Investing in megatrends is harder than it seems. Some investors pay too much for assets because they are seduced by overhyped megatrends and the prospect of quick gains.

Others focus too much on a theme and not enough on the company or its valuation. They believe the megatrend will lift all companies in a sector even though that rarely happens.

Worst, product issuers latch on to hot themes to attract retail capital. Some Exchange Traded Fund issuers overseas launched thematic ETFs at the top of markets to cash in on hype. They burnt investors because the supposed “megatrend” turned out to be a fad.

Also, most megatrend action is usually overseas, meaning Australian investors have to buy global shares directly or use globally focussed managed funds. Australia has no large, listed cybersecurity companies, video and eSports producers, or wind-farm manufacturers.

Limited fund choice is another issue. Most active managed funds in Australia invest based on asset classes rather than a single theme. There are only a few active healthcare funds, for example.

ETF issuers are filling the megatrend-investing void with thematic index funds. BetaShares’ Global Cybersecurity ETF (HACK) is an example. HACK provides exposure to global cybersecurity companies with a combined capitalisation of almost $1.1 trillion.

Money is pouring into HACK and other thematic ETFs, and the Australian ETF market generally. The combined value of Exchange Traded Products (including managed funds) rose 53% to $96.5 billion over one year to end-February 2021, ASX data shows.

On some estimates, the number of ETF investors in Australia has almost doubled to 1 million over one year. Anecdotally, a new generation of investors is using thematic ETFs to trade sector themes, such as technology, and build portfolios arounds megatrends.

Thematic ETFs are a useful tool for long-term investors. But as with any financial product, investors need to understand the features, benefits and risks of thematic ETFs.

Concentration risk is a key issue. Some thematic ETFs have higher stock concentration risk: HACK is based on an index with only 40 cybersecurity companies.

Other thematic ETFs are based on indices that have stocks with lower liquidity. This can potentially widen the ETF’s buy-sell spread, which is a cost to investors.

Always look under the “bonnet” to understand what an ETF holds. Make sure you’re comfortable with companies in the index and its average valuation.

HACK, for example, had an average Price Earnings (PE) multiple of 32 times at end-February 2021, which looks okay given the cybersecurity industry’s growth prospects and compares to other large tech companies that typically trade on higher valuation multiples.

I have written favourably about HACK several times for this report over the past three years. The ETF’s three-year annual return was 20% to end-February 2021.

Remember, megatrend investing requires patience. You need an investment timeframe of at least 5-7 years, preferably longer.

As money flows into renewable assets, it’s possible that valuations could become overheated. A sensible long-term approach is required.

Finally, view thematic ETFs as portfolio “satellites” – ideas you believe can achieve a higher return and complement lower returns in the portfolio core. Never base a portfolio entirely on themes; that is a recipe for poor diversification and wealth destruction.

Climate-change investing

Caveats aside, few investment megatrends are more compelling than climate change. As I wrote last month in this report, climate-change investing has gone up several notches with Joe Biden’s election as US President and China’s pledge of carbon neutrality by 2060.

It feels like there’s been more progress in the past six months on addressing climate change (at least in terms of policy “pledges”) than in the past decade. Some keen judges I know say more money is targeting renewable assets as capital is reallocated to lower-carbon assets.

I outlined a favourable view on the NZ renewable energy utilities, Meridian Energy and, to a lesser extent, Mercury Energy, in this report last month. Both companies are trading well below their 52-week high because the market is concerned about the outlook for wholesale energy prices.

Long-term investors should have exposure to global climate-change investment thematics. That is, the clean-energy giants that are making solar panels, wind farms, batteries and other renewable technologies. Or supplying raw materials to make renewable-energy equipment.

Australian investors must look globally, even though ASX-listed cleantech companies performed well in the past three years. The Deloitte Cleantech Index, a barometer of 90 stocks, had its best year in a decade, up 32% in 2020. But many stocks in that index are speculative.

Rather than invest directly in stocks – and take on single-company risk – investors should consider “buying the trend”. That is, using an ETF to own dozens of global stocks that will profit from climate-change technologies and associated demand.

There will inevitably be as many climate-change losers as winners, given the pattern of megatrend investing. Having diversified exposure to the trend makes sense.

Here is a snapshot of three climate-change-related ETFs that provide exposure to this trend. Each is bought and sold like a share on ASX. Each has foreign-currency risk, so prospective investors also need a view on the Australian dollar’s direction.

1. VanEck Vectors Global Clean Energy ETF (CLNE)

Launched last month. VanEck was first to market with its clean-energy ETF on ASX. CLNE tracks the S&P Global Clean Energy Index, which is considered the market benchmark.

The ETF currently provides exposure to 29 of the largest, most liquid global companies involved in clean-energy production and related technologies and equipment.

A third of the ETF’s underlying index is in clean-energy power producers and energy traders. The rest is concentrated in semiconductor companies, electrical equipment and electric utilities.

CLNE had an average PE of 34 times over the past 12 months and an average price-to-book ratio of 3.6 times. The ETF’s underlying index returned 25% annually over the past five years, although that is no guarantee of future returns.

I like the look of CLNE and VanEck’s record with thematic ETFs. CLNE’s annual management fee is 65 basis points.

