One of the most fascinating parts of the development of the exchange-traded fund (ETF) market is the honing of the investment exposures, in many cases into quite specialised opportunities.

After investors got used to ETFs based on the major indices, the symbiotic relationship between ETF issuers and index providers got rolling, and the result has been some very good ETFs for investors that have a bit more human input, in terms of the design of the index underneath the ETF vehicle, and what that index (and thus the ETF) is targeting.

A great example of this is the tie-up between ETF issuer Van Eck and the proprietary research of Morningstar, which has brought Australian investors the VanEck Vectors Morningstar Wide Moat ETF (ASX: MOAT). For the purposes of overseas diversification MOAT is a great stock – it only has US-listed stocks, but in this day and age a lot of the big US stocks just happen to have their home listing in the US, and are more global megacaps than US stocks, with revenues coming from all over the world. The attraction of the MOAT is that it is built to track the Morningstar Wide Moat Focus Index, which comprises stocks that go through the Morningstar research process that’s based around the firm’s concept of a company’s sustainable competitive advantage, or “economic moat.”

Morningstar looks for businesses that have a clear competitive advantage that allows a company to generate positive economic profits for its shareholders, over an extended period. In theory, a company with an economic moat can fight-off competition and earn high returns on capital for many years to come.

Morningstar has identified five main attributes that represent a moat:

- Switching costs – the obstacles that keep customers from changing from one product to another.

- The “network effect,” which occurs when the value of a good or service increases, for both new and existing users, as more people use that good or service.

- “Intangible assets” are things such as patents, government licences, and brand identity that enable a company to outperform competitors at bay.

- Cost advantage – a company with a cost advantage can produce goods or services at a lower cost, allowing them to undercut their competitors or achieve higher profitability.

- Efficient scale – this benefits companies operating in a market that only supports one or a few competitors, limiting rivalry.

Depending on its combination of these aspects, a company whose competitive advantages Morningstar expects to last more than 20 years has a wide moat; one expected to be able to stave-off its rivals for ten years has a narrow moat; while a firm with either no advantage, or one that Morningstar feels will quickly dissipate, has no moat.

For a company to be assessed to have a wide economic moat, the Morningstar research team must be virtually certain that it will still be generating positive excess normalised returns ten years from now. In addition, excess normalised returns must, more likely than not, be positive 20 years from now.

Only the widest of moats, then, make it into the MOAT portfolio, which currently stands at 48 stocks.

It’s important to stress that, while the Morningstar economic moat rating is a process designed to uncover companies with the best chance of providing superior long-term returns to alternative investments, like anything in investment, it’s not fool-proof. Morningstar is quite open about the fact that in any given year, moat ratings can change. COVID-19 changed the picture for long-term competitive advantage for many stocks: for example, three cruise-line companies – Norwegian Cruise Line, Royal Caribbean and Carnival Cruise Lines – lost their moats completely in the wake of the pandemic.

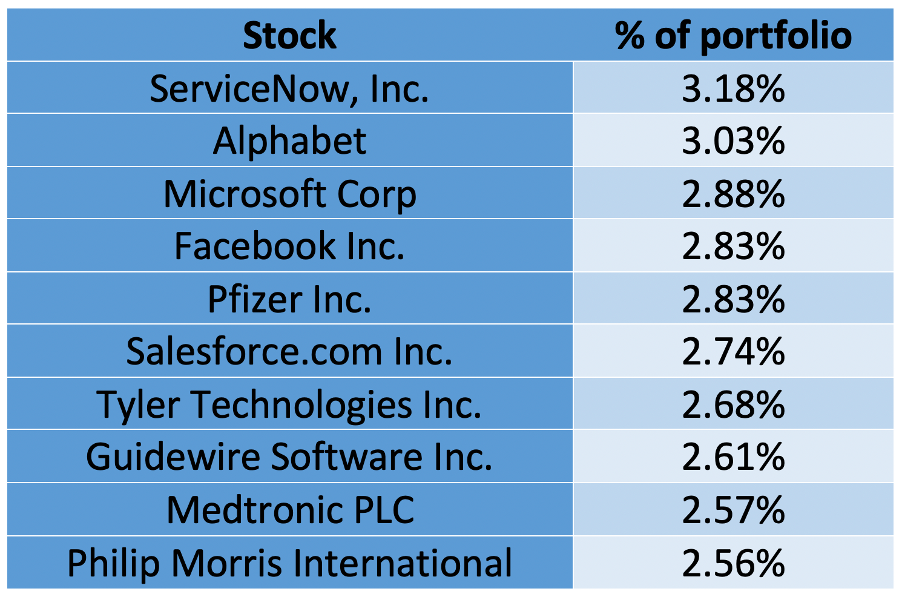

At the moment (end-August), the MOAT ETF’s top 10 holdings are:

The $362 million fund has traded on the ASX since June 2015. Since inception it has generated a return of 21.1% a year, with 19.7 percentage points of that coming from unit price performance and 1.4 percentage points coming from income. The total return is about 0.6% a year less than the index’s performance, in A$.

Over the last five years, the MOAT has returned 19.4% a year.

