Share price levels are arbitrary measures, but occasionally we like to put together lists of promising stocks united solely by their similar share prices. Here is the latest 4 stocks under 40 cents list.

1. Micro-X (MX1, 32 cents)

Market capitalisation: $145 million

Three-year total return: 2.9% a year

Analysts’ consensus valuation: 61 cents (Thomson Reuters)

Australian x-ray technology company Micro-X, which listed in 2015 (at 50 cents), is another of the country’s unsung success stories. Starting out as a developer and producer of diagnostic lung imaging equipment, Micro-X was the first company to bring “cold cathode carbon nanotube” X-ray technology to the world market – cold cathode technology uses an X-ray tube with a cold electron source material, controlled by a small voltage.

This is different to the X-ray technology in use today, which uses a heated filament to generate electrons inside a vacuum tube to create X-rays – this has barely changed since Wilhelm Röntgen invented the process in 1895. But the cold cathode tube technology allows much smaller and lighter equipment, with more precise and instantaneous electronic control.

The first product from Micro-X’s platform, the Nano mobile ultra-lightweight digital x-ray system, used mainly for bedside imaging, is used in 14 countries, and generated $4.2 million in sales in 2020 (all of the company’s revenue). But three more miniaturised X-ray products are in the offing:

- A mobile X-ray camera for allowing military, security and police operators to assess potential IEDs (improvised explosive devices); Micro-X says this technology, with a target launch of 2022, has an addressable market of $1.8 billion.

- Rover, an adapted version of the Nano for emergency medical, military, disaster relief, veterinary use; the product was approved by the US Food & Drug Administration (FDA) in May, and has an addressable market in the NATO countries alone of about $170 million. The first sales have been made to the Australian Department of Defence and the World Health Organisation (WHO):

- A miniature X-ray scanner built-into an automated airport security checkpoint; this product has two contracts worth US$4 million ($5.3 million) with the US Department of Homeland Security, with the first installations expected in 2023. Micro-X says the global addressable market is US$24 billion ($31.6 billion).

- The Tomo brain CT scanner – lightweight, mobile medical imaging technology that can quickly diagnose strokes at the scene of incidents or in the ambulance, allowing treatment within the critical “golden hour” after a stroke. Micro-X says the product, being built in collaboration with Fujifilm, is a “potential game-changer in modern stroke management,” and has a global addressable market of US$5 billion ($6.6 billion). First sales are expected in 2026.

Micro-X is a good local manufacturing story: its core R&D, engineering and production capability is in Adelaide, with CNT tube manufacturing line and approximately 95% Australian locally manufactured content.

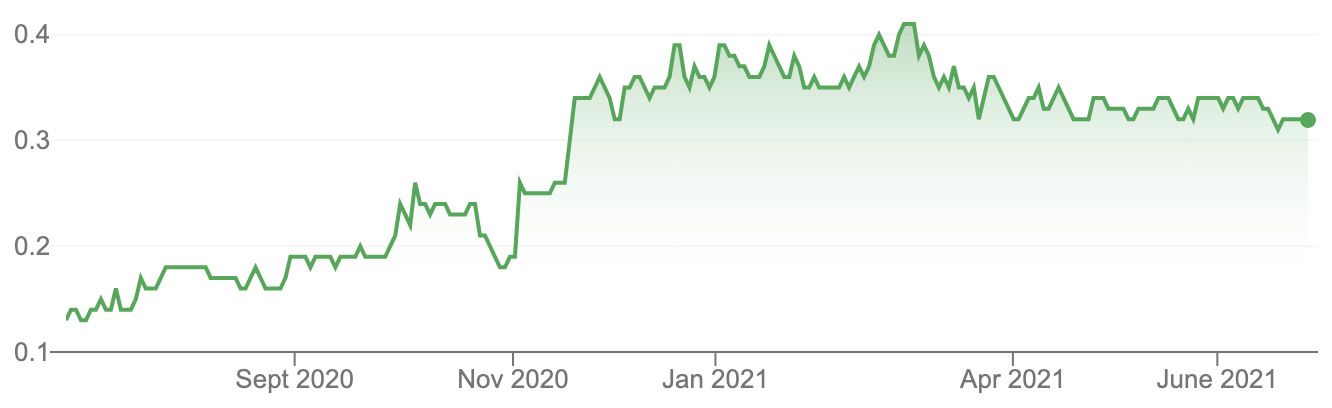

Listing has not been a great experience for Micro-X’s IPO subscribers, who have seen an initial peak of 57 cents slide as low as 12 cents in mid-2020. But positive news on the product expansion front has rejuvenated the share-price outlook.

