Last week I doubled down on an investment I like for the future by using the current sell-off to buy a quality company that’s now at a really attractive price. Sure, it could fall further, especially if the Fed on Wednesday raises by 100 basis points rather than 0.75%, or if it says things to spook market players, but I’m sure the company in question will look great in 2023 if not before.

Giving me confidence that my decision to invest after the sell-off was the right one was the news that Dustin Moskowitz, CEO of software company Asana in the US, actually bought $US349.9 million worth of his company’s stock in a private placement. CNBC reported that this was “nearly 10 times larger than the next biggest buy this week,” and “the executive has bought nearly $1.6 billion of the stock since May”.

I love seeing executives backing their own judgement. This gutsy action made me think about the quality companies on the local market that have been trashed with the recent sell-off, but that analysts are tipping have potential. And that potential is likely to show up when interest rates stop rising and stocks become popular again.

1. Goodman Group (GMG)

An easy start in putting a collection of crazy-priced quality companies is the Goodman Group (GMG), which the analysts see a 27.7% rise ahead. Four out of six experts have expectations of 30%+ for this company. GMG is a world-class REIT playing in the industrial space, and its chart suggests its current share price looks under the odds.

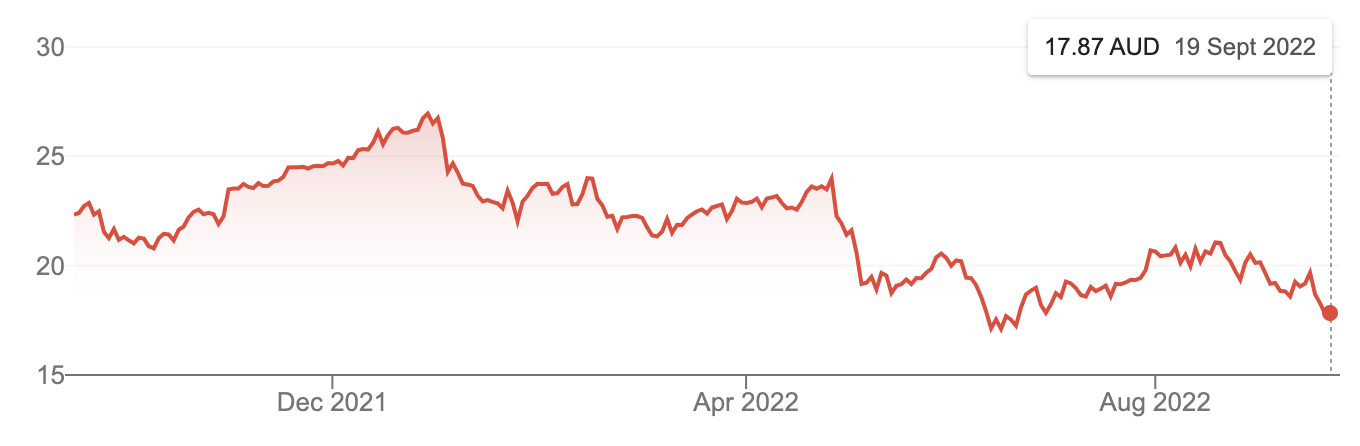

Goodman Group (GMG)

This was a $26.50 in December last year and is now $17.80. The chart shows that the company’s declining share price coincides with the 2022 period of rising interest rates that started in the US first and then kicked off here in Australia.

2. ANZ

It would be silly to ignore one of our big four banks that the analysts see a lot of upside in. ANZ Banking Group (ANZ) has been showing some signs that it’s becoming relatively more competitive of late. The FNArena survey of analysts has a consensus rise of 12.90%. UBS sees a 27.39% rise ahead, while both Credit Suisse and Citi have a 23% plus prediction for the bank’s share price.

