The story of 2022 is one where growth stocks have copped it as interest rates have been jacked up by central banks, and value, as well as big cap stocks, have performed better. If you don’t believe me, look at these two financial sector stocks — Commonwealth Bank of Australia (CBA) and Tyro Payments (TYR).

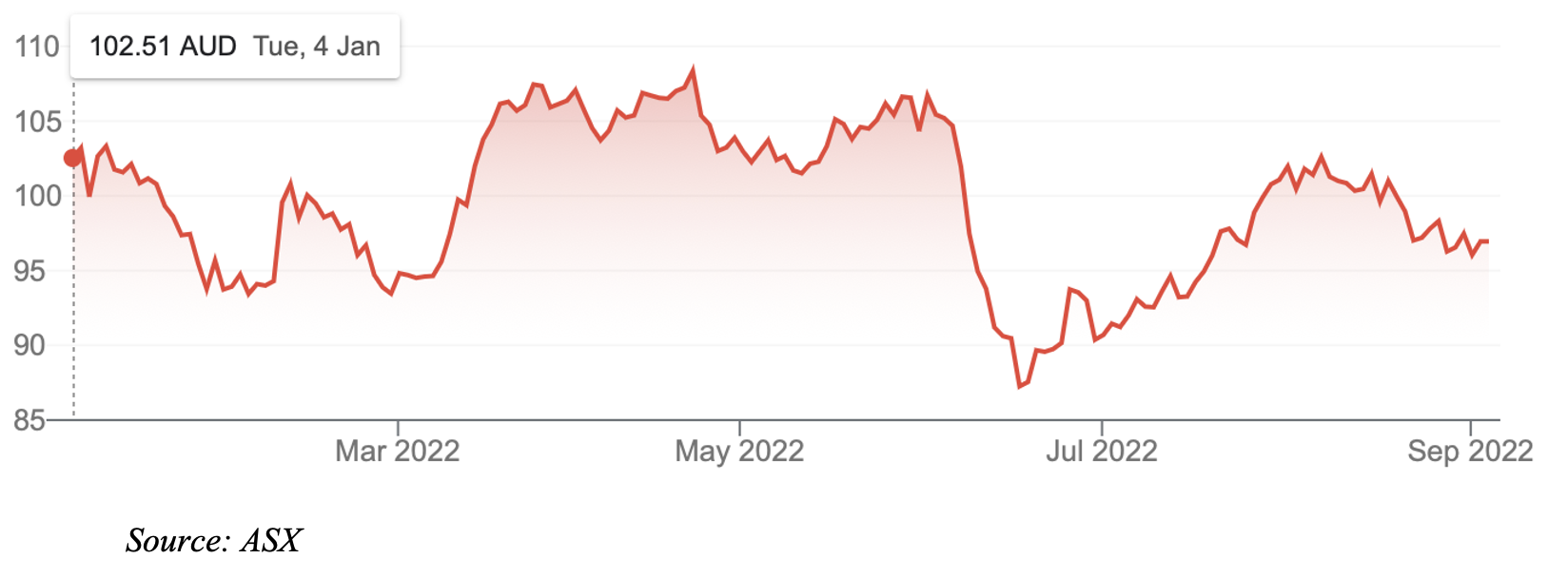

Commonwealth Bank of Australia (CBA) Year-to-Date down 5.42%

Tyro Payments (TYR) YTD down 66.4%

As you can see, the big cap CBA has been only slightly affected by the 2022 stocks sell-off, while Tyro, a small bank primarily in the payments space, has been trashed.

Incidentally, the analysts think Tyro has a 53% upside, sometime in the future, but they’ve been barking up that tree for a long time! UBS sees an 83% upside for its stock price, while Morgans sees 73%.

The big appeal of small-cap stocks is the potential big returns, but they’re not as reliable as the likes of CBA and other large-cap stocks. Also, you might have to wait a long time for a share price recovery (Appen (APX) investors have found that out), and given the current company performance, it might never see the good old days when this $3.60 stock was $40! That was only two years ago.

The beauty of small caps is that when they take off, you can see huge returns, but picking the right one is easier said than done. Getting the timing right is another challenge.