Micro-X (MX1)

Source: Google

2. Tietto Minerals (TIE, 31 cents)

Market capitalisation: $141 million

Three-year total return: 37.2% a year

Analysts’ consensus valuation: 67.5 cents (Thomson Reuters)

West African gold explorer Tietto Minerals is on fast-tracking the development of its Abujar Gold Project in Cote d’Ivoire, where it continues to rack-up spectacular intercepts, including a standout hit of 1 metre at 532.5 grams per tonne (g/t) of gold, and 1 metre at 174 g/t gold, reported in May.

The current resource at Abujar stands at 81.2 million tonnes at 1.2 g/t of gold, giving just over three million ounces of contained gold.

The company expects its recently completed drilling program will underpin a material upgrade to ore reserves at Abujar, of 15.7 million tonnes at 1.7 g/t of gold, for 860,000 ounces of gold (the maiden open-pit) reserve, within a larger figure of 22.9 million tonnes at 1.5 g/t gold, of mining inventory and “open-pittable” inferred resources. But only about 10% of Tietto’s ground at Abujar has been explored.

Tietto is moving into the mine development phase, with work-in-progress during the June quarter including front-end engineering and design, as well as site and camp construction. Tietto has secured all necessary mining and environmental approvals, with the signing of a formal mining convention with the national government the final regulatory step to be achieved. The pre-feasibility study (PFS) showed that the Abujar open pit project could produce 200,000 ounces of gold in its first year, and more than 180,000 ounces a year over the first six years. The life-of-mine inventory currently stands at 1.1 million ounces at an average all-in sustaining cost (AISC) of US$839 an ounce – at present, gold trades above US$1,780 an ounce. On the pre-feasibility numbers, Abujar certainly looks to be a robust, long-life project, that is estimated to be able to pay back its US$230 million ($303 million) capital costs in just 2.8 years.

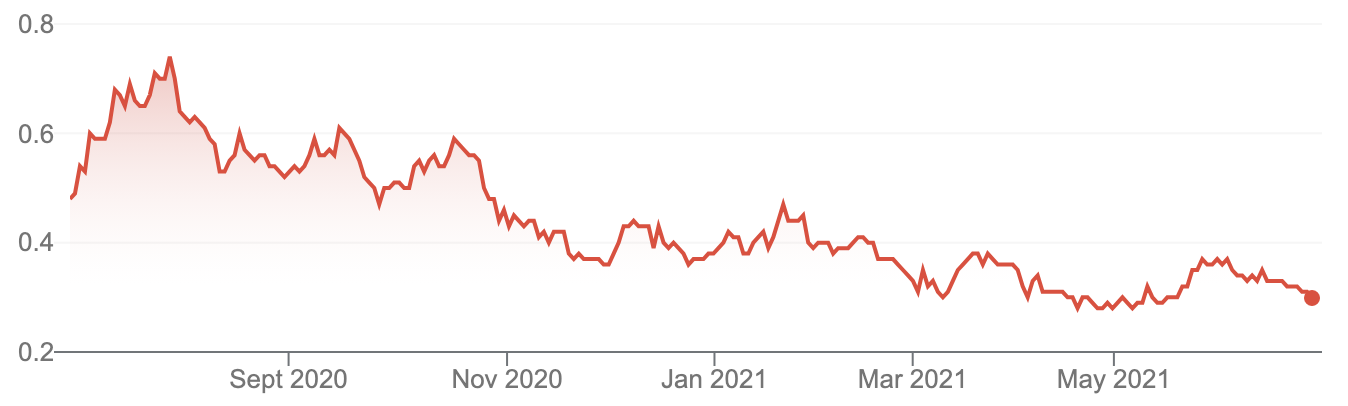

Tietto Minerals (TIE)

Source: Google

3. Spirit Technology Solutions (ST1, 27.5 cents)

Market capitalisation: $183 million

Three-year total return: 3.2% a year

Analysts’ consensus valuation: 47.5 cents (Thomson Reuters)

The former Spirit Telecom has spent the last two years transforming itself from a telecommunications provider to a full-service IT business, signified by the change to the current name in October 2020. The rationale was to exit consumer businesses to become a one-stop-shop for the IT and telco needs of the small-to-medium-sized business, corporate and government sector, offering high-speed internet, mobile, voice, cloud, cyber-security and managed services. A swag of acquisitions over the last couple of years – 13 in total – have been arranged into three main brands: Spirit Internet & IT, for small-to-medium-sized business; Trident Technology Solutions, for the essential services offering; and Intalock Cyber Security, for the corporate and government sectors.

