I always have mixed feelings writing about takeover targets. Part of me thinks investing on the basis of takeover speculation is a sure-fire way to lose money. It’s hard enough picking a takeover target. Getting the timing right is near impossible. Over the years I’ve seen companies that were nominated as takeover targets remain untouched for years. Eventually, they are snapped up, after years of market underperformance.

Lower takeover premiums are another issue. About three-quarters of takeovers in the eight months of 2021 were through schemes of arrangement, Gilbert + Tobin research shows. In 2020, the split between schemes of arrangement and takeovers was even.

In 2021, Seven Group’s $9bn off-market takeover offer for Boral was the only transaction exceeding $1bn not structured as a scheme of arrangement, noted Gilbert + Tobin.

Schemes of arrangement require the co-operation of the target company to succeed. These deals, agreed to by the target board, usually have a lower bid-ask spread. Simply, they enable more deals to be done, but at a lower takeover premium to get control.

Investors hoping for a flurry of hostile takeovers on the ASX in FY22 – and multiple competing bids – that send share prices soaring will be disappointed. More likely is private equity firms and super funds working with target companies on deals agreed (or recommended) at the start.

As I have written before for this Report, investors should never buy companies on the basis of takeover speculation. Think of a takeover bid as the sizzle rather than the sausage. If you’re relying on a takeover bid to crystallise value in an investment, you’re speculating.

As to my mixed feelings, the positive in takeover analysis is it forces you to think about quality, undervalued companies that would appeal to a larger rival or private equity firm.

My starting point is competitive advantage: what does the company own that is hard to replicate? And would those assets be more valuable in the hands of a larger rival? Then comes valuation: is the market mispricing the true value of that target company’s assets?

In preparing this article, I considered 30-40 potential takeover targets. Here are the six small-cap companies I settled on. They suit experienced investors who understand the features, benefits and risks of this form of investing. I’ll cover large-cap takeover targets in next week’s column.

