At the start of the financial year, I nominated “five income favourites” (see https://switzerreport.com.au/5-income-favourites-for-the-new-financial-year/). The criteria for selection was:

- No banks or Telstra;

- No resource companies (because they are ‘price-takers’ and have almost no influence over the revenue they earn);

- ASX top 150;

- Reasonably defensive (as demonstrated by a low beta and qualitative assessment);

- Expectation that earnings and dividends should continue to grow;

- Forecast dividend yield higher than 3.0%;

- Preference for franking; and

- Variety of industry sectors to support diversification objectives.

The stocks nominated (in alphabetical order) were Amcor (AMC), Charter Hall Long WALE REIT (CLW), Coles (COL), JB Hi-Fi (JBH) and Medibank (MPL).

Over the last few weeks, each company has reported profits and dividends, and given an outlook for the year ahead. Let’s see how they are travelling and whether the selections are still sound.

Firstly, their recent share market performance and whether dividends met expectations.

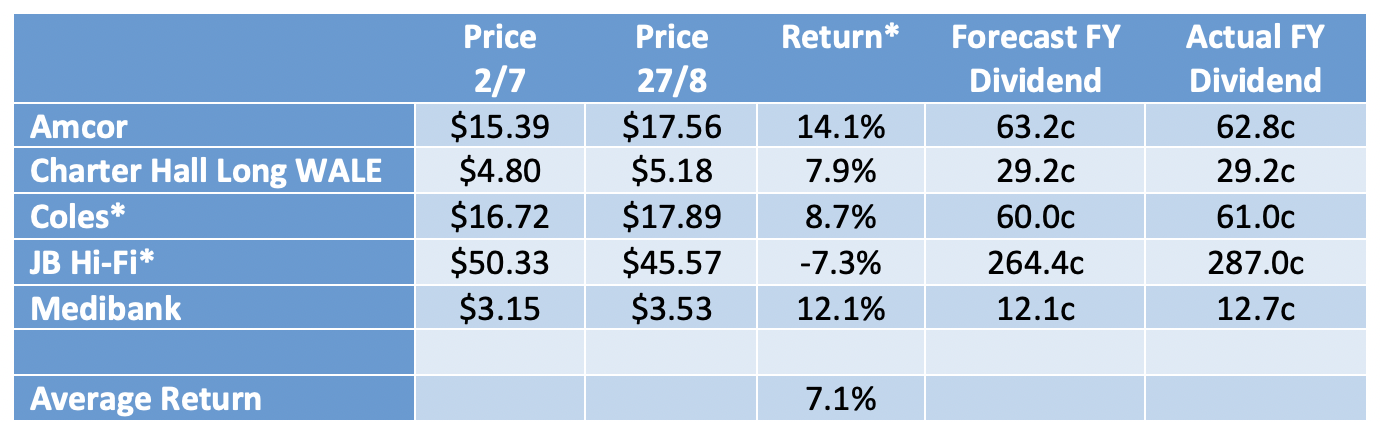

* Return Includes dividend if trading ‘ex’

As the table above shows, the average return for these stocks from 2 July to 27 August is 7.1%. This is higher than the market’s overall return, which according to the movement in the S&P/ASX 200 Accumulation Index, is up 3.0% over the same period. In terms of dividend income, Coles, JB Hi-Fi and Medibank delivered higher income than originally forecast, Charter Hall Long WALE REIT the same, and Amcor very marginally lower.

So far so good… but where do these stocks go now? Let’s see what they said with their results and what the brokers are now forecasting.

1. Amcor (AMC)

Sector: Materials

Last price: $17.56

Broker Target Price: $18.54

FY22 Forecast Dividends 67.8c FY22 Forecast Yield: 3.9%, unfranked

The brokers were impressed with Amcor’s fourth quarter result and guidance for FY22. The global packaging solutions company guided to EPS (earnings per share) growth in FY22 of 7% to 11% on a comparable currency basis. It said that it expected free cash flow of approximately US$1.1bn to US$1.2bn, with US$400m of cash to be allocated to a share buyback.

The consensus broker target price has risen to $18.54 ($17.18 in July). Individual targets range from a low of $17.20 from Credit Suisse though to a high of $20.00 from Morgan Stanley. There are 5 ‘buy’ recommendations and 2 ‘neutral’ recommendations.

