Market promoters always talks about bull and bear markets. When the market rallies, they tell investors to buy more. When the market falls, it’s time to snap up bargains.

Everything is about buying more stock through a bullish lens. When their ideas tank, perma-bulls fall back on their “buy for the long-term” excuse.

Far fewer commentators talk about a different kind of equities scenario: a long, grinding market that slowly drifts lower over many years. The kind of market that makes you think the bulls will never return and that single-digit returns are the norm. A market that frustrates you into making bad investing decisions.

In this scenario, there’s no single-day capitulation or washout. There’s no crash that forces investors to sell good stocks with the bad. Nor is there a ‘V-shaped’ recovery.

Instead, the market has a slow, painful contraction. As inflation and interest rates stay elevated, the average Price Earnings (PE) multiples compress a little each year. For example, over five years, stocks that traded on a PE of 15 now trade on 10. They lose one PE point a year. Combined with lower earnings, share prices edge lower.

This is the worst scenarios for market promoters. A market that drifts sideways or slightly lower over several years doesn’t get investor pulses racing.

A sideways market doesn’t sell newspapers, investment newsletters or broking research. It doesn’t unleash a torrent of Initial Public Offerings (IPOs), corporate capital raisings or a wave of hostile takeovers (that are seen through by bidders). A sideways market doesn’t drive higher turnover, brokerage, or investment fees.

Promoters who always talk in terms of bulls and bears forget that markets can also have long patches of sideways movement. Consider the last three years for Australian shares: the S&P/ASX 200 is almost flat over this period (on a price basis).

Over 10 years, the ASX 200 has returned 4.45% annually. When dividends are included, the total annualised return is almost 9% – solid rather than spectacular.

My point is: for all the talk about bull and bear markets, Australian equities (before dividends) haven’t done much for a decade.

Of course, there are always star stocks beneath index averages. Moreover, one can interpret the market differently depending on the time period chosen.

But over three, five and 10 years, the ASX200 had edged slightly higher. Thank heavens for dividends. Without them, we would have had a long, mostly flat market.

I expect this sideways pattern to continue, possibly edging lower as economic growth slows. The big change is interest rates. An upturn in the interest-rate cycle is the most important change for equities markets in years.

Commentators often speculate about where rates will be next month or this time next year. Or when they will start to fall. Who knows? Long-term charts of interest rate movements show a 40-year cycle of rising rates (1945-1981) broadly followed by a 40-year cycle of falling rates. Now, rates are rising again after turning negative in Europe this year.

I’m not suggesting we have decades of rates pain ahead. The influence of central banks creates a different type of rate cycle compared to previous ones. Everything is moving faster. But I can’t imagine that after a year or so of rates pain, this rate-cycle upturn can end quickly and that we’ll return to super-low rates and rising asset prices.

Readers of this column know I have worried about inflation for the past few years. I did not believe higher inflation was a transitory response to supply-chain bottlenecks during COVID-19. Some of the inflation we see today is the result of forces that have been building for more than a decade and will not be resolved quickly.

Granted, some causes of recent higher inflation are unwinding. Shipping rates are falling as global growth slows and lower commodity prices will take pressure off prices.

But longer-term structural trends that will underpin higher-than-inflation for years, are just starting. These include more companies bringing some production back onshore to safeguard against supply-chain risks as geopolitical tensions rise. The growth of autocracies is a big problem for globalisation, which helps lower prices.

The second trend is the ageing global population. The exit of Baby Boomers from the workforce will profoundly affect labour supply, savings rates and tax revenue. I believe the market is under-appreciating the effects of an ageing population on inflation.

My base case is that inflation and interest rates will stay higher for longer than the market expects. If I’m right, a long, grinding market that drifts lower over several years – and slowly strangles portfolios as living costs rises – is possible.

Of course, that scenario could change quickly. Some good news from China on its. COVID-19 elimination policy and better news on its property woes would help.

So, too, would an end to the Russia/Ukraine war, greater certainty on energy security and a de-escalation of US-China tensions. None of this will happen any time soon.

Strategies for a sideways market

My starting point is that investors will need a higher allocation of equities and cash in their portfolio. More growth assets will be required to help portfolios achieve a decent return (after inflation). But with that comes higher risk. More cash is needed to provide liquidity to buy more equities during inevitable market sell-offs.

The next strategy is yield. In a sideways market, dividends will provide a higher proportion of the total return for most investors.

A 10% total return might come from 3-4%of capital growth and the 4-6% of grossed-up yield. That would be a good result in a sideways market and lot better than putting your funds in cash or bonds.

Risk-management is the third part of this strategy. The key is achieving higher yield while reducing risks. That requires using managed funds for stock diversification and choosing those that have better yield prospects.

I like using Listed Investment Companies (LIC) for yield. Their underlying funds provide diversification and there’s the possibility of buying them a discount to their Net Tangible Assets.

I also like that LICs, as listed companies rather than open-ended funds, can manage their dividend payouts and franking credits through retained earnings.

Here are three LICs that suit yield-focused investors in this market:

1. Clime Capital (CAM)

This yield-focused LIC has a gross yield of about 9% (after franking) on Bell Potter numbers. Clime invests in mostly large-cap Australian equities.

Clime is trading at a 3% discount to its indicative NTA, meaning investors can buy it for slightly less than the market value of its assets. Clime has ranged from a 10% discount to a 6.5% premium over the past five years, Bell Potter research shows.

Clime Capital is no world-beater, but it’s steady yield and quarterly dividends appeal. It’s a good choice for long-term investors, such as Self-Managed Superannuation Funds that want decent income in a sideways market.

I suspect income investors would be pleased with a 9% grossed-up yield and some capital growth from Clime Capital in the next 12 months.