1. Lark Distilling Co

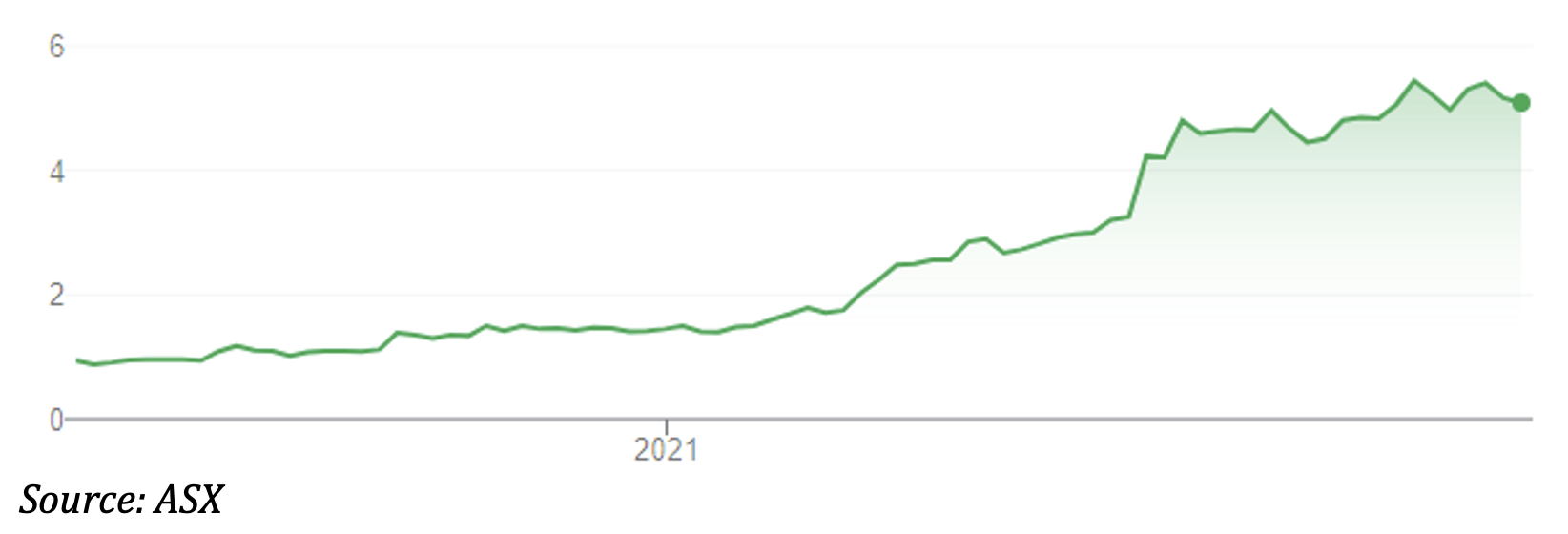

The premium whiskey producer from Tasmania has starred in 2021, its shares up almost four-fold from their 52-week low to $5.06. Lark wants to become the Penfolds of the Australian whiskey industry and has the award-winning product to do that.

Prospective investors might be turned off buying Lark after its rally this year. By end-FY22, Lark says it will have more than 2 million litres of whiskey under maturation, worth $430 million. Lark’s market capitalisation is $371 million. There’s been much consolidation in the global alcohol industry as big players snap up boutique producers of craft beers and spirits.

Lark Distilling Co (LRK)

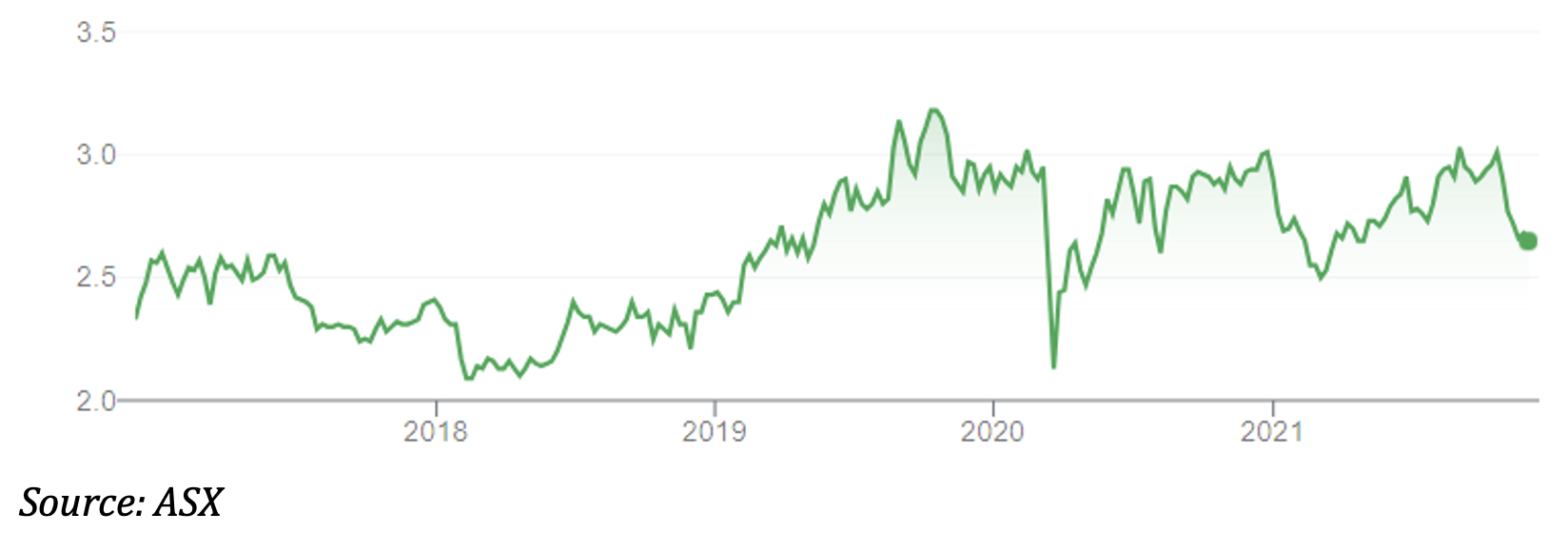

2. Waypoint REIT (WPR)

Formerly Viva Energy REIT, Waypoint owns a portfolio of more than 420 service stations and convenience stores across Australia – a hard-to-replicate niche property asset.

