I’ve long held the view that I don’t have to pick the bottom of the market for a stock or the overall index, and most of the time I probably can’t pick it. I know I’ve occasionally got the timing right for the S&P/ASX 200 Index or the S&P 500 in the US, but there’s always a bit of luck in good timing calls.

One of my best calls was BHP in 2016 when it was in the $14 region. I kept asking the experts on my old Sky Business channel program, SWITZER if this had to be the buy time. Few wanted to commit but CMC’s Michael McCarthy was a believer. However, I didn’t go long until the price hit around $16.

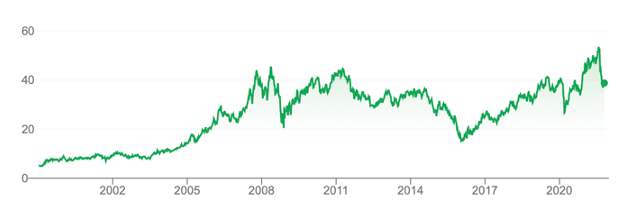

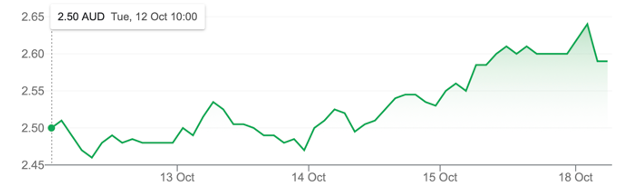

BHP

My investing technique was to not worry if I missed the first 5-10%. As long as I was certain that the uptrend had started, I was happy to get on a winner. The chart above shows how this late BHP play paid off.

I figure a $22 gain on a $16 outlay is a 137% gain over 5 years, or about 27% a year. And then there are dividends plus franking! And this was via one of the best companies in the world, which underlines the value of listening to Warren Buffett, who has taught us to be greedy when others are fearful.

So what companies out there are possibly turning to the positive ahead of an uptrend? Unfortunately, none are as good as BHP, but most of the following ideas are pretty good businesses that have looked like they’ve been gaining friends in recent times.

1. Why I like Appen

The first is Appen (APX). I keep watching this one as I’ve backed this in my writings and in my own SMSF. I always thought that 2022 would be the make or break year, so its recent rise is good to see.

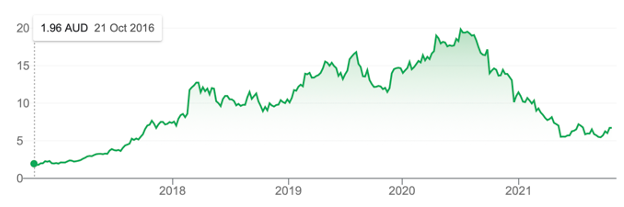

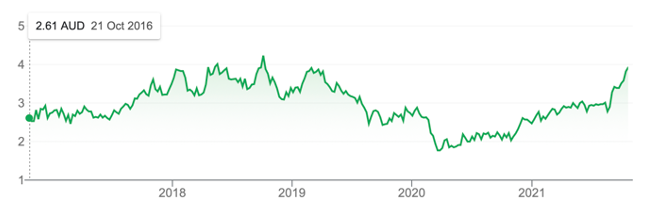

Appen (APX)

Appen is up only 3.21% in a month but was up 14% since October 6. That’s a nice rise and was driven by no standout news. However, it did fall 20% after reporting a big slump in profit. On the plus side, in July, Citi’s Siraj Ahmed tipped that APX could be a takeover target. “With the recent increase in M&A and given Appen’s position as a leader in the AI training data space as well as client exposure, we would not be surprised if Appen was a potential acquisition target for an IT Services or BPO firm,” he said. “We note Appen’s main competitor Lionbridge was acquired by Telus International for 16x – 20x EV/EBITDA versus Appen currently trading at 13x.” (AFR)

The consensus survey of analysts on FNArena says a 38.1% rise is in the wings. And Citi sees 76% upside!

2. Update on A2Milk

The next company showing a bit of uptrend form is A2Milk. This is another I gave a year to when it fell from grace.

A2Milk (A2M)

Its fall from grace was in July last year when it was nearly a $20 stock. By December, its share price had halved. That’s when it looked like a good buy. This was a quality company but it was believable that the Coronavirus and the breakdown in Chinese tourism to Australia were contributing factors to the company’s struggles.

However, there was more wrong with the company. And on October 8, Slater and Gordon mounted a class action against the company’s failure to inform the market properly. Since then, its share price is up 11%.

