With the end of the financial year not too far away, here are five actions to take to get the most out of the superannuation system.

- Concessional superannuation contributions

Can you make additional concessional contributions to super? Concessional contributions include your employer’s 11.5%, salary sacrifice contributions and any amount you claim as a personal tax deduction. Your concessional contributions cannot exceed $30,000 in aggregate.

Up to age 75, anyone can make most contributions. However, if you are between 67 and 74 years, you must still pass the ‘work test’ in order to make a personal contribution for which you claim a tax deduction. The ‘work test’ is defined as working 40 hours over any period of 30 consecutive days. If you are 75 or over, only mandated employer contributions (the compulsory 11.5%) can be made.

- Non-concessional superannuation contributions

Can you make additional personal (after tax) contributions? The cap on non-concessional contributions is $120,000. Up to age 75, anyone can make a non-concessional contribution provided their total superannuation balance on 30 June 2024 was less than $1.9 million.

If you are under 75 (for at least one day in 24/25), you may be able access the ‘bring forward rule’, which allows up to 3 years’ worth of contributions in one year. Potentially, you could contribute $360,000 in one hit and a couple could get a combined $720,000 into super.

Super balances are measured each June 30 (i.e. your balance on 30 June 24 determines whether you can make non-concessional contributions in 2024/25) and include all amounts in accumulation and pension. If your total super balance was less than $1.66 million on 30 June 2024 and you haven’t made any non-concessional contributions in the previous two years, then under the ‘bring forward’ rule, you could contribute up to $360,000 this year (prior to 1/7/25). If your total super balance was between $1.66 million and $1.78 million, then the maximum amount you can access under the bring-forward rule is $240,000, and if your balance is between $1.78 million and $1.9 million, you are limited to $120,000. Above $1.9 million, you can’t make non-concessional contributions. For the next financial year (25/26), the total superannuation balance cap will increase from $1.9 million to $2 million.

- Government co-contribution

Can you access, or can a family member, access the Government co-contribution? If eligible, the Government will contribute up to $500 if a personal super contribution of $1,000 is made.

The Government matches a personal contribution on a 50% basis. This means that for each dollar of personal contribution, the Government makes a co-contribution of $0.50, up to an overall maximum of $500. To be eligible, there are four tests. The person’s total income must be under $45,400 (it starts to phase out from this level, cutting out completely at $60,400), they must be under 71 at the end of the year, they can’t have more than $1.9 million in super at the start of the year and most importantly, at least 10% of their income must be earned from an employment source.

While you may not qualify for the co-contribution, this can be a great way to boost a spouse’s super or even an adult child. For example, if your kids or grandkids are university students and doing some part time work, you could potentially make a personal contribution of $1,000 on their behalf – and the Government will chip in $500!

- Tax offset for spousal contributions

Can you claim a tax offset for super contributions on behalf of your spouse? If you have a spouse who earns less than $37,000 and you make a spouse super contribution of $3,000, you can claim a personal tax offset of 18% of the contribution, up to a maximum of $540. The tax offset phases out when your spouse earns $40,000 or more. Your spouse’s income includes their assessable income, reportable fringe benefits and any (though unlikely) reportable employer super contributions. One additional eligibility test – your spouse’s total super balance on 30 June 2024 must be less than $1.9 million.

- Pension payments

Finally, if you are taking an account-based pension, have you been paid enough? The Government requires that you take at least the minimum payment, otherwise your fund will potentially be taxed at 15% on its investment earnings, rather than the special rate of 0% that applies to assets that are supporting the payment of a super pension.

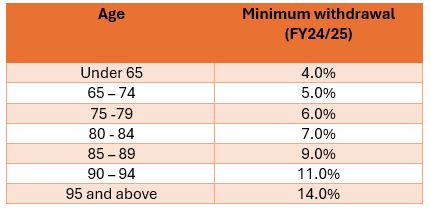

The minimum payment is based on your age and calculated on the balance of your super assets at the start of the financial year (1 July). The factors to apply this year are shown below.

For example, if you were aged 66 on 1 July 2024 and had an account balance of $1 million, your minimum payment is 5% of that one million or $50,000. You can take your pension at any time or in any amount(s), but your aggregate drawdown over the year must exceed the minimum amount. If you commenced a pension mid-year, the minimum amount is pro-rated according to the number of days remaining until the end of the financial year.