There’s been a consolidation of petrol-station property this year. In May 2021, Dexus acquired APN Property Group. Dexus became manager of the APN Convenience REIT (now the Dexus Convenience REIT), which has 94 petrol stations, mostly on Australia’s East Coast.

Waypoint REIT is an attractive listed property trust, with or without a takeover. It has high-quality tenants, a long weighted average lease expiry, an attractive forecast yield (about 6%) and is trading at a slight discount to its Net Tangible Assets (NTA).

The main risk is that electric-vehicle charging stations reduce demand for traditional petrol stations, but mainstream use of EVs seems a long way off. More likely is a larger REIT seeing the property redevelopment potential of petrol stations on busy roads in capital cities. Many of these sites would be worth more as apartment blocks, although they have site-remediation costs.

Waypoint REIT (WPR)

3. Janison Education Group (JAN)

The education technology (edtech) company has rallied from a 52-week low of 47 cents to $1.40, delivering on the potential this column has previously identified in the company.

Janison provides standardised assessment platforms, so far delivering 6 million digital exams in 117 countries. About 3,500 schools worldwide use Janison’s main online assessment products. That’s a valuable network for a large edtech firm to exploit with other products.

As more people learn online, the digital-assessment market has excellent long-term growth prospects. For all the hype, edtech is tiny in the scheme of the global education market, meaning it has a long runway of growth ahead. Janison’s success so far will surely catch the attention of a larger edtech firm or private equity player that sees the potential of online exams.

Janison Education Group (JAN)

4. Hotel Property Investments (HPI)

There has been more corporate activity in the Australian Real Estate Investment Trust (A-REIT) sector as large A-REITs snap up smaller players. In October, HomeCo Daily Needs REIT and Home Consortium entered into a merger with Aventus Group (pending unitholder approval).

In the pub sector, Charter Hall Long WALE REIT in September acquired half of ALE Property Group, which has a national portfolio of 78 pubs leased to the Endeavour Group, Australia’s largest pub owners. And pub operator Redcape Hotel Group delisted from the ASX in November.

The Australian Financial Review last month described pubs as the “hottest real estate play in the country” with $1.5bn worth of venues changing hands in FY21. Pubs with prime locations and long-term leases to large tenants are in demand from private equity.

Hotel Property Investments (HPI) has a good portfolio of assets. It owns more than 50 pubs, many of them in Queensland. HPI’s average weighted lease expiry of 10 years appeals, as does its spread of lease-expiry dates and relatively higher contracted revenue growth.

In a market showing greater interest in pub properties, HPI must look interesting to a large A-REIT or private-equity fund that can do more with its pub portfolio.

Hotel Property Investments (HPI)

