One of the best maxims for a long-term investor is take the tip from Warren Buffett to “be greedy when others are fearful…” And with three blue chip stocks copping a market dumping, I couldn’t help thinking about one of my favourite Buffettisms, which goes like this: “Whether socks or stocks, I like buying quality merchandise when it is marked down.”

I’ve had three big memorable plays when I really bet against the market. The first one was another big go at Macquarie in 2008 with the GFC crash. I got in around $26, felt sick when it hit $18 but toasted Treasurer Wayne Swan when he got behind all our banks and the rest is history — great history for our super fund!

The second and third ones were when I invested in BHP and Rio following big sell offs in 2016, when the former dived from $36 to around $14.

In 2011, it was a $44 stock!

Believing both BHP and Rio were quality stocks that simply needed time and an economic boom to change their fortunes and their share prices, I went back in at prices that make me look like a genius today. Of course, I have other stock plays that remind me I can get it wrong, but those mistakes have generally improved my investing overall.

As Henry Ford once said: “The only real mistake is the one from which we learn nothing.”

So here are the companies that have copped it recently — BHP, Woodside Petroleum and Newcrest.

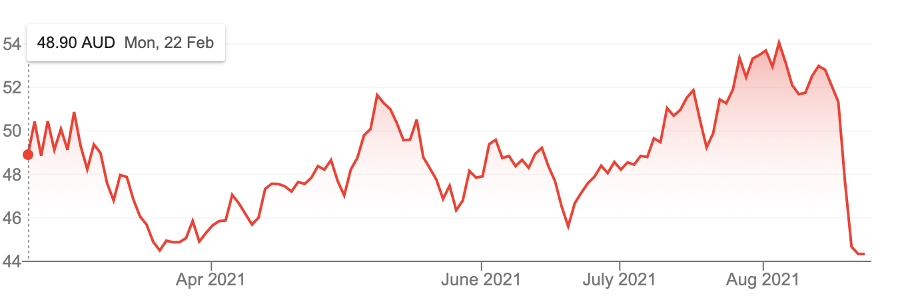

BHP (BHP)

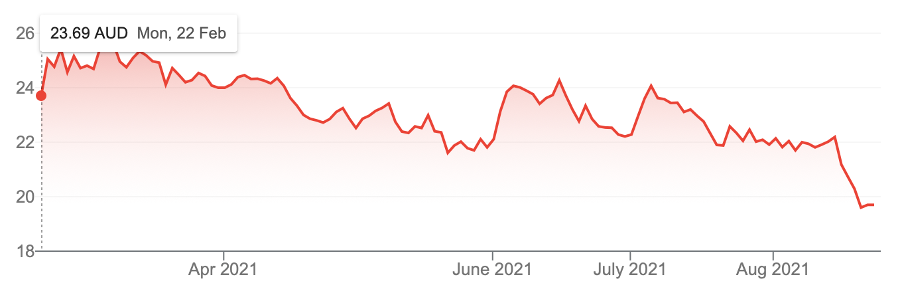

Woodside (WPL)

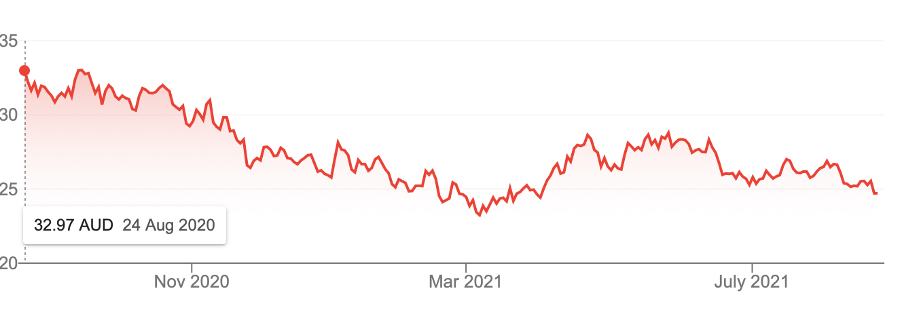

Newcrest (NCM)

Yep, they’re blue chip or quality outfits and the question you have to ask yourself is: even if they don’t spike higher in the next six months, when the world economy rebounds and opens up via high vaccination rates, will these companies do well?

