About this time each year, investment commentators nominate their top stocks or sectors for the coming year. I’ll do the same over December, starting with a theme: US-dollar weakness in 2023 and how to position portfolios.

First, some caveats. Never rely solely on publications for investment ideas. Always do further research of your own or talk to your adviser. In the next few weeks, newspapers and newsletters will be full of year-ahead ideas. They might not suit your needs.

With currencies, recognize that forecasting movements in US or Australian dollars in the short term is near impossible. If you’re looking for ideas on which currencies to trade in the next few months – and how to do so – this column is not for you.

My interest is the effect of currency moves on portfolios in 2023. Moving from unhedged to currency-hedged Exchange Traded Funds (ETFs) could be the smart play.

As a young investor, I learned about currencies the hard way. In the early 1990s, I had most of my savings in unhedged international equity funds. No sooner did I invest than the Australian dollar began to rise against the Greenback.

The funds’ underlying assets did okay, but unfavourable currency moves dampened returns. It was immensely frustrating watching US share markets rise, only to lose money on my funds because the Australian dollar rallied for a few years. My funds were worth less when converted back to our currency.

Since then, I’ve mostly favoured currency-hedged funds. If I form a strong view on an underlying sector or theme, I don’t want additional currency risk (which is harder to form a view on). Currency-hedged funds cost a little more, but eliminate that risk.

To be clear, I don’t expect significant weakness in the US dollar in 2023. With so much volatility and geopolitical risk, the Greenback’s safe-haven status is vital. Nor do I expect inflation to retreat quickly, allowing sooner-than-expected US rate cuts.

But it’s a good bet that US inflation has peaked from its 40-year high and that the US Federal Reserve will slow the pace of interest-rate rises next year. US Fed Chairman Jerome Powell said as much in a speech in the US earlier this month.

Moreover, commodity prices will stay elevated next year even as global economic growth slows. Underinvestment in new commodity projects, particularly in fossil fuels, will create ongoing supply issues, adding to a new commodities supercycle.

That would be good for commodity-based currencies, such as the Australian dollar.

Markets have started to price in this dynamic. The Australian dollar has rallied from about US62 cents in mid-October to US67 cents.

But if, like me, you prefer to focus on longer-term cycles, a different story emerges. The Australian dollar has been in a downtrend for over a decade.

From about US$1.10 in mid-2011, our dollar has been in retreat against the Greenback. The big question is whether that trend is turning.

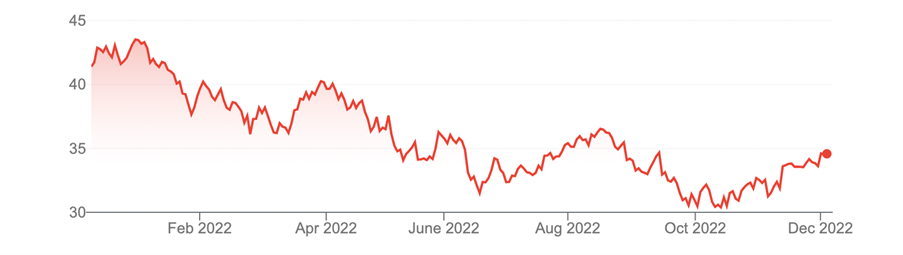

Chart 1: AUD/UD

Source: Trading economics

Although I don’t expect big gains in the Australian dollar next year, it could be enough to hurt investors here who have a decent allocation of international equities and are unhedged for currency moves.

In a low-return environment, unfavourable currency moves are the last thing investors need. Here are three ways to play currency moves in 2023.

1. Currency-hedged ETFs

If the Australian dollar rises 10% against the Greenback (all things being equal), the value of your US investments would fall by 10% when converted back to our currency, and vice versa. Unhedged ETFs work best when our dollar is falling.

The easiest way to see the difference is by comparing unhedged and hedged ETFs for the same underlying basket of securities in an ETF.

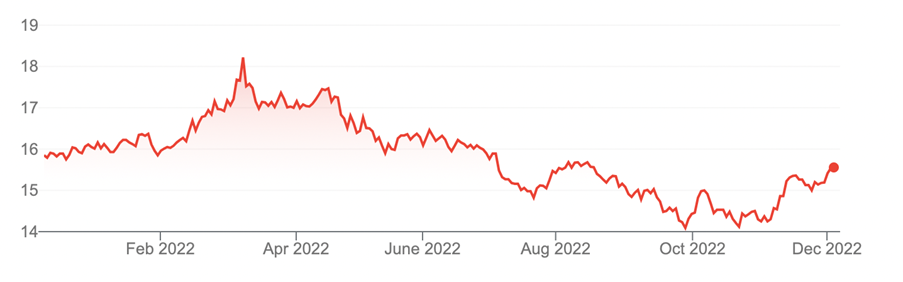

The VanEck MSCI International Quality ETF (QUAL) is down 11% over 12 months to end-November 2022. In contrast, the VanEck MSCI International Quality (hedged) ETF (QHAL) is down 16%. The difference in returns is currency hedging.

