In last week’s column, I explained my view on global equity markets in 2022. Inflation fears and rising bond yields will constrain equity returns and increase volatility. That view is reflected in the market’s awful start to 2022.

Australia’s inflation result this week shocked. Headline inflation of 3.5% in the year to end-December 2021 trounced market expectations. The results will pressure the Reserve Bank to abandon its view that interest rates will first rise in late 2023 or 2024.

I also warned last week that long-duration growth stocks, such as big tech companies, were vulnerable to heavier price falls – and that it was too soon to buy tech.

So far, so good. In the US, the Nasdaq 100 Index was belted last week, amid fears of rising inflation and rates. Higher interest rates make it harder to buy tech stocks with nose-bleeding valuations or those priced on revenue rather than profit.

The Nasdaq is headline towards bear market territory, down 14% year-to-date. Massive falls in tech stars like Netflix (down 38% year-to-date) will attract bargain hunters. However, I see US tech underperforming the market this year, albeit with occasional rallies.

I do, however, like the prospects for Asian tech stocks at current levels. Big tech in China was slaughtered last year. In addition to inflation and interest rate fears, Chinese tech faced a regulatory crackdown in China, a slowing local economy, and a backlash in the US from regulators and some investors. And, of course, the effects of Covid.

Chinese e-commerce leader Alibaba Group Holdings has shed 53% over one year. Social-media star Tencent Holdings slumped 39% in that period. Internet star Baidu Inc has tumbled 40% over one year. E-commerce Group JD.com is down 26%.

Alibaba Group Holdings – ADR (NYSE: BABA)

Some fund managers and analysts last year argued that Chinese tech offered screaming value after heavy price falls. They were too early. Those with large portfolio allocations to Chinese stocks or who tried to bargain hunt last year were burnt. That said, some Chinese tech stocks look badly undervalued after further price falls.

Consider Alibaba Group. Morningstar this week valued Alibaba at US$188 a share, versus the current US$120 (NYSE: BABA). The consensus price target of 51 analysts who cover Alibaba is US$201. Most analysts have buy recommendations, which is usually a cause for concern, but in Alibaba’s case makes sense.

At US$120, Alibaba is on a forward Price Earnings (PE) multiple of 12.5 times, based on consensus analyst forecasts. That’s less than the average PE for the Australian share market. For a company with almost a billion users, and a dominant position in a giant market, Alibaba’s PE looks undemanding.

Chinese tech should, of course, trade at a valuation discount given regulatory risk in China and the US, and the ongoing trade war. But if one believes China is unlikely to socialise its star industry, Chinese tech is interesting at current valuations.

I emphasise that Asian tech stocks suit experienced investors who are comfortable with higher volatility. This is not a sector for the risk-averse or faint of heart. Nor does it suit those seeking short-term gains; there is too much uncertainty.

Risks aside, there is much to like about the long-term prospects for Asian tech. Attractions include a large and growing population, a high proportion of young consumers, and higher rates of technology adoption compared to the West.

My preference with high-risk contrarian ideas is usually to ‘buy the sector’ through Exchanged Traded Funds (ETFs) rather than punt on individual companies. I’d rather own a portfolio of Asian tech stocks and spread the risk, and gain that exposure via the ASX rather than investing directly through offshore exchanges.

The ASX has plenty of tech ETFs that cover broad-based indices, such as the Nasdaq 100, or technology themes. There are a few choices for Asian tech exposure. Here are two Asian-focused ETFs on my radar.

1. BetaShares Asian Tigers ETF (ASIA)

Launched in September 2018, ASIA tracks an index of the 50 largest technology and online retail stocks in the region (excluding Japan).

ASIA’s top holdings include Samsung Electronics, Taiwan Semiconductor, Tencent Holdings, Alibaba Group, Meituan, Infosys and JD.com. By country, about 44% of the ETF is invested in China and roughly that much again in Taiwan and South Korea combined.

