Investors often think that they have to look further down the capitalisation curve to find the best value, but that is not always the case. I’ve been going through the Australian market’s 50 largest stocks, and here are what I believe are three great large-cap bargains for 2023.

1. Qantas (QAN, $6.23)

Market capitalisation: $11.7 billion

12-month total return: 28.7%

Three-year total return: –5.4% a year

Expected FY23 dividend yield: no dividend expected

Analysts’ consensus price target: $7.60 (Stock Doctor/Thomson Reuters, 16 analysts), $7.70 (FN Arena, seven analysts)

The national flag carrier was one of the stocks hardest hit by the COVID pandemic, for obvious reasons, such as the worldwide grounding of the industry, through to recent capacity constraints, persistent staffing issues and the volatile price of jet fuel. Airlines have not looked like a good buy, but the savvy investors who bought into QAN at the depths of the COVID Crash in March 2020, when the situation looked its worst, at $2.36 — down 63% in four weeks — have made a killing.

But there is still very good value in QAN, with pent-up demand for travel looking capable of underpinning healthy demand for quite a while.

Last month, Qantas announced its second profit upgrade in six weeks. The airline now expects first-half underlying profit (pre-tax) of between $1.35 billion and $1.45 billion, lifted from the guidance it gave in October, of between $1.2 billion and $1.3 billion. This follows five consecutive half-years of heavy losses due to the pandemic and cumulative statutory losses of $7 billion (in full-year FY22, Qantas reported an underlying loss of $1.86 billion.)

This is despite fuel costs remaining significantly elevated compared with FY19: Qantas now expects its fuel bill to reach a record high in FY23, at about $5 billion. To put this in context, its international capacity is still about 30% below pre-COVID levels (although international capacity is now expected to increase from 61% of pre-COVID levels in the first half of FY23 to 77% in the second half, as the company takes delivery of new planes and returns others [A380s] from storage.

At the same time, Qantas is paying-down debt as revenue inflows accelerate: net debt is now expected to fall to an estimated $2.3 billion and $2.5 billion by 31 December 2022, about $900 million better than expected in the October update.

As Qantas powers back into profit, analysts are quite positive on the stock. The most bullish broker on the stock, Morgan Stanley, has a price target on QAN of $9.00, which if borne out would represent a gain of 44.5%. No dividend is expected in FY23, but analysts believe Qantas will return to dividends in FY24.

2. Aristocrat Leisure (ALL, $32.95)

Market capitalisation: $21.7 billion

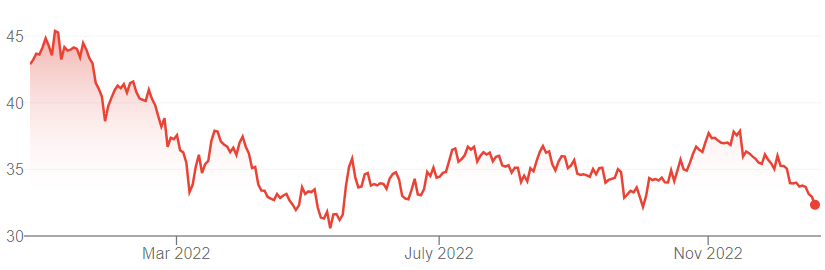

12-month total return: –23.6%

Three-year total return: –1.2% a year

Expected FY23 (September) 1.9% fully franked (grossed-up, 2.7%)

Analysts’ consensus price target: $41.60 (Stock Doctor/Thomson Reuters, 14 analysts), $41.26 (FN Arena, seven analysts)

Aristocrat Leisure is one of the ASX’s global leaders, having been a major world player in gaming machines for many decades – it is currently the second-biggest designer and manufacturer, just behind the UK-based International Game Technology (IGT) –and is now moving heavily into digital (online) and smartphone gaming. The company’s regulated gaming products are available in more than 100 countries. Aristocrat’s mobile-first game publishing arm, Pixel United, is a top-five game publisher in the tier 1 western markets.

Traditionally, Aristocrat has generated most of its revenue from the US through the supply of poker machines to casinos: its games comprised 17 of the top 25 premium leased products in the North American market in FY22. But in FY22, Pixel United contributed 46.5% of total revenue. Aristocrat has become a much more diverse business than just gaming machines in recent years: where 50% of its annual revenue was recurring just four years ago, that proportion is now 80%.