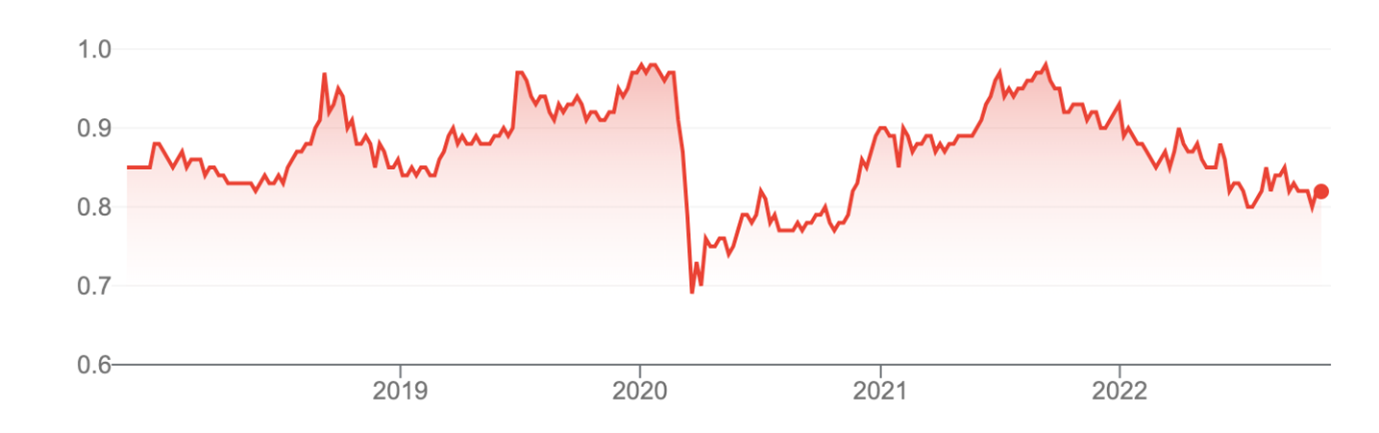

Chart 1: Clime Capital

Source: ASX

2. Future Generation Investment Company (FGG)

This philanthropy-focused LIC is expected to deliver a grossed-up dividend yield of about 8% on Bell Potter numbers. FGG uses leading LIC managers for its fund-of-funds investment strategy.

FGG is trading at an 10% discount to its indicative NTA, meaning investors can buy it at a discount to the value of its underlying assets. Always take care with NTA discounts: some LICs trade at large discounts for years, frustrating investors.

FGG’s discount is a touch higher than its 5-year average (8%). If the LIC’s discount reverts to its mean (as often happens over long periods), FGG could deliver modest upside on growth and provide a handy yield. Its philanthropy benefits are another plus for those of us who like the idea of our investment fees supporting those in need.

FGG has tumbled this year as global equity markets have fallen, providing a more attractive entry point for new investors in this LIC.

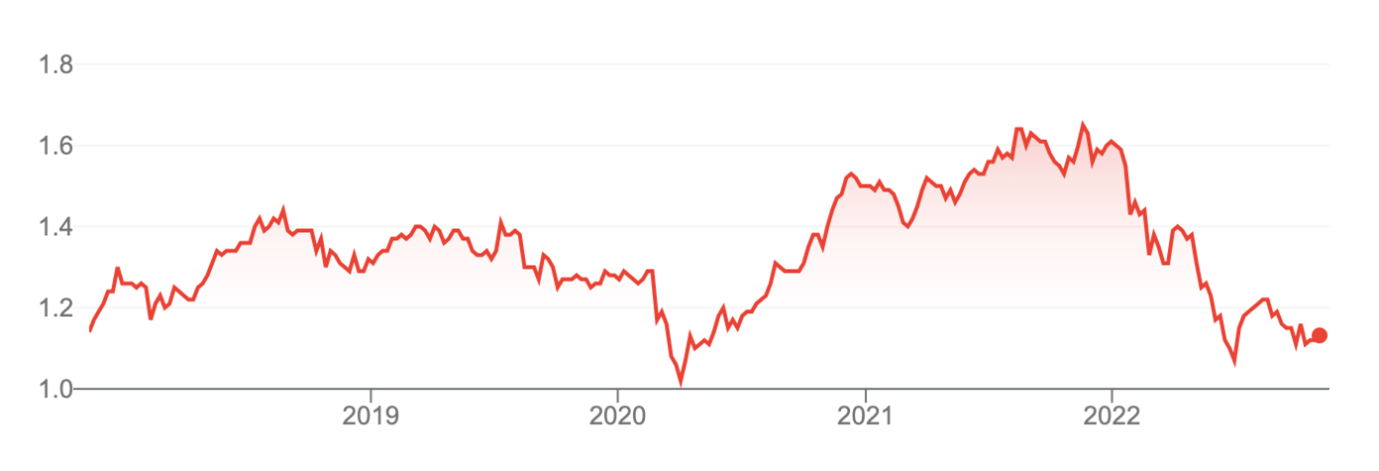

Chart 2: Future Generation Investment Company

Source: ASX

3. Djerriwarrh Investments

This income-focused LIC has an expected gross yield of 7% on Bell Potter forecasts.

The LIC is trading at a slight discount to NTA. Long term, there have been periods where Djerriwarrh has traded at a decent premium to its NTA.

Djerriwarrh comes from the same team as Australian Foundation Investment Company, the market’s leading LIC. Djerriwarrh’s investment strategy – particularly its use of options strategies to enhance income returns – suits this market.

In a long, grinding sideways market, every basis point of extra return – from yield, capital growth, or buying a quality LIC below its NTA – matters more.

Chart 3: Djerriwarrh Investments

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at October 25, 2022.