I like how ASIA provides exposure to a range of tech sectors, particularly semiconductors, a clear winner from the boom in artificial intelligence and the Internet of Things (connected devices). ASIA’s geographical spread is another attraction as it reduces regulatory risk (although the ETF’s China exposure is still high).

At end-December 2021, ASIA traded on a forward PE ratio of 20.7 times and price-to-book (P/B) ratio of 3.6 times. For comparison, BetaShares’ Nasdaq 100 ETF (NDQ) traded on a forward PE of almost 30 times and P/B ratio of 9.4 times.

Clearly, Asian tech is trading on vastly lower aggregate valuation multiples compared to the largest Western tech companies. A hefty discount is warranted given the uncertainty in Chinese tech, but the gap between Eastern and Western tech has become too large. That’s an opportunity for long-term portfolio investors.

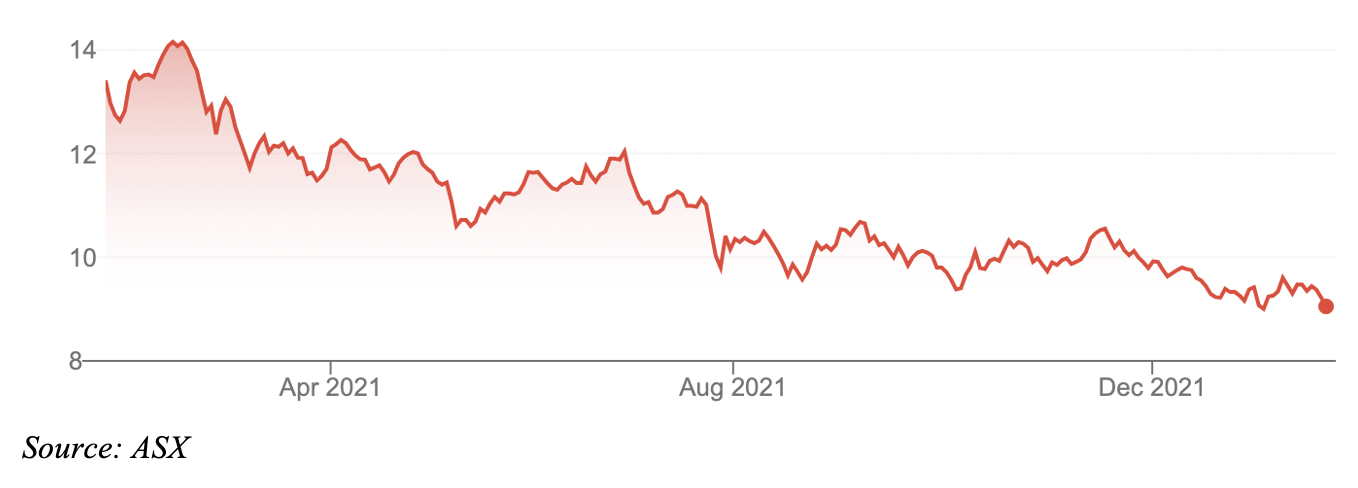

On performance, ASIA has lost almost 15% over one year to end-December 2021.

Savvy investors know the best time is often when news is at its worst. That looks to be the case with Asian tech. These investors also understand the importance of rotating between sectors and geographies to seize opportunities.

ASIA’s annual management fee is 0.57%.

BetaShares Asian Tiger ETF (ASIA)

2. VanEck China New Economy ETF (CNEW)

CNEW provides exposure to 120 companies domiciled in mainland China and which trade on the Shanghai and Shenzen securities exchanges.

The ETF’s underlying index includes companies in the Chinese technology, healthcare, consumer discretionary and consumer staples sectors.

Tech had a 9.4% weighting in CNEW at end-December 2021, although that gets closer to 25% if one adds in the exposure in media/entertainment, semiconductors and software and services.

