Lovisa Holdings

Source: Google Finance

3. Advantage

Call it an ‘economic moat’, ‘competitive advantage’ or ‘secret sauce’ … what is it about the company that gives it a head start over competitors? And an advantage that delivers pricing power, higher margins, and a defendable market position?

For some companies, the advantage is scale. They deliver goods or services more efficiently than their competitors. For others, it’s brand. New market entrants struggle to compete in a market dominated by a well-known brand. Speed is another advantage. Companies that consistently move faster and are more agile than their competitors can dominate their market for years.

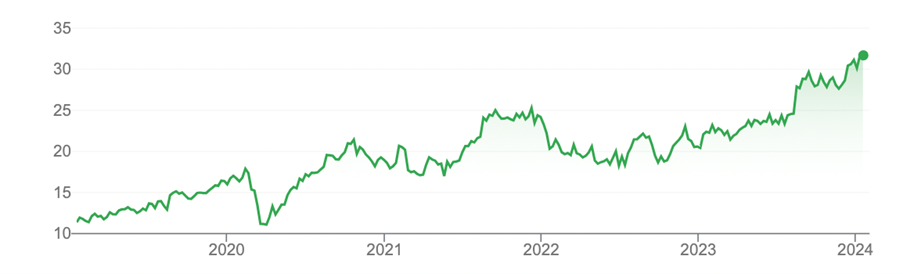

Network effects are another advantage. Car Group (ASX: CAR), my favoured online marketplace stock, is an example. How could any new entrant in Carsales.com’s market in Australia compete with its network of car dealers, car buyers and brand in Australia? This is a formidable barrier to entry.

Chart 3: Car Group

Source: Google Finance

4. Industry

My investment style is built on bottom-up analysis: that is, treating each company on its merits rather than buying or selling based on industry or macro trends. But one must always analyse companies in the context of their industry.

I want to own small-cap companies in attractive industries that have a long runway of growth ahead. And avoid companies in industries in structural decline that are being disrupted by new technologies.

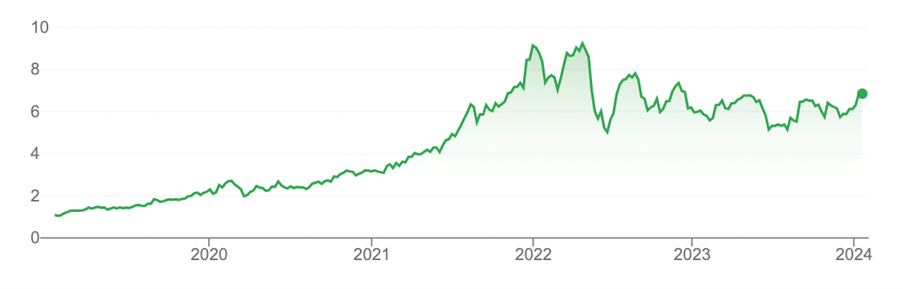

Johns Lyng Group (JLG), covered in this column last year, is an example. The integrated building services provider rebuilds and restores property after damage from floods, fires, and other weather events. As the frequency and intensity of natural disasters increase due to climate change, Johns Lyng is well-positioned in an industry that (sadly) has years of growth ahead.

Chart 4: Johns Lyng Group

Source: Google Finance

5. Management execution

There are lots of ways to assess the management of small- and mid-cap companies. Some fund managers look at management experience and depth, the board, whether management has sufficient ‘skin in the game’ and ‘insider buying’.

I prefer numbers. I’m less interested in what management might do and more focused on what they are doing (management execution).

Return on Equity (ROE) is how I assess management execution. ROE shows how hard management is working each dollar of shareholder capital.

I look for small- and mid-cap companies with high and rising ROE over time. That tells me management is working the business harder each year, and a rising ROE increases the company’s intrinsic value and ultimately its share price.

Technology One (ASX: TNE), a long-term favourite of this column, is an example. In 2022, the technology services provider’s ROE was a whopping 41.4%, Morningstar data shows. In 2014, TNE’s ROE was 32%.

In contrast, Telstra Group’s (ASX: TLS) ROE in 2022 was 11.3%. In 2014, Telstra’s ROE was 32.35%. This crude comparison shows a stock with a high and rising ROE (Technology One) and another with modest, falling ROE (Telstra).

Chart 5: Technology One

Source: Google Finance

6. Shockproof

When analysing stocks, I always do a ‘pre-mortem’. I imagine what could go wrong and how the company would fare. For example, what would happen to a retailer if the economy slowed sharply? Or a mining services company if commodity prices tumbled and big miners curtailed exploration spending and cancelled contracts.

Of course, no company is fully shock proof. But those with high switching costs (where it’s hard for customers to give up the service or leave for a competitor), defensive products, recurring earnings or long-term contracts provide more comfort.

Cash flow is a critical shock absorber. I want to own companies with high free cash flow that can fund growth internally. Beware companies with high debt or those growing through rapid acquisitions (and regular equity capital raisings).

Collins Food (ASX: CKF), owner of KFC and Taco Bell stores, has defensive traits. Cheaper fast-food treats appeal when the economy slows, and people eat out less. Collins exceeded market expectations in its latest result, despite an economy that had 13 consecutive interest-rate rises and higher inflation.

Chart 6: Collins Food

Source: Google Finance

7. Valuation

Although last on this list, valuation is a critical piece in the investment puzzle. I want to own small- and mid-cap companies when they are mispriced by the market or irrationally oversold during periods of market panic.

The aim is to buy quality companies when they trade at bottom-quartile valuations. Then, add to those positions when the valuations inevitably fall from time to time (no stock rises in a straight line over long periods).

My investment style is to buy out-of-favour stocks (often after a period of significant price decline). That doesn’t mean you can’t make money buying rising stocks or those on high Price Earnings (PE ratios). Too many investors give up high PE stocks because they underestimate the growth of E (earnings) in the PE.

That said, my investment style has more of a contrarian or ‘deep-value investing’ approach. You don’t want to be too rigid with investing. You’d never buy Car Group or REA Group, for example, if you only focused on low PE stocks. What matters is whether the company’s valuation sufficiently reflects its future growth.

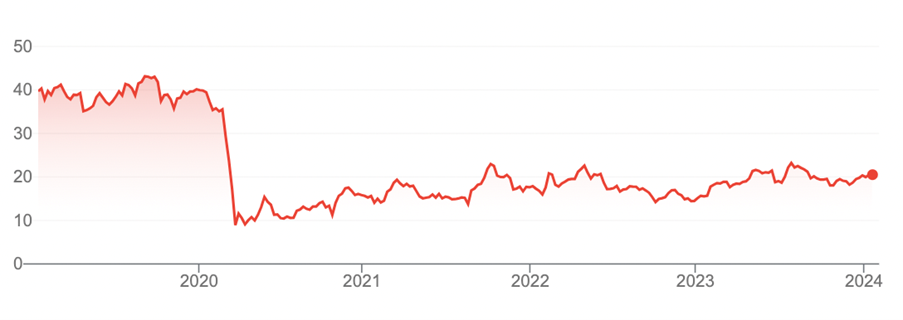

Consider Flight Centre Travel Group (ASX: FLT), a stock I covered in the column in November 2023. The travel agent has been smashed over the past five years due to COVID-19, a slowing economy and disruption from online travel providers.

Flight Centre has many challenges, but there was much to like about its latest trading update. In late 2023, Flight Centre traded well below consensus price targets from analysts. The market was reluctant to recognise Flight Centre’s performance – and seemingly more focused on bad news than good for the company. That created the opportunity.

Chart 7: Flight Centre Travel Group

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation, and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 15 January 2024