A really smart guy, and I mean a really smart guy, rang me on Sunday afternoon, to see if I agreed with his view on what the RBA Governor might do on Tuesday. And this conversation made me go want to go fishing for quality stocks that the market, right now, is not too enthusiastic about.

You might recall that in September I was keen to buy banks because I knew they’d eventually come good and especially as we were doing so well beating the Coronavirus and the economy was poised to rebound strongly given the stimulus from Treasurer Josh Frydenberg and the RBA’s Phil Lowe.

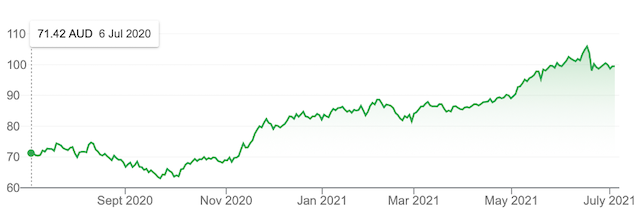

In case you need reminding how good an investment strategy it is to buy quality companies out of favour, have a look at this chart of the CBA over the past year.

Commonwealth Bank

One of the best banks in the world has rebounded 68% since late September. In fact all of our big four banks are rated as world class performers and have been great investments since that time last year.

Right now, stay-at-home stocks are back in favour because of lockdowns and the hardly impressive vaccination program, but what will Australia look like in six months-time?

By January, we should be vaccinating at a rate of knots with Pfizer due in bulk in October and this is where my smart guy comes in. He thinks by mid-2022, international borders will be open and non-vaccinators will be taking their health into their own hands. Foreign workers will be coming back, along with overseas students and by year’s end a new normal, resembling the old normal, albeit with a number of virus-affected life processes, will have been established.

The RBA will have to backtrack on its “rates won’t rise until 2024” virtual promise but this will be a fast-growing economy with jobs aplenty and the stock market should still be on the rise.

That said, I told my mate I didn’t think Dr Phil will be U-turning on his easy monetary policy this week and because of that we will have strong economy when vaccinations take root and stocks out of favour today will storm back into popularity.

So what quality companies do the analysts like, even if it takes until 2022 for them to deliver?

1. My first blue chip

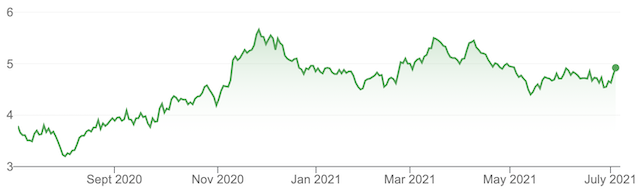

My first blue chip play is Qantas (QAN). The current share price is $4.79 but the analyst’s average target share price is $5.84, which implies a 21.9% gain!

FNArena says six experts make guesses on the future stock price and the most optimistic is Morgan Stanley, which thinks $7 or a 46% gain lies ahead. With these analysts we don’t know the timeframe they work off but I’m happy to wait a year for 46% or 21.9% gain.

Qantas (QAN)

Source: Google

2. My second quality play

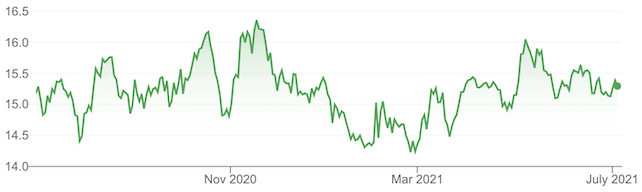

My second quality company play is Amcor (AMC), which the analysts see an 11.4% rise ahead. It’s now at $15.39 and the average target price is $17.15 but Morgan Stanley thinks it’s on the way to $19.00. If these guys are right, Amcor could have 23% upside.

Amcor (AMC)

Source: Google

3. Let’s talk gold

Let’s not ignore businesses that do well when markets get scared or when inflation starts to rise. Gold is often the commodity that doomsday merchants run to and many investment experts suggest that most investors should have exposure to that which glistens.

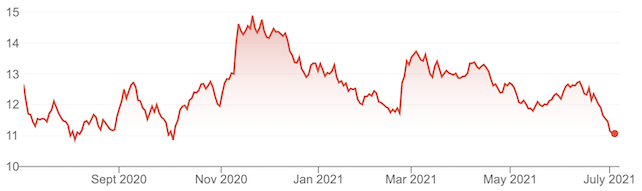

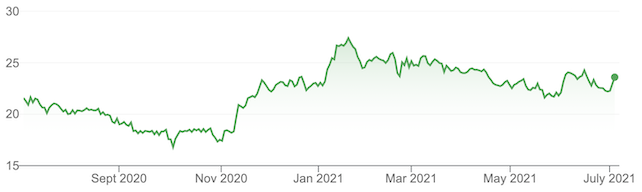

One company in the goldfields with an historically good reputation is Northern Star Resources (NST) as the chart below shows.

Northern Star (NST)

Right now as the world economies rebound with enormous support from governments and central banks that don’t want to raise interest rates, the spooked factor is low but if inflation eventually surprises, negativity could spike and that’s when the gold price could head north. This would be good news for the well-named Northern Star, which the analysts think has an average target price gain of 30%!