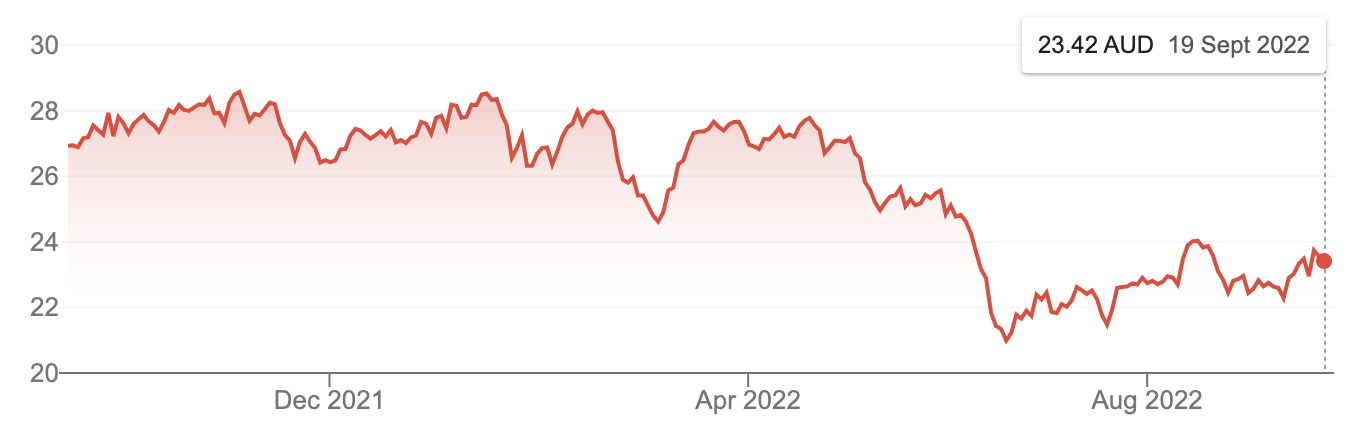

Meanwhile, the bank’s five-year chart shows that its price was in the $27-$28 band after the bounceback that followed the Coronavirus crash, but then the rate-rise programs here and overseas coincided with a fall in its share price to a low of $20.99. At $23.55 now, there’s a building trend that could easily take off when rate rises look to be dissipating as inflation falls and we avoid a recession.

Australia and New Zealand Banking Group Limited (ANZ)

Clearly, the optimistic calls from analysts imply they agree with my best-case scenario for inflation, rate rises and recession.

3. Xero (XRO)

To the tech space and I can’t rule out Xero (XRO) as a quality company of the future. If I were the CEO of Xero, I’d be very long on this stock. Morgan Stanley’s company-assessing experts clearly agree with a 77% upside forecast for the company. The consensus rise is a nice 16.1% but not all analysts are giving the company the thumbs up. Both UBS and Macquarie see a 16.26% drop in its stock price ahead.

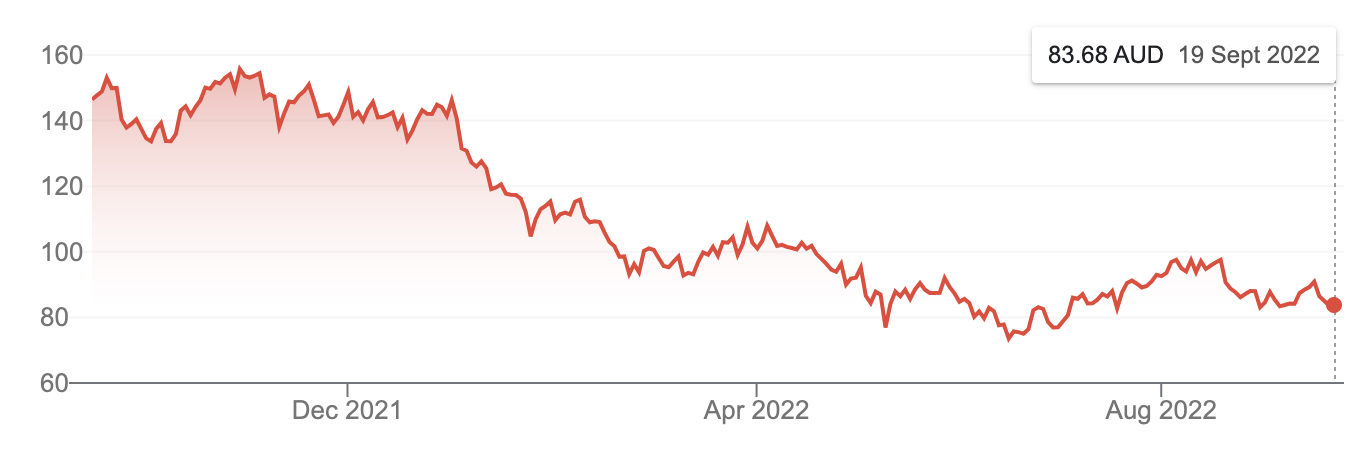

Xero Limited (XRO)

