One of the best small-business stories to emerge from COVID was the success of Providoor, a new food-ordering platform that delivers restaurant meal-kits to homes.

Launched by celebrity chef Shane Delia, Providoor brings ingredients and recipes from upmarket restaurants to consumers, who finish the meal off in their kitchen. It’s a bit like a luxury version of HelloFresh or Marley Spoon for foodies who like to cook.

Like most fast-growing ventures, Providoor has had some glitches, partly due to higher-than-expected demand for its service. The service took off during COVID as consumers craved for gourmet meals when their favourite restaurants were shut.

Providoor is the latest variation in the booming ready-to-cook (RTC) market. More people are subscribing to meal services that deliver ingredients and recipes to homes. That’s creating opportunity for investors to buy companies here and overseas in the RTC market.

The global meal-kit delivery market is expected to reach about US$20 billion by 2027, underpinned by annual compound growth of almost 13%, according to Grand View Research Inc. Most industries would kill for that rate of long-term growth.

Some consumers subscribe to meal-kit services because they are time-poor. Others subscribe because they are bereft of meal ideas and need culinary inspiration. For some, meal-kits are a way to try new recipes and a form of entertainment as they create fancy dishes.

COVID will boost meal-kit growth in several ways. First, regular trips to the supermarket will be less popular with consumers who worry about catching the Coronavirus. Second, some of the extra people who tried meal-kits during the pandemic will become long-term customers of meal-kit providers.

Then there’s the megatrend of people spending less time cooking meals from scratch. Witness the booming ready-to-eat market as Uber, Menulog and Deliveroo ferry breakfasts, lunches and dinner to the masses each week.

Consider how supermarkets are changing their product mix. Their fridges are devoting more space to ready-to-eat meals and their shelves to meal-kit products. Is it any wonder Americans now spend more on eating out and takeaways than on their weekly grocery shop?

Within a decade, it will be the norm for more Australians to eat the majority of their meals out, use food-delivery services or meal-kits. A mix of food channels seems like: groceries for part of the week; eating out or takeaways later in the week; and meal-kits when time allows.

Australian investors have few ways to play this trend locally. Marley Spoon (MMM), a favoured micro-cap of this column, is the best-known ASX-listed meal-kit provider. Youfoodz Holdings (YFZ), a December 2020 Initial Public Offering (IPO), is another option.

My Food Bag, another fast-growing food-box provider, is reportedly gauging interest from institutional investors in an IPO on ASX. Expect a few meal-kit providers to list on ASX via IPOs in coming years as investor interest in this category grows.

Here are three ways to play the trend:

1. HelloFresh (HFG SE)

Listed on the Frankfurt Stock Exchange, HelloFresh is the leading global meal-kit provider.

Its sales in the nine months to September 30 more than doubled to €2.6 billion compared to the same period in 2019. With restaurants and cafés temporarily shut during COVID, HelloFresh’s active customer base grew 92% to 5 million.

HelloFresh shares soared more than threefold during 2020 to €72.5. A few investment banks have issued “underweight” recommendations on HelloFresh due to its sharply higher valuation. The stock trades on a whopping Price Earnings (PE) of almost 50 times.

There are two ways to look at HelloFresh. The first is that the COVID-induced spike in demand for its service will reverse when lockdown restrictions ease, more people return to work in CBDs, and overseas restaurants open up. Meal-kits will be less popular when life returns to normal.

The bull case says COVID has legitimised HelloFresh as a way of ordering groceries rather than a novelty or one-off solution. That was the view of Munro Partners, which tipped HelloFresh as its top idea at the 2020 Sohn Hearts and Minds Investment Leaders Conference.

I’m somewhere in between. The meal-kit experience during COVID will provide long-term benefits for HelloFresh. Its business model is sustainable and it has many growth options by providing speciality meal-kits (gluten-free, for example), or through acquisitions.

But I’d wait until HelloFresh’s rally subsides and look to buy the stock during the next market correction, or as market jitters about lower short-term demand for its services increase. It’s a great stock to put on the portfolio watchlist with a view to buying nearer €50, a potential point of support on its price chart.

Chart 1: HelloFresh SE (HFG)

Source: Yahoo Finance

2. Youfoodz Holdings (YFZ)

I first noticed Youfoodz at my local gym. Young gym-goers seem to load up on Youfoodz’s high-protein, low-fat meals available from the gym’s fridges.