The smart-beta ETF chooses Chinese companies it believes to have the best GARP (growth at a reasonable price) attributes. Stocks are chosen based on their growth, value, profitability and cash flow. Stocks in the index are equally weighted.

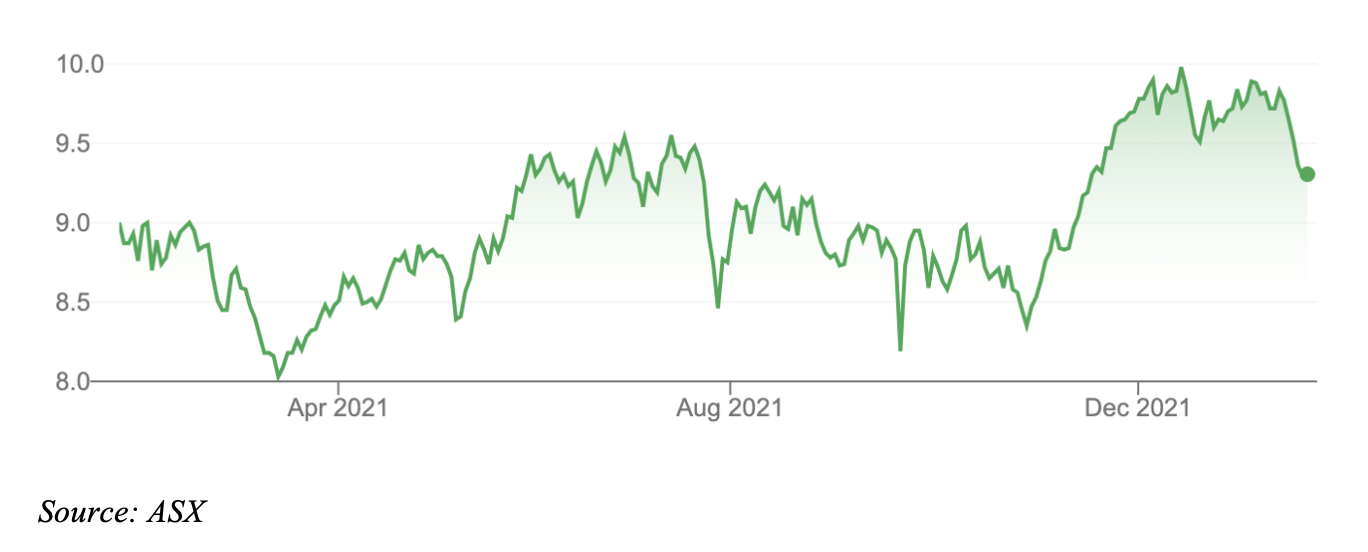

CNEW has returned 15.9% over one year to end-December 2021. Over three years, the annualised return is 27.4%.

At end-December 2021, CNEW traded on a trailing PE ratio of almost 19 times and P/B ratio of 4.1 times. That is not overly demanding for believers in China’s long-term growth prospects, particularly in sectors like biotechnology.

Unlike the ASIA ETF, CNEW is a play on a range of sectors at the forefront of China’s ‘new economy’. CNEW’s focus on finding reasonably valued growth stocks mitigates some risk. But the ETF is far less of a contrarian play on Chinese tech.

Long-term investors who want exposure to Chinese sectors with faster growth prospects might find a place for CNEW in their portfolio. Those seeking exposure to Asian tech stocks trading at bargain prices should stick to ASIA.

CNEW’s management fee of 0.98% is relatively high for an ETF. Its smart-beta methodology and exposure to stocks that trade on Chinese exchanges require a higher fee.

VanEck China New Economy ETF (CNEW)

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. The information in this article should not be considered personal advice. It has been prepared without considering your objectives, financial situation or needs. Before acting on information in this article consider its appropriateness and accuracy, regarding your objectives, financial situation and needs. Do further research of your own and/or seek personal financial advice from a licensed adviser before making any financial or investment decisions based on this article. All prices and analysis at 26 January 2022.