That’s the criteria I’m now using for most of my investments. One group are reopening trade stocks that will also be lifted by the economic growth surges next year. The second group of investments are longer-term plays, such as Lynas for rare earths and a number of companies for lithium/battery opportunities linked to the electric vehicle road ahead.

My economic forecasting buddies are strong about global growth in 2022. This is bound to roll over into 2023 as the Delta variant of the Coronavirus has stolen growth from this year. What we’ve lost this year with lockdowns, inhibited spending by consumers and businesses will eventually kick in 2022 and 2023.

Both BHP and Woodside will benefit from this expected economic uplift and the innovations put forward last week will be pluses for both companies down the track. Meantime, with an economic boom, gold will eventually spike as inflation concerns rise taking interest rates higher.

This would be good for Newcrest, which also is a copper player, and we know copper is a winner with a big, global economic boom.

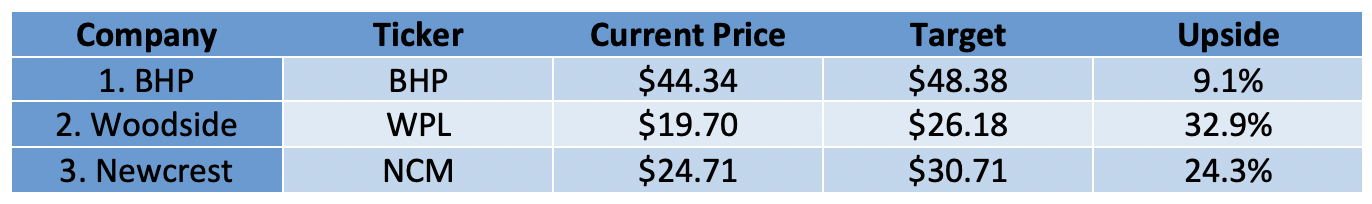

And the analysts surveyed by FNArena agree:

On iron ore, the experts at Macquarie seem to have studied at the Peter Switzer school of optimism, thinking BHP’s share price is heading to $58. If they’re on the money, that’s a 30% gain ahead!

Notwithstanding the 9.1% gain for BHP shown up, if bought in equal proportions, the average potential gain across the three stocks is 22%. It’s 29% if the Mac Bank guys are right.

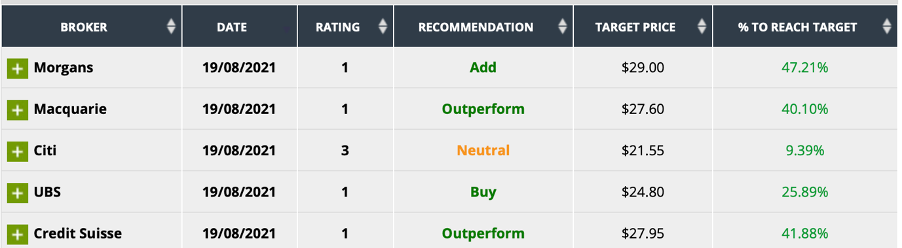

On Woodside, Morgans are the most optimistic with a $29 call, but both Macquarie and Credit Suisse see a $27 plus result out there waiting to happen.

The following table shows what the analysts think about Newcrest. Three out of five experts think a 40% plus gain is a distinct possibility.

My analysis rests on a 2022 economic comeback as 2021’s lockdowns have reduced near-term growth and the following revelations about oil are put it into perspective.

Asia accounts for around 35% of global oil demand, half of this comes from China, just as Beijing is imposing a “zero tolerance” strategy, which means travel is highly restricted in a number of China’s major cities.

Last week we saw July retail sales up 8.5% but the forecast was 11.5% and CNBC noted: “China released economic data for July that showed slower-than-expected growth as the world’s second-largest economy battled floods and a resurgence of Covid-19.”

Sell-offs today on infections should eventually turn into buying opportunities on high vaccination rates tomorrow, or more precisely in 2022.

Remember what Warren advised us: “Whether socks or stocks, I like buying quality merchandise when it is marked down.”

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.