In particular, the company’s move into the online real money gaming (RMG) business – which comprises digital gaming, online sports betting and digital lotteries – is an exciting part of the business, with Aristocrat estimating that the current global total addressable market (TAM) is US$70 billion ($104 billion). The company launched a dedicated online RMG business in February 2022: in October, this business was branded Anaxi. Anaxi is the third business unit within Aristocrat Group, sitting alongside Aristocrat Gaming and Pixel United. In October, Anaxi was augmented with the acquisition of UK-based Roxor Gaming, a leading business-to-business (B2B) online RMG supplier: Roxor’s Remote Game Server (RGS) and publishing technology will underpin Anaxi’s growth plans.

The market has marked-down Aristocrat shares because of a proposed $5 billion takeover

of UK-based gaming and software company Playtech Plc. in 2021, which lapsed in February 2022. Acquiring Playtech would have materially diversified Aristocrat’s operations into the online RMG segment and broadened the company’s customer and geographic footprint, in particular giving it a competitive edge in the growing US online gambling market (in states where the practice is legal.) The war in Ukraine has also not helped: Pixel had to relocate about three-quarters of its 1,000-strong Ukrainian staff to elsewhere in the country or abroad, due to the conflict.

But analysts expect healthy growth in earnings and dividends for ALL in FY23, with growth moderating in FY24. The company has good momentum after lifting revenue by 18% and profit by 31% in FY22 – call that 12% and 24% respectively in constant-currency terms – and with a (small) fully franked dividend on offer as well, Aristocrat appears very attractive buying.

3. ResMed (RMD, $31.77)

Market capitalisation: $45.5 billion

12-month total return: –10.2%

Three-year total return: 12.9% a year

Expected FY23 (June) dividend yield: 0.8%, unfranked

Analysts’ consensus price target: $38.14 (Stock Doctor/Thomson Reuters, 14 analysts), $36.62 (FN Arena, six analysts)

ResMed is one of the world’s leading makers of devices and software solutions that help treat and manage sleep apnoea, chronic obstructive pulmonary disease (COPD) and other respiratory conditions. The company’s continuous positive airway pressure (CPAP) products prevent the airways from closing during sleep, to provide better, more effective breathing, and prevent snoring.

The portfolio of products includes airflow generators, diagnostic products, mask systems, headgear and other accessories. ResMed sells its products in more than 140 countries, with 57% of revenue coming from the US, Canada and Latin America. The company says that “under-penetrated markets” in sleep and COPD give it long-term growth opportunities.

In FY22, the dual ASX- and New York Stock Exchange-listed company announced a 12% increase in full-year revenue to $US3.6 billion ($5.1 billion) and a 64% surge in net profit to $US779.4 million, broadly meeting analyst expectations.

Overall, revenue from sleep and respiratory care products lifted 13% in the year, while revenue from ResMed’s software-as-a-service products (which help patients get treatment from home rather than the hospital) rose 7%. The company paid a full-year dividend of US$1.70 a share – 17 Australian cents for its ASX-listed CHESS Depositary Interests (CDIs), up from 15.6 cents in FY21.

ResMed is benefiting from its own technology upgrades – such as its most advanced platform innovation to date, the 100% cloud-connectable AirSense 11, and the AirSense 10 Card-to-Cloud solution – as well as the problems at its major competitor, Dutch rival Philips, which has become entangled in several safety recalls for its devices. ResMed believes that Philips will be out of the market until about August 2023.

Philips’ issues brought ResMed a windfall revenue gain estimated at up to $US250 million, about 75% of that coming in the US market. And it gained market share on the back of that, while increasing – ResMed says – its technological advantage. ResMed has more than 9,300 patents and designs, and ploughs about 7% of revenue into R&D every year, to maintain this position.

ResMed has experienced a lot of problems with the supply of components as supply-chain issues affected many global companies, but these are moderating. The company remains a dominant player in the CPAP marketplace, with an addressable market in sleep apnoea treatment that it describes as “huge,” with that market growing at a much faster rate than the general healthcare industry.

ResMed has not given guidance for FY23, but CEO Mike Farrell said when announcing the FY22 result: “Looking ahead, we are confident in our ability to grow steadily throughout fiscal year 2023 and to continue delivering for all stakeholders. We are investing in R&D to drive accelerated adoption of digital health solutions in sleep apnoea, COPD, and outside-hospital care, as we progress towards our goal to improve 250 million lives in 2025.”

The stock is a great exposure to a high-quality global healthcare company serving a growing area of healthcare demand – and RMD looks to be an excellent pick-up at current levels.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.