That’s why I believe ETF investors in international equities need to consider currency trends carefully. QHAL has underperformed QUAL this year, but a rising Australian dollar next year will work in its favour.

QHAL is an interesting smart-beta ETF. It invests in about 300 international equities (ex-Australia) based on return on equity, earnings growth and low financial leverage.

QHAL has been an average performer over the past three years (the annualised return over that period to end-November 2022 is 7%). It could do better if the Australian dollar continues to gain against the Greenback in 2023.

Chart 2: VanEck MSCI International Quality ETF – currency hedged (QHAL)

Source: Google Finance

2. Gold

In September, I identified an emerging opportunity in gold bullion. I wrote: “Some US investment banks I follow predict the US dollar will continue to rally this year before starting to turn in early 2023. If they’re right, we could be within a few months of a turn in the gold price. It’s impossible to know, but history shows that the big gains in gold often happen quickly, meaning it’s better to buy too early than too late.”

The big headwind for gold in 2022 was US dollar strength. When the US dollar rises, the gold price usually falls. Conversely, when the US dollar falls, gold rises.

Rising interest rates worldwide this year were another headwind for gold. Because gold pays no income, it becomes less attractive compared to other assets when rates rise.

In September, I held off buying gold through the Global X Physical Gold ETF (GOLD) because I expected further rises in the US dollar and interest rates. GOLD (unhedged for currency moves) is up slightly since then.

Unhedged and hedged gold exposure has pros and cons in portfolios. Unhedged gold tends to provide better portfolio diversification and more of a buffer during big sharemarket sell-offs (when the Australian dollar typically falls).

Hedged gold exposure is a better strategy when the currency is near its low (when it traded near US60 cents, for example) – and more of a tactical portfolio idea.

I’m becoming more positive on gold amid expectations of slowing US rate rises and a moderating or easing US dollar in 2023. I favour the hedged gold ETF variety.

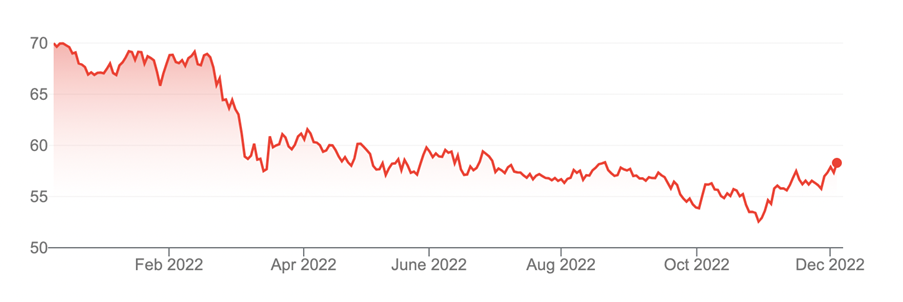

The BetaShares Gold Bullion ETF – currency hedged (QAU) provides exposure to physical gold bullion, hedging for currency movements in the AUD/USD exchange rate.

QAU is down almost 11% over one year to end-October 2022. In contrast, the Global X Physical Gold ETF (unhedged) has a positive return. Hedged gold ETFs would outperform unhedged ones in 2023 if the Australian dollar strengthens.

Chart 3: BetaShares Gold Bullion ETF

Source: Google Finance

3. Emerging markets

Emerging markets are usually a terrible short-term asset when investors retreat to the safe-haven US dollar during market volatility.

A rising US dollar hurts emerging countries on two fronts. First, these nations typically have a higher proportion of US dollar debt. The strengthening US dollar increases the servicing cost of that debt and its value in local-currency terms.

A rising US dollar has played a key role in several emerging-market crises. Rapid devaluation of the local currency versus the Greenback puts a rocket under the value of debts to be repaid and interest costs. Countries quickly go broke.

The iShares MSCI Emerging Markets ETF (IEM) is down almost 12.5% over one year to end-November 2022. Like all emerging-market ETFs on ASX, IME is unhedged.

IEM fell from about $74 in February 2021 to $53 in October and now trades at $58.20. Market expectations that US inflation has peaked and that the pace of US rate rises will slow, and that US dollar gains will moderate, have sparked interest in IEM.

For most long-term investors, emerging markets should have only a small portfolio allocation, given the risks. But after barely providing any return over the past five years, IEM could be a tool for emerging-market exposure in 2023.

Chart 4: iShares MSCI Emerging Markets ETF

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at December 6, 2022.