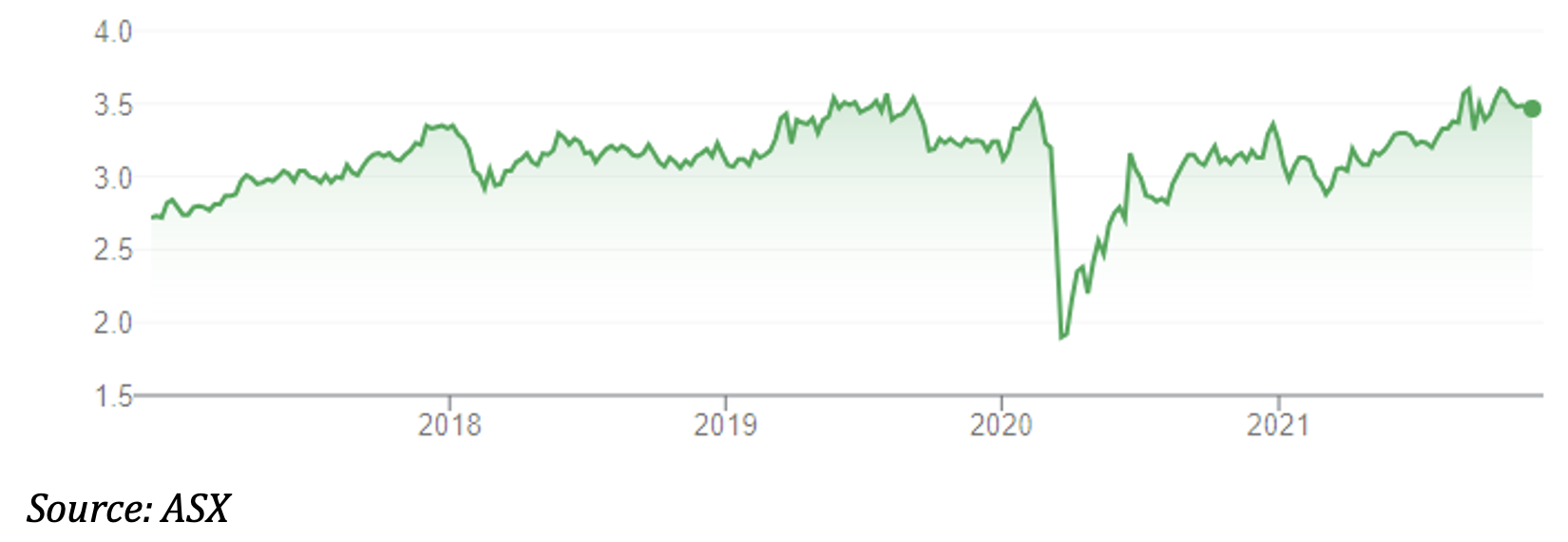

5. Vista Group International (VGL)

The New-Zealand based company sank from above $5 in 2019 to almost $1 during the March 2020 share market crash. Vista provides software for cinema management, film distribution and customer analytics for global cinema chains. Its flagship service is cinema management.

Like other cinema-related businesses, Vista was hammered because of Covid. The company’s cash flow in 2020 was 81% lower than a year earlier. The business lost $11 million in 2020 (EBITDA).

For all the short-term problems, Vista has a strong market position. Its share of cinema exhibition companies (20+ screens) is 51% worldwide (excluding China). Vista’s technology extends from the moviegoer experience to exhibition, distribution and film production.

Vista has a difficult business to replicate and a valuable global customer network. The cinema industry has been written off many times, most recently because of movie-streaming services, but continues to grow. As the world recovers from Covid, so, too, will cinemas eventually recover. Capitalised at $516 million, Vista must look interesting to large tech companies or private equity firms.

Vista Group International (VGL)

