At this time each year, reports often focus on the best-performed stocks or funds. I prefer to examine the worst performers for the year.

Granted, most of these stocks deserve their bruises. But it’s a useful contrarian exercise to consider the worst stocks, managed funds or Exchange Traded Funds (ETFs) over 12 months. Or the sector or investment themes the market thumped this year.

I recently did this exercise with ETFs. Using ASX data, I examined the one-year return of 271 ETFs over 12 months to end-November 2022. You can do the same by downloading the latest ASX Investment Products report, which has great information.

I excluded from the analysis leveraged ETFs that magnify gains and losses. Active ETFs that aim to outperform their benchmark were also excluded. Some of these funds’ poor performance was more due to their manager than the underlying asset class.

Moreover, I only considered equity ETFs for this analysis. Contrarians might look at ETFs over bonds, currencies, commodities or alternative assets. But that is a column for another time.

Overall, I was surprised at how many ETFs had lost more than 20% in a year. Asia-focused ETFs, emerging-market ETFs and small- and mid-cap ETFs were mostly thumped. So, too, were many climate-focused or sustainability-themed ETFs.

Local and global tech and biotech ETFs were belted in 2022. That’s no surprise as tech and other growth stocks underperformed, amid rising inflation and interest rates.

Several tech-focused thematic ETFs – such as cloud computing, artificial intelligence and robotics, and esports and video games were hammered. Investors couldn’t get enough of thematic global tech ETFs a few years ago.

That’s the bad news. The good news is that parts of the ETF market look far more interesting after heavy price falls, at least for prospective investors.

Here are three contrarian ETF ideas for 2023:

1. Global X FANG+ ETF (FANG)

To be clear, I think it’s still too early to dive back into the global tech sector, even after horrendous sector underperformance this year. Interest rates have further to rise as inflation remains stubbornly high. That will be a recurring headwind for tech.

But there’s a case to add tech exposure to portfolios in 2023, carefully and gradually. I don’t expect a dramatic reversal in sector performance next year. If anything, more Total Addressable Market (TAM) tech stocks could fail next year.

Contrarians should stick to the biggest and best in tech. The household-name companies that have the balance sheets, market positions and audiences to weather the storm. Avoid speculative tech stocks or tech ETFs over risky themes or geographies.

The Global X FANG+ ETF is a simple tool for big-tech exposure. FANG mostly comprises 10 tech giants, such as Netflix, Apple, Microsoft, Alphabet, Amazon.com and Tesla. About 85% of the ETF is invested in the US; the rest in China.

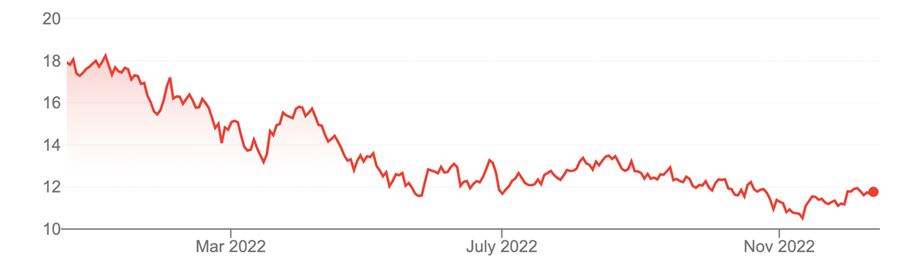

FANG is down 37% over one year to end-November 2022. It trades on an average Price Earnings (PE) ratio of about 27 times and a price-to-book ratio of 3.4 times. A few years ago, those metrics were almost unthinkable for the world’s top tech stocks.

Prospective investors in FANG must be able to withstand short-term volatility. Tech could continue to underperform in the first half of 2022 as rates rise. Currency is another consideration; I expect the US dollar to moderate next year.

Chart 1: Global X FANG+ ETF (FANG)

Source: Google Finance

2. iShares ASIA 50 ETF (IAA)

I considered including a China ETF as a contrarian global equities idea. The VanEck China A50 ETF (CETF); the VanEck China New Economy ETF (CNEW); and the iShares China Large-Cap ETF (IZZ) were the main contenders.