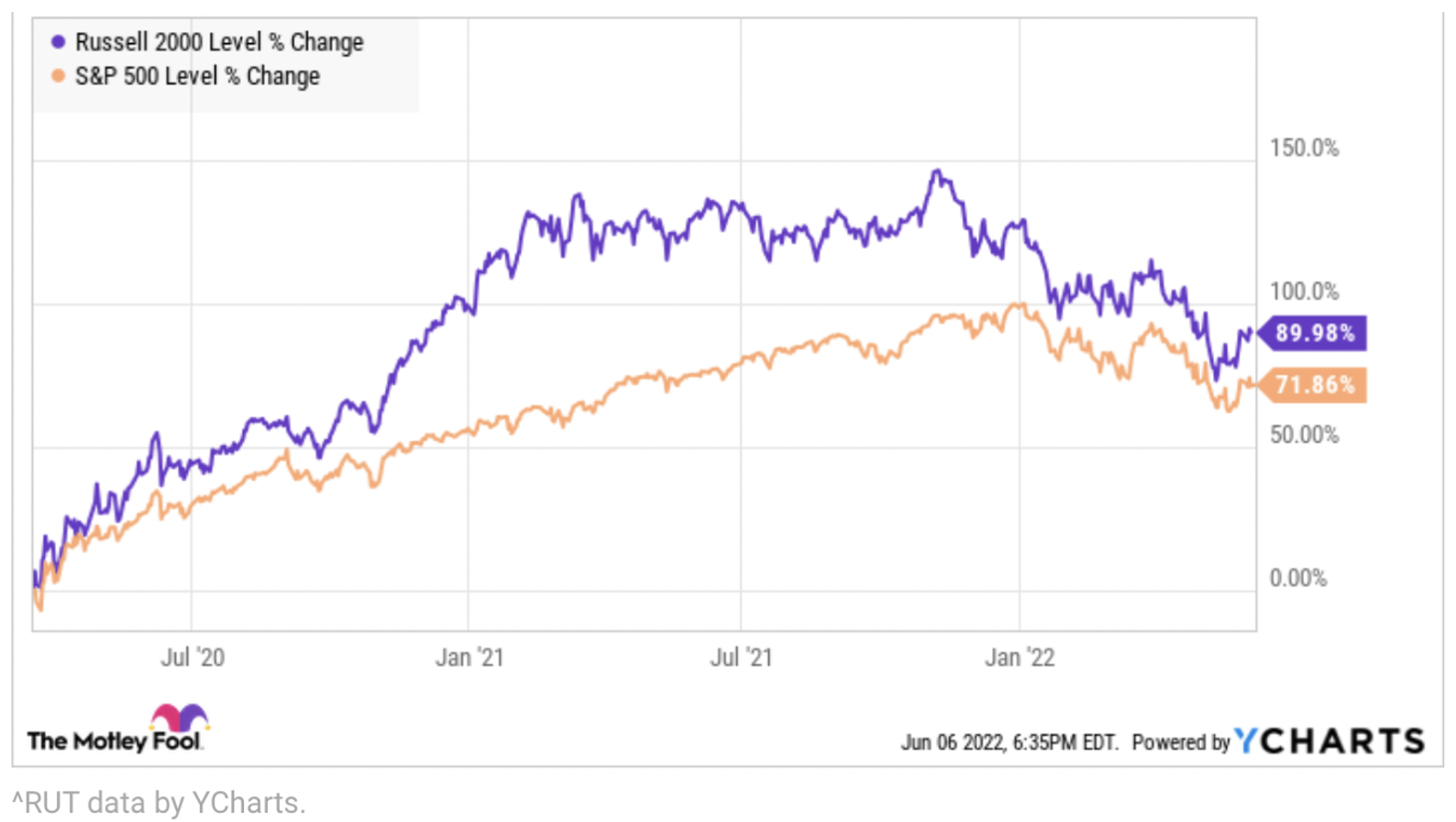

Motley Fool has pointed out when small caps do well: “Due to their higher volatility, small-cap stocks tend to outperform during young bull markets, when stocks are quickly moving higher. For example, since the Russell 2000, which tracks the performance of US small-cap stocks, bottomed out on March 18, 2020, it’s outperformed the much larger US S&P 500 by a significant margin, as the chart below shows. However, you’ll notice that since the bear market in the Russell 2000 began on November 8, 2021, the small-cap index has underperformed its large-cap peer, showing how volatility swings both ways.”

My view is that a new bull market is possible when interest rate rises peak and would be powered up even more when interest rates start to be cut, or the market believes there will be no more rises and/or if the Ukraine war will soon come to an end.

There is a potential upswing in demand in 2023, especially if the Federal Reserve manages to avoid a recession for the US economy. So, I’m looking at small cap investments inspired by Warren Buffet’s advice to “be greedy when others are fearful”. That makes a small cap fund (or an ETF linked to the Small Ord Index) seem like a pretty sensible play but you could also collect a group of small-cap stocks to give you both exposure to small end-of-town stocks while being diversified at the same time.