But I’m not alone in liking Northern Star. Out of the six analysts, two say it will “outperform”, two say “buy” one says “equal weight” and one says neutral with the latter holding a target price of $14.20 compared to the current price of $10.09. That is 40.7% upside!

4. Next up LLC

The next company I was going to dump until I saw what the analysts think about this usually quality business. The stock in question, Lendlease (LLC), is under challenge from workers staying at home and economies and their businesses apprehensive about investing in a virus-infected and -affected commercial world.

Lendlease (LLC)

Source: Google

Not only are its office blocks less valuable, the goal to create urban communities around residential complexes integrated into consumer-oriented businesses, has hit obstacles while the world works out where people want to live nowadays.

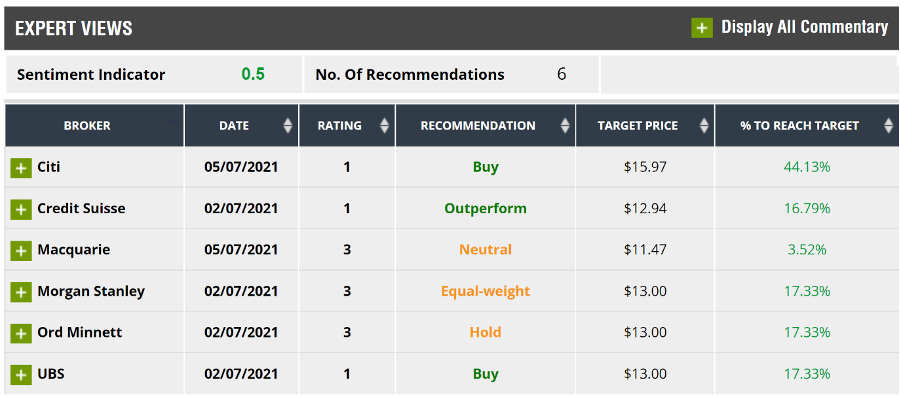

Still this has not rattled the experts who size up Lendlease, as the table below shows.

Source: FNArena

Have a look at what Citi’s expert thinks — a $15.97 price tag implying a 44.3% gain! That said the 20% average gain makes me want to give Lendlease another year in the Switzer super fund.

5. Let’s talk Woodside

My final quality company is a reopening winner but it has been winning for some time. It worries me because it is connected to those hard-to-read countries in OPEC+, who can surprise us at times and this can really hit the price of oil.

Do you remember when the Coronavirus crash hit home in February last year? The futures price of oil went negative! How does that happen? Did I say this is a hard to read domain?

The analysts clearly see higher oil/gas prices and Woodside (WPL) is therefore tipped to rise 19.9% on average. The biggest fan is the broker Morgans who has a target price of $28.80, which is tipping a 25.4% rise in the share price.

Woodside (WPL)

Source: Google

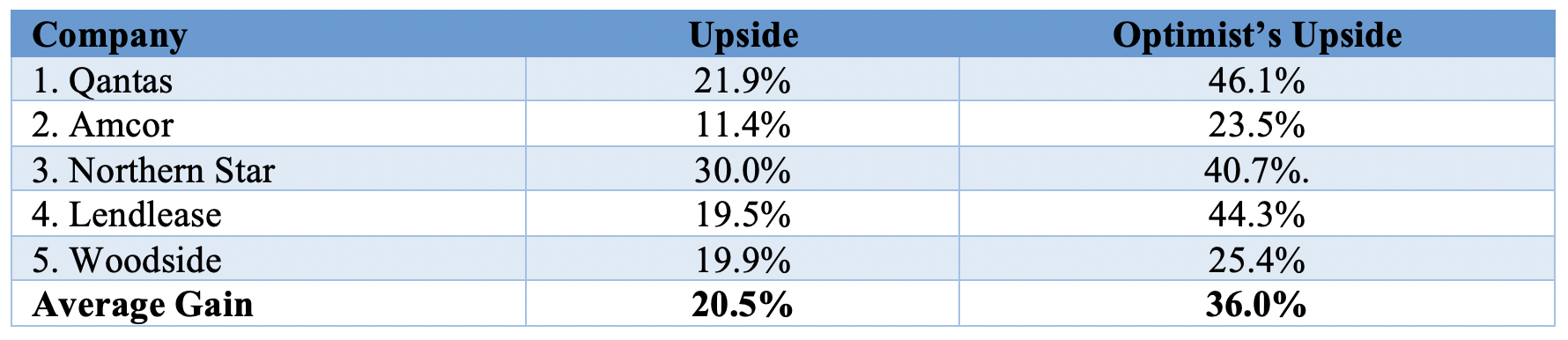

Calculating the average return

So let’s calculate the average return based on the consensus target prices of these 5 quality companies.

If the optimists are right, these five quality companies could return around 36% before we added in dividends and franking credits. However, even if the returns of these companies match the average expectations, pocketing 20.5% before dividends and franking is a dam good result from investing in best of breed operations.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.