Chinese equities have been crunched by the country’s troubled COVID-19 elimination policy; property fears; and a general economic slowdown there.

Add to that rising geopolitical tensions with the West – and uncertainties over Taiwan – and there is a long list of reasons to avoid Chinese equities. This market is not for the risk-averse.

At face value, several large-cap Chinese equities look materially undervalued, at least compared to their Western peer companies. Alibaba Group Holdings, on a forward Price Earnings (PE) of just under 10, looks like a bargain compared to large US e-commerce stocks, for example.

But these valuations can deceive. For starters, several large-cap Chinese equities have complex ownership structures, governance shortcomings and their markets lack the usual mechanisms, such as hostile takeovers, that enable value to be realized.

That said, every stock has its price. Rather than bet solely on China, I’ve chosen the iShares ASIA 50 ETF (IAA) to spread geographic risk across 54 companies in the region.

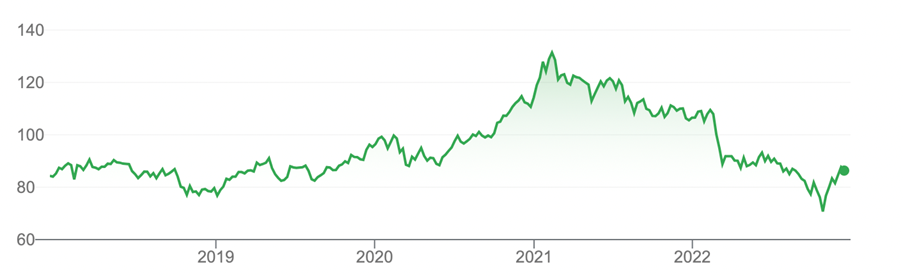

By country, IAA has 42% of the fund in China, 21% in Taiwan and 20% in South Korea. By sector, just under a third of IAA is invested in information technology.

IAA has lost 20% over one year, continuing a tough few years. But that’s a good starting point for contrarians and other long-term investors who could buy after a period of multi-year underperformance.

As bleak as it looks now, Asian equities could attract foreign fund flows as signs emerge that the US Federal Reserve will slow the pace of rate rises. Expectations that China will continue softening its tough COVID-19 elimination policy would be another boost.

Chart 2: iShares Asia 50 ETF (IAA)

Source: Google Finance

3. SPDR S&P/ASX Small Ordinaries Fund (SSO)

Small-cap Australian shares have badly underperformed their large-cap peers. The S&P/ASX Small Ords Accumulation Index is down 14% over one year to end-November 2022, ASX data shows. The S&P/ASX 200 Accumulation Index is up 5%.

The performance of the Small Ords is boosted by the small resource stocks. Small industrials have been collectively crushed. On some broker analysis, small industrials are collectively trading at COVID-19 crisis levels.

Fears of recession in 2023 and general risk aversion have battered many small stocks. When volatility is high, more investors retreat to the perceived safety of large caps or cash. They avoid riskier smaller companies with less liquidity.

Small-cap stocks – particularly small industrials – look more attractive. Memo to ETF issuers: we need a small industrials ETF to fine-tune small-cap investing in this market.

For now, I’ll stick to the SPDR S&P/ASX Small Ordinaries Fund. It’s down almost 14% over one year to end-November 2022, ASX data shows.

As the pace of interest-rate rises slows, and as risk aversion slowly retreats, small caps could outperform in 2023 after a long period of underperformance. They could do particularly well if Australia’s economic slowdown is milder than the market expects.

I usually prefer active rather than index funds for small-cap exposure because this is a stock-picker’s market. But using a small-cap ETF to add exposure as a portfolio building block makes sense – in a part of the market horribly out of favour.

Chart 3: SPDR S&P/ASX Small Ordinaries Fund (SSO)

Source: Google Finance

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at December 15, 2022.