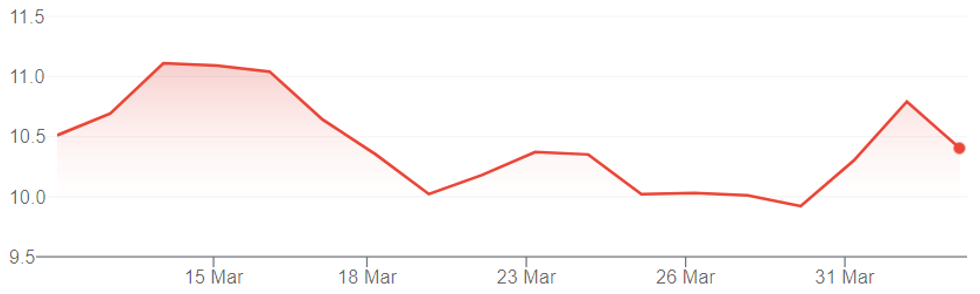

Chart 1: VanEck Vectors Global Clean Energy ETF

Source: ASX

2. BetaShares Climate Change Innovation ETF (ERTH)

VanEck’s main competition in climate-change index investing comes from BetaShares’ new Climate Change Innovation ETF. Also launched last month, ERTH provides exposure to 100 global companies that BetaShares says are at the forefront of tackling environmental challenges.

The index on which ERTH is based returned 37% annually over three years to end-February 2021.

ERTH takes a different approach to VanEck’s CLNE. ERTH includes companies that derive at least half of their business from “green revenue” that reduces or avoids carbon emissions.

Zoom Video Communications, for example, is included in ERTH. Investors who want broader exposure to companies that reduce or avoid carbon emissions should consider ERTH. It also has less stock-concentration risk that CLNE (100 stocks versus 29 stocks).

Investors who want exposure to specialist clean-energy companies should stick with CLNE.

ERTH’s annual management fee is 65 basis points.

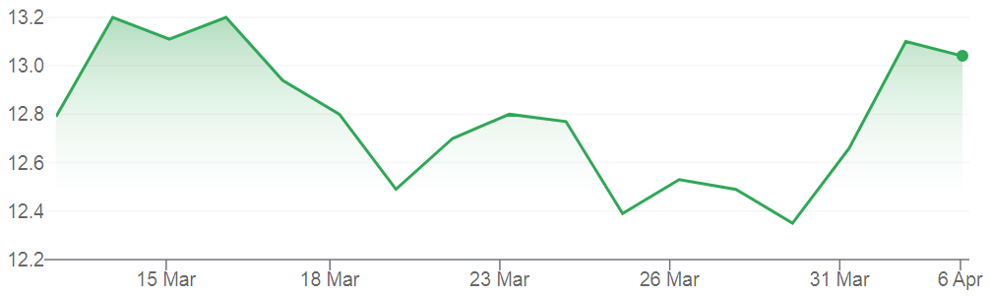

Chart 2. BetaShares Climate Change Innovation ETF (ERTH)

Source: ASX

3. ETFS Battery Tech and Lithium ETF (ACDC)

Launched in 2018, ETF Securities’ battery-focussed ETF has had cracking performance. ACDC returned 66% over one year to end-February 2021, such was the demand for emerging battery technologies for electric vehicles. And for mining companies that supply materials for these batteries.

ACDC has a narrower focus on climate-change investing. It provides exposure to the energy-storage and production boom within the renewable-energy sector.

The ETF’s underlying index holds 31 companies, almost half of which (by market capitalisation) are in Japan and the United States. ACDC also holds several Australian miners that supply raw materials for batteries. Pilbara Minerals and Galaxy Resources are the top two holdings.

ACDC also provides exposure to several car makers, including Tesla, Nissan Motor Co, Renault SA and Daimler AG.

The ETF arguably has a higher risk profile than the other climate-change-focussed ETFs given the inclusion of minerals producers. But it also has potentially higher upside.

After such strong gains over 12 months, investors will need a long-term view with ACDC. The ETF could easily give back some of those gains in the next six months if markets wobble.

But battery technology is one of the most promising sectors within climate-change investing – a megatrend within a megatrend, if there is such a thing.

ACDC’s annual management fee is 69 basis points.

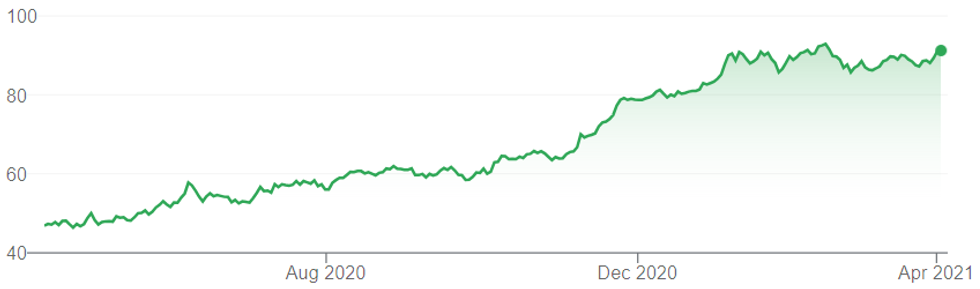

Chart 3: ETFS Battery Tech and Lithium ETF

Source: ASX

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at April 7, 2021.