In a May update, Spirit said its total recurring and S&P (solutions and projects, which includes government infrastructure) revenue had surged 150 per cent in a year, to $35.7 million. The company has racked-up ten consecutive growth quarters, from December 2018 to March 2021.) The company said pro forma revenue (taking into account all of the combined acquisitions) was running at about $140 million a year, with recurring revenue running at $65 million–$70 million. It says it is winning larger accounts nationally, through bundling of products. The most recent acquisition, the $50 million purchase of telecommunications equipment company Nexgen in May, will be a major driver of organic sales growth in FY21.

The national expansion, unified brand-building and organic growth outlook is looking very promising for Spirit. Analysts expect the company to be profitable at year-end (June 30), with significant growth in earnings per share (EPS) coming in FY22 – with expected earnings pricing Spirit on 14.7 times expected FY22 earnings. However, a dividend is not foreseen until at least FY23.

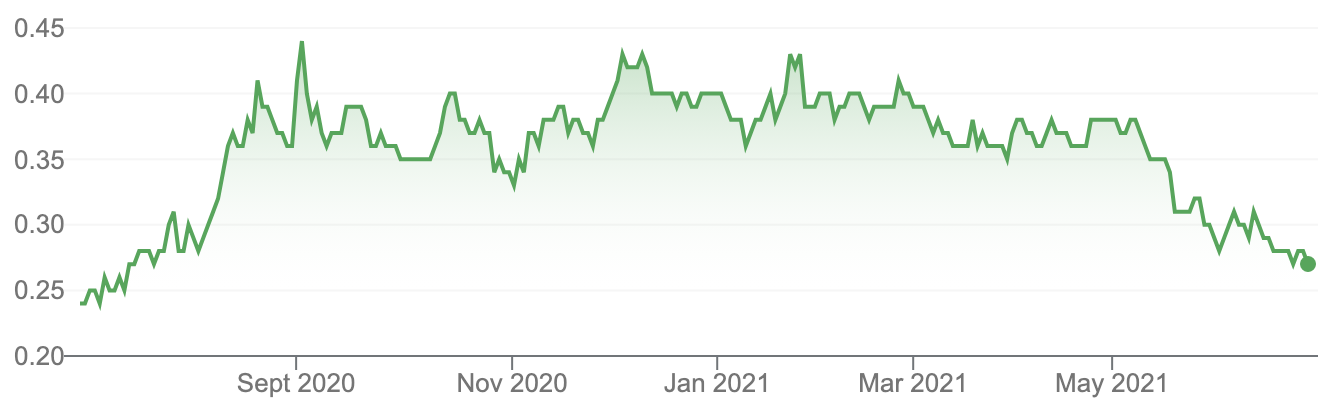

Spirit Technology Solutions (ST1)

4. ioneer (INR, 33 cents)

Market capitalisation: $673 million

Three-year total return: –2.2% a year

Analysts’ consensus valuation: 55 cents (Thomson Reuters)

ioneer owns the most advanced lithium development project in the US, at Rhyolite Ridge in Nevada; the project also contains boron. As mentioned last week with American Pacific Borates (ABR), which also has a boron deposit in the US, boron has huge potential emerging uses in the electric vehicle (EV) industry, both in the permanent magnets in the powertrain of an EV and in the lithium-ion batteries (and in the highly promising lithium-sulphur battery technology) used in EVs and renewable energy.

The Rhyolite Ridge project is planned to include a quarry, the first sulphuric acid plant permitted in the State of Nevada, an ore processing facility responsible for boric acid and lithium carbonate production, and a spent ore storage facility. ioneer claims that it will be the “lowest-cost lithium producer in the world, with industry-leading margins.” This cost structure, lower than any other brine or mineral producer, will be enabled by significant credits from the boric acid created in the process – the boric acid will offset about 52 per cent of the total cost. ioneer already has offtake and sales agreements for most of the boron production.

ioneer says the operation will be energy-independent and using co-generated zero-carbon power: the project’s acid plant features heat recovery technology, which means the plant will generate all of the electricity (and heat) needed for its operations, on-site. Thus, the project can boast that it uses carbon dioxide-free energy, which will be an important part of its “green” credentials.

Rhyolite Ridge is scheduled to start construction in the fourth quarter of the year. Potential investors should know that there is a concern over a floral species that lives on the site, Tiehm’s Buckwheat: the US Fish and Wildlife Service (FWS) will decide in September whether to list the plant as an “endangered species.” Earlier this month, ioneer stated: “We have carried out significant work on propagation and transplantation of the species and remain confident the plant and the mine can successfully coexist.”

ioneer (INR)

Source: Google

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.