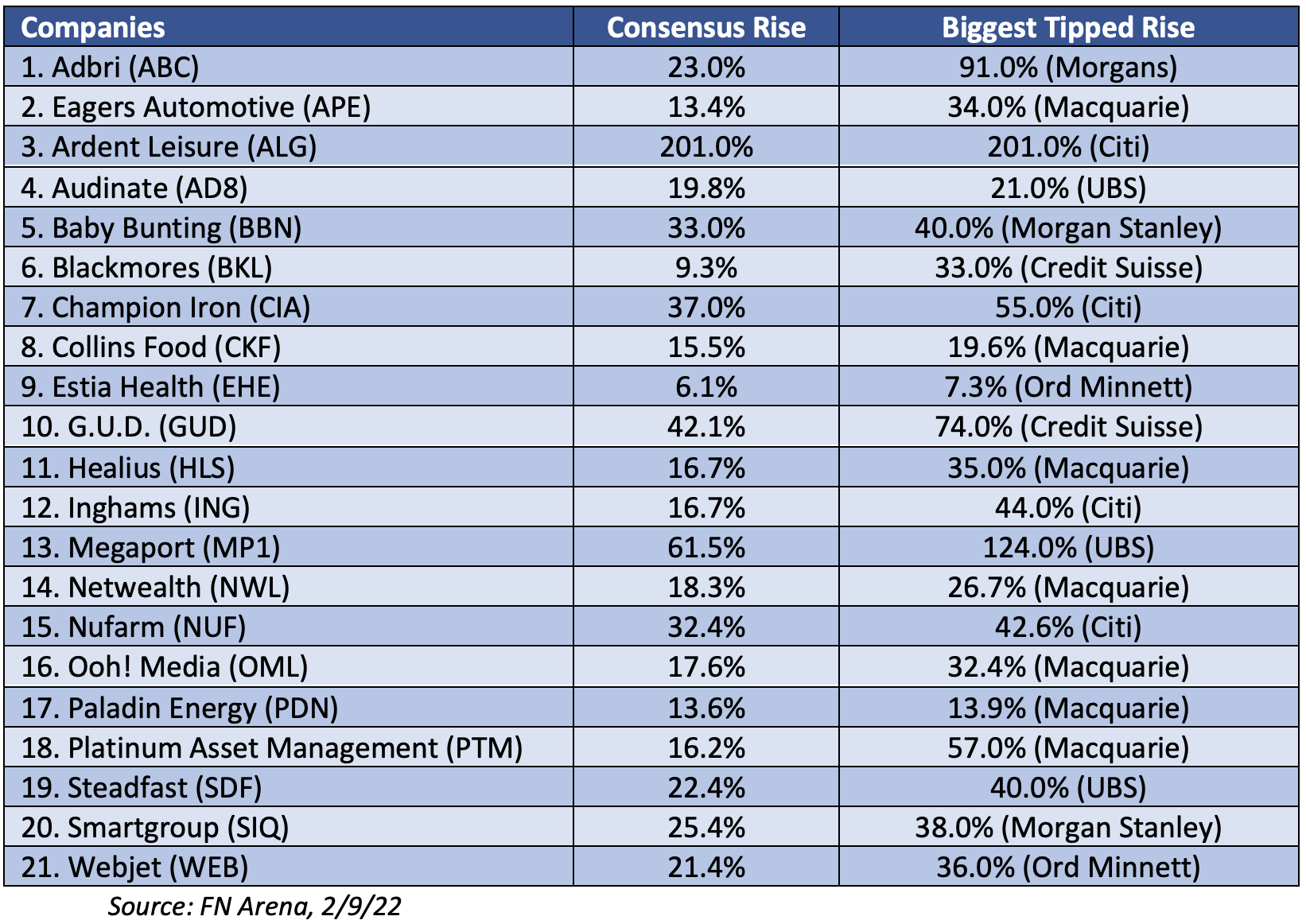

I’ve found 21 stocks the analysts like which are also in the Small Ords Index. I’ll show you the consensus call on these companies from the FNArena survey of analysts and I’ll highlight what the most supportive analysts think about these companies. I’ve looked for companies in different sectors with plenty of stock price upside.

Both Ardent Leisure and Paladin Energy had only one analyst examining the company, but most others had a good number of experts assessing the businesses.

If you decide to take a punt on any of these small caps, you might have to wait until growth/tech stocks take off because the end of the rate-rise program from central banks, especially in the US, is nigh. With many of these companies, the nice gains synonymous with small caps, won’t happen necessarily in the near future but as New Zealand model Rachel Hunter said in this Pantene Shampoo ad from the 90s: “It won’t happen overnight but it will happen.”

By the way, some of these companies mightn’t live up to the expectations of the analysts but I suspect many will have nice rises when the bull market resumes convincingly.

Important: This content has been prepared without taking account of the objectives, financial situation or needs of any particular individual. It does not constitute formal advice. Consider the appropriateness of the information in regards to your circumstances.