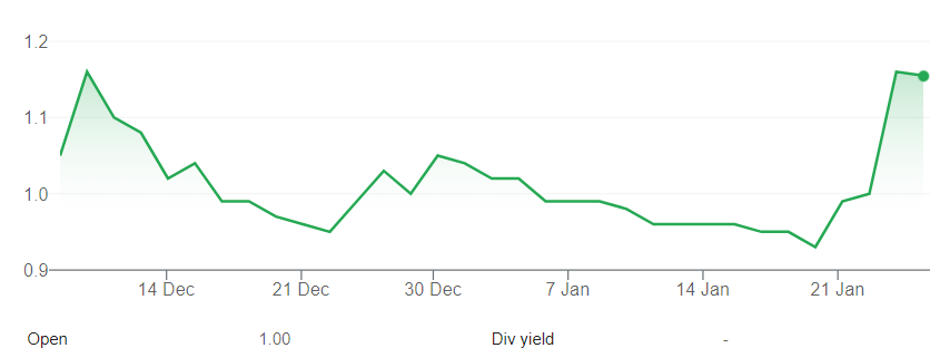

Youfoodz sought $70 million in a December 2020 IPO at $1.50 a share. The stock looked a little pricey at the offer and fell a quarter on its first trading day. It hit 93 cents earlier this month in a rising sharemarket as its IPO fizzle started to fade.

Youfoodz shares rallied to $1.16 this week after a trading update for second-quarter FY21. Management reaffirmed prospectus forecasts, outlining strong growth across the business.

Youfoodz prepared more than 4.8 million meals in the quarter, up 28% on the same period a year earlier. Home-delivery orders soared 45%, in part due to higher COVID-related demand.

Half-year net revenue for FY21 rose almost 16% to $73 million. Youfoodz said the sales-growth momentum had continued into the third quarter.

The result impressed. Stronger consumer sales offset slightly lower wholesale demand from petrol stations and other outlets that stock Youfoodz meals.

Youfoodz has plenty of growth avenues. The Brisbane-based company in November launched a next-day delivery service in New South Wales and is building its meal-subscription services through a mobile App launch that will help grow recurring sales.

In wholesale, Youfoodz added 700 stores during the second quarter to stock its product and believes it can expand in the corporate market through airline partnerships. The company’s snack-food range could benefit as airline travel recovers.

I like Youfoodz’s product, strategy and execution. It’s a ready-to-heat meal provider rather than a meal-kit company, but the basic premise is the same: time-poor consumers wanting nutritious meals at home, without having to source ingredients, cook and wash up.

Youfoodz is capitalised at $155 million. It had $35 million in net cash at December 2020 and is well funded. The company can build a much bigger brand, particularly among younger consumers who fit its meals into their active lifestyle.

As a newly listed micro-cap, Youfoodz suits experienced investors who are comfortable with higher risk. For those who fit the bill, Youfoodz is one of the more interesting micro-caps on ASX at the current price, given its growth rate in a high-potential meal segment.

Chart 2: Youfoodz (YFZ)

Source: ASX

3. Marley Spoon AG (MMM)

In December 2019, I wrote favourably on Marley Spoon for the Switzer Report. Marley Spoon was at 56 cents then. It hit 35 cents at the start of 2020, then soared to $3.55 as COVID restrictions took hold. It’s now at $2.79.

My initial interest was based on potential growth in the meal-kit market and because Woolworths took a small stake in Marley Spoon. Bigger tie-ups between grocery chains and popular meal-kit providers are a no-brainer as demand for meal-kits grows.

Marley Spoon is releasing its quarterly results as this issue of the Switzer Report publishes (January 28). I expect good growth and possibly a lift in Marley Spoon’s shares, given recent price weakness. A poor result would hammer the stock, given COVID tailwinds for meal-kits.

I like Marley Spoon’s business model, brand and product. A high proportion of repeat customers in its revenue stream is encouraging and suggests its product is a genuine meal-replacement alternative rather than a novelty consumers try once or twice.

Marley Spoon grew its active customer base by 85 per cent to 362,000 people in third-quarter 2020, compared to the same period a year earlier. If it can maintain a high level of repeat business, the company should achieve a faster growth rate that drives the next leg of its share-price rally.

The well-run Marley Spoon is also growing quickly in the United States and Germany. Share-price gains will be slower from here, but I like the company’s prospects in the global meal-kit market.

Marley Spoon shares have been volatile and the stock would have more appeal closer to $2 a share (it traded near there in early December). It’s not for the risk averse.

Better to stand aside for now as the market digests Marley Spoon’s soaring share price in 2020 and the implications for meal-kit demand as COVID restrictions worldwide eventually ease. My hunch is Marley Spoon will eventually be acquired by a larger competitor. The stock has excellent long-term potential, but may have run too hard, too fast for now.

Chart 3: Marley Spoon (MMM)

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 27 January 2021.