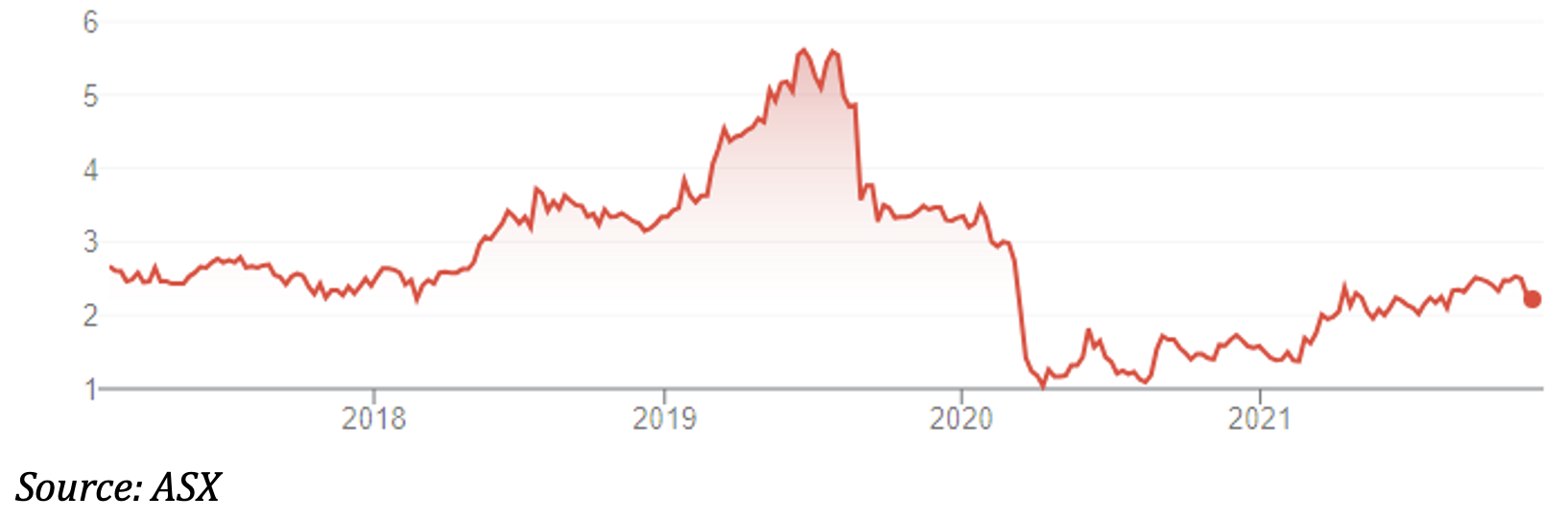

6. iSelect Group (ISU)

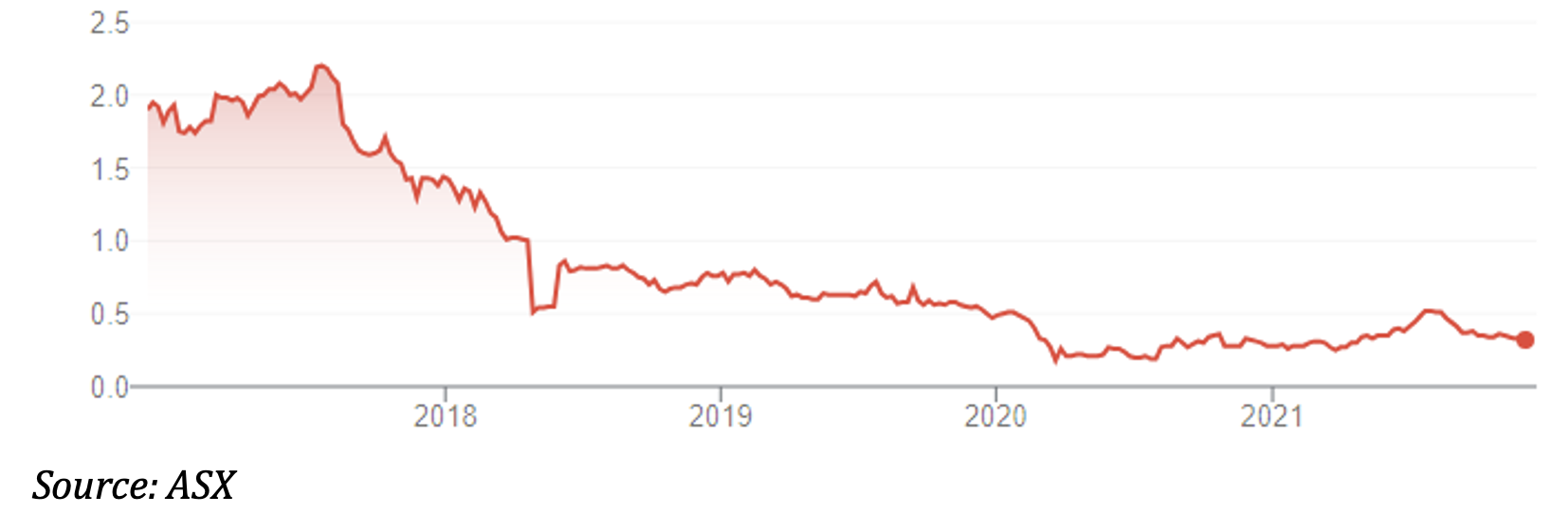

How much lower can iSelect fall before a rival company (Compare the Market) or private equity firm pounces on the embattled business? iSelect showed signs of life earlier this year but has slumped from a 52-week high of 55 cents to 31 cents. It traded above $2 in 2017.

The online marketplace for health insurance, energy and telecommunication services has had a long list of problems: a fine for misleading advertising, management and board changes and previously sub-optimal marketing and lead generation/conversion.

At ISU’s current market capitalisation of $68 million, the market is paying little for its brand, market position and customer base (much of the residual value is in ISU’s trail fees, much of which are paid by health insurance companies for policies bought through ISU).

ISU has been a recurring disappointment over the past five years but there’s latent upside in the business if it improves its marketing/distribution/product strategy (early signs are promising). If ISU’s new management can’t fix the business, a larger firm will surely step in.

iSelect Group (ISU)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 30 November 2021.