The MOAT ETF is managed for 0.49% a year. This is more than 12 times what the iShares S&P 500 ETF (ASX: IVV) costs – that ETF gives investors exposure to the large, established US companies in the S&P 500 index. IVV has given investors a five-year total return of 18.4% a year. I think that extra 1% a year of performance will pay for itself.

That is, of course, if you don’t mind holding Philip Morris – which might be a stock too far for some investors, although a glance at the Philip Morris website tells you that its purpose, these days, is “achieving a smoke-free future.” The company has announced an ambition for smoke-free products to bring-in more than half of its total net revenues by 2025. There must be enough dedicated vapers for the company to qualify for a Morningstar moat.

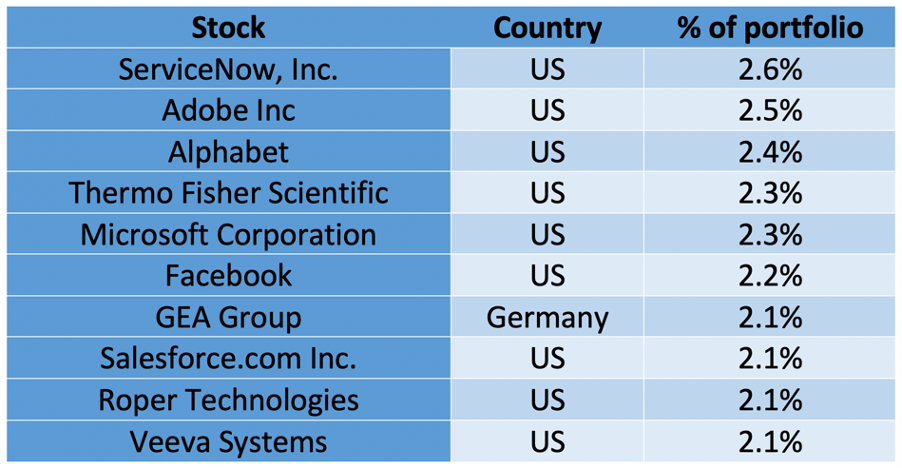

In September 2020, Van Eck launched the international version of MOAT – the Van Eck Morningstar International Wide Moat ETF, ASX code GOAT. This gives investors exposure to a diversified portfolio of international “wide moat” companies, based on the Morningstar Developed Markets ex-Australia Wide Moat Focus Index.

At the moment, the GOAT ETF’s top ten holdings are:

GOAT has only been going for 11 months, but performance is running at 30.5% a year. The six-month figure is 24.4%. GOAT costs investors 0.55% a year.

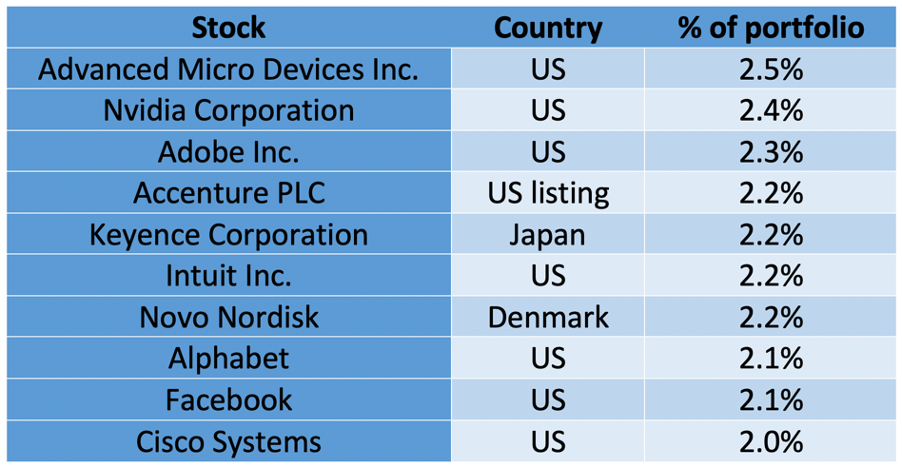

Another ETF that is built from a similar starting point is the BetaShares Global Quality Leaders ETF (ASX: QLTY), which is built around the Global ex-Australia Quality Leaders 150 Index of German index provider iSTOXX, which is owned by the Deutsche Boerse (the German stock exchange). This index targets the “quality” stock factor, which encompasses companies that show a high return on equity and profitability, low leverage (debt-to-equity ratio) and earnings stability. This focus on quality aims to produce superior long-term performance compared to benchmark global equities indices. Not only are this ETF’s constituent companies rated high-quality, they are drawn from a range of geographies and global sectors, many of which are under-represented in the Australian share market.

At the moment (end-August), the QLTY ETF’s top ten holdings are:

The QLTY fund has given Australian investors a return of 23.9% a year, after fees, since inception in November 2018, and 20.4% a year over the last five years. Importantly, the quality focus has helped limit falls when the market falls

QLTY is a bit cheaper than MOAT and GOAT, at 0.35% a year. Those are very solid returns for a slightly tweaked international exposure – giving returns of that kind of magnitude time to compound is a very sound idea, in your global allocation.

All three of these unhedged ETFs represent attractive exposures, with easily understood focuses – there is a bit more thought going into their construction than just following a major global index.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regard to your circumstances.