Source: nabtrade

Following the share price jump, Amcor’s forecast yield for FY22 is now 3.9%. This is unfranked as Amcor earns most of its monies offshore.

Not a thrilling yield, but certainly a company that is heading in the right direction.

2. Charter Hall Long WALE REIT (CLW)

Sector: Real Estate

Last price: $5.18

Broker Target Price: $5.38

FY22 Forecast Dividends 30.9c FY22 Forecast Yield: 6.0%, unfranked

Charter Hall Long WALE REIT’s result was in line with expectations Guidance for operating EPS growth of 4.5% in FY22 was a fraction lower than some brokers had forecast, but that didn’t stop an increase in the consensus target price to $5.38 ($5.17 in July). Of the five major brokers who cover the REIT, there are 3 ‘buy’ recommendations and 2 ‘neutral’ recommendations

The REIT’s NTA (net tangible asset value) at 30 June was $5.22. The well diversified $5.6bn property portfolio has a WALE (weighted average lease expiry) of 13.2 years and is 98.3% occupied. Gearing is 31.4%.

Charter Hall Long WALE REIT (CLW) – 11/16 – 8/21

The brokers forecast a distribution of 30.9c in FY22, putting CLW on a distribution yield of 6% (unfranked)

A stock to buy on market dips.

3. Coles (COL)

Sector: Consumer Staples

Last price: $17.89

Broker Target Price: $18.57

FY22 Forecast Distribution 61.7c FY22 Forecast Yield: 3.4%, 100% franked

An in-line result, with the brokers liking the increase in supermarket share in the final quarter. That said, most brokers query whether Coles can make further gains in share given the required investment in distribution and logistical capabilities.

The consensus target price increased to $18.57 (from $17.69 in July), with a range of $16.50 from UBS at the bottom to a high of $19.80 from both of Macquarie and Morgans. There are 3 ‘buy’ recommendations, 2 ‘neutral’ recommendations and 1 ‘sell’ recommendation.

Coles (COL) – 11/18 – 8/21

The brokers forecast a very small increase in dividend to almost 62c in FY22, putting Coles on a fully franked dividend yield of a touch over 3.4%.

Coles is trading at a reasonable discount to its main competitor Woolworths and its PE (price earnings) multiple of 22 times forward earnings is not over the top. For income seekers, there is still value in Coles.

4. JB Hi-Fi (JBH)

Sector: Consumer Discretionary

Last price: $45.57

Broker Target Price: $52.71

FY22 Forecast Distribution 214.8c FY22 Forecast Yield: 4.7%, 100% franked

Since July, broker forecasts have increased as have earnings and dividend estimates for FY22. The consensus target price is $52.71 (up from $51.90 in July), a 15.6% premium to the last ASX price of $45.57.

Reflecting a variety of views about the impact of Covid on the business, the brokers are neutral on JB Hi-fi with 1 ‘buy’ recommendation, 5 ‘neutral’ recommendations and 1 ‘sell’ recommendation. Some brokers expect the gross margin to come under pressure, while others are worried should lockdowns continue.

JB Hi-Fi (JBH) – 8/16 to 8/21

Source: nabtrade

Attractively priced on a forward PE multiple of 14 times FY22 earnings and 14.1 times forecast FY23 earnings, JB Hi-Fi is forecast to pay a dividend of 214.8c in FY22. This gives a prospective dividend yield of 4.7%.

5. Medibank Private (MPL)

Sector: Financials

Last price: $3.53

Broker Target Price: $3.50

FY22 Forecast Distribution 12.8c FY22 Forecast Yield: 3.6%, 100% franked

The highlights of the Medibank result were policy holder growth, market share gains and a reduction in operating expenses. The largest private health insurer in Australia, Medibank increased market share by 0.37% to 27.3%. Health insurance operating profit was marginally ahead of expectations. Not surprisingly, brokers increased their target prices, with the consensus rising from $3.15 in July to $3.50.

Looking ahead, the brokers see the stock as fully priced. There are 2 ‘buy’ recommendations and 5 ‘neutral’ recommendations, with the target price ranging from a low of $3.28 through to a high of $3.80.

Medibank Private (MPL) – 7/16 – 7/21

Medibank should pay a dividend in FY22 of around 12.8c per share. Fully franked, this puts it on a prospective yield of 3.6%.

Medibank looks a touch expensive. Buy in a market pullback.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.