As a close watcher of Australia’s superannuation system, I get used to staying up late on Budget night to go through the changes tucked away in the fine print of the Budget Papers. For some reason, our politicians can’t keep their hands off the system.

Tuesday night’s budget only heralded one change – and that had been pre-announced! This was a record for “least change”. However, there are flow through changes from previous Budgets which means that there are still material changes to the system starting on 1 July.

And with the prospect of an Albanese Government and a further Budget if elected, we may see additional changes this year. So far, the ALP has kept fairly quiet on their plans for super, but in Opposition, they opposed ‘catch-up’ concessional contributions. The continuation of this innovative arrangement allowing working mothers and others who step away from employment to make additional contributions upon returning to the workforce could be at risk.

That’s still a hypothetical – In the meantime, here are 5 important changes that come into effect on 1 July.

- Employers will now contribute 10.5% to super

The rate of employer contributions to super (the so-called ‘super guarantee levy’) is increasing from 10.0% to 10.5%. If you earn $100,000, your employer will now contribute $10,500 rather than $10,000 to your super fund.

In July of 2023, the rate will rise again to 11.0%, with a further increase to 11.5% on 1 July 2024. The final increase to 12.0% is scheduled to take effect on 1 July 2025.

Technically, super is only payable up to the ‘maximum contribution cap’, which rises to $60,220 per quarter (an annual salary of $240,880). Above that level, the employer isn’t required to pay super on the excess amount – although many choose to do so.

- Work test abolished for 67 to 74-year-olds

Announced in last year’s Budget, the ‘work test’ for those aged 67 to 74 is being abolished from 1 July. Retirees and others in that age bracket will now be able to top up their super by making personal or non-concessional contributions without having to meet the ‘work test’.

They can contribute up to $110,000 of their own monies to super. They will also be able to access the ‘bring-forward rule’, where they can potentially make three years’ worth of non-concessional contributions (up to $330,000) in one hit. A couple could potentially get $660,000 into super.

As always, there is an important caveat. The ability to make non-concessional contributions and access the ‘bring forward rule’ is governed by your total superannuation balance. If this is more than $1.7 million you are not eligible to make non-concessional contributions.

If your total superannuation balance at the end of the previous financial year (i.e. on 30 June) was between $1.59 million and $1.7 million, you can’t access the ‘bring-forward’ rule (but can make a non-concessional contribution of up to $110,000). If your total super balance was between $1.48 million and $1.59 million, the maximum contribution under the ‘bring-forward’ rule is $220,000.

Salary sacrifice contributions will also be allowed for those aged 67 to 74 (subject to the concessional contributions cap of $27,500).

- ‘Downsizer’ age reduced to 60

Another change for older Australians is that the minimum age to make a ‘downsizer’ contribution is being reduced from 65 years to 60 years. You can make a downsizer contribution of up to $300,000 per person from the proceeds of selling the family home. You need to have owned the home for more than 10 years and it must be your main residence, with the contribution made within 90 days of receiving the proceeds of the sale.

Importantly, the ‘downsizer’ contribution doesn’t count against your non-concessional cap limit, so it is an easy way to boost retirement savings which can then grow in a concessionally taxed environment – up to 15% in the accumulation phase and 0% in the pension phase.

- First Home Super Saver Limits increased to $50,000

For younger Australians, the maximum amount that can be released from super under the First Home Super Saver Scheme will be increased on 1 July 2022 from $30,000 to $50,000. This is a “no-brainer” of a scheme for young Australians saving for their first home. Under the scheme, they can contribute additional amounts into super via salary sacrifice (up to $15,000 per annum), have these amounts grow at a guaranteed rate about 3% above the term deposit rate in a concessionally taxed environment, and then access these to help purchase their first home. A couple could potentially save $100,000 through this scheme.

- Minimum withdrawals from super by retirees halved

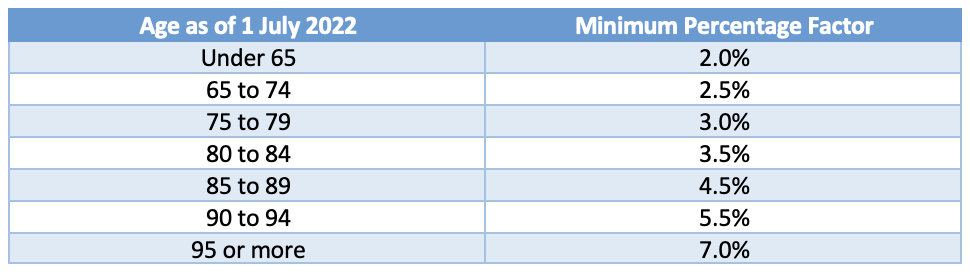

The Government is continuing a measure introduced at the time of the Covid-19 pandemic which halves the amount self-funded retirees are required to take from their super each year as a pension. Known as the ‘minimum percentage factor’, this is applied to your super account balance at the start of the year and determines the minimum amount that must be withdrawn as a pension. It is aged based, and because it is designed to “encourage” retirees to use up their super, the factor increases as you get older.

For example, if you are aged 70 on 1 July and have a super balance of $1.0 million in the pension phase, your minimum pension withdrawal must be 3% or $30,000. You can take more, but it must be at least $30,000 in the year. The table below shows the factors that apply for the 22/23 financial year.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.