Xero is regarded as a tech company and has been caught up in the tech sell off linked to rising interest rates. At the start of the year, XRO was a $144 stock but it’s now down to $83.59. I’m betting that when tech stocks fall back into favour, XRO will lead the charge up for share prices.

4. JB Hi-FI (JBH)

Retail is out of favour today as we switch spending from products to services, after overdosing on buying ‘stuff’ during the pandemic lockdowns. This temporary pullback on buying products won’t last forever. This sell-off provides an opportunity to pick up a quality company such as JB Hi-Fi (JBH) at (excuse the pun) a bargain basement discount.

The consensus forecast price is $47.39. It’s now at $41.39 but the likes of Morgans and Citi see a 20% higher price out there waiting to eventually happen, while Credit Suisse thinks a 29.4% rise lies ahead.

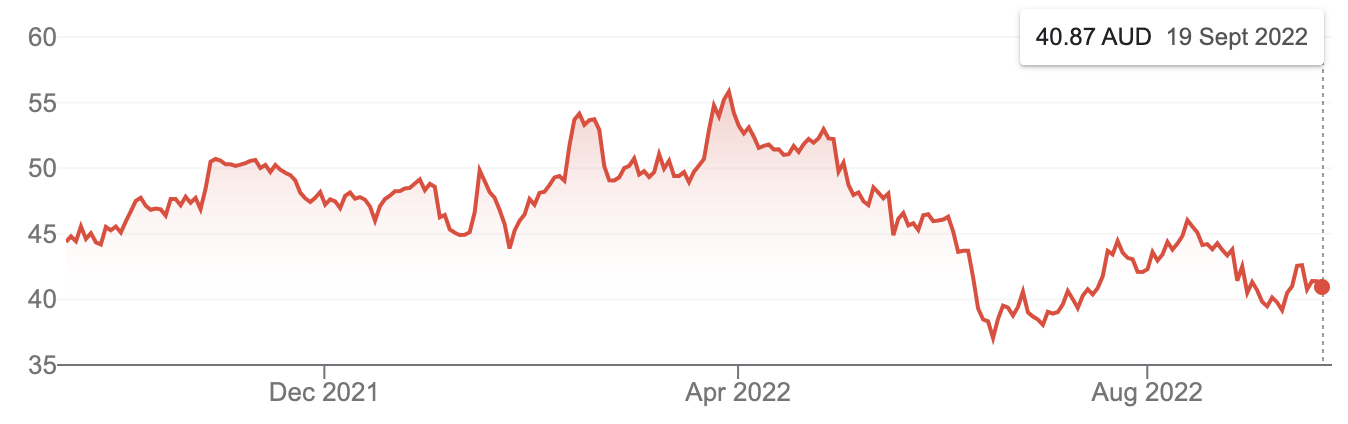

The chart below shows that the retailer’s share price peaked around late March and hasn’t been helped by the central bank’s decision to take thousands of dollars from households with mortgages each month. Its recent low was about $37 so there have been bargain hunters who’ve made about 12% by picking the bottom. Over time, there seem to be a lot more potential rises out there waiting to eventually happen.

JB Hi-Fi Limited (JBH)

5. South32 (S32)

One of the trends of recent times is the sustained support for miners and diversified miners that have exposure to many of the minerals of the modern industrial complex.

South32 Limited (S32)

South32 (S32) produces commodities including bauxite, alumina, aluminium, copper, silver, lead, zinc, nickel, metallurgical coal and manganese. These are likely to benefit from any economic recovery, which is very possible in 2023. An end to the Ukraine war would also be a plus for the company, which would help the EU fight potential recession threats linked to higher energy prices, thanks to Vladimir Putin.