By the way, there has been talk that A2M is a takeover target, with reports suggesting Nestle was closely watching the company’s share price fall. As a starter, anyone who wants to bet Chinese tourists will return to Australia might be willing to speculate on this once-perceived world class top quality company.

It’s no BHP, but it does have sufficient quality in its history to make it an interesting play.

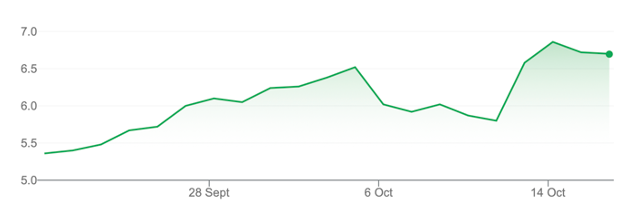

The consensus of analysts is not convinced with the target price 9% less than the current $6.73, but the one-month chart shows interest is mounting.

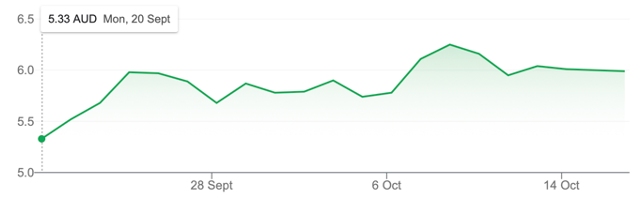

A2M one month

The stock is up 25% over the past month.

3. Nuix – a nice month of rises

The next speculator that has had a nice month of rises is Nuix (NXL). I’ve talked about this recently and it looks like the market has softened its view on the company in the past week. But the chart of the past six months tells us that it might be a short-term fluctuation.

Nuix (NXL) six months

Last week was a good one for the stock, with a rise of 3.6%. But I reckon you need more before you could be confident that the market has forgiven the company’s management for unreliable accounts.

NXL 5 days

The punter would move now, but the more cautious will wait for a more convincing trend, and then this could be a winner down the track. One analyst that tracks the company is Morgan Stanley, which has a 145% upside price target for NXL.

That said, be cautious with this one, as there could still be a bit of a wait before it delivers.

4. Moving away from tech stocks

Getting away from tech stocks and a real surprise package has been South 32 (S32). This has already turned but the consensus still thinks there’s a 9.3% rise ahead for its stock price.

However, Macquarie tips a 28.2% rise and Credit Suisse thinks it’s more like 17.95%. The chart shows that the company has been on the comeback trail since April 2020 but really has had uplifts in November last year and in August this year.

South 32 (S32)

It’s now around $3.92. Its all-time high is around $4.23 but it’s now mining the ‘stuff’ that seems to be popular in the world of electric vehicles and tech.

Recently it told the market that it had entered into binding conditional agreements with Sumitomo Metal Mining and Sumitomo Corporation to acquire a 45% interest in the Sierra Gorda copper mine in Chile. Copper is a favoured material for the world ahead and so is many of the minerals S32 digs up — bauxite, alumina, aluminium, metallurgical coal, manganese, nickel, silver, lead and zinc.

The stock is up 18.68% in the past month.

5. My final risky play

This is my final risky play that looks promising, based on its trend from the last month. And it’s AGL. The analysts see it as having a potentially 14.5% higher stock price but Ord Minnett thinks it could be 25.82%, while Morgans plumps for 21.38%.

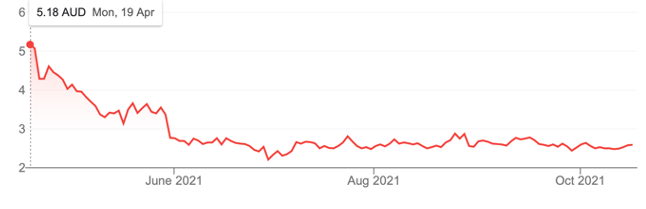

AGL one month

And that’s despite a 12.38% rise for the month! This fits the classic nice rise, which could be the sign of things to come. But it’s not a BHP-type company and it has a maze of curveballs to deal with, though the one strong argument is that Australia will need energy in the future.

AGL’s big news has been its planned demerger. Under the plan, AGL Energy will split into a new company AGL Australia under Christine Corbett, while former chairman Graeme Hunt will lead a new coal-focused generator, Accel Energy. Accel will retain a 15-20% stake in AGL Australia.

There is nothing I can write with confidence that can swing you into this stock, but at this stage, the market seems to be getting on board with AGL.

(On tonight’s TV show i.e. Switzer Investing, I will have Michael Gable look closely at these companies’ charts to see if there’s a compelling reason to invest in them. Go to the Switzer Financial Group YouTube Channel to find the show tonight.)

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.