The chart above shows how the company weathered the rate-rise program. It took a fall in June but has started a rebuilding phase.

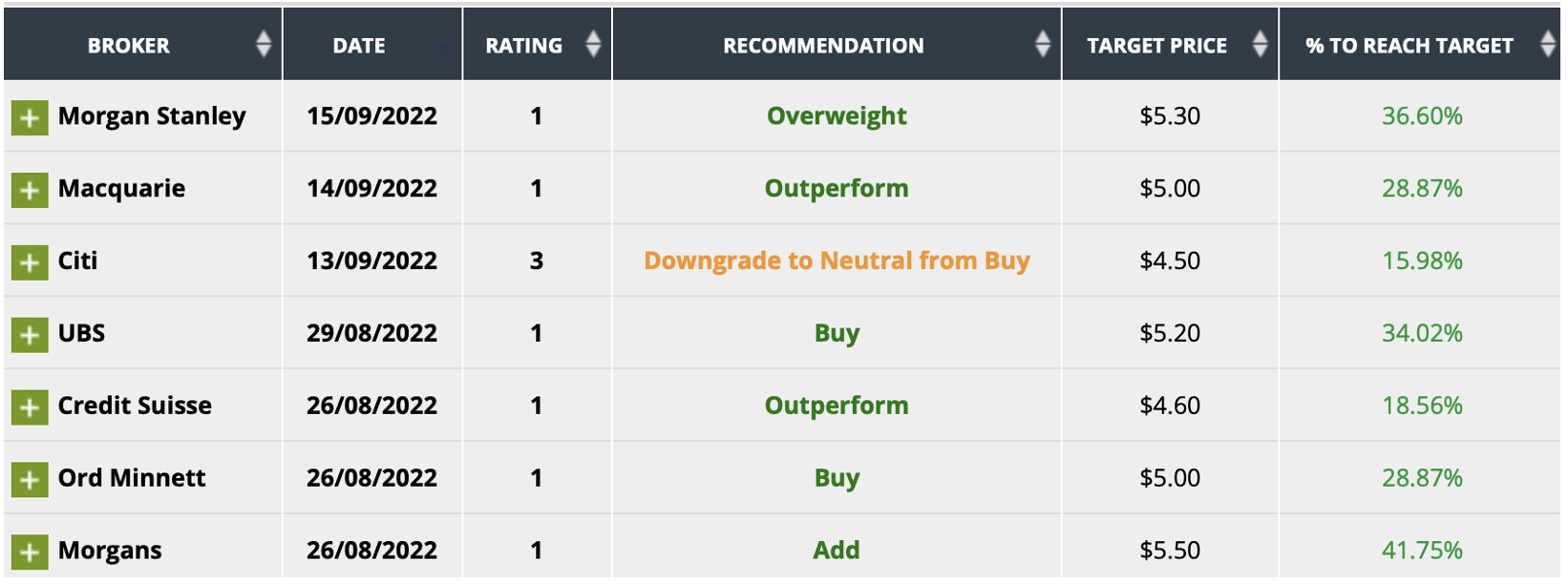

All the analysts surveyed by FNArena like S32, as the following table shows.

The consensus rise was a big 29.2%, but the likes of Morgans with a 41.7%% call and Morgan Stanley and UBS with their 30%+ predictions show that they have a lot of faith in the company’s potential.

Conclusion

Obviously, more companies fit this bill of quality businesses that have been beaten up by the stock market. If more sell-offs happen in coming weeks, there’ll be plenty of historically educated market experts and professional players who’ll be looking for better-than-average companies that have been oversold on a short-term basis but have a lot to offer the ‘buy and wait’ investor, like Asana’s CEO, Dustin Moskowitz.

By the way, in the US last week, the CEOs of Energy Transfer, American Homes 4 Rent and Stanley Black & Decker all were reported as having dug deep into their own pockets to buy their own company’s share prices, arguably because they disagree with the assessment by the market of the value of their businesses.

As Warren Buffett has taught us: “